The Macquarie stock pick to play the housing recovery

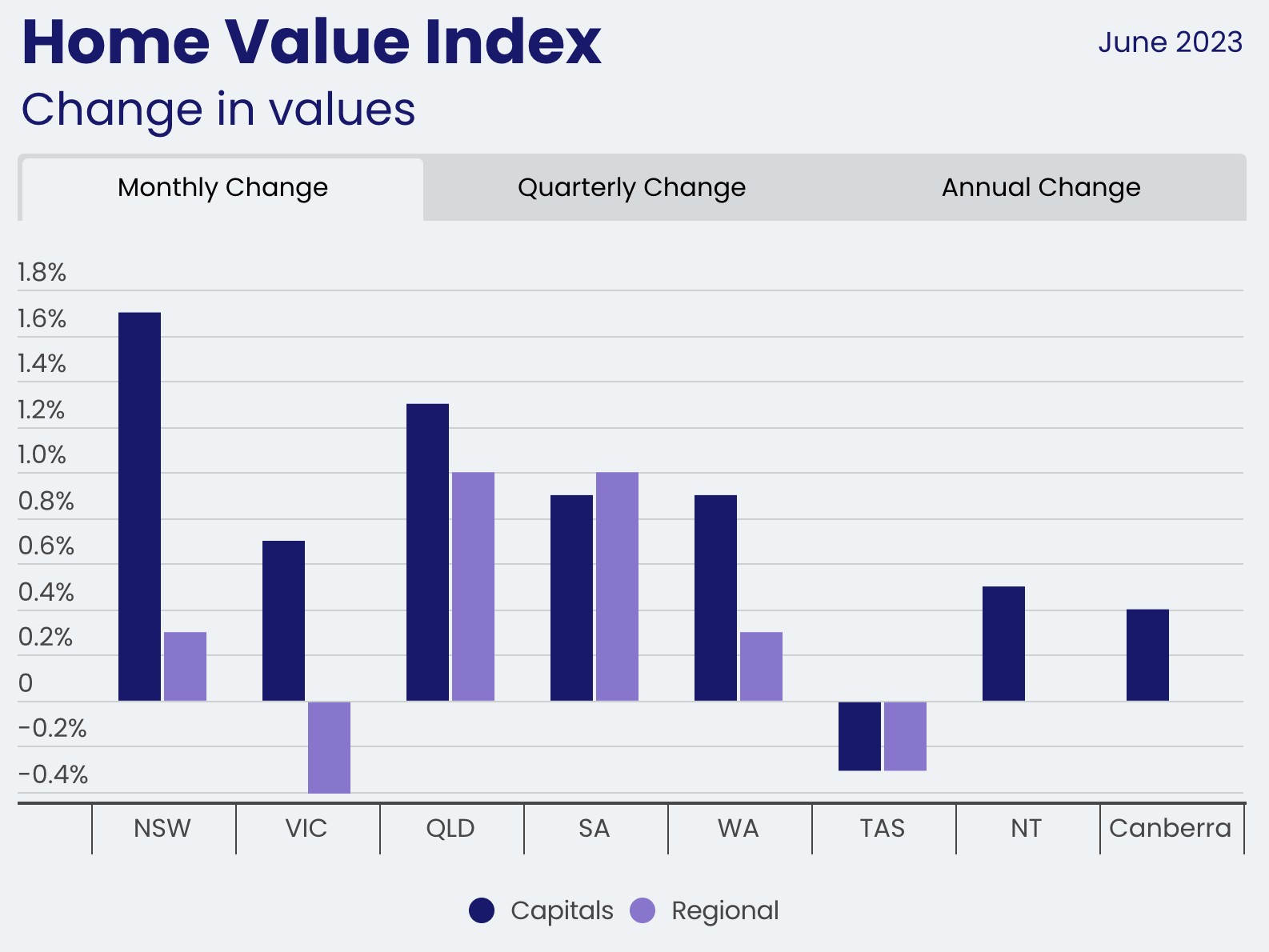

The Australian housing market has continued its recent upward trajectory, recording four consecutive months of growth following a previous dip earlier this year. Recent data from CoreLogic indicates that house prices across the country experienced a 1.1% increase in June, albeit at a slightly slower pace compared to May's growth rate of 1.2%.

While most capital cities saw positive gains, Hobart bucked the trend with a slight decline of -0.3%. Sydney led the charge with prices up 1.7% across June.

In this wire, I'll explore the factors contributing to this growth, the potential impact of today's Reserve Bank of Australia (RBA) decision to pause rate hikes, and Macquarie's pick for an equity to play this theme.

What's driving the recovery?

The resurgence in house prices in Australia can be attributed to a combination of factors. Firstly, the country has been experiencing robust population growth, which has generated strong demand for housing. Increased migration and internal movement have created a significant need for residential properties.

Secondly, house price supply has dwindled, amplifying the demand-supply gap and subsequently driving up prices. These factors have created a conducive environment for the recent growth in house prices.

Can this continue?

Despite the recent positive trends, market sentiment has taken a hit as speculation regarding potential interest rate increases mounts. Tim Lawless, CoreLogic Research Director, expressed his view that further rate hikes could dampen market activity.

“If we do see another rate hike on Tuesday or in August, I think that would take some further heat out of the marketplace.”

With the anticipation of additional rate adjustments in the near future, buyers may become more cautious and opt to wait and observe the market before making significant property investments. The impact of these expectations on the housing market is yet to be fully realised, but may see the price recovery continue to decelerate in the coming months.

Impact of the RBA's pause

With the RBA's decision this afternoon to pause interest rate hikes (despite Taylor Swift's inflation-spiking era's tour), we may see house prices continue to recover through July, as homeowners receive some reprieve.

On the other hand, as Hans Lee explained in his wire The RBA pauses for the 2nd time in 4 months (but don't rejoice just yet), we may see a return to hiking in August, and as such house prices are unlikely to accelerate drastically.

How to play the "housing-adjacent" market

With house prices recovering, and pressure growing on existing supply, an opportunity may be presenting itself in housing adjacent stocks. In other words, those that may be recipients of outsized demand as new dwellings receive heightened investment.

One such stock is Boral Ltd (ASX: BLD).

As a supplier of a wide variety of construction materials, including quarry products, cement, concrete, asphalt and recycled materials, Boral is a potential beneficiary of a recovering housing market, particularly if today's rates pause is maintained in future RBA decisions.

Corroborating this idea, Macquarie recently published an improved outlook on the building materials company.

Macquarie's call: Boral Ltd (ASX: BLD)

As a result of a recent investors' day, alongside site visits to NSW assets, Macquarie believes that Boral Ltd's earnings expectations should be higher than previously anticipated.

Furthermore, progress has been made on a chlorine bypass at Berrima, which will eventually allow up to 60% alternative fuel usage, thereby enabling emissions reductions. Macquarie believes this progress represents medium-turn cost benefits, even in excess of carbon credits.

In sum, Macquarie argues that Boral Ltd may represent an opportunity to take advantage of a macroeconomic tailwind and holds promising internal prospects.

5 topics

1 stock mentioned

1 contributor mentioned