The market narrative Bob Desmond isn't buying (and 5 stocks he is)

Investors tend to fixate on macroeconomic conditions. Australia’s national obsession with residential property and calls of dramatic housing price crashes in the wake of COVID and the rising interest rate environment are prominent examples.

The reality has been vastly different – on average, Australian house prices surged more than 30% between March 2020 and February 2024, according to CoreLogic data.

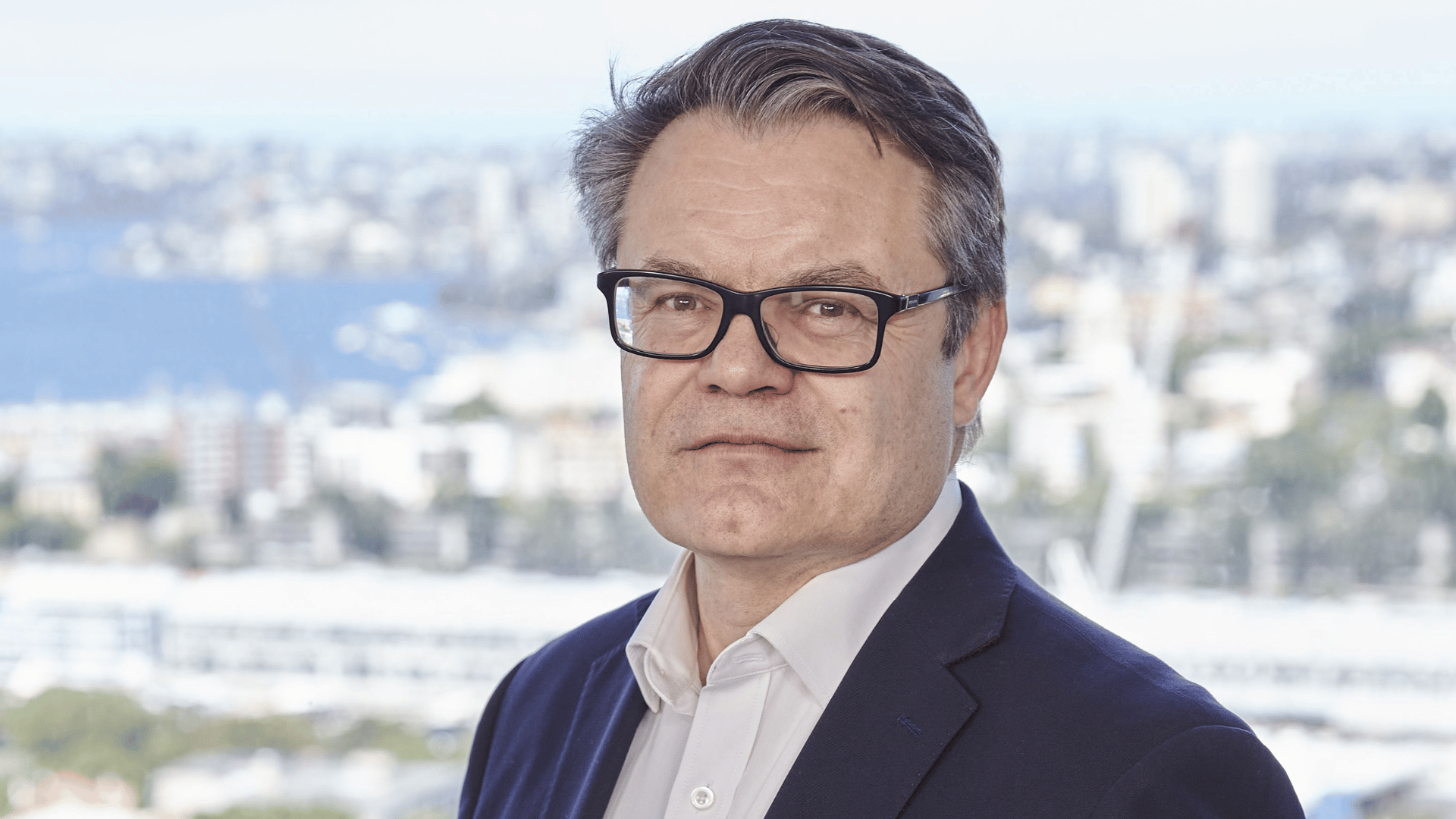

Such a disparity between expectations and reality is one reason Claremont Global portfolio manager Bob Desmond steers clear of macro considerations.

“You could even point to something like the [US Federal Reserve], they only get 20 to 30% of their forecasts correct and they have access to the best information in the world,” Desmond says.

“Not only do you have to get your forecast right, you then have to get your market call right…it’s like compound probability.”

As Desmond explains, if you had a 50% chance of getting your macro call right and the same chance of picking stocks to benefit from this, you then have a 25% overall chance of selecting correctly.

.png)

Standout results from US earnings

While macro considerations don’t play a key role in Desmond’s fundamental, bottom-up investment process, the environment has been largely supportive for the Claremont Global portfolio in the latest US quarterly earnings season.

“In consumers, we’ve seen a little bit of softness, as called out at the margin by some companies but that’s more at the bottom end [of the socioeconomic mix],” Desmond says.

He also notes steady employment figures in the US have benefited payroll and human resources services business Automatic Data Processing (NYSE: ADP). In its quarterly earnings update, management noted its employer services business saw an 8% increase in revenue. This was driven in part by a 2% rise in the average number of worksite employees paid.

Desmond highlights technology as the standout, with mega-cap technology firms Microsoft and Google owner Alphabet ranking among Claremont Global's five largest holdings.

Microsoft (NASDAQ: MSFT)

“Microsoft's revenue, excluding the Activision-Blizzard business, was up 14% and again it saw good margin progression,” Desmond says,

He also notes Microsoft’s cloud computing business, Azure, continues to grow at 31%.

“Microsoft just keeps delivering and we can see a potential path to monetisation on CoPilot. This is not a core part of the thesis, but it will be potentially nice icing on the cake,” Desmond says.

Alphabet (NASDAQ: GOOGL)

“Google was a real standout and the market quite liked it,” Desmond says, noting the share price jumped 10% on the back of the result.

“But for us, the key there was obviously nice constant currency revenue growth of 16% [and] margin improvement, which was up 390 basis points. A key part of our thesis on Google is that their margins could be considerably higher.”

Visa (NASDAQ: V)

A stalwart of the portfolio, Claremont Global has held the global payments company for the last seven years. Desmond highlights Visa’s year-on-year growth of 8%, 23% and 18% across payment volumes, its value-added services business and cross-border transactions, respectively, from the latest result. He also notes management reiterated its guidance for low double-digit revenue growth for the year.

“They are our biggest companies and also our fastest-growing companies. We certainly don't buy into the narrative that they are too big to grow or there's a problem with their concentration in the index,” Desmond says.

Finding quality tech stocks (without overpaying)

Desmond notes the propensity for market commentators to attach labels – such as the “Magnificent 7” (or the FAANGs before that). While it’s easy to apply such labels, he emphasises each business is unique, using Microsoft and Google as examples.

“Google is a technology business, but it's using technology to solve an advertising problem. Microsoft is using technology to solve business productivity and business solutions,” Desmond says.

His team doesn’t look for businesses with the fastest-changing technology but for those with a demonstrated history of “earnings, resiliency and business models that are sustained through time".

“The thing that's tricky with technology is it can be very fast-changing and that means you have to be right on top of the changes that are coming,” Desmond says.

Examples here include IBM missing the advent of the PC, and Microsoft’s failure to foresee digital music – which is where Apple gained a foothold and then dominated with its rollout of mobile phones.

And remember Intel?

“They completely dominated their space in the late 90s and then are not really anywhere at the moment,” Desmond says.

These examples highlight why Claremont Global focuses on the more stable parts of the industry structure, preferring companies with strong network effects and whose earnings come primarily from businesses rather than consumers.

US tech isn't a bubble

While Alphabet and Microsoft tick the team's “quality” box, Desmond also holds a view that others in the space are also not as expensive as many investors think. Referring to the "Magnificent 7" grouping of Apple (NASDAQ: AAPL) , Alphabet (NASDAQ: GOOGL), Microsoft (NASDAQ: MSFT), Amazon (NASDAQ: AMZN), Meta Platforms (NASDAQ: META), Nvidia (NASDAQ: NVDA) and Tesla (NASDAQ: TSLA), Desmond believes the latter is an outlier.

“At the moment, the numbers look to me like Tesla is a car company,” he says, while conceding there’s a chance he’s wrong on that.

He also regards Apple as more of a consumer product than a technology company.

Looking across the other four – Meta, Alphabet, Microsoft and Amazon – Desmond emphasises they all have classic network effects. He believes valuations are not crazy – the most expensive is Amazon on 37x with an estimated long term growth rate is excess of 20%, compared to something like Costco (NASDAQ: COST) on 46x with an estimated long term growth rate of 10%. Which is more expensive?

“And they’re not that expensive. I remind people that Alphabet is on a 22-times earnings multiple, which is the same multiple as CBA.”

“All I hear about is how expensive all these businesses are but for the growth they’re delivering and the competitive advantage they have, I don’t see why people keep saying that,” Desmond says.

The fastest-growing of them all – Nvidia – is unlikely to ever make its way into a Claremont Global portfolio. "We aren't smart enough to forecast that profit growth," Desmond says.

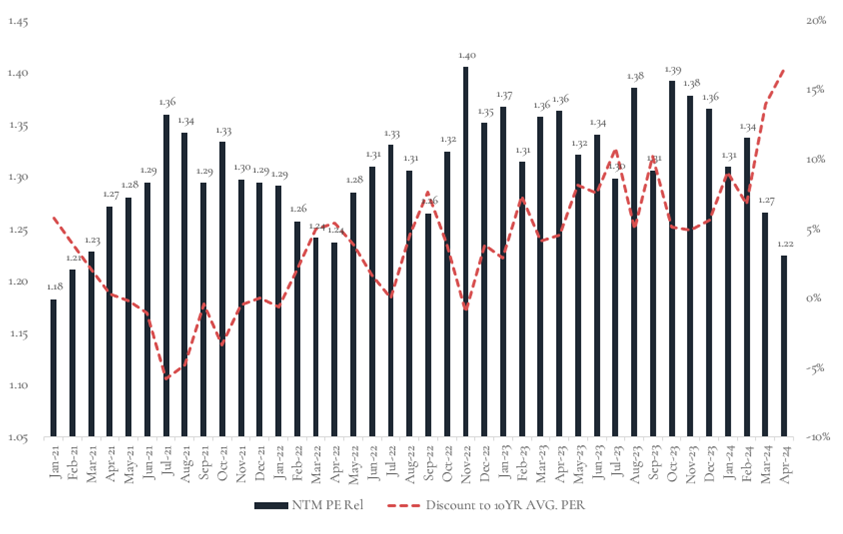

How expensive are Claremont Global’s stock holdings now?

While defining his investment style as Quality Growth rather than Value, Desmond notes valuation plays an important role in his stock picking.

This valuation discipline served his investors well during the momentum-driven market in the latter stages of the COVID pandemic at the end of 2021 into 2022.

The largest market weight in the portfolio is the US, comprising 58% of the holdings by revenue source. The largest US market index, the S&P 500, currently trades on an average PE multiple that is 14% ahead of the 10-year average.

“When I look at the multiple on our businesses today, they're about 3% below their collective 10-year average. So, relative to the market, we feel pretty good."

Emphasising his point about valuation discipline, Desmond notes his team also tracks the absolute value of every business it owns and reports this as a weighted number.

“At the moment the average business that we own is trading around a 12% discount to value…We like the valuation of the portfolio both in the absolute and relative sense," he says.

In line with this, he believes the fund will continue to deliver on its target return of between 8% and 12% per annum: “We feel reasonably confident we can get to the middle or the right side of that equation over the next five years,” Desmond says.

PE Relative of the Claremont Global portfolio

Why Claremont Global avoids resources, healthcare

One of the largest drivers of profit upgrades among US companies this earnings season were among the energy and materials sectors – two areas that Claremont Global explicitly avoids.

That partly comes back to running such a highly concentrated fund – distilling a universe of some 40,000 potential holdings across global markets into just 10 to 15 companies.

“Having that level of concentration, you need to have a very narrow range of outcomes. And that means what we are looking for is highly predictable earnings in five years, highly predictable business models which result in stable multiples through time,” Desmond says.

He argues that’s not something you typically find in energy or commodities. And coming back to the opening point, making the right stock buys depends on getting big macro calls correct.

“You have to be able to forecast not only economic growth, you're going to have to also forecast supply demand imbalances. That's an area where we just don't have any edge, so we just stay away from it,” Desmond says.

It’s a similar story in the healthcare space, where the fund avoids the fastest growing (and riskier) pharmaceuticals companies because of the over-reliance on forecasting.

“You’re trying to make a forecast of a blockbuster [drug], you've got to make a forecast on generic challenges, you've got to make forecasts on US election results and what that means for drug pricing. Experience has taught me that's quite difficult to do on a consistent basis,” Desmond says.

Instead, his focus on healthcare companies – which form 20% of its portfolio by sector weight – focuses on those providing precision instruments, hospital and medical device sterilisation and animal healthcare.

A manufacturer of medicines and vaccines for animals, Zoetis (NYSE: ZTS) is one of Claremont Global's five largest company holdings. “It’s a much simpler business to understand because it's privately funded and most of the drugs are off-patent,” Desmond says.

Access 10 to 15 of the world’s best companies in one ASX-listed fund

2 topics

13 stocks mentioned

2 funds mentioned

1 contributor mentioned