The Match Out: ASX down 2% for the week as US 2-year bond yields crack 5%, Have a great weekend all

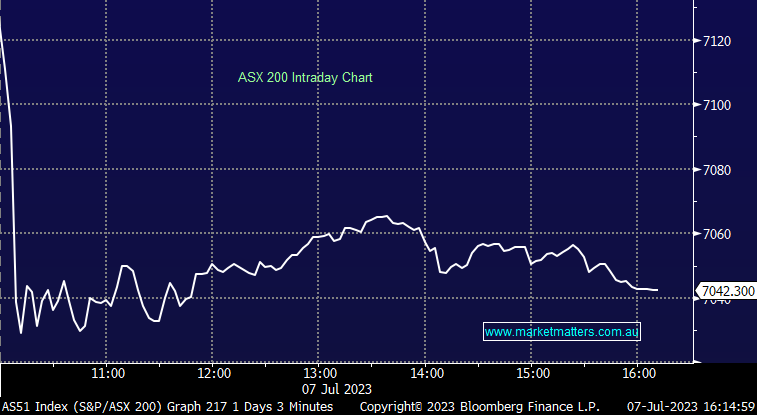

The local market fell to levels not seen in 3 months today on the back of a swift turn higher in bond yields The local 10-year yield was up 15bps/~3.5% early on in the session, settling at 4.255% driving a shift away from risky assets. There was little appetite to add exposure on a Friday either, resigning the market to a ~200pt drop over the last 3 sessions. All sectors closed lower while the ASX200 closed down 2.24% for the week.

- The ASX 200 finished off -121pts/ -1.69% at 7042

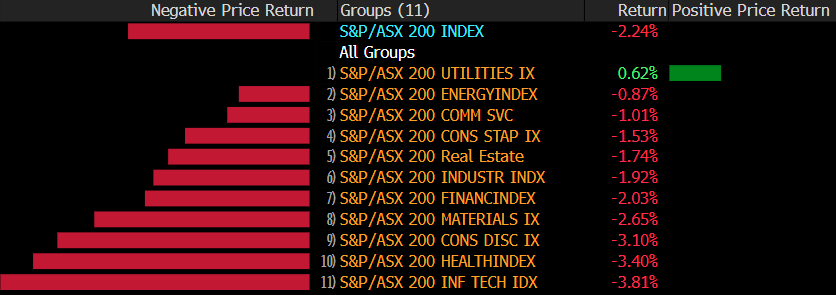

- All sectors down but the relative performers were Utilities (-0.72%), Energy (-1.13%) & Staples (-1.20%)

- Property (-2.60%) and Consumer Discretionary (-2.40%) the weakest links.

- Strength in the US jobs market has led to expectations of more rate hikes there (and here), but more importantly, the pricing out of rate cuts putting pressure on equities.

- US-Non Farm Payrolls are out tonight and will provide a more robust insight into the state of the US labor market, consensus is for +230k jobs added and the unemployment rate to tick down to 3.6% from 3.7%.

- The AFR was running a headline this afternoon that said….’Not an economy on its knees’, as the most talked about ‘certain’ recession continues to prove elusive.

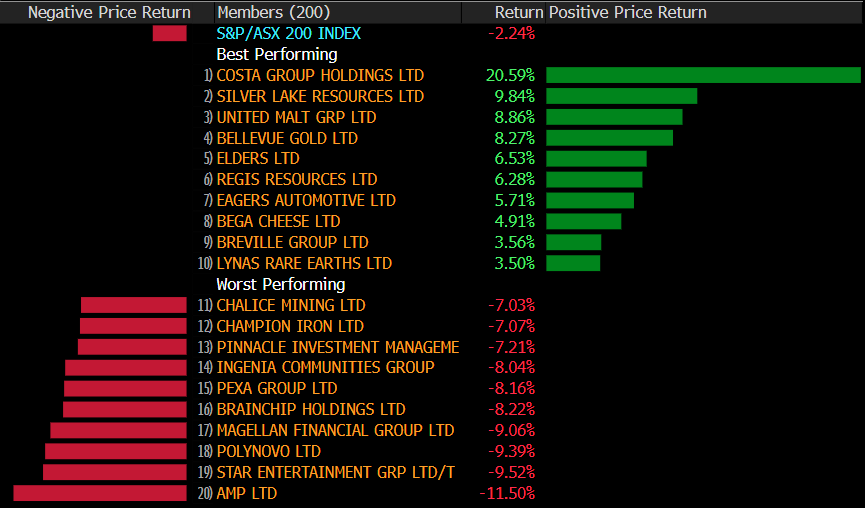

- Pinnacle (ASX: PNI) -5.23% pushed out a sneaky update after the market closed yesterday, saying conditions remained challenging. Stock fell today.

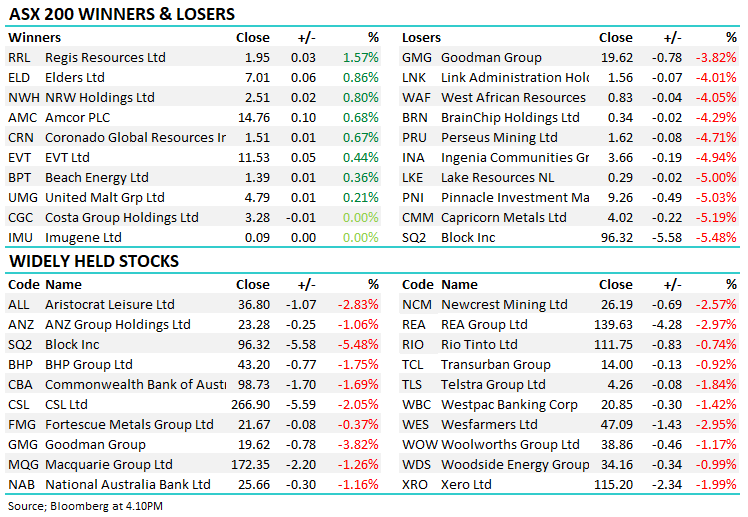

- Elders (ASX: ELD) +0.86% was one of only 8 stocks on the ASX200 that closed higher today, others of note included Regis Resources (ASX: RRL) +1.57%, NRW Holdings (ASX: NWH) +0.80% & Amcor (ASX: AMC) +0.68%. We’ve turned more positive on ELD having avoided the stock throughout FY23.

- Magellan (ASX: MFG) -3.25% fell again today, a tough week following a softer FUM update. We have turned more positive on MFG of late, with a few questions through the Weekend Q&A about our updated thoughts. Keep an eye out for those tomorrow.

- Iron Ore was flat in Asia.

- Gold edged higher during our time zone, +$US5 to $US1915

- Asian stocks were down but not as much as our own, Hong Kong -0.57%, Japan -0.86% while China was off -0.10%

- US Futures are flat.

ASX 200 Intraday

ASX 200 Daily

Sectors this week

Stocks this week

Broker Moves

- BHP AU: BHP Raised to Buy at SBG Securities; PT A$51.95

- DHG AU: Domain Holdings Cut to Neutral at Evans & Partners Pty Ltd

- FPR AU: FleetPartners Group Ltd Cut to Equal-Weight at Morgan Stanley

- REH AU: Reece Rated New Neutral at Evans & Partners Pty Ltd; PT A$15.11

- RIO LN: Mining Sector Raised to Hold at Liberum on Balanced Price Risks

- RIO LN: Rio Tinto Raised to Hold at SBG Securities; PT 5,500 pence

- S32 AU: South32 Raised to Buy at SBG Securities; PT A$4.77

- TLC AU: Lottery Corp. Cut to Equal-Weight at Morgan Stanley; PT A$5.50

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

6 stocks mentioned