The Match Out: ASX down but not out, UBS pushes through big upgrades on AGL

Another weaker session for local stocks today however ‘buyers of the dip’ saw the local market recover over half of its early losses as it tracked a bounce by US futures, influential names such as BHP and Com Bank (CBA) closed well off their respective lows with the banks in particular catching our attention with ANZ closing positive on the day, while the IT sector followed US counterparts higher.

- The ASX 200 finished down -35pts/ -0.49% at 7199

- The IT sector was best on ground (+0.93%) while Utilities (+0.37%) & Communications (+0.17%) closed higher.

- Materials (-0.98%) and Financials (-0.64%) struggled.

- Copper stocks have been hit of late, Sandfire (SFR) fell another 4.86% closing at $5.87. A block of 6.8m shares (1.5% of float), traded at $5.90 this afternoon – worth around $40m.

- Gold names endured another tough session following continued strength by the $US e.g. Gold Road Resources (GOR) -3.09%, Newcrest Mining (NCM) -2.11% and Northern Star (NST) -1.09%.

- UBS have pushed through some chunky upgrades for AGL Energy (AGL) +1.92% which closed above $9 today. They say while consensus estimates already expect AGL to double earnings from FY23 -24, they believe they underestimate AGL’s earnings from 2024-27 which they tip to grow at a 10% CAGR (v 1% consensus). They have a BUY and $9.60 PT – we own in the Market Matters Income Portfolio from $6.96 and intend to hold.

- Treasury Wines (TWE) +0.31% said Australia’s wine exports to China could take years to recover fully after any easing of tariffs.

- Elders (ELD) -3.77% continues to test fresh 3-year lows as the unforgiving market refuses to go “bargain hunting” – we retain no interest.

- Incitec Pivot (IPL) -7.84% whacked after 1H23 earnings missed the mark by around 10%, weakness in the fertilizer division to blame.

- James Hardie (JHX) +1.71% up on broker upgrades following its solid result on Tuesday

- Temple & Webster (TPW) +19.05% jumps as they cycle through COVID comps and return to growth. They also said AI was helping. Throw out the buzzwords for the bots! Not a bad strategy TPW.

- Sigma Healthcare (SIG) -1.45% held their AGM where management reiterated its guidance for FY24 EBIT in the range $26m to $31m

- Not a lot happened for the Uranium stocks today despite a bill banning Russian uranium imports passed the US House of Representatives. It will need to clear the Senate and be signed by President Joe Biden before becoming law, but an interesting development.

- Iron Ore was ~2% higher in Asia today.

- Gold was down overnight to ~US$1988 before tracking sideways in Asia.

- Asian stocks were mixed Hong Kong down -1.18%, Japan +0.74% while China fell -0.36%

- US Futures are all up, around +0.10%

ASX 200 Chart - Intraday

ASX 200 Chart - Daily

Broker Moves

- Select Harvests Cut to Sell at CLSA; PT A$4.10

- James Hardie GDRs Raised to Overweight at Jarden Securities

- PointsBet Raised to Outperform at Credit Suisse; PT A$1.60

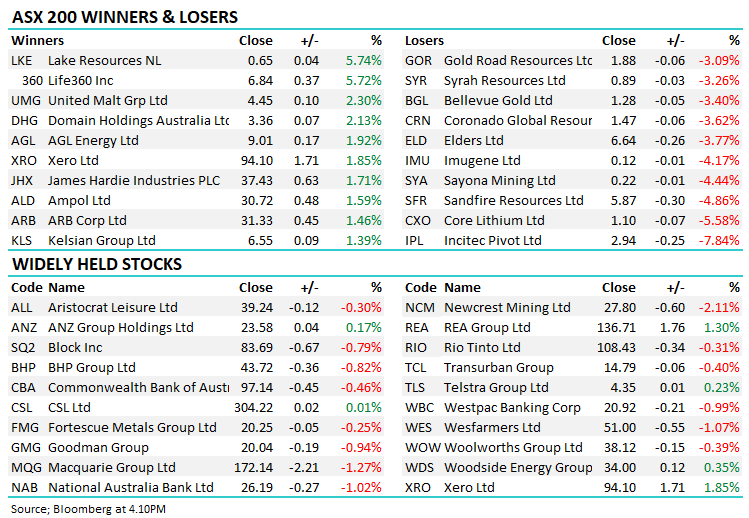

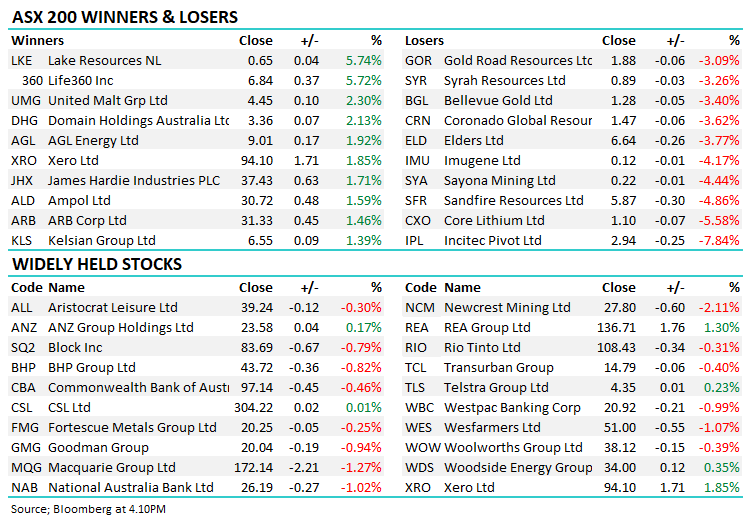

Major Movers Today

Have a great night

The Market Matters Team

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic