The Match Out: ASX drifts lower, Gold & Coal stocks buck the trend

A distinct holiday feel about today’s trade and while the index drifted lower, it still felt like there was a lack of sellers about, and as soon as we get a semblance of positivity from overseas markets, it’s that lack of selling that is key to any Christmas rally that might unfold.

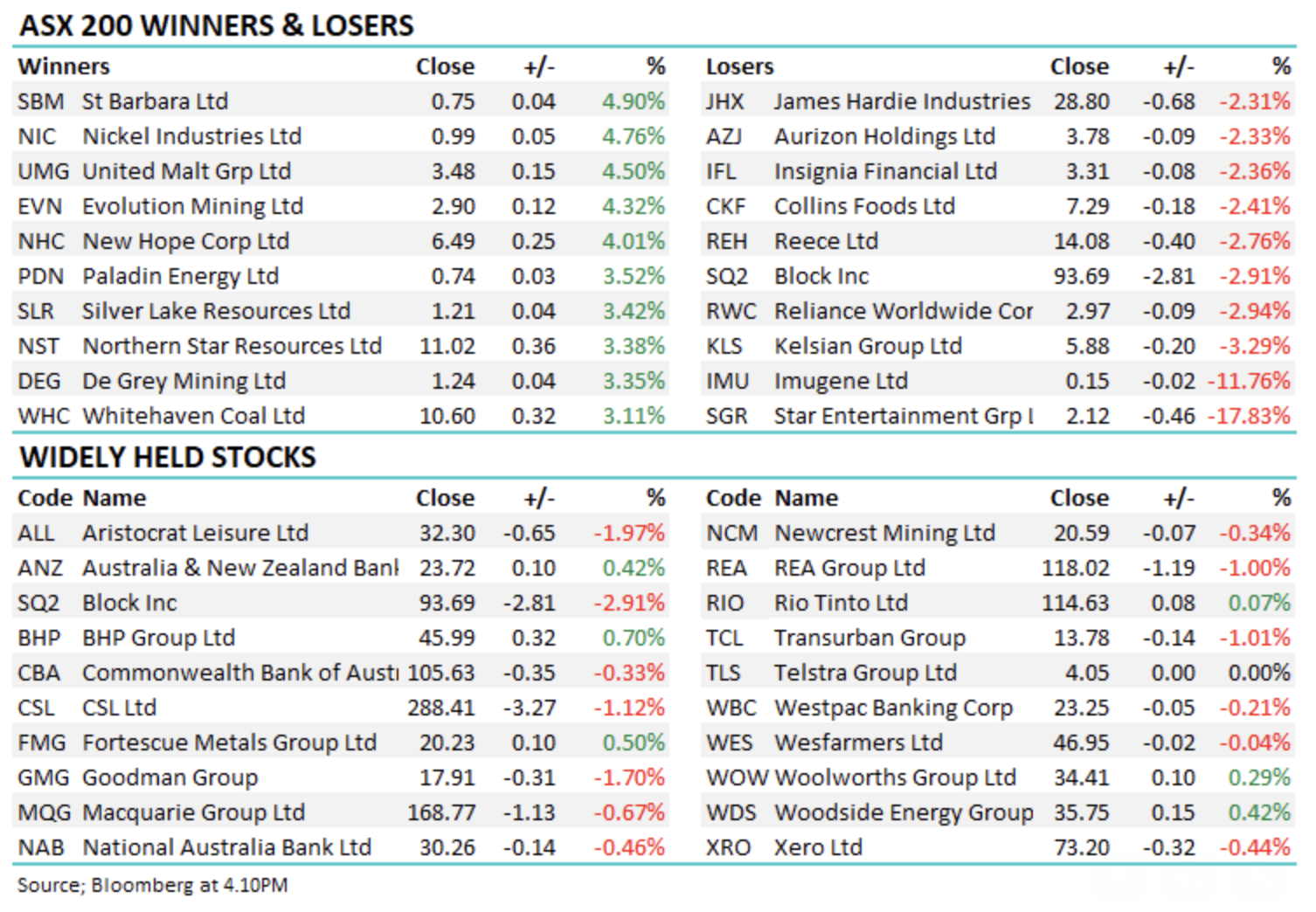

- The ASX 200 finished down -14pts/ -0.21% at 7133

- The Energy sector was best on ground (+0.52%) while Materials (+0.45%) were also positive.

- Property (-1.08%) and Industrials (-0.88%) the weakest links.

- ANZ has downgraded its Australian GDP forecast to 1.5% year-on-year by the end of 2023, from 1.8% previously

- They also said that Gold should hit US$1900 if that sort of scenario was to play out.

- The obvious pockets of strength today came from Gold & Coal, two themes we’ve discussed multiple times in recent notes.

- Whitehaven Coal (ASX: WHC) +3.10% & New Hope Coal (ASX: NHC) +4.01% the standouts in the coal sector

- Evolution Mining (ASX: EVN) +4.32% topped the Gold sector amongst the larger caps while St Barbara (ASX: SBM) +4.9% was strong amongst the 2nd tiers – we own both.

- Newcrest (ASX: NCM) -0.34% on the other hand was the stark underperformer following news that CEO & MD Sandeep Biswas was retiring with the CFO to stand in while they find a replacement.

- Star Entertainment (ASX: SGR) -17.83% whacked on proposed changes to casino tax in NSW.

- Perenti (ASX: PRN) +10.6% rallied after upping FY23 guidance – momentum across mining services is strong at the moment.

- PE firm Anchorage Capital has bought David Jones. David Teoh of TPG fame was also in the ix but was pipped at the post.

- Iron Ore prices were lower on the back of Chinese lockdowns, off around 2.5% but remaining resilient at $US108.50.

- Gold was up overnight and flat in Asian trade today, settled $US1791 at our close.

- Asian stocks were down, Hong Kong off -0.62%, Japan -1.17% while China fell -1.52%

- US Futures are all very flat .

ASX 200 Chart

Star Entertainment (ASX: SGR) $2.12

SGR -17.83%: Was hit today following changes to taxation in NSW that seemed to blindside SGR with the company saying that no details have been made available in relation to the potential reforms including as to how the taxes would be levied or applied at this stage. They went on to say there had been no consultation from the New South Wales Government and they were seeking to urgently engage with the NSW Government as to the sustainability of the proposed tax changes and the impact on its business . They say it is too early and there are simply too few details to ascertain the potential impact of the proposed changes.

Perenti (ASX: PRN) $1.20

PRN +10.60%: The mining services company that used to be known as Ausdrill upped their FY23 guidance today saying that improved conditions and a contract for work at Evolution Mining’s Ernest Henry mine were the main drivers i.e. operational performance rather than anything else.

The details as follows:

- Now expects FY23 revenue of A$2.7b-2.9b vs A$2.6b-2.7b previously

- Now sees FY23 EBITA of A$230m-250m vs A$215m-230m previously

Broker Moves

- Aurizon Cut to Hold at Morgans Financial Limited; PT A$4

- Pilbara Minerals Cut to Market Perform at CICC; PT A$3.64

- Core Lithium Raised to Outperform at Macquarie; PT A$1.30

- Aurizon Raised to Accumulate at CLSA; PT A$4.11

- IGO Raised to Buy at Citi; PT A$17.20

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned