The Match Out: ASX edges higher but RBA still pondering further hikes

The ASX had a positive session, although finished ~40pts below the highs after the latest RBA minutes showed another rate hike is not off the table. The list of today’s winners is an eclectic bunch with one thing in common, most have had a horrible last 12-months, perhaps some bargain hunting might be about to emerge,

- The ASX 200 finished up +29pts/ +0.42% to 7056

- The IT sector was best on ground (+1.33%) while Property (+1.12%) and Financials (+0.78%) also did well.

- Healthcare (-1.21%), Utilities (-0.28%) and Consumer Discretionary (-0.26%) underperformed.

- Australian bond yields moved higher, the 3-year up 13bps to 4.08% following overseas moves + the RBA minutes kept the door firmly ajar for further rate hikes, bond traders have now fully priced in another 0.25% increase by August next year.

- Bapcor (ASX: BAP) -11.53% had a tough day after providing an update at their AGM, saying that 1Q24 trading has been tough amid deteriorating retail conditions – more on this in tomorrow’s Portfolio Positioning Report

- HUB24 (ASX: HUB) +1.42% was up, but finished a long way from early highs after reporting a strong start to FY24 with net inflows of $2.8bn for the quarter, up 34.7% on the previous quarter and broadly in line with PCP. They also announced a number of developments which were a net positive, we think, but those who bought the breakout today will be disappointed.

- TPG Telecom (ASX: TPG) +5.6% rallied on an AFR report saying that Vocus was seeking about $6bn in debt financing, to be used for takeover and Vocus debt refinancing – TPG in the crosshairs!

- Magellan (ASX: MFG) +0.92% is in the news as activist investor Sandon Capital pushes for change – we met with the team at Sandon last week and agree with their approach, and will be supportive of their calls for MFG to concentrate on getting their existing business right, before trying to grow again.

- Rio Tinto (ASX: RIO) +1.2% rallied on strength in Iron Ore prices + stronger than expected copper production for the 3Q.

- Gold stocks cooled today after a good run, Northern Star (ASX: NST) -1.05% and Evolution (ASX: EVN) -0.57%.

- Uranium stocks have also pulled back in the last few sessions, taking a breather after a very solid run, Paladin (ASX: PDN) -3.65% to 92.5c having hit $1.14 late in September.

- The stable of Wilson Asset Management (ASX: WAM) LICs traded ex-dividend today.

- Iron Ore was up 2.7% in Asia, Fortescue (ASX: FMG) +1.35% & BHP Group (ASX: BHP) +0.86%, although both were a long way below highs.

- Gold was down $US4 in Asia at $US1916

- Asian stocks were mostly higher, Hong Kong up +0.70% & Japan put on +0.9%, while China added +0.11%

- US Futures are mildly lower.

- US stocks we own in our International Equities Portfolio reporting this week include: Blackstone (BX US) & Freeport McMoran (FCX US)

ASX 200 chart - intraday

.png)

ASX 200 chart - weekly

.png)

Broker moves

- AVADA Group Rated New Buy at Unified Capital

- Red 5 Cut to Hold at Canaccord; PT 32 Australian cents

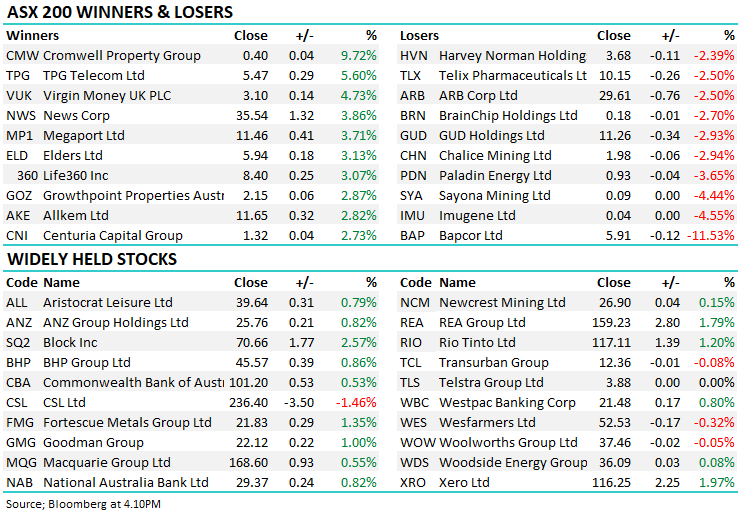

Major movers today

.png)

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live

1 topic

11 stocks mentioned