The Match Out: ASX ends day and week higher, Tech and Commodities lead, Have a great weekend all!

It’s been a very good second half of the week for the ASX as some positive company announcements drove eight stocks in the ASX 200 up more than 10% on the week. And fortunately for MM, we hold four of them across our portfolios, which has led to a good pocket of outperformance. Today saw a carbon copy of yesterday in terms of both the IT and Materials sectors underpinning the rally, while Utilities were the only area to finish the day lower.

- The ASX 200 rallied +50pts /+0.69% to 7362

- IT and Materials were the two hot sectors, although buying was broad-based.

- China is easing mortgage curbs to support the property sector, reports saying the nation’s central bank added enough medium-term funds to keep financial-system liquidity at existing levels.

- This situation is akin to controlled demolition. Evergrande will fall, but I bet there will be very little rubble that gets outside the compound!

- HUB 24 (ASX: HUB) +5.79% rallied again today following yesterday’s very strong update. It’s clear that the growth in independent platforms is accelerating, which bodes well for the entire sector. While we own HUB in our Flagship Growth Portfolio, Praemium (ASX: PPS), which we hold in the Emerging Companies Portfolio, reports its quarterly numbers on Monday.

- We had a briefing from Paul Flynn at Whitehaven Coal (ASX: WHC) +0.62% this morning post their quarterly production numbers this week. The market for their product remains very tight and while prices will ebb and flow, that sort of market dynamic we believe will continue and prices will remain high overall + we could even see some capital management i.e. share buybacks or dividends at the halve rather than the full year given the speed of deleveraging that is playing out – stay long.

- Copper stocks are breaking out, Oz Minerals (ASX: OZL) +5.17% today while more leveraged Sandfire Resources (ASX: SFR) was +6.93% - we’re bullish both

- Gold is knocking on the door of $US1800, a weaker US dollar helping.

- Iron Ore Futures mostly flat in Asia.

- Asian markets were all up, Japan up +1.54%, Hong Kong up +1.33% while China added +0.60%

- US Futures are trading higher, up around 0.40%

ASX 200 Chart

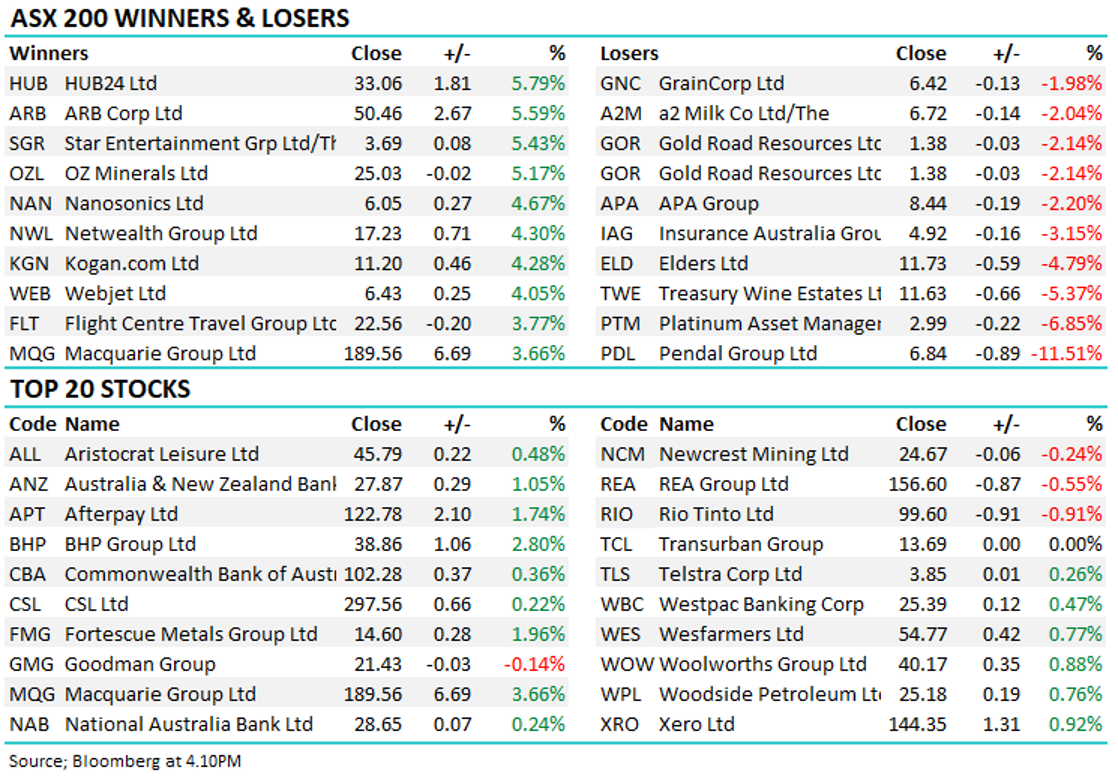

Stocks this week (Source: Bloomberg)

Sectors this week (Source: Bloomberg)

SRG Global (ASX: SRG) 50c

SRG -1.96%: We missed covering this yesterday, but the construction contracting and mining services business hosted its AGM with some positive snippets. While many other contracting businesses are struggling to maintain margins, SRG has managed to keep a lid on wage cost pressure and continue to win work. Management reiterated guidance of 15% EBITDA growth in FY22, with $1 billion of work in hand and a pipeline of another $6 billion worth to bid on – plenty to keep them busy and grow earnings into.

MM remains bullish and long SRG.

SRG Global (ASX: SRG)

Broker moves

- Western Areas Cut to Hold at Canaccord; PT A$3.30

- ARB Raised to Buy at Citi; PT A$55.45

- Whitehaven Cut to Hold at Bell Potter; PT A$3.50

- Treasury Wine Rated New Underweight at Barrenjoey; PT A$10

- Hub24 Raised to Positive at Evans & Partners Pty Ltd; PT A$27.58

- Elders Cut to Hold at Bell Potter; PT A$13.45

- APA Group Cut to Hold at Morgans Financial Limited; PT A$8.71

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

5 stocks mentioned