The Match Out: ASX jumps most in 2 months, M&A in focus with bids for LTR & UMG

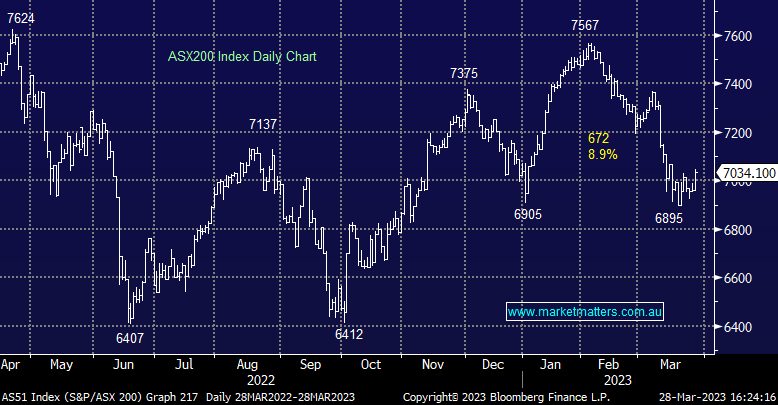

- The ASX 200 finished up +72pts/ +1.04% at 7034

- The Energy sector was best on ground (+4.14%) while Materials (+2.19%) & Financials (+1.11%) were also strong.

- Healthcare (-0.94%) and Tech (-0.61%) the weakest links.

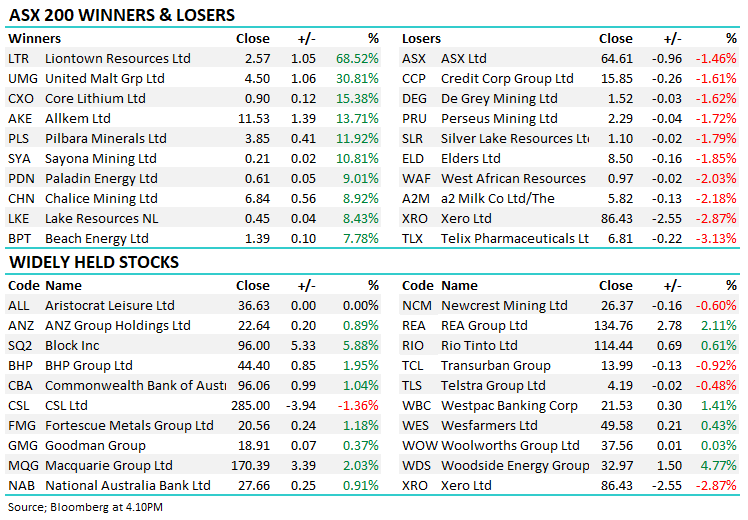

- United Malt Group (ASX: UMG) +30.81% traded to 12-month highs after receiving a bid. UMG has entered into exclusive due diligence with Malteries Soufflet after their $5/sh cash bid was announced.

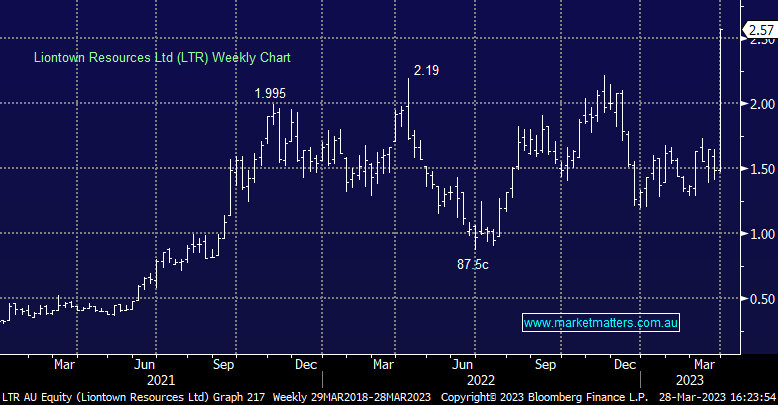

- Liontown Resources (ASX: LTR) +68.52% was also in the crosshairs of a deal today which caused lithium names to rip higher. More on that below

- SRG Global (ASX: SRG) +2.07% won another contract, this time a $55m deal with Fortescue (ASX: FMG). We recently added SRG to the Emerging Companies portfolio with today’s announcement taking them over the $1b mark in contract wins this financial year already.

- Premier Investments (ASX: PMV) +5.63% bounced after a number of brokers upgraded numbers following a strong 1H result. Portfolio Manager Harry Watt joined Ausbiz yesterday to talk retail – click here to watch

- Local Retail Sales data was also out midmorning, up +0.2% for February which was in line with expectations. CPI will be released tomorrow with a wide range of expectations in the market – anywhere from 7% to 7.6% compared to last month’s 7.4%

- Coal stocks caught a bid with improving energy prices, Whitehaven Coal (ASX: WHC) +6.11% and New Hope (ASX: NHC) +4.24%

- Iron Ore added +1.75% in Asia today with all three bulk miners up as a result. BHP (ASX: BHP) saw the best of it, up 1.95%.

- Gold was up marginally in Asia, nothing too significant, sitting at ~US$1958 at our close. Gold stocks were mostly lower though, Evolution (ASX: EVN) fell 1.35%

- Asian stocks were mixed, Japan’s Nikkei flat, Hong Kong and China both up 0.6%.

- US Futures are all up, around +0.15%.

ASX200

Liontown Resources (ASX: LTR) $2.57

LTR +68.52%: the junior lithium company disclosed that it had received 3 takeover offers from global giant Albemarle, sending shares to a new all-time high. The $2.50/sh all-cash bid values Liontown at over $5b and was a 63% premium to yesterday’s close. Liontown rejected the deal saying it undervalues the opportunity in front of the company which expects to start production at its Kathleen Valley project in mid-2024, a view the market agreed with as the stock closed above the bid today. Lithium has been under pressure over the last 3 months as battery manufacturers draw down inventory, however, today’s bid highlights the long-term opportunity in the space and supported a number of lithium stocks as a result.

Liontown Resources

Broker Moves

- Ingenia (ASX: INA) Rated New Buy at Citi; PT A$4.40

- a2 Milk (ASX: A2M) Cut to Hold at Bell Potter; PT NZ$7.30

- Synlait Milk (ASX: SM1) Raised to Accumulate at CLSA

- Premier Investments (ASX: PMV) Raised to Accumulate at CLSA; PT A$28.50

- Beach Energy (ASX: BPT) Raised to Overweight at JPMorgan; PT A$1.65

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

13 stocks mentioned