The Match Out: ASX rallies 1%, US Fed sets a clear path of tapering, Evergrande up 10%

It was a strong day out for the index, gains in technology and energy leading the way. Healthcare and Materials were the main laggards, but still eked out gains of around 0.2%. The talk out of Fed meetings in the US was the main topic on investors’ minds today, Evergrande taking a back seat. The embattled Chinese developer saw shares rally 10% in Hong Kong today as Government support seems to be on its way.

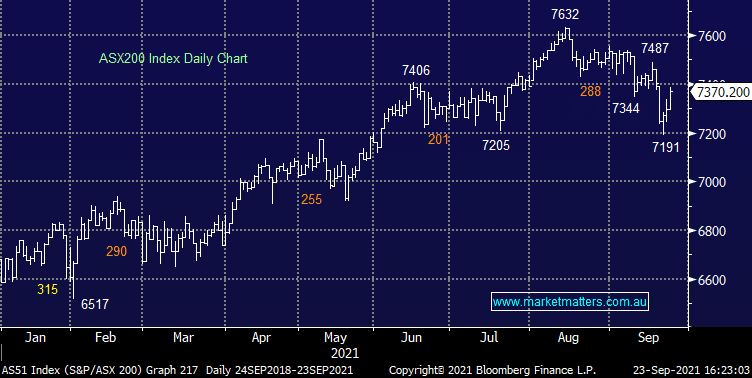

- The ASX 200 finished up +73pts / +1.00% to 7370 – the strongest session since 2nd August

- All sectors closed in the green today. Tech was the standout though strong energy prices helped that sector higher as well

- Tech index heavyweight Afterpay (APT) rallied more than 4% supported by ~2.8% gains for both Wisetech (WTC) and Xero (XRO).

- Materials were left behind today – iron ore stocks rallied early but gave up ground as the session rolled on. Most other commodity stocks were strong though, particularly coal names while yesterday’s top up of copper stock Oz Minerals (OZL) in the Flagship Growth portfolio proved fruitful, rallying +2.68%

- The takeover battle for AusNet (AST) helped support the utility sector

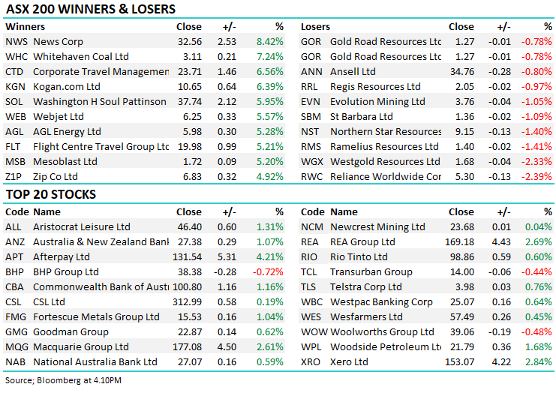

- News Corp (NWS) led the index with a +8.42% jump after shareholders voted to double the share buyback to $US1b

- Travel stocks caught a bid, another day closer to re-opening is the trade here. Corporate Travel (CTD) jumping 6.56%

- Insurance Australia (IAG) said it had received 435 claims relating to the Victoria Earthquakes as of 9AM this morning, though still too early to tell where the claims number will land.

- Transurban (TCL) came back online after completing the ASX’s biggest raise of the year. Shares held up well falling just -0.44% on an entitlement adjusted basis.

- The US Federal Reserve started to set the path away for tapering this morning. Many commentators thought the plan showed bond buying would slow faster than expected, however the market seemed to enjoy a more clear outlook. We will get more out of the Fed tonight

- Gold eased slightly in Asia, trading ~$1,762/oz

- Iron Ore Futures were higher

- In Asia, Shanghai Composite is trading +0.2% higher but is trading near intra-day lows.

- US Futures are pointing to another green night, S&P Futures pointing up +0.30%

Washington H Soul Patts (ASX: SOL)

SOL +5.95%: a bumper FY21 result for the investment company with regular NPAT up 93%. Contributions from investments in Brickworks (ASX: BKW) and New Hope Coal (ASX: NHC) were up 95% and 43% respectively while the main drag on the result came from TPG (ASX: TPM), though mostly as a result in a change in accounting methods relating tot eh investment. WHSP is now finalising a merger with Milton, on track for completion in less than two weeks. It is hoped the merger will increase diversity of the portfolio, NAV and increase liquidity and index weighting of SOL.

Broker moves

- Bapcor Raised to Buy at Citi; PT A$8.25

- PEXA Group Rated New Overweight at Barrenjoey; PT A$23

- AGL Energy Raised to Overweight at JPMorgan; PT A$7.55

- Rio Tinto Raised to Neutral at Oddo BHF; PT 5,100 pence

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

5 topics

10 stocks mentioned