The Match Out: ASX rallies ahead of US Rates decision, Energy the standout

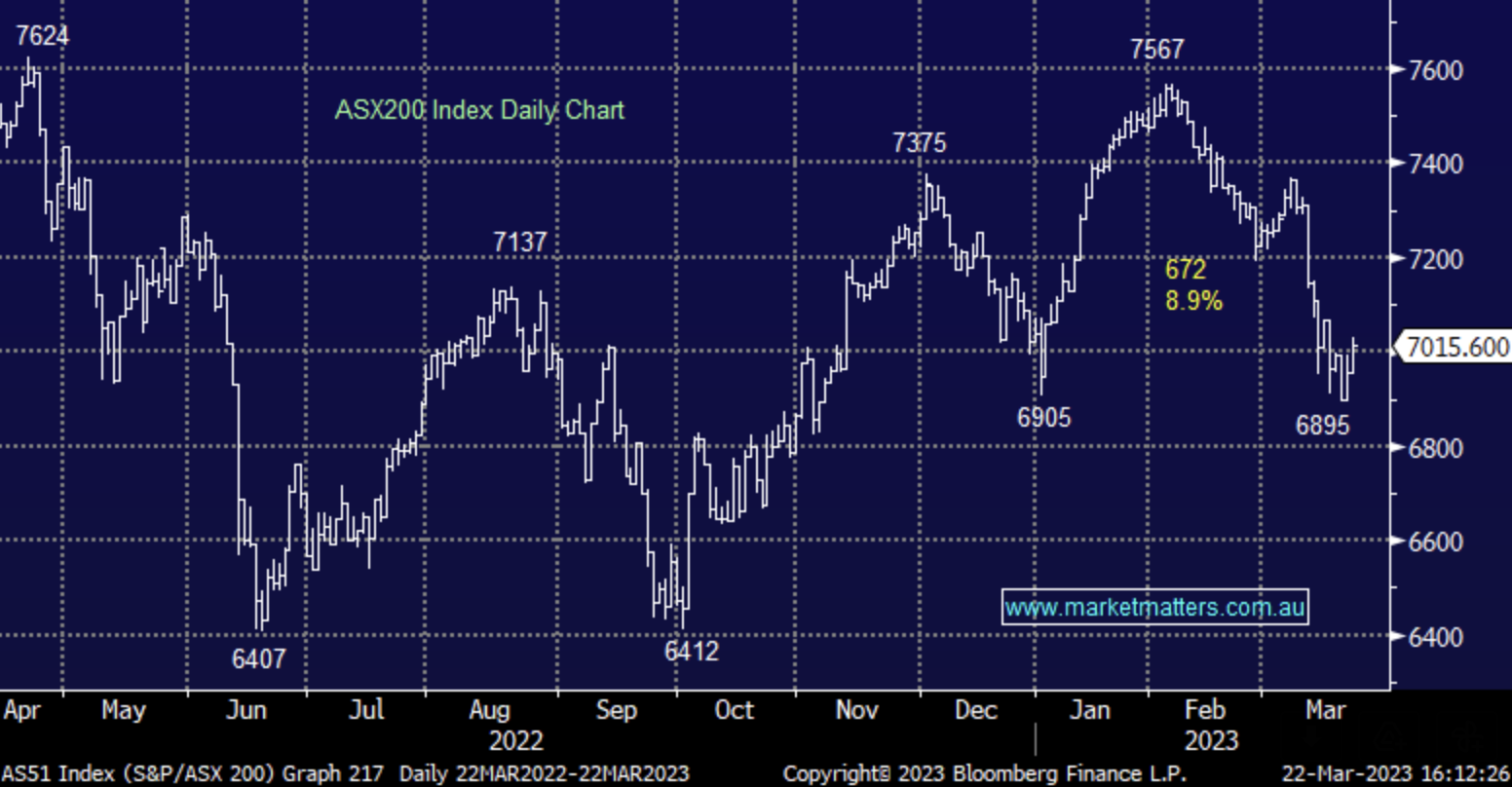

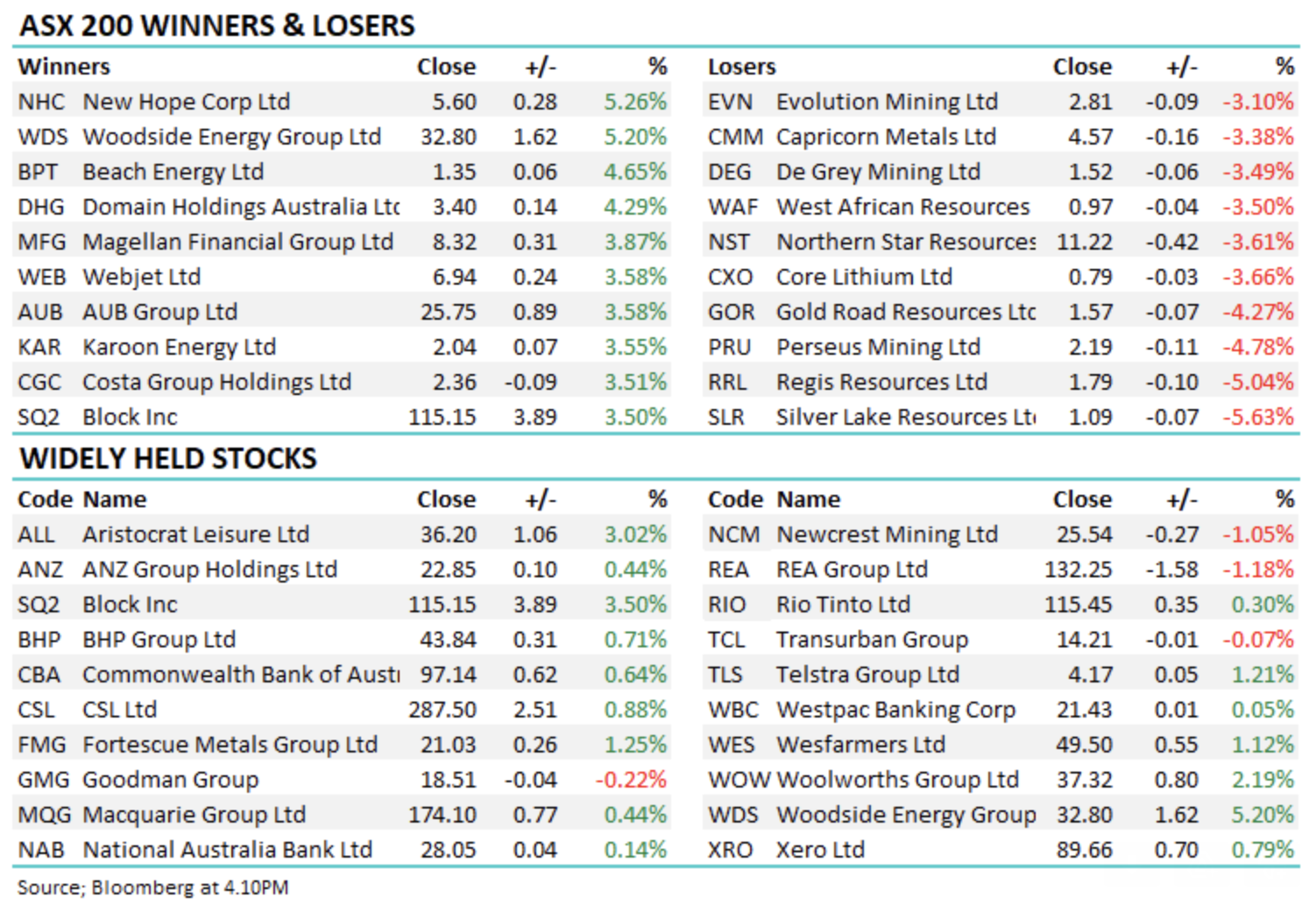

Another positive session pushing the ASX 200 back up through 7000 as a strong bounce back in Energy and steady buying in Materials & Financials underpinned strength at the index level, 70% of the market finished the day on the right side of the ledger as nerves start to calm – for now at least, ahead of the US interest rate decision tonight.

- The ASX 200 finished up +60pts/ +0.87% at 7015

- The Energy sector was best on ground (+4.19%) while Staples (+1.77%) & Consumer Discretionary (+1.42%) were also strong.

- Property (-0.41%) was the only sector to close lower

- The Federal Reserve Rates decision today with a 0.25% hike expected and priced in – more on this below.

- Lead Portfolio Manager James Gerrish on Ausbiz this morning discussing Hybrid Securities – Click Here to Watch

- National Storage (ASX: NSR) Trading Halt: Was out raising some $$ today to replenish the war chest, something they typically do once a year.

- KMD Brands (ASX: KMD) +1.06%: 1H results for the recreational apparel company came in largely as expected given most numbers were pre-released

- New Hope (ASX: NHC) +5.26% was strong again today after a solid 1H23 result yesterday and a great dividend announcement. We own.

- Perpetual (ASX: PPT) +2.81% has been incredibly soft in recent weeks, obviously a leveraged play on markets that have been tough, however, some respite from Jarden this morning who raised it to buy equivalent and $27 PT. We own a small 2.75% position in the Income Portfolio as a result of the Pendal takeover, and we’re looking to up weight this at some point.

- Hybrids were bought into recent weakness today – the AN3PI which we own hit $97 yesterday and closed at $100.30 today.

- Morgan Stanley think Seven Group Holdings (ASX: SVW) is likely to take Oz Minerals (ASX: OZL) place in the ASX 100, while Neuren Pharmaceuticals (ASX: NEU) should make the cut for the ASX 200

- Iron Ore has finally given back some recent strength, trading lower for a third day on signs that the steel market isn’t picking up even as peak construction season approaches, it traded below $120 a ton for the first time in six weeks today. Fortescue Metals (FMG) +1.25% and Rio Tinto (RIO) +0.30% still bucked the trend.

- Gold was weaker overnight, down US$40 and was flat in Asia today, ticking around $US1940 at our close.

- Asian stocks were solid, Hong Kong added +2.02%, Japan +2% while China was up +0.26%

- US Futures are flat

ASX 200 Chart

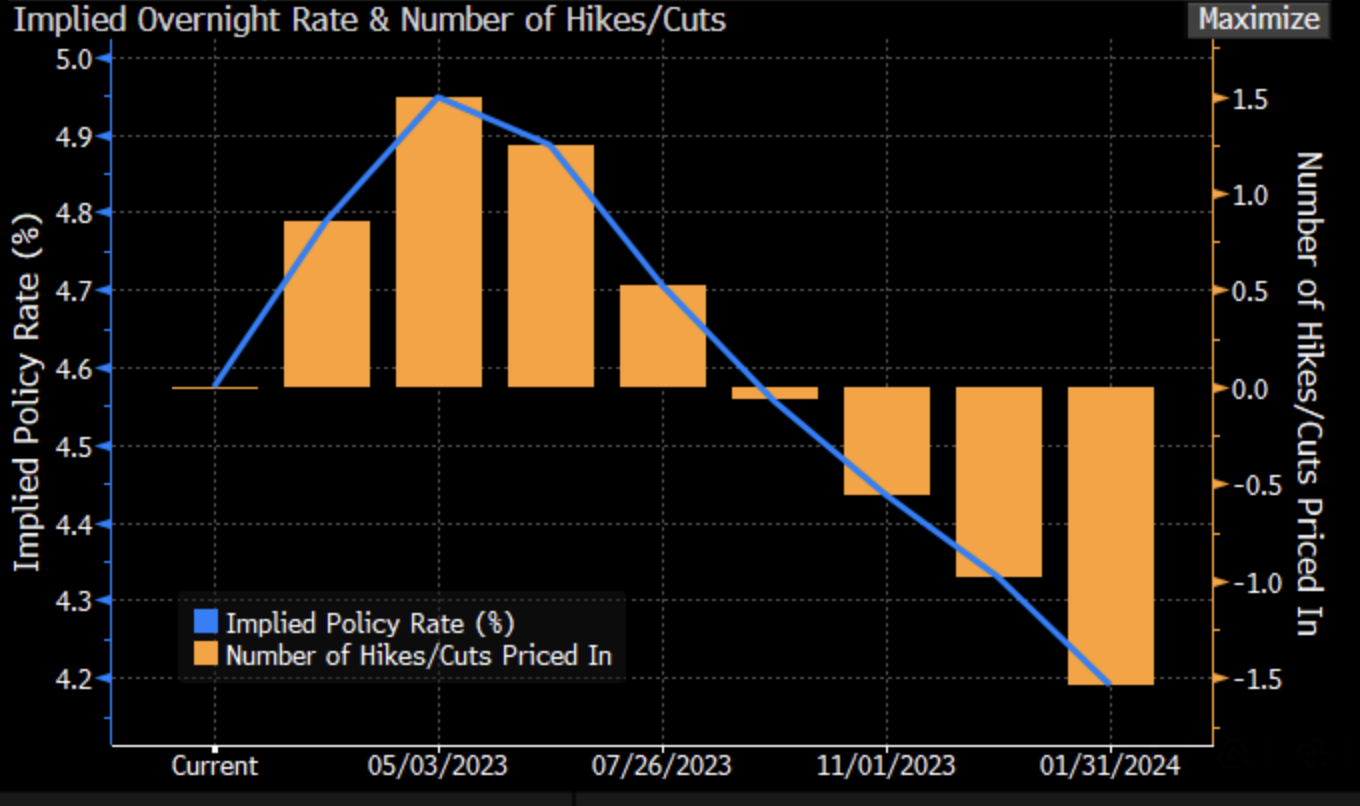

US Rates Decision

The US Federal Reserve is expected to raise rates by 0.25% tonight, however, the hike is expected to be a ‘dovish one’ with commentary likely to suggest that they’re nearing a ‘wait and see’ moment. At MM, we think they would be better off pausing now given what’s` playing out in markets and the financial tightening this will clearly have, with banks becoming more reluctant to lend, however we suspect they’ll move and equities will take it well, a sign of confidence in the system!

- The below chart looks at expectations for rates, Futures pricing one and done before a series of cuts

US Interest Rate Expectations – Source Bloomberg

Buy Hold Sell with Livewire Markets

Earlier in the month, Lead Portfolio Manager James Gerrish featured on Buy Hold Sell with Blake Hendricks from Firetrail Investments, covering 3 heavily sold-off stocks (and 2 now on fundies’ radars)

National Storage REIT (ASX: NSR) $2.45

NSR (Trading halt): Was out raising some $$ today to replenish the war chest, something they typically do about once a year. The $325m equity raise was being structured as an institutional placement ($300m) with an attached $25m share purchase plan for existing retail holders, the price determined via a bookbuild with a range of $2.33-$2.41 being touted. They then ask for bids in 1c increments and the deal gets done. Street Talk reported this afternoon the price was set at the lower end of the range, being $2.33. The SPP will be priced at the same level as the placement, although best to wait for confirmation on price by the company!

- We like NSR and it remains on the MM Hitlist, a pullback into the low $2.30’s will have us interested.

KMD Brands (ASX: KMD) 95c

KMD +1.06%: 1H results for the recreational apparel company came in largely as expected given most numbers were pre-released. Sales jumped +19% in their largest segment of surf, while Kathmandu saw 51% growth on pcp and Oboz (which is their hiking boots brand) was up 124% to a new record. Total group sales were 35% higher to $NZ548m, Underlying EBITDA +344% to $45m and the company will pay a 3cps dividend for the half, all as expected. The outlook was what the market was after, and the strong sales momentum seems to have continued as travel and tourism picks up with February sales up 32%. On the negatives, KMD is carrying a decent debt balance at the moment, and higher rates will impact their FY earnings.

Broker Moves

- Stanmore Resources Ltd Rated New Buy at Ord Minnett; PT A$4.40

- Mincor Cut to Hold at Bell Potter; PT A$1.70

- CBA Raised to Neutral at Jarden Securities; PT A$98

- Perpetual Raised to Overweight at Jarden Securities; PT A$27

- Mincor Cut to Neutral at Jarden Securities; PT A$1.40

- ANZ Group Raised to Overweight at Jarden Securities; PT A$24.80

- DGL Group Rated New Hold at Barclay Pearce Capital; PT A$1.93

- Arafura Rare Earths Rated New Overweight at JPMorgan

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned