The Match Out: ASX slides as the RBA hikes rates with more to come, more outflows at Magellan

The ASX was positive/strong early, considering there was no trade in the US overnight, with a more positive session in commodities the catalyst. But after an 11am peak, it was all one way traffic from there, with another leg lower following the RBA’s decision to hike rates by another 0.50%.

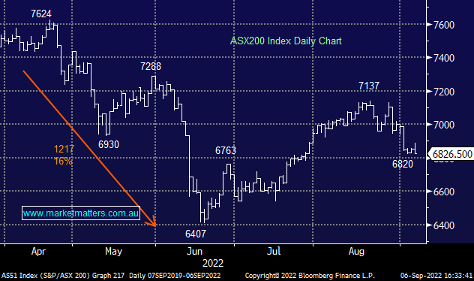

- The S&P/ASX 200 lost -25points / -0.38% to close at 6826

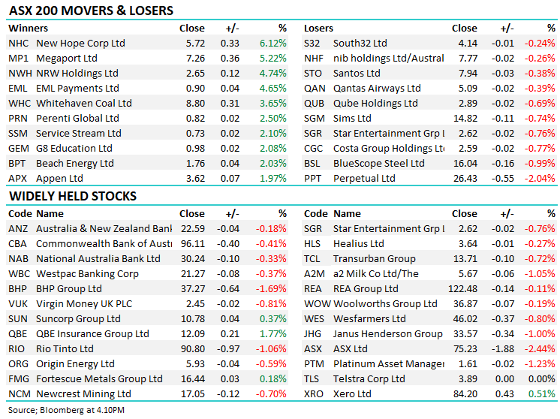

- IT (+0.67%) and Energy (+0.50%) led the line while Communications (+0.07%) also outperformed.

- Utilities (-1.86%) were the standout drag, while Materials (-0.70%) also fell.

- As expected the RBA raised interest rates this afternoon by 50bp to 2.35% - with more to come, although we suspect that will be the final 50bps hike.

- Equities retreated post the RBA’s move while the AUD fell below 68c.

- Our Research Lead Shawn Hickman was on Ausbiz this morning talking Copper and Gold stocks – Click Here to view

- Magellan (ASX: MFG) -2.01% fell on a weak FUM update for August – the slide continues

- Uranium and Lithium stocks were the star of the show today, Paladin (ASX: PDN) +7.78% and Pilbara Minerals (ASX: PLS) +7.03% both held in Market Matters Portfolios.

- Coal stocks continue to be supported, New hope Coal (ASX: NHC) +6.12% the main winner while Whitehaven Coal (ASX: WHC) continues rally up another +3.65% to a new record at $8.80

- Elders (ASX: ELD) -0.35% drifted lower despite a positive Australian crop report for September which included a circa 9% upgrade to the Australian winter crop forecast and forecast back-to-back strong Australian summer crops.

- AGL Energy (ASX: AGL) -2.09% starting to look interesting again closing today at $7.04

- Iron ore was higher, up +2% in Singapore.

- Gold also advanced in Asia trading for US$1719/oz.

- Coal in Asia hitting a new high at $US439/mt

- Asian markets were mostly higher, the Nikkei in Japan fell -0.14%, but other markets were up, Hong Kong +0.50% & China put on +0.91%

- US Futures are higher, up around 0.60%

ASX 200 chart

Magellan (MFG) $12.19

MFG -2.01%: the fund manager reported their FUM flows for August showing the slide continues. A total of $1.3b in outflows were recorded in the month alone, coupled with an additional $1.3b fall from performance and FX movements. The outflows were split pretty evenly between retail and institutional money, though focussed on international and infrastructure funds with the Aussie Equities FUM actually higher in the month. It follows a $5.2b outflow in the June quarter, now down nearly 40% calendar year to date. Shares are on around 10x FY23 earnings, make it extremely cheap, however there remains a lot of work in turning around these flow numbers.

Broker moves

- Integral Diagnostics Rated New Hold at Barclay Pearce Capital

- Resimac Group Rated New Buy at Barclay Pearce Capital; PT A$2.38

- Peter Warren Automotive Rated New Buy at Barclay Pearce Capital

- Aurelia Rated New Buy at Barclay Pearce Capital; PT A$1.07

- Gold Road Rated New Buy at Barclay Pearce Capital; PT A$1.47

- Perseus Rated New Buy at Barclay Pearce Capital; PT A$2.29

- AOF AU Rated New Underperform at Barclay Pearce Capital

- Breville Cut to Neutral at Macquarie; PT A$23.10

Major movers today

Enjoy your night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

7 stocks mentioned