The Match Out: ASX snaps 4-day sell-off, Property stocks & the ‘dirty-bird’ shine!

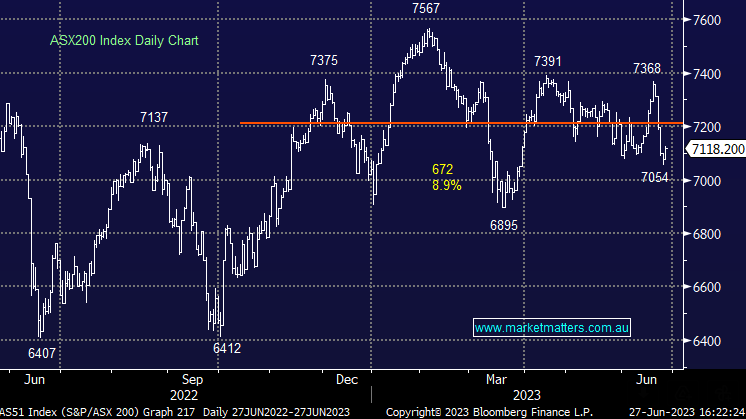

Some respite from the recent selling today with the market snapping a ~300pt/ 4.1% pullback for the ASX 200 over just 4 trading days, as buying amongst the influential miners and the under-pressure property stocks drove the index higher, 3 days before we rule the books off on FY23. As we wrote this morning, the Australian bourse is up ~8% before dividends, a healthy result if we consider both the economic backdrop and geo-political headwinds in play, as the RBA hiked interest rates at an unprecedented speed taking them to fresh 11-year highs, the US experienced a Banking Crisis, China’s economy is struggling to recover from extreme COVID lockdowns and war is still raging in Ukraine to name just a few.

In our opinion, we have entered a new cycle that’s going to last for years as interest rates end their more than three-decade-old bear market i.e. markets are going to be dominated by stock and sector rotation as global economic strength ebbs and flows.

- The ASX 200 finished up +39pts/ +0.56% at 7118

- The Property sector was best on ground (+1.95%) while Materials (+1.16%) & Financials (+0.66%) were also strong.

- Communications (-0.65%) and IT (-0.37%) the weakest links.

- The ANZ Roy Morgan consumer confidence survey again painted a bleak picture, its 17th straight week below 80pts which is the longest it has been this low since the recession of 1990/91.

- That speaks to how downbeat we all are, however, the share market is not necessarily the economy and some companies will continue to thrive.

- Property stocks did well today on the back of reports NSW premier Chris Minns wants to loosen development rules on Sydney’s apartment developers.

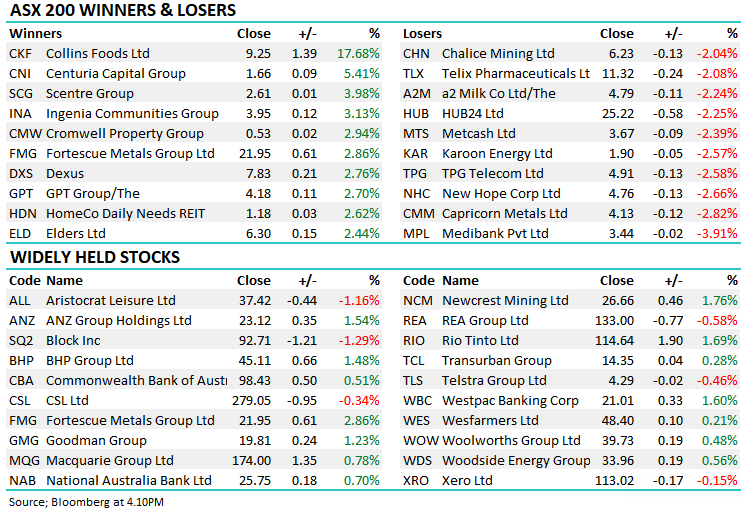

- Centuria (ASX: CNI) +5.41% was solid, albeit this has been a frustrating position for us, Centre Group (ASX: SCG ) +3.98% & Dexus (DXS) +2.76% were also strong.

- Medibank (ASX: MPL) -3.91% fell after APRA took aim at the insurer post the recent cyber incident, requiring them to hold $250m more capital.

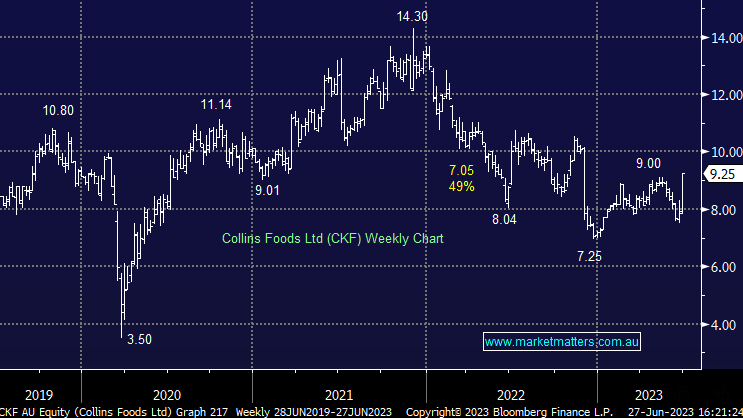

- Collins Foods (ASX: CKF) +17.68%, the owner of the ‘dirty-bird’ delivered weak profits, but not as weak as the market had anticipated, will this be a theme over the upcoming reporting period?

- PointsBet (NYSE: PBH) was in a trading halt pending a likely takeover transaction.

- Metcash (ASX: MTS) -2.39% gave back half of yesterday’s rally, as Citi has cut its PT by 7% to $4 . UBS are more upbeat with a $4.50 PT and buy, however, they did reduce that from $4.75 following yesterdays FY23 update.

- Magellan (ASX: MFG) +2.44% was up supported by an AFR article that claims the struggling manager could be worth more than $15. We’ve recently turned more positive on MFG, agreeing with the genesis of the article. MFG closed today at $8.83.

- Bega (ASX: BGA) -0.87% had a volatile session following a trading update, they say fewer cows means higher competition for farm gate milk which is pushing up prices.

- Star Entertainment (ASX: SGR) -0.50% traded sub $1 today, the first time ever for the struggling casino operator.

- Elders (ASX: ELD) +2.44% is starting to look interesting, perhaps the worst is now behind them, they’ve certainly had a tough year.

- A2 Milk (ASX: A2M) -2.24% on the other hand looks horrible, with more downside likely in MM’s view.

- Iron Ore was ~4% higher in Asia today supporting Fortescue (ASX: FMG) +2.86% & RIO +1.69%

- Gold was up a touch overnight and edged higher today, ~US$1927 at our close.

- Asian stocks were solid, Hong Kong added +2.10%, Japan was flat, while China rallied +1.33%

- US Futures are all up, around +0.30%

ASX 200 Chart

Collins Foods (ASX: CKF) $9.25

CKF +17.68%: the owner of KFC and Taco Bell franchises rallied to a 6-month high today following a beat on FY23 results released this morning. Revenue was up 14% to $1.35b, though Net Profit After Tax (NPAT) fell to $51.9m. Despite this, the fall was better than feared, coming in around ~8% above consensus expectations. Shares were weak into the result, hitting a 5-monthh low on fears rising costs would chew into both margins and volumes, however, the company has managed to steer itself through the squeeze so far. The biggest win came from Europe which saw margins improve in the 2H while still growing sales. FY24 has also started well with positive same-store sales growth for the first 7 weeks seen across all business segments. That includes +8.8% for the key KFC Australia brand which includes ~14% increase in price and a ~6% drop in volume.

Broker Moves

- DDH1 Cut to Neutral at Macquarie; PT A$1.01

- Perenti Cut to Neutral at Citi; PT A$1.25

- Technology One Raised to Buy at Goldman; PT A$18.30

- NEXTDC Rated New Overweight at Barrenjoey

- Megaport Rated New Neutral at Barrenjoey; PT A$7.50

- WA1 Resources Rated New Speculative Buy at Argonaut Securities

- DDH1 Cut to Hold at Bell Potter; PT 94 Australian cents

- DGL Group Cut to Speculative Buy at Blue Ocean; PT A$1.05

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

12 stocks mentioned