The Match Out: ASX treads water to start the week

Markets @ Midday: Market Matters Midday update with Harry Watt – Listen Here

A lackluster way to start the week with the market chopping around in a tight 27pt trading range as strength in Energy & Property was offset by weakness amongst the Resources, particularly the Lithium stocks that got the jitters after a new Chinese Lithium Futures product was met by a barrage of selling…

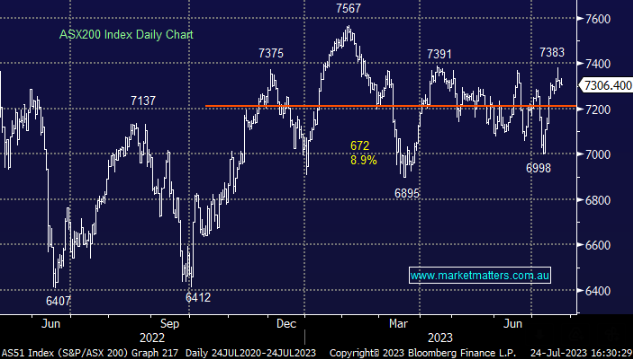

- The S&P/ASX 200 lost -7pts points / -0.10% to close at 7306

- Energy (+2.20%), Real-Estate (+0.91%) & Communications (+0.78%) the pick of the bunch.

- Materials (-1.41%), Staples (-0.34%) and IT (-1.45%) the biggest drags.

- Core Lithium (ASX: CXO) -17.24% hit today after saying they would produce 90-100k tonnes of Spodumene in FY24 (largely inline with expectations) however their FY25 guidance was weak as they flagged capacity constraints at their processing plant. In a recent Resource Webinar (here) we discussed the complexities in producing Lithium and this is an example of that playing out.

- They chose a bad day to come out with negative news with Lithium prices on the skids – China has launched a new Lithium Futures Exchange that traded limit down when it launched on Friday. We’ll have more in this once our Chinese interpreter goes through the finer details!

- Other Lithium stocks were also lower, Pilbara (ASX: PLS) -5.75%, Allkem (ASX: AKE) -5.58%, Mineral Resources (ASX: MIN) -2.57% and Global Lithium (ASX: GL1) -6.98%

- Energy stocks had a strong day - Coal companies were generally bullish with Whitehaven (ASX: WHC) +3.14%, Bowen Coking Coal (ASX: BCB) +3.57% & New Hope (ASX: NHC) +3.65% while Woodside (ASX: WDS) +2.34% looks to have broken out of its range.

- Signs growing that demand is starting to overcome supply in energy markets should be bullish – for our updated views on the coal stocks see last week’s note on the topic here.

- South32 (ASX: S32) -2.62% fell after writing down the value of its proposed Hermosa project in the US to the tune of US$1.3bn.

- Monadelphous (ASX: MND) -4.73% lost ground after JP Morgan downgraded to Neutral….lots of other broker moves out today which are listed below.

- Lots of Central Bank action this week including….

- The Fed is expected to hike rates to 5.25%-5.5% on Wednesday, their highest level in 22 years. The decision will be closely followed by a statement by Jerome Powell.

- The ECB is expected to hike rates by 0.25% on Thursday with the most attention resting on Lagarde’s plans beyond July i.e. is the ECB approaching the end of the most aggressive tightening cycle in its 25-year history?

- The BOJ is not expected to pivot towards tighter monetary policy with no changes expected on Friday, interest rates around zero are a distant memory in Australia.

- Inflation data due out in Australia on Wednesday which will go a long way in determining whether or not the RBA pause - currently, the probability of a hike is sitting at 45%.

- Iron Ore was up a touch in Asia, but nothing dramatic.

- Gold was flat at $US1960 at our close

- Asian stocks were mixed, Hang Seng off -2.3%, the Nikkei in Japan added +1.1%, while China lost -0.61%

- US Futures are flat – stocks we own in our International Equities Portfolio reporting this week include Microsoft (MSFT US), First Solar (FLSR US), Peabody Energy (BTU US), Brunswick (BC US) & Chipotle (CMG US).

ASX 200 Chart

Bowen Coking Coal (ASX: BCB)

BCB +3.57%: the Queensland coal company rallied today in line with peers, though they also released their June quarter production numbers late in the day. Operationally they’ve shown an improvement with Run-of-mine (ROM) numbers up 27.3% on pcp, though they only managed a 15% increase in coal sales. This has constrained cash flow for the company which should be seeing a greater benefit from higher coal prices but instead has seen stockpiles grow 85% on pcp. The good news is that $31.4m in sales have been booked for this month with four ships of Bowen Coal hitting the seas in June. 199kt of coal was shipped in total for the month, a rate they are aiming to maintain for the current quarter which would put them well ahead of expectations. Bowen recently raised money to fund the continued ramp-up of their processing plant along with other growth projects.

Broker Moves

- Northern Star Cut to Hold at Ord Minnett; PT A$12.30

- Ingenia Raised to Overweight at Jarden Securities; PT A$4.40

- Aurizon Cut to Neutral at Jarden Securities; PT A$3.70

- Centuria Capital Cut to Neutral at Jarden Securities; PT A$1.80

- Centuria Industrial Raised to Neutral at Jarden Securities

- Abacus Property Cut to Neutral at Jarden Securities; PT A$2.85

- Adbri Cut to Underweight at JPMorgan; PT A$2.20

- Accent Group Cut to Sell at CLSA; PT A$1.50

- Premier Investments Cut to Sell at CLSA; PT A$19

- Myer Raised to Reduce at CLSA; PT 65 Australian cents

- Harvey Norman Cut to Sell at CLSA; PT A$3.30

- Breville Cut to Sell at CLSA; PT A$18.50

- JB Hi-Fi Cut to Reduce at CLSA; PT A$45

- CSR Raised to Reduce at CLSA; PT A$5.30

- Boral Raised to Reduce at CLSA; PT A$4.30

- Wesfarmers Raised to Buy at CLSA; PT A$57.10

- REA Group Raised to Reduce at CLSA; PT A$153

- Carsales.com Raised to Buy at CLSA; PT A$29

- Woolworths Group Cut to Reduce at CLSA; PT A$40.50

- James Hardie GDRs Raised to Accumulate at CLSA; PT A$45

- Monadelphous Cut to Neutral at JPMorgan; PT A$13

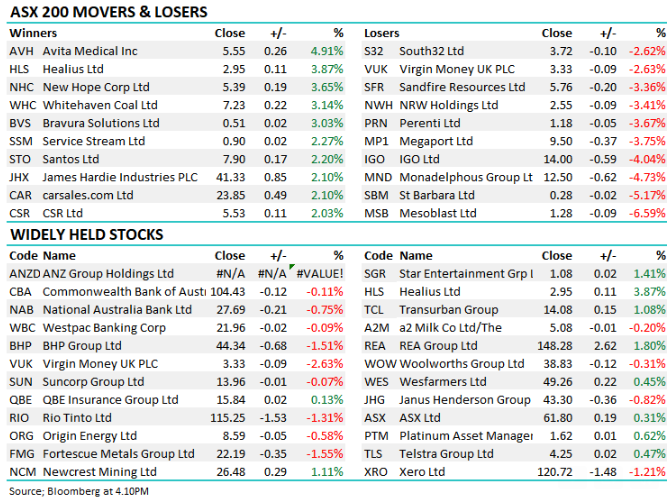

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

11 stocks mentioned