The Match Out: Data takes ASX to new highs, BHP puts up a reasonable quarter

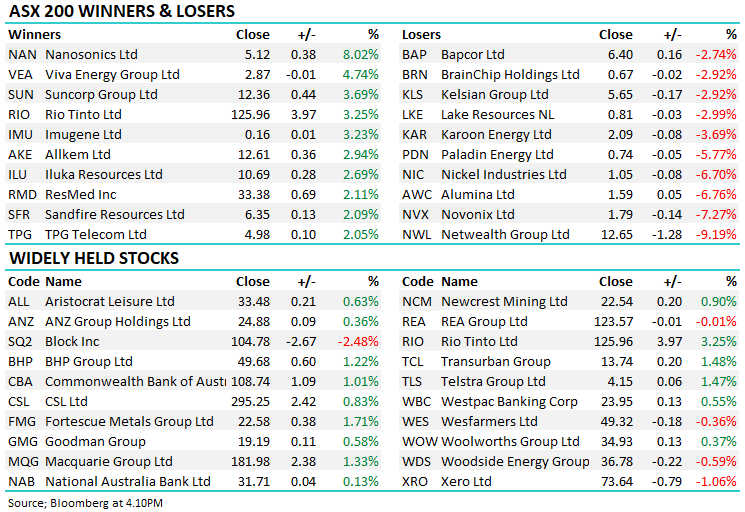

Local shares shrugged weakness seen in international markets today to storm to a new 8-month high. The market eased slightly on the open, however, once employment data hit at 11.30am, buyers stepped up to the plate. Despite the strength in the index, only half of the ASX200 managed a gain today- clearly the heavyweights doing the heavy lifting. The influential sectors of Materials and Financials were the top performers while Tech and Energy both struggled.

- The ASX 200 finished up 41pts/ +0.57% at 7435

- The Materials sector was best on ground (+1.02%) while Telcos & Healthcare (both +0.9%) were also strong.

- The laggards included Real Estate (-0.94%) and Utilities (-0.65%).

- Local employment data was the main driver of the buying. Unemployment unexpectedly rose slightly to 3.5% and the Participation rate dropped 0.2% on a surprise fall in employment. Bond yields fell as a result with investors bringing forward their expectations of a more accommodative RBA.

- BHP +1.22%, 2Q production numbers out today were reasonable. More on that below

- Praemium (ASX: PPS) & Netwealth (ASX: NWL) both reported 2Q FUA flows. We touch on the investment platforms stocks below.

- Nanasonics (ASX: NAN) +8.02%, the medical devices company upgraded revenue growth expectations from 20-25% to 36-41% after a strong 1H. Margins are also expected to increase with the added scale.

- Alumina (ASX: AWC) -6.76%, struggled after their JV partner flagged higher costs and lower prices. The company is hopeful that a resurgence in Chinese demand can turn the tide.

- Santos (ASX: STO) -1.63%, 4Q production numbers were largely in line, though guidance was weak as they wind down one asset and struggle to ramp up another.

- Iron Ore rose 0.95% in China today with Rio Tinto (RIO) once again seeing the best of the gains in the space, up +3.25%

- Asian stocks were mixed again. Japan’s Nikkei struggled the most, currently trading down -1.4% while the Hang Seng trades marginally higher.

- US Futures are all weaker by between 0.1-0.2% each.

ASX 200 Daily Chart

Investment Platforms – Netwealth (NWL) $12.65 & Praemium (PPS) 78.5c

NWL -9.19%, PPS -1.26%: both stocks released 2Q Funds Under Administration (FUA) updates today and followed the slide seen in peer Hub24 (HUB) after their update earlier in the week. Netwealth saw FUA inflows of $2.1b, with FUA rising 7.4% in the quarter, though inflows were slower than 2Q22. Praemium posted a similar slowdown on their end, seeing just $1b of net inflows across the 1st half. Retail investments have been hindered by low sentiment across the board, weighing on these companies ability to scale operations. The slowing growth weighed on shares today, though Netwealth said the margin on cash held on behalf of clients would increase to 1.35% from the start of the calendar year, up from 1.15-1.2% in the first half thanks to rising interest rates – a phenomenon that is likely to be seen across the peer group as well.

Praemium (PPS)

.png)

BHP Group (BHP) $49.68

BHP +1.22%: The Big Australian continues to knock on the door of $50/sh, doing little to harm its prospects in today’s 2Q production update. Western Australian Iron Ore ran at a record pace in the 1H, with 2Q production up 1%. Copper production was also strong, up 16% and met coal coming in +10% on 2Q22. Guidance remained unchanged across the segments despite a fall in production of thermal coal and nickel, though the company noted production will be at the low end of the guidance range for copper and coal. Overall, a decent announcement today, though shares lagged peers.

.png)

Broker Moves

- Mirvac (ASX: MGR) Group Cut to Neutral at Macquarie; PT A$2.30

- Suncorp (ASX: SUN) Raised to Overweight at Morgan Stanley; PT A$14.50

- Insurance Australia Group (ASX: IAG) Raised to Equal-Weight at Morgan Stanley

- Woodside (ASX: WDS) Cut to Underweight at Jarden Securities; PT A$33

- Karoon Energy (ASX: KAR) Cut to Neutral at Jarden Securities; PT A$2.30

- GPT Group (ASX: GPT) Raised to Equal-Weight at Morgan Stanley; PT A$4.84

- Scentre Group (ASX: SCG) Raised to Overweight at Morgan Stanley; PT A$3.55

- Vicinity (ASX: VCX) Raised to Equal-Weight at Morgan Stanley; PT A$2.26

- Nickel Industries (ASX: NIC) Cut to Underperform at Jefferies; PT A$1

- Ampol (ASX: ALD) Cut to Accumulate at CLSA; PT A$31.87

- Telix Pharma (ASX: TLX) Cut to Accumulate at CLSA; PT A$7.90

- Integral Diagnostics (ASX: IDX) Cut to Neutral at Citi; PT A$3.20

- Ansell (ASX: ANN) Cut to Neutral at Citi; PT A$30.75

- ResMed GDRs Raised to Buy at Citi; PT A$37

- Redbubble (ASX: RBL) Cut to Hold at Morgans Financial Limited

- Ampol (ASX: ALD) Cut to Neutral at Credit Suisse; PT A$30

Major Movers Today

.png)

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

19 stocks mentioned