The Match Out: Despite all the doom & gloom, ASX up ~5% for the Quarter

A solid day to end the week, month & quarter with the ASX putting in strong back-to-back sessions, the market up +3.2% this week alone led by a strong bounce back in Material stocks. For the quarter, the market was up +5.40% inclusive of dividends with the Consumer Discretionary sector up an impressive 12% - this goes to show that market performance doesn’t correlate with mainstream media headlines, so much for the doom & gloom in retail!

- Today, the ASX 200 finished up +55pts/ +0.78% at 7177

- The Material sector was best on ground (+1.88%) while Healthcare (+1.09%) & IT (+0.83%) were also strong.

- Energy (-0.84%) and Staples (-0.03%) the weakest links.

- End of month & end of the quarter and it’s been a good one for Market Matters Portfolios – more details out next week however the Flagship Growth Portfolio is up north of 7.5% for the period while it’s added ~22% FY23 to date.

- IT’s great to see the increase of investors using our new digital investment platform, Market Matters Invest making it incredibly easy to invest in our portfolios – welcome aboard!

- If you’d like to sign up for our Free Monthly Portfolio Update report, you can do so here which provides monthly insight into performance and portfolio positioning.

- More bank downgrades today, this time CLSA reducing NAB, WBC & BOQ, coming on the back of a sector downgrade from UBS earlier in the week. The old saying that analysts make sheep look like independent thinkers rings true!

- Porter Davis Homes, the country’s 12th-largest home builder, has gone into liquidation, more than 1700 projects in limbo across Victoria and Queensland.

- EML Payments (ASX: EML) +30.95 rallied hard (from a dismal base) after the Central Bank of Ireland provided some certainty around their future, instilling a nil percent growth cap to PFS card services until 31st March 2024. Not long ago this would have been taken as a negative, however, the SP has fallen some much the news is actually a net positive. They re-affirmed guidance for FY23, being revenue of $235-$245m and underlying EBITDA of $26 - $34m.

- HMC Capital (ASX: HMC) -1.64% completed a $125m placement at $3.50 to help fund the purchase of some Healthscope assets.

- We had Tom Alan in today, Energy Analyst from UBS refreshing his views on the sector. They have buys on AGL Energy (ASX: AGL), although the stock is now at their $8.05 PT, Beach (ASX: BPT) & Santos (ASX: STO). We own AGL and Woodside (ASX: WDS) across MM portfolios – they have a hold on WDS, preferring STO.

- Iron Ore was ~1.2% higher in Asia today supporting Fortescue (ASX: FMG) +4.07% & RIO +2.46%

- Gold was up overnight to ~US$1980 and flat today – Evolution (ASX: EVN) +2.97% a standout while Newcrest (ASX: NCM) +1.05% is knocking on the door of 12 month highs.

- Asian stocks were solid, Hong Kong up +0.84%, Japan +1.08% while China was up +0.21%

- US Futures are all up, around +0.20%

ASX 200 Chart - Intraday

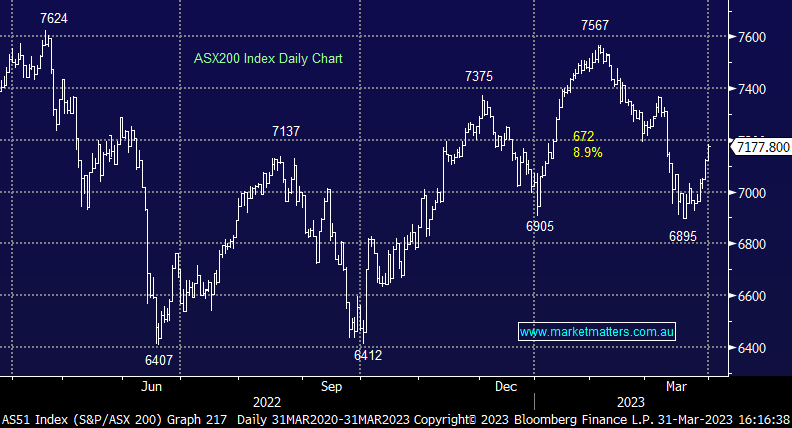

ASX 200 Chart - Daily

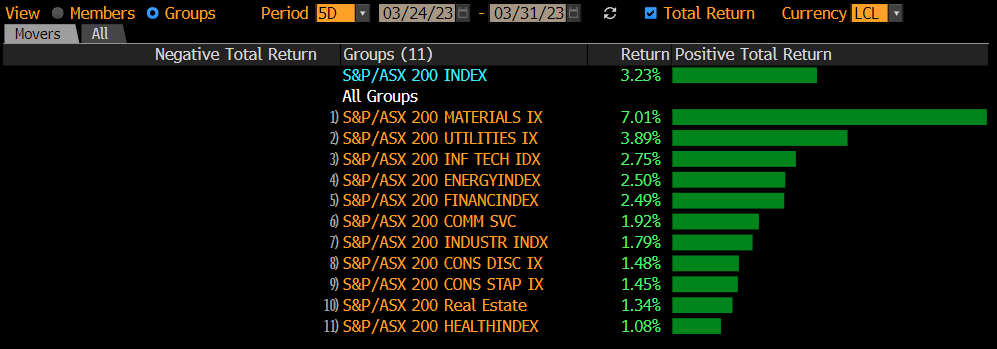

Sectors this week – Source Bloomberg

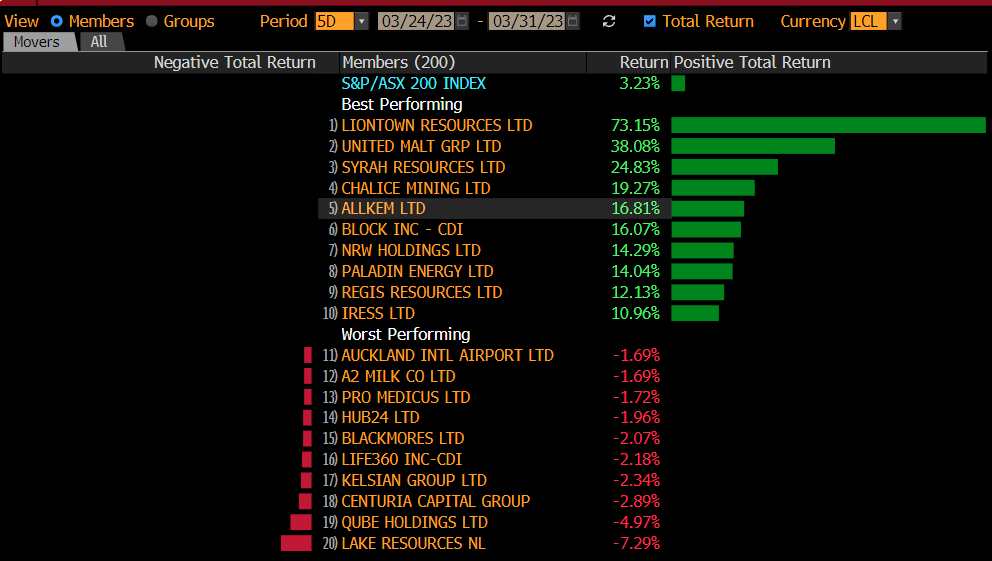

Stocks this week – Source Bloomberg

Broker Moves

- Westpac (ASX: WBC) Cut to Accumulate at CLSA; PT A$22.80

- Bank of Queensland (ASX: BOQ) Cut to Reduce at CLSA; PT A$6.20

- NAB (ASX: NAB) Cut to Reduce at CLSA; PT A$27.90

- Nib (ASX: NHF) Raised to Overweight at Jarden Securities; PT A$7.50

- Mincor (ASX: MCR) Cut to Underweight at Jarden Securities; PT A$1.40

- HMC Capital (ASX: HMC) Raised to Reduce at CLSA; PT A$3.81

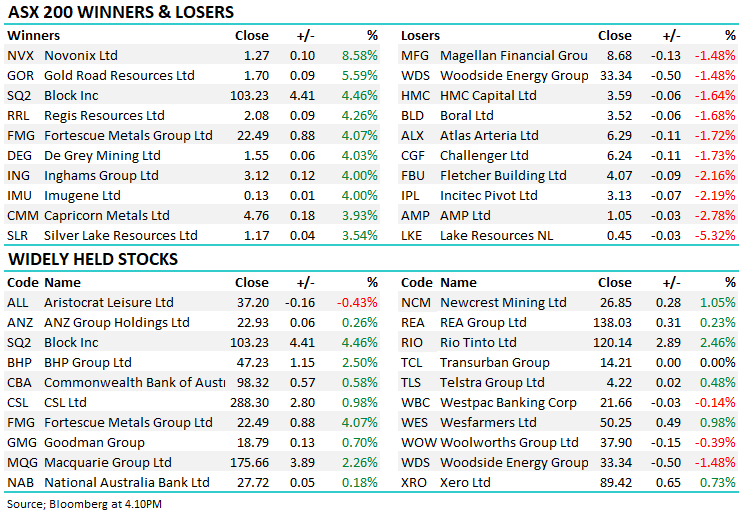

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned