The Match Out: Easter optimism filters into solid session, RBA minutes suggest rates will rise sooner rather than later

It was a solid session for local stocks today, albeit a very quiet one with the market rallying early before treading water late in the day. Minutes from the RBA’s April meeting showed a growing inclination to raise rates sooner than originally thought which underpinned higher bond yields - Healthcare and IT stocks came under pressure as a consequence while Energy and Materials remained firm.

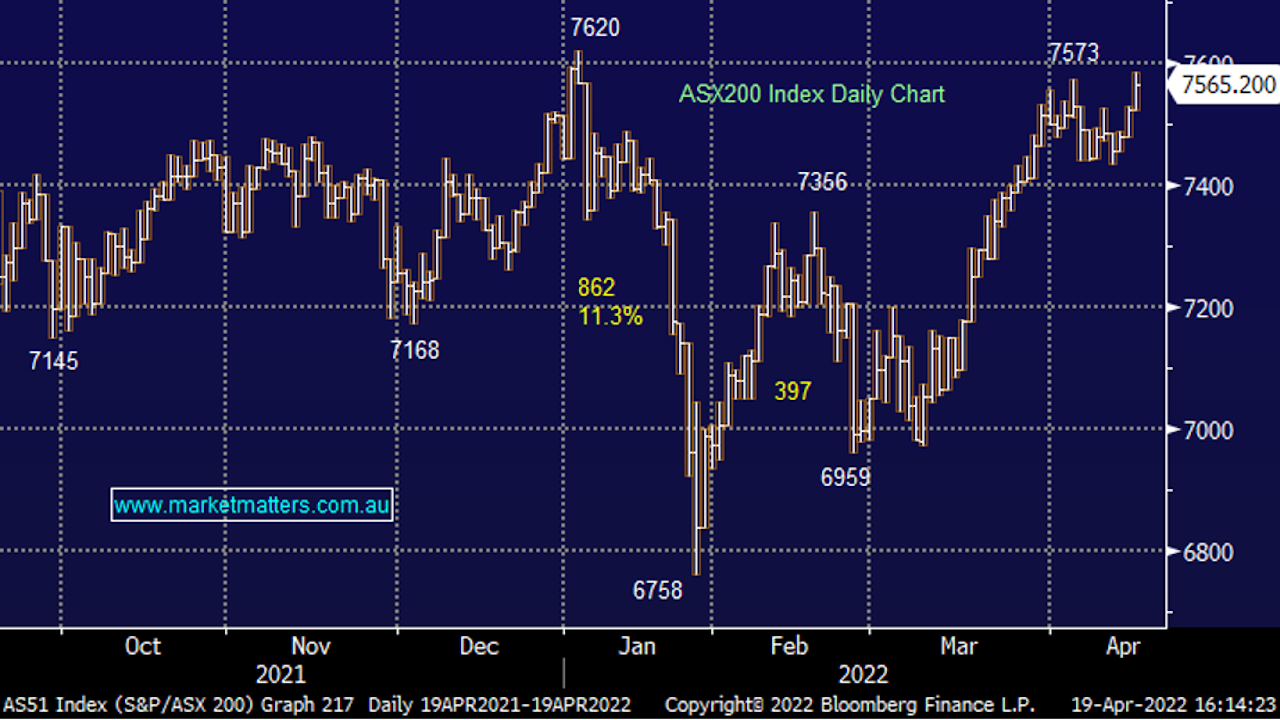

- The ASX 200 finished up +41pts/ +0.56% at 7565.

- The Energy sector was the best on ground (+1.26%) while Materials (+1.03%) & Utilities (+0.97%) were also strong.

- Healthcare (-0.66%) and IT (-0.55%) the weakest links.

- In the minutes from its April policy meeting, the RBA seems to have brought forward its intentions to increase rates saying that recent strength in inflation and wage data could prompt action sooner than first thought.

- The AUD went up on the release and so too did Aussie bond yields, the 2-year yield +0.088% to 2.11% while the 10-year yield added +0.105% to 3.075%.

- The rise in longer-dated bond yields cast a shadow over technology while the banks enjoyed the move, Westpac (ASX: WBC), NAB and ANZ were all around 1.2% higher, CBA up +0.48%.

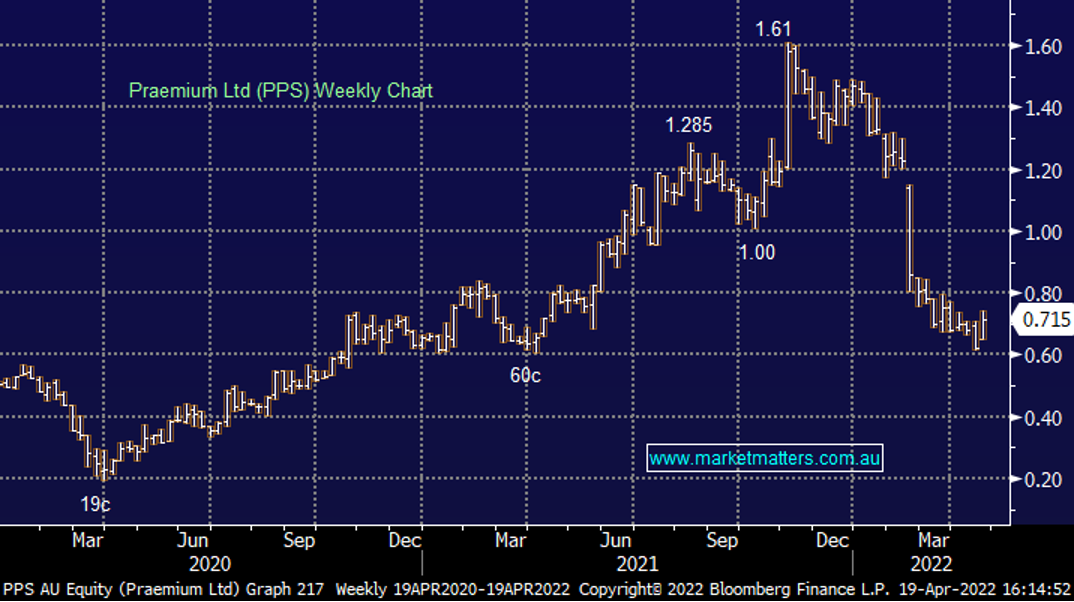

- Praemium (ASX: PPS) +15.32% allayed some fears today around fund flows following a weaker than expected update from Netwealth on Thursday saw the sector sold.

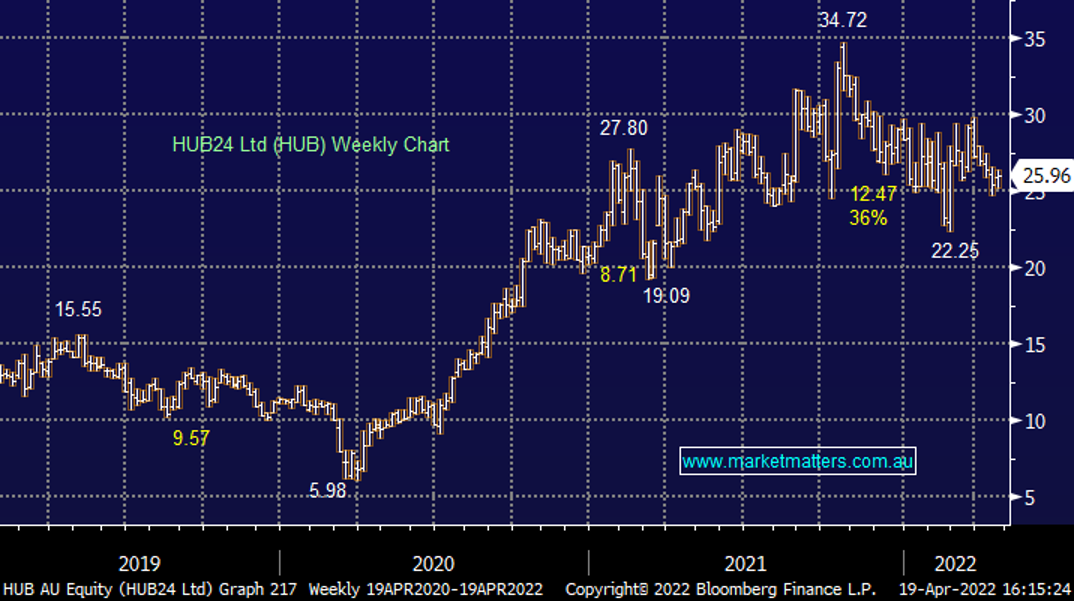

- HUB 24 (ASX: HUB) +2.04% was up but not to the magnitude of PPS, it was also out with a quarterly update that was stronger than NWL.

- Positive news for Syrah (SYR) +14.33% getting initial approval for a US$107 million loan from the US Dept. of Energy (DOE).

- Austal (ASX: ASB) +3.03% rallied today on a visit from the PM announcing 2 new Cape-Class Patrol Boats for the Navy for $124m.

- Calix (ASX: CXL) +2.46% announced an agreement with Suvo Strategic Minerals (ASX: SUV) whereby CXL will assist SUV in accelerating its Metakaolin green cement supply initiative – basically a cement additive. We remain long CXL in our Emerging Companies Portfolio.

- Iron Ore was around 2% lower in Asia today coming off the boil.

- Gold was up overnight and flat in Asia at around US$1975.

- Asian stocks were mixed, Hong Kong down -2.4%, Japan up +0.86% while China was off -0.40%

- US Futures are all up, Nasdaq the best of them +0.66%.

ASX 200

HUB 24 (ASX: HUB) $25.96

HUB +2.04%: 3Q22 update out this morning with the investment platform recording net flows of $2.6bn which was up +36% YoY. This was a better outcome than Netwealth (NWL) reported last Thursday with FUA +16% YoY. There was a lot of uncertainty during the period – global conflicts, rising rates, central banks tightening policy etc so in that context we’ve got to applaud HUB for delivering in such a challenging environment. Total funds on the platform of $51.0bn, an increase of +43% YoY plus their non-custodial funds called PARS was +$17.3bn, up +9.7% on this time last year. We have management in tomorrow morning to run through the detail.

HUB 24

Praemium (ASX: PPS) 71.5c

PPS +15.32%: a strong rally for the investment platform today, bouncing back from recent weakness thanks to a decent funds under administration (FUA) update. The company noted total FUA fell in the three months to March to $47.7 billion, however softer international markets and currency moves weighed while net inflows topped $700 million. We hosted CEO Anthony Wamsteker and new CFO David Coulter today. Here are some of the key takeaways:

- The core business continues to perform with decent inflows despite the seasonally weak period. They were particularly pleased with the performance of their VMAAS product which only HUB24 has a comparable product.

- Costs are being managed well and synergies continue to be realised following the Powerwrap acquisition

- The sale of the international business remains on track to be completed sometime before September. This will generate around 20cps of capital which will likely find its way back to shareholders in some form.

- The Netwealth (NWL) deal falling over certainly put pressure on the stock. Praemium was reluctant to reveal its secrets to a close competitor without a binding offer. The team was very confident that consolidation in the space would continue which should continue to support the stock.

Praemium (PPS)

Syrah Resources (SYR) $1.795

SYR +14.33%: received initial approval for a $US107m loan from the US Dept. of Energy (DOE) helping shares jump today. The battery minerals company has received the conditional commitment to help build the expansion phase of Vidalia active anode material facility in Louisiana, inputs to batteries and electric vehicles, with the US Government looking to support the supply of critical minerals in the country. Once the loan is approved, the initial expansion of the project will be fully funded with the remaining capital requirements coming from a raise completed earlier in the year.

Syrah Resources (SYR)

Broker moves

- Uniti Group Cut to Neutral at Jarden Securities; PT A$5

- GrainCorp Rated New Hold at Jefferies; PT A$8.70

- WiseTech Rated New Neutral at Goldman; PT A$53

- Technology One Rated New Buy at Goldman; PT A$13.90

- Capricorn Metals Cut to Hold at Canaccord; PT A$4.25

- IGO Cut to Hold at Canaccord; PT A$12.50

- Nickel Mines Raised to Buy at Canaccord; PT A$1.50

- Panoramic Resources Cut to Hold at Canaccord

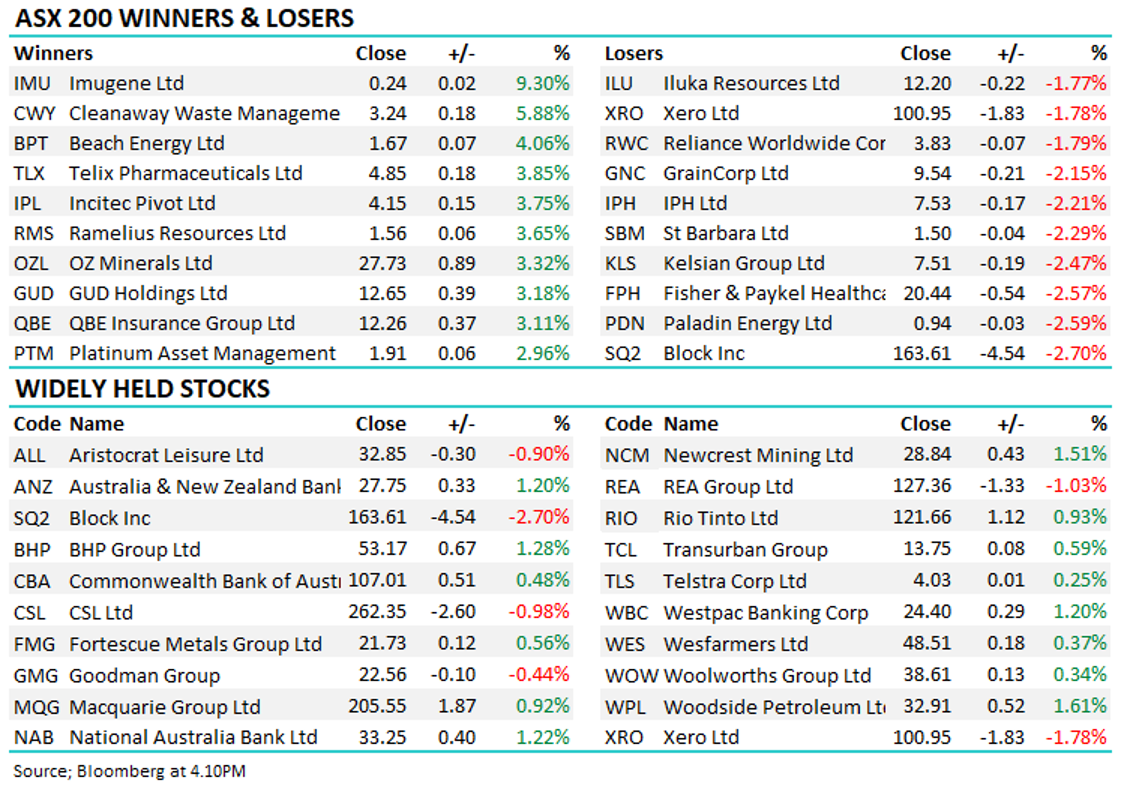

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned