The Match Out: Equities rally on Friday to post a +0.5% gain for the week, Energy leads the way, Select Harvests (SHV) first half disappoints

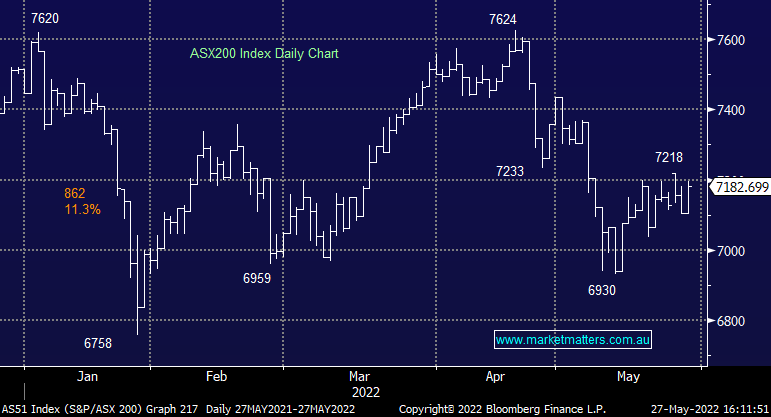

The ASX200 enjoyed a strong finish to the week rallying +1.08% on broad-based buying following the strong night on Wall Street. The futures selling reappeared around 10.30 am but it felt they were finishing off a large order with the weakness exhausted into lunchtime. While over 75% of the market contributed to the day’s advance it was solid gains in the consumer discretionary & large-cap miners plus ongoing strength in the banks that caught our eye. Again the market is knocking on the 7200 door, a break clear on the upside next week might see some decent buyers return to compound the last 2-week’s gains.

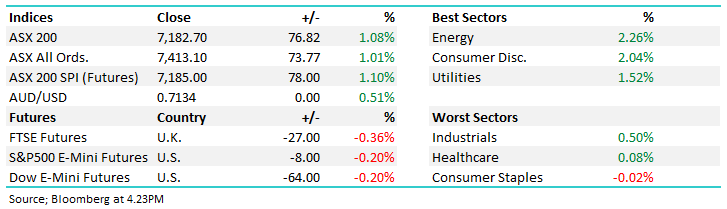

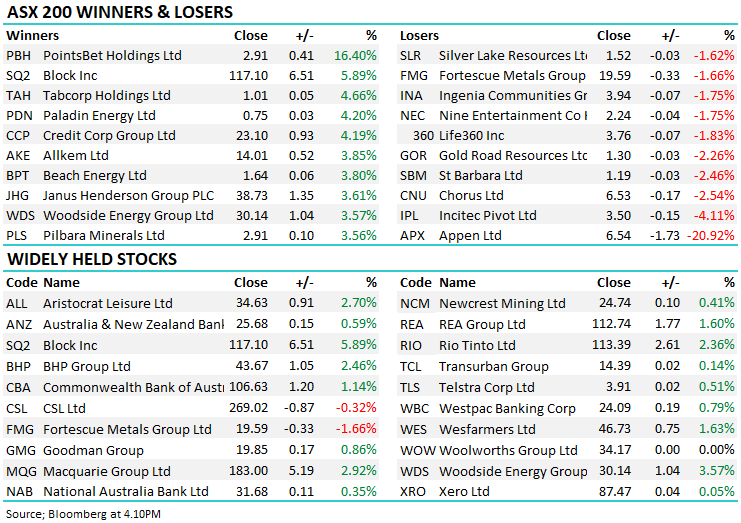

- The ASX 200 finished up +76pts/ +1.08% at 7182

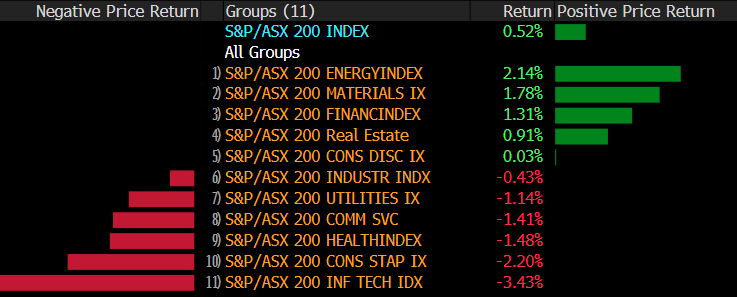

- The Energy sector was best on ground (+2.26%) while Consumer Discretionary (+2.04%) & Utilities (+1.52%) were also strong.

- Consumer Staples (-0.02%) was the only sector to close lower on Friday.

- Commodity markets bounced back, rallying post the close yesterday and continuing on today. Exposed sectors helped carry the index into the weekend as a result.

- Consumer names were missed today following retail data printing at 11.30 am. The +0.9% gain MoM was slightly below expectations. Discretionary still managed a good gain but staples remain under pressure with inflation a key issue.

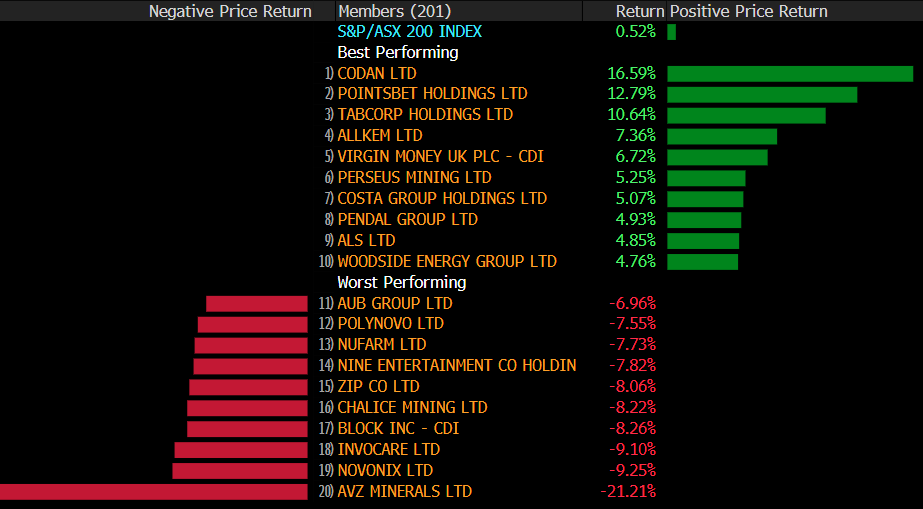

- PointsBet (PBH) +16.4%, rallied after value investment adviser State Street lodged a substantial shareholder notice today.

- Appen (APX) -20.92%, tumbled after Telus International pulled their $9.50/sh bid as quickly as they launched it. Appen kept their cards close to their chest in the ordeal but it seems to have worked against them. They also hosted their AGM today with management trying to paint a rosy picture though the outlook remains tough

- Iron Ore was ~4% higher in Asia today though the most leveraged name, Fortescue (FMG), fell -1.66% on the day

- Gold was marginally higher in our session, +$US3/+0.16% to ~US$1,853

- Asian stocks were strong, particularly China focussed indices with the Shanghai and Hang Seng indices up 2.2%

- US Futures are all down around -0.2% at our close

Select Harvests (ASX: SHV)

SHV -5.85%: a soft day for the almond producer with a disappointing first half result weighing on the shares in SHV. Revenue fell 19% but was still a small beat, but EBITDA at $15.8m was behind expectations. EBITDA was dragged by higher corporate & processing costs which are expected to continue to drag earnings in the near term. Wet weather has hampered their harvesting ability and the almond market has been hampered by high stockpiles and supply chain issues. These problems will pass and the outlook for Select should improve as a result.Stocks of the Week

Sectors of the Week

Broker moves

- New Hope Cut to Neutral at Citi; PT A$3.50

- Volpara Health Rated New Underperform at Barclay Pearce Capital

- Champion Iron Cut to Neutral at Goldman; PT A$7.90

- Lottery Corp. Rated New Neutral at Credit Suisse; PT A$4.60

- Reliance Worldwide Reinstated Buy at Goldman; PT A$4.80

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

3 stocks mentioned