The Match Out: Market strong early, weak late as Chinese growth fears weigh

The market was strong early with futures rallying ~75 points at the outset however weaker than expected data from China saw the market roll over mid-morning. IT stocks had a 2nd session of gains as bond yields continued to stabilize while a takeover tilt for Brambles (BXB) saw the Industrials fire up.

- The ASX 200 finished up +17pts/ +0.25% at 7093 – was up +74pts at its best hitting 7149.5

- The Industrial sector was best on ground (+2.42%) while IT (+2.14%) & Communications (+0.70%) were also strong.

- Healthcare (-0.60%) and Materials (-0.48%) the weakest links.

- China data was weak today, Industrial Production & Retail sales were the main catalyst which caused some growth fears mid-morning – an outline of that is below.

- Brambles (BXB) +11.22% higher on takeover talks with private equity.

- Goodman Group (GMG) -0.61% said earnings growth would be +23% for FY22 – in line with current consensus.

- Qube Logistics (QUB) +5.76% after finishing their off-market buy-back. This is a stock worth some consideration.

- Step One Clothing (STP) -56.25% whacked on a big downgrade. It is now 1/10th the price when it IPO’d in October 21.

- The recent Halo (HAL) IPO is now trading 64c, it’s lost nearly half its value since listing 2 weeks ago. A tough market for new issues however not surprised this one tanked.

- Citi downgraded Wesfarmers (WES) -0.62% to a sell.

- Gold is back testing recent lows ~US$1805

- Asian stocks were mixed, Hong Kong up +0.14%, Japan +0.34% while China was off -0.33%

- US Futures are all down around -0.70%

ASX200

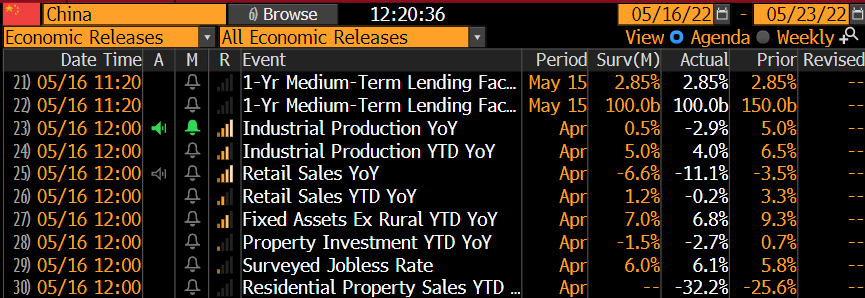

Chinese Data

A raft of Chinese economic data out this morning that was weaker than expected and detailed below. Our market and US Futures rolled over after these prints given the evidence of further cooling courtesy of lockdowns.

Chinese Economic Data Today – Source Bloomberg

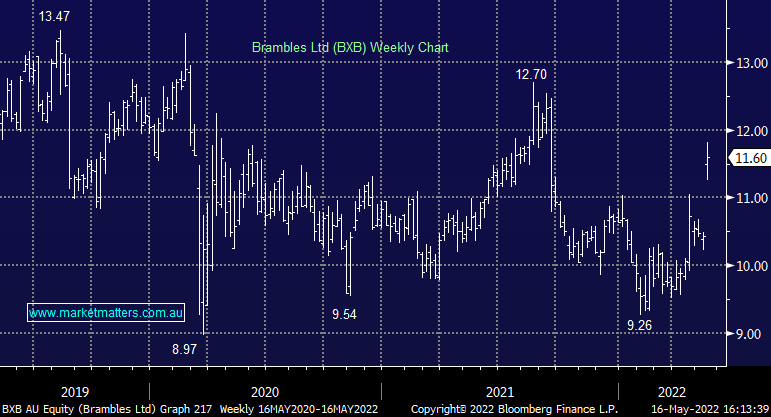

Brambles (BXB) $11.60

BXB +11.22%: the logistics business confirmed it was engaged in takeover discussions with private equity outfit CVC today. Talks are in preliminary stages but media reports are suggesting a $13.9 billion bid is in play for the pallets business. Brambles has been searching for ways to unlock value in the business, recently completing a sizable buyback and looking to transform its operations to be more sustainable and efficient. CVC are yet to be granted due diligence or secure funding so there is plenty more to play out here.

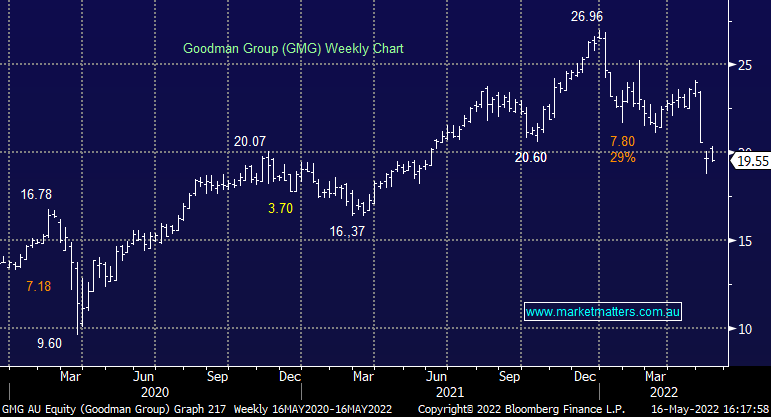

Goodman Group (GMG) $19.55

GMG –0.61%: Opened firmly this morning after they reconfirmed FY22 guidance for earnings per share (EPS) growth of 23% which was in line with current market expectations, however, the stock tapered off throughout the session. In terms of commentary, Greg Goodman talked up the opportunities for GMG as the environment gets more challenging, saying that this environment suits "older heads" such as his. To give some context around this comment, Greg nearly lost it all during the GFC as over-geared property companies were hit. That experience has led GMG on its current path running with low gearing (~7% currently), heaps of liquidity and a very nimble operation that has done spectacularly when since those scary GFC days.

Today, GMG is almost hoping for tougher times to ease the competitive tensions playing out, particularly on the development side. One area that did catch MM’s attention was commentary on Amazon which generally accounts for 6-10% of their development work. That will slow reflecting recent comments from Amazon CFO Brian Olsavsky that it "has too much space right now versus our demand patterns".

Step One Clothing (STP) 21c

STP -56.25%: Online undie retailer took a knife to earnings expectations today, sending the stock plummeting. They closed 86% below where they IPO’d last November at $1.53. Revenue guidance was lowered from 21-25% growth down to 15-20%, and EBITDA expectations were cut 50% to $7-8.5m ahead of their first full-year result. The downgrade was blamed on slower than expected growth in the US and UK as well as slowing sales of their female line. While they have passed on some price increases, margins aren’t expected to grow with warehousing and marketing costs coming through. The low end of updated guidance would mean a negative EBITDA contribution in the second half.

Broker Moves

- Universal Store Rated New Buy at Citi; PT A$5.83

- Toys R. Us Anz Rated New Buy at Moelis & Company

- Premier Investments Raised to Buy at Citi

- Wesfarmers Cut to Sell at Citi

- Endeavour Group Rated New Overweight at JPMorgan; PT A$8.60

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

10 stocks mentioned