The Match Out: Stocks fall 0.6%, Banks to curb lending, Stay long Energy!

The ASX was looking promising this morning with futures implying a start to trade up +40 points however that quickly evaporated as the more influential sectors of financials & resources came under pressure which accounts for ~40% of the ASX 200.

The move from our counterparts over the ditch to raise interest rates and imply more was to come prompted selling around midday while the move to increase serviceability buffers along with a downgrade from an influential broker on CBA had the banks on the back foot, all in all, another soft session for stocks.

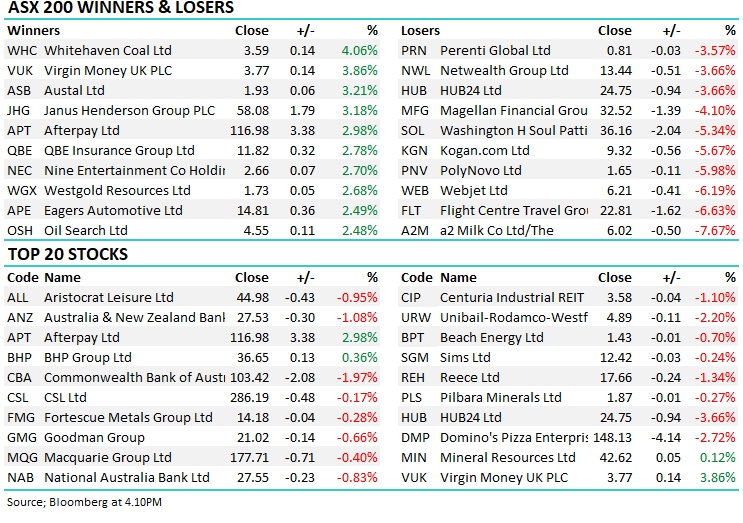

- The ASX 200 fell -41pts /-0.58% to 7206 today

- Energy remained at the top of the leaderboard and has rallied strongly for the past month, while IT stocks also bounced back

- APRA announced this morning they intend to raise the minimum interest-rate buffer that lenders need to account for when assessing home-loan applications as they try to cool house prices. Banks now need to assess new borrowers’ ability to meet loan repayments at an interest rate that is at least 3 percentage points above the loan product rate up from the 2.5 percentage points commonly used by banks at present. That shaves about 5% off borrowing capacity – not a big deal really but a sign they want to cap prices all the same

- House prices are tied heavily to the availability of credit, so this incremental tightening to credit is an incremental negative for house prices

- JP Morgan cut CBA to underweight today and $95 PT, plus there are a bunch of other broker moves in stocks we own outlined below.

- New Zealand’s central bank raised interest rates for the first time in seven years today plus signalled further increases will likely be needed to tame inflation. The cash rate was increased by a quarter percentage point to 0.5% and while that was in line with most economists expectations it’s still a big move to be a first-mover globally and further say that “The committee noted that further removal of monetary policy stimulus is expected over time.”

- A2 Milk (A2M) -7.67% on a class action, seems overdone on the downside

- Austal (ASB) +3.21% wins a steel shipbuilding contract, hopefully the first of a few and a very clear sign that their depleted order book can be refilled – one of the weakest positions in the Emerging Companies Portfolio although we remain holders.

- Whitehaven Coal (WHC) topped the ASX 200 again, I know it’s getting hot however the share price continues to lag the appreciation in the underlying commodity

- Pilbara Minerals (PLS) had a good production update – we like PLS here

- Our Weekly Video Update below covers portfolio performance for the month of September – 4/5 MM portfolios finished up in a weak period for the market. Best of them being Emerging Companies +5.91% while the Flagship Growth added +0.56%. A reminder to subscribers that full performance reporting is available on each portfolio page – click here

- The Market Matters Webinar tomorrow titled Commodities – Where to from here? Is now full.

- Gold continues to hang around US$1750

- China is closed for the start of this week – back Thursday , Hong Kong & Japan lower

- US Futures are trading down

ASX 200

Market Matters Weekly Video update

Today, our Author & Lead Portfolio Manager James Gerrish covers Portfolio Performance & Positioning with Harry Watt following a strong September overall in a tough market. Remember to like video (if you do!) and subscribe to the You Tube Channel so we can continue to produce this sort of content.

Austal (ASB) $1.93

ASB +3.21%: announced a milestone contract win at lunchtime today, helping shares in the shipbuilder trade higher through the afternoon against a weaker session more broadly. Austal won their first steel vessel contract from the US Navy, a $US145m contract to build two salvage and rescue ships. They have invested a significant amount in getting their steel ship capabilities up to standard, and while this isn’t the first contract, it is an important step to fully utilizing their capabilities with the world’s largest navy.

MM is long and bullish ASB

Austal (ASB)

Pilbara Minerals (PLS) $1.87

PLS -0.27%: Delivered a decent set of September quarter production numbers today and importantly, beat their shipping guidance which is key when Lithium prices have more doubled amid a tightening market. The company produced 85,759 dmt of spodumene concentrate in the quarter, up from 77,162 dmt in the June quarter. More product into a hot market saw the company’s cash balance increase to $137m.

MM is bullish PLS

Pilbara Minerals (PLS)

Broker moves

- OZ Minerals Raised to Buy at Goldman; PT A$26.40

- Whitehaven Cut to Neutral at Goldman; PT A$3.90

- AMP Rated New Neutral at Jarden Securities; PT A$1.20

- Hub24 Rated New Underweight at Jarden Securities; PT A$26.80

- Netwealth Rated New Underweight at Jarden Securities; PT A$13.90

- IOOF Holdings Rated New Buy at Jarden Securities; PT A$5.30

- AGL Energy Raised to Equal-Weight at Morgan Stanley; PT A$6.47

- CBA Cut to Underweight at JPMorgan; PT A$95

- Baby Bunting Raised to Add at Morgans Financial Limited

- Evolution Raised to Overweight at JPMorgan; PT A$4.60

- CSL Raised to Buy at Jefferies; PT A$327.85

Major Movers Today

Commodities – where to from here?

Join me and analysts Peter O’Connor & Michael Clark from Shaw & Partners on Thursday 7 October at 11:30am for a discussion on iron ore, coal, nickel, uranium and everything commodities.

To register for this webinar, please click here.

4 topics

8 stocks mentioned