The Match Out: Stocks rally, IT sector puts on ~2%, Super Retail (SUL) upgraded

A fairly lacklustre morning gave way to a bullish afternoon for stocks with the IT sector surging back into vogue at the expense of Energy, the first day of red in many thanks a ~2% pullback in Crude Oil overnight. Overall, good session for Aussie stocks.

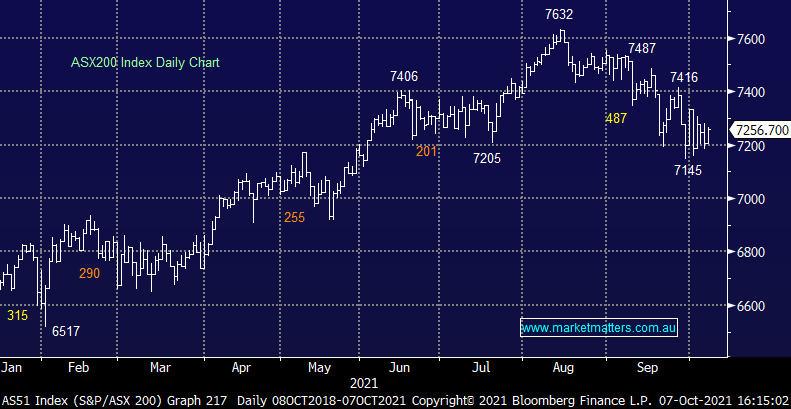

- The ASX 200 added +50pts /+0.70% to 7256 today

- IT came back into focus today rallying more than 2% as the rise in bond yields took a breather in the US overnight. I’d hate for readers to get the impression we are going to shun technology stocks from here given our view of rising interest rates, that’s not the case however our weightings from a portfolio perspective will be lower.

- NSW pushing forward with a more aggressive move towards normality…Kids going back to school early - Whoo Hoo!

- Magellan (MFG) is now near ~$30 experiencing a huge P/E re-rate and brokers are still split on what next similar to our view we wrote this morning. Today Evans & Partners + Morgans downgraded while Macquarie upgraded.

- Super Retail (SUL) + was strong today on a UBS upgrade

- Whitehaven Coal (WHC) –6.96% hit today on a pullback in Coal prices overnight. Expect high volatility here but there is more upside left in this trade

- Calix (CXL) +14.44% which we hold in the Emerging Companies Portfolio had a strong update today – we like the direction of this cutting edge company

- Lithium stocks were strong today, Pilbara (PLS) up 7% which is nice on the day after we added

- Gold continues to hang around US$1758 – Peter O’Connor remains bullish Gold sighting Regis Resources (RRL) as hit No 1 pick today

- Asian markets higher today – Hong Kong the best of them up +2.30%

- US Futures are trading up ~0.50%

ASX 200

Webinar Today – Commodities, where to from here?

Thanks to all those who attended the Market Matters Webinar today – the turnout was very strong and shows a high level of interest currently in the Commodities space. A recording will be made available to those that registered and will be posted on the Market Matters Website for those subscribers that could not make it.

We’ll also provide some further insight in upcoming reports of the key takeaways. Suffice to say, we a bullish the majority of the commodity space at this juncture and it will continue to feature across Market Matters Portfolio’s. Thanks to the key input from Analysts Peter O’Connor & Michael Clark.

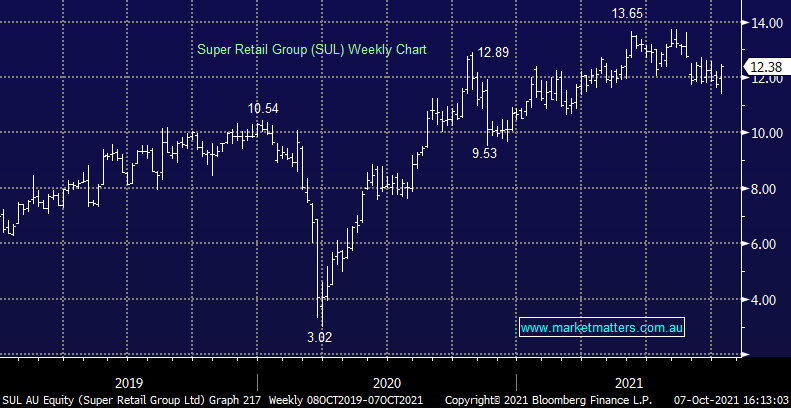

Super Retail Group (SUL) $12.38

SUL +7.75%: Strong today on the back of a bullish UBS report as they upgraded to buy and put a $13.50 PT on the retailer. We’ve owned this stock in the past, we like it and agree with much of the UBS commentary.

Their confidence has improved around the Australian consumer based on feedback from their economics team, however they also have this thing called the UBS Evidence Lab which does on the ground research and that paints a positive picture for consumption given a strong labour market and still rising household savings with ~$120bn in excess consumer saving.

MM is bullish SUL

Super Retail Group (SUL)

Broker Moves

- Magellan Financial Cut to Hold at Morgans Financial Limited

- Magellan Financial Raised to Outperform at Macquarie; PT A$38

- Star Entertainment Rated New Underweight at Barrenjoey

- Crown Resorts Rated New Equal-Weight at Barrenjoey; PT A$10.80

- Magellan Financial Cut to Negative at Evans & Partners Pty Ltd

- HomeCo Cut to Underweight at JPMorgan; PT A$6.40

- Rio Tinto Raised to Outperform at Exane; PT 5,630 pence

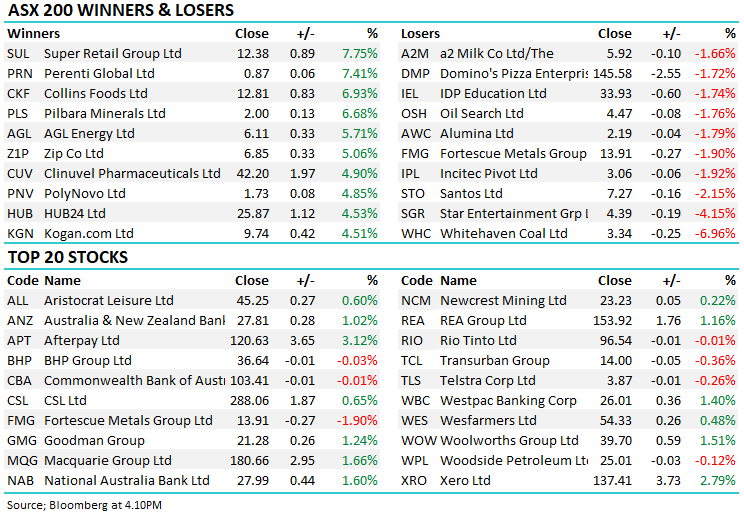

Major Movers

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

4 topics

6 stocks mentioned