The Match Out: Stocks rally on reopening, big $$ paid from dividends this week, Sandfire's massive acquisition

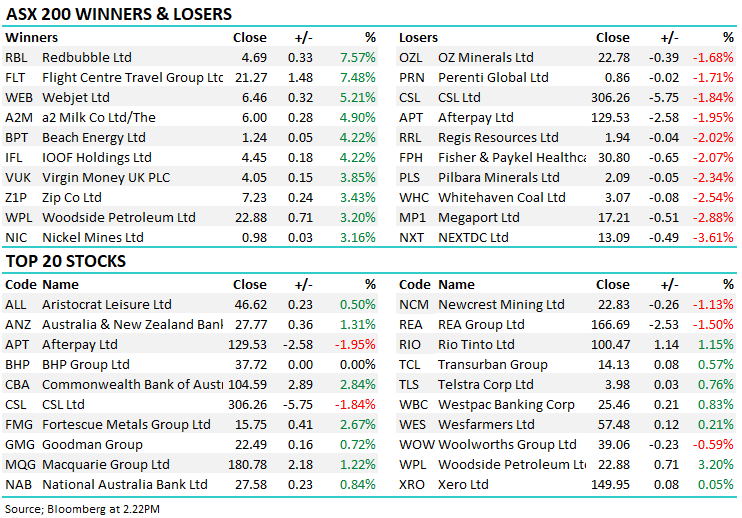

A bullish session for the ASX to kick off the last week of the month and quarter with the market enjoying the more concrete rhetoric around re-opening as laid out by Glady’s today. Unsurprisingly, travel stocks were strong however we also saw good gains from the Energy & Financial sectors at the expense of the Covid winners in IT & Healthcare. While the ASX200 finished +0.57% higher, the high was seen at midday and we tracked lower into the close – a big MOC order knocked the market ~20pts lower in the match.

- The ASX 200 added 41pts /+0.57% to 7384 today

- Energy stocks continued to rally with Oil prices actually breaking to fresh recent highs implying that concerns towards the demand side of the curve have dissipated, even if the rally is more supply-driven. MM remains overweight the Energy Sector looking for some catch up by the lagging local names

- Financials have been quiet in recent times however today we saw decent buying in the banks led by CBA which put on +2.84%. This makes sense as investors soon collect $40bn in dividends and another $14.6bn in franking credits. Payment dates are more important when thinking about the cashflow to the investor and we’re getting to the pointy end of this, about ~$19bn paid last week while the big $6.6bn + $2.8bn in franking credits from Fortescue Metals (FMG) will be paid on the 30th Sep. Money will find its way back into the market and that was starting to get obvious today given the sectors that ran.

- Gold has continued to be weak with the ASX gold stocks trading at 52-week lows. They’re cheap, they scream value however the backdrop of rising rates not a good one for Gold – we’re neutral here.

- Evergrande remains firmly in the headlines with a heap of news articles around the missed payments to creditors. It’s not the bond investors we should care about, it’s the impact on the broader Chinese property market which has been a significant driver of Chinese growth and thus world growth for the past decade. As suggested this morning we doubt China will let this go too far i.e. they’ll contain it however it is something we should monitor closely.

- Uranium stocks hit today following their overseas counterparts lower. We took the opportunity to go back into Paladin (PDN) ~77c in the Emerging Companies Portfolio having sold nearer $1. This is a volatile stock and we left room to average ~60c if it continues to pull back

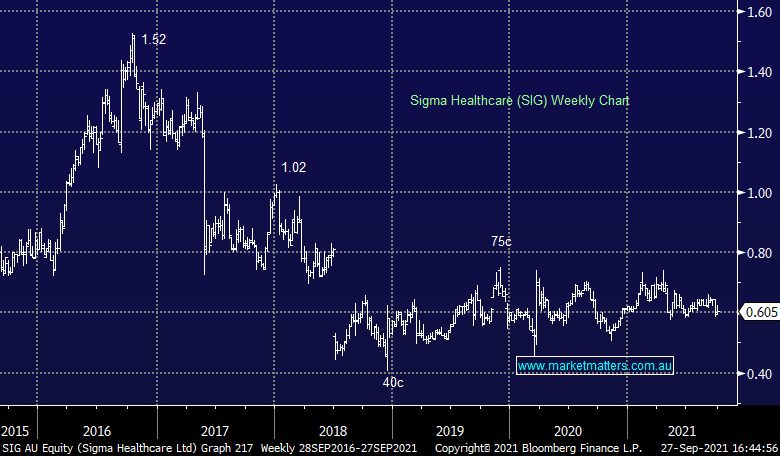

- Sigma (SIG), the pharmaceutical wholesaler re-joined the running to take out Priceline owner Australian Pharmaceutical Industries (API) today in a battle that’s now spanned 3 years – Harry covers this below

- We met with APA Group (APA) today as part of their roadshow to convince investors their tilt at AusNet (AST) is a good one. If they are successful, they’ll need to raise ~$1.5bn in new equity however there are compelling synergies to the deal – and perhaps more than what analysts are currently factoring in. This is a quality infrastructure stock that has been sold down on the back of 1. Their tilt at Basslink & now 2. Their tilt at AusNet (AST). We will cover our thoughts / intentions here in coming notes.

- A small cap we like is ReadyTech (RDY) +5.3% today having made a small bolt on acquisition in student management software business Avaxa

- Gold was higher during Asian trade today ~$US1758

- Iron Ore Futures were also up, rebounding from recent weakness, Fortescue (FMG) +2.67% as a result.

- In Asia, Japan & Hong Kong were trading flat, China was +0.50%

- US Futures are trading higher, around 0.4%

ASX 200

Sandfire Resources (SFR) $5.41

SFR -6.89%: Back online today after making a massive acquisition known as MATSA which is a Spanish copper asset they’ve paid $2.6bn for. When I say massive I’m not exaggerating, the acquisition consideration was ~2x SFR’s market capitalisation and is clearly hoped to be a company transforming deal. The deal is to be funded by a combination of debt & equity, with the equity raising split into a $120 million placement to AustralianSuper, a $165 million institutional placement and a $963 million one-for-one non-renounceable rights issue.

The placement and rights issue was at $5.40 a share, which was a 13.2 per cent discount to the last close, and ~7% discount to TERP ($5.76). AustralianSuper also committed to sub-underwrite the retail portion of the entitlement offer to another $150 million. The company lined up another $1.1 billion in fresh debt, including a $200 million facility from ANZ Banking Group and a $US650 million ($897 million) loan from a bunch of banks including Macquarie, Citi, Natixis and SocGen.

We like Copper but we like Oz Minerals (OZL) more than SFR

Sandfire Resources (SFR)

Sigma Healthcare (SIG) 60.5c

SIG +1.68%: the pharmaceutical wholesaler re-joined the running to take out Priceline owner Australian Pharmaceutical Industries (API) today in a battle that’s now spanned 3 years. Wesfarmers had thrown a bid in for API only a few months ago at $1.55/sh cash, in a deal that looked all but wrapped up before Sigma’s moves today. They have offered 2.05 shares in SIG along with 35c cash for API shareholders, worth $1.57/sh prior to today’s session. API has engaged Sigma now in a move that would like to mean Wesfarmers would have to bump up their offer to have a chance. The merged Sigma/API would likely come up with $45m/yr in cost synergies with API holders owning 48.8% of the business.

Sigma Healthcare (SIG)

Broker moves

- Vita Group Cut to Hold at Ord Minnett; PT 93 Australian cents

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned