The momentum trade is breaking down

One of the biggest mistakes you can make as an investor is to believe that other investors think like you. And that when a stock or sector is moving, you must be missing something. Therefore, you need to jump on board regardless.

This is how FOMO (fear of missing out) works. It’s rooted in the base emotion of greed, but people get FOMO because their underlying investment principles and understanding of the market are flawed.

As a value investor, I’m constantly reminding myself that ‘the market’ doesn’t care about value. What you’re witnessing right now is a resurgence of the post-COVID stimulus days where it was all about momentum.

Think about the trillions of dollars of capital flowing through global equity markets. I have no idea of the exact numbers, but my guess is a high proportion of that is controlled by leveraged funds and machines chasing momentum.

The easiest way to make quick money on Wall Street is to lever up and chase a trend. Especially after you’ve suffered a 30%-50% drawn down and need to make back your losses.

These trend following machines couldn’t care less about valuations or the businesses prospects. They’re in it for a good time, not a long time.

Which brings me to my point…

That is, there are increasing signs that the momentum trade that has propelled Wall Street higher this year may be coming to an end.

Apple is the poster stock here. In our recent What’s Not Priced In podcast (recorded on 3 August), I highlighted the divergence occurring between Apple’s price and momentum – as defined by its RSI (relative strength index). As you can see below, while price continued higher, momentum began to wane.

I pointed out that this was a warning sign heading into Apple’s results. And sure enough, the stock price plunged in the following days. While it’s now oversold and due for a bounce, that sharp move lower suggests the leveraged momentum machines are bailing out.

Also note that oversold conditions rarely occur in bull markets!

It’s not just Apple. It’s a similar picture across the other big tech stocks. The FANG index, which includes the 10 biggest tech stocks on Wall Street, shows a similar price/momentum divergence:

Momentum is fine if there is valuation support. But that’s not evident in this market. Just take a look at the proxy for the equity risk premium. In Australia and the US, the 10-year bond yield (a proxy for the risk-free rate) is around 4%.

The S&P500 trades on a forward P/E multiple of 19, which equates to an earnings yield of 5.26%. That’s a skinny equity risk premium of just 1.26%.

In Australia, the ASX200 trades on a forward P/E multiple of around 15. But take out the low multiple iron ore miners (indicating lower earning ahead) and three of the big four banks all trading on a below market P/E, I estimate the rest of the market trades on a P/E multiple similar to the S&P500.

All risk, no reward

Again, that makes for a low equity risk premium. Right now, its all risk and little to no reward.

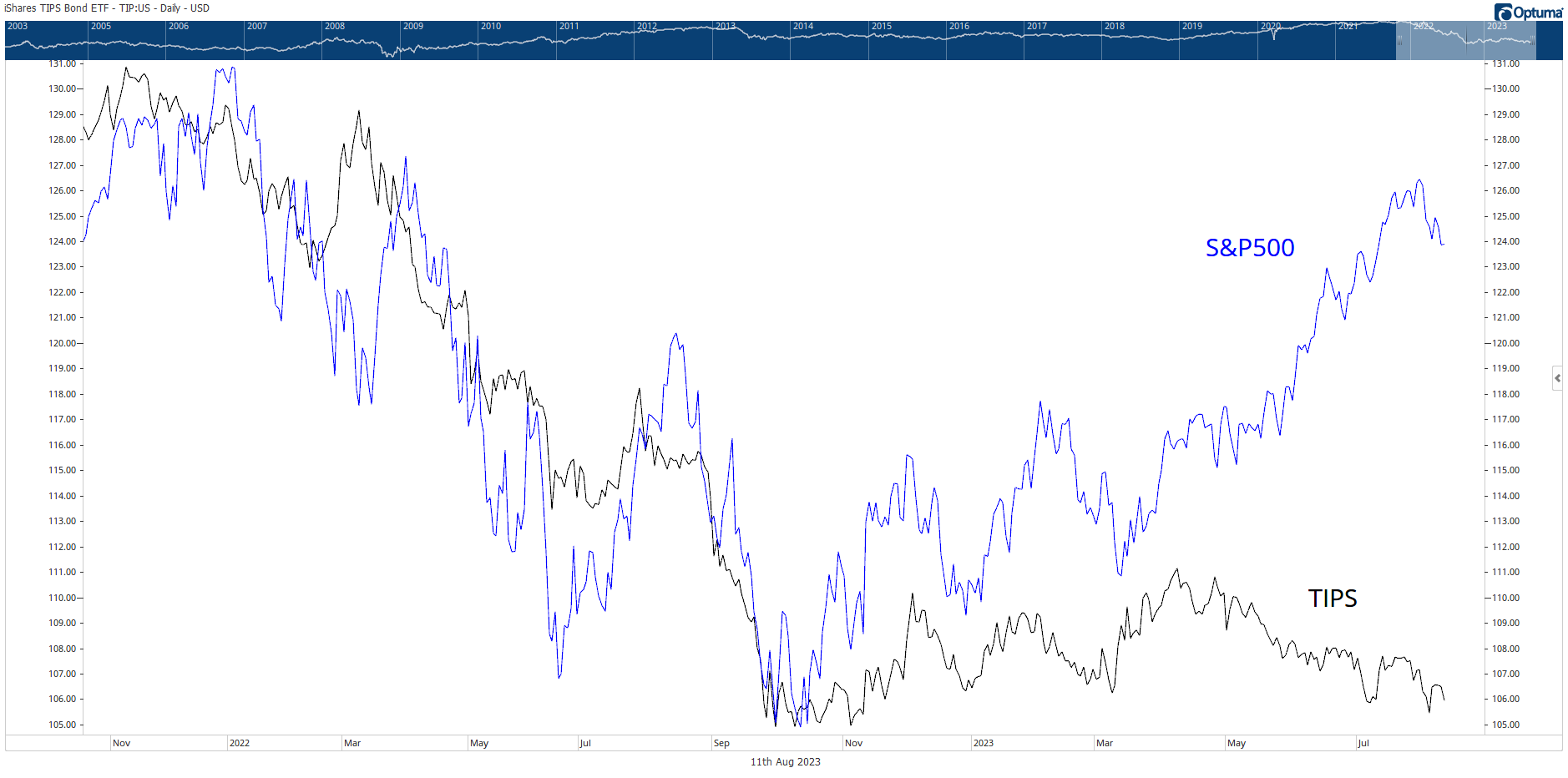

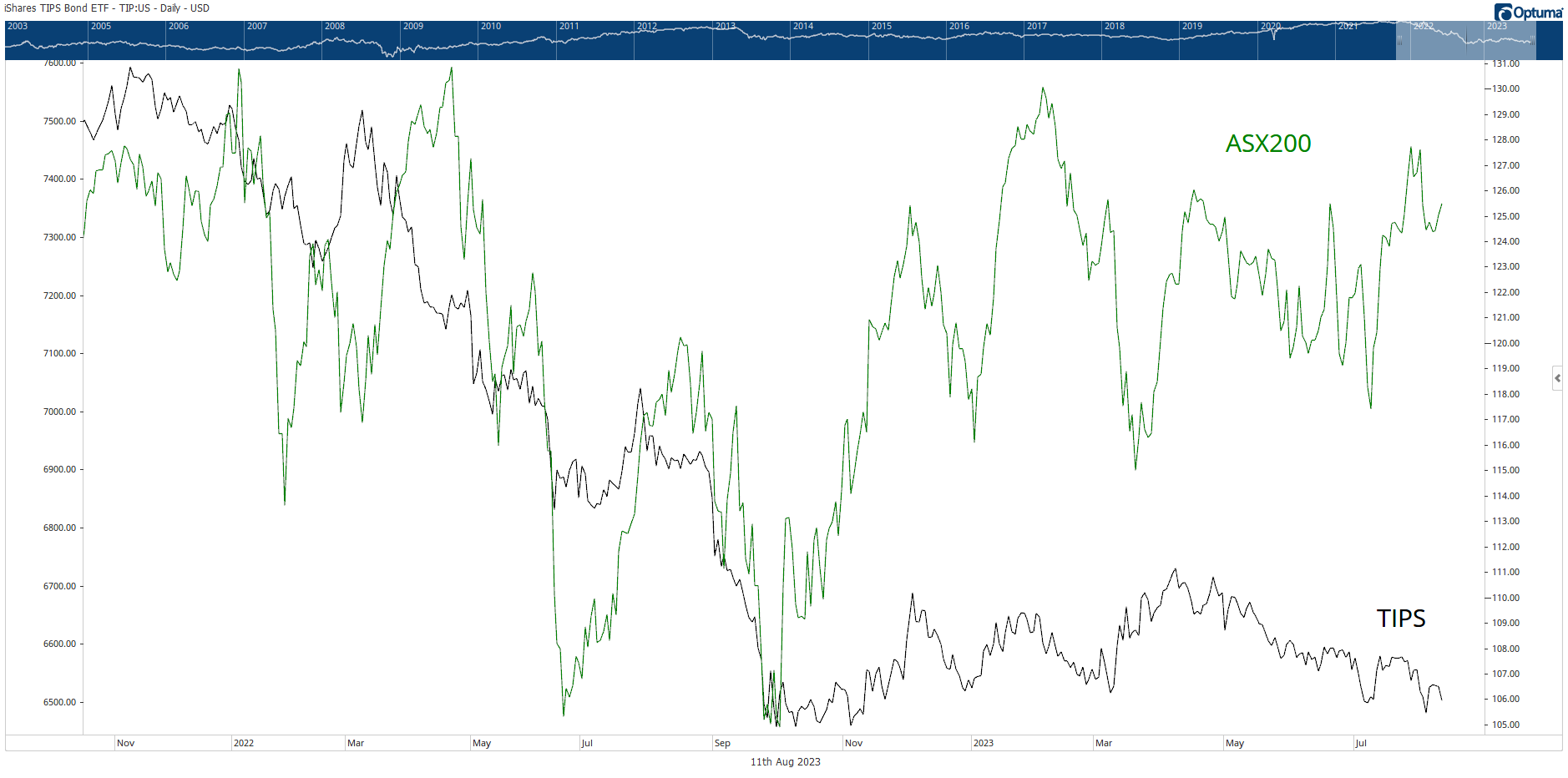

To show you what I mean, have a look at these next few charts. They show stocks in the US and Australia versus the price of TIPS (Treasury inflation protected securities).

TIPS are a proxy for real US interest rates. When the price of TIPS declines, it means rising real rates. When the TIPS price advances, it means falling real rates.

The charts below show that real interest rates in the US were rising during 2022 (falling TIPS). It was the reason why you saw such a big bear market. But real rates peaked (meaning TIPS bottomed) in September/October 2022. That’s when the S&P500 bottomed too…

The S&P500 has rallied strongly from that low. And while TIPS initally followed a similar path, the two markets have gone their separate ways since April/May. This coincided with AI mania and the associated momentum trade getting a head of steam.

Meanwhile, real rates rallied back to last years highs.

High real interest rates are a headwind for stocks. This is why the breaking of the momentum trade is so important for the near term outlook. There is little fundamental support for stock prices here.

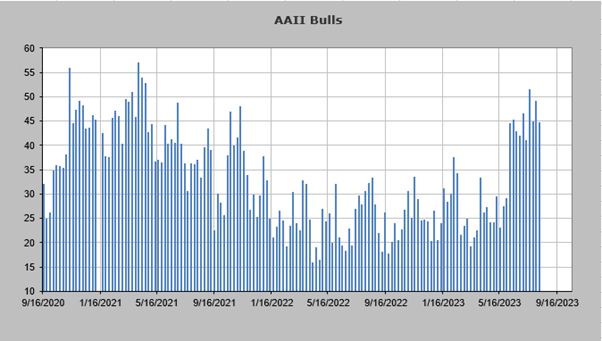

Also, note how price influences investor sentiment. Ever since the AI/momentum surge, investors have become more bullish. Bullish sentiment is now approaching the highs from the former bull cycle.

Again, this is important to the momentum trade. If ‘everyone’ is maximum bullish, who is left to keep the momentum going?

Source: Helene Meisler @hmeisler

While the ASX hasn’t experienced the same surge as the US, it has still rallied back close to its former highs. And as you can see below, there is a decent divergence between the ASX200 and TIPS.

The conclusion is that the last few months’ rally is all about machines and leveraged hedge funds chasing and punting on momentum. When that momentum stops, the pros will bail. That leaves the small investor, who thought the rally was based on something real, holding the can.

In the same way that momentum works on the upside, it works on the downside too. Price will then drive sentiment lower, and the value guys will get a buying opportunity.

Judging the recent performance of the tech giants, that buying opportunity might be closer than you think. The momentum trade could well be breaking down here.

***

Don’t forget, as a valued Livewire reader, we're offering you an opportunity to gain immediate access to my Fat Tail Investment Advisory with an incredible discount of up to 70% when you join today.

2 topics