The most contrarian investment to make right now

In recent weeks I’ve been discussing ‘peak inflation’ and the headwinds facing stock markets with clients.

This week, it appears to have dawned on investors that these headwinds are a reality. And with this week’s inflation numbers in Australia coming in stronger than expected, peak inflation could be here too.

I’ll explain what I mean by that in a moment.

As far as stocks go, US markets in particular look vulnerable after their recent falls. They’re enjoying a bounce now from oversold conditions, but the trend is firmly on the downside.

In the weeks ahead, it will be important to see whether the March lows hold for the NASDAQ and the S&P500. The charts of some of the big tech stocks, like Amazon and Alphabet, look dicey.

US bonds, on the other hand, have stopped selling off for now. Peak inflation? This could be the start of a bond market rally. More on that later.

First though, let’s dissect the Aussie market. While the ASX200 has outperformed the US of late and is not far off its highs (despite the falls early this week), there is plenty going on under the hood.

So today I’ll give you a bit of a sector breakdown to see where you should be adding and what you should be avoiding.

Let’s start with the ASX 200…

It rallied all the way back to its previous highs last week, but couldn’t go any further. As you can see below, it’s twice tried to break through its August 2021 peak, and failed both times.

This ‘triple top’ chart pattern suggests the Aussie market is in the process of turning back down again, or at least pausing for a while. Still, if you consider that the NASDAQ is near its Russian war induced lows from earlier this year, the Aussie market is nowhere near that.

Much of this week’s selling occurred in the resource sector, a former favourite of the ‘inflation trade’. The sharp falls suggest peak inflation may be behind us.

As you can see in the chart below, the ASX200 Resources index has really tanked in the past week or so. Not including today’s moves, it’s down around 12% from the peak. While still technically in an uptrend, a break below the most recent (March) low would suggest the trend is turning.

Of course, the big iron ore miners drive the Resources index. And with iron ore prices tanking 8% on Monday, it’s not surprising to see the big boys leading the drop.

And the reason iron ore prices are falling is, in a word, China.

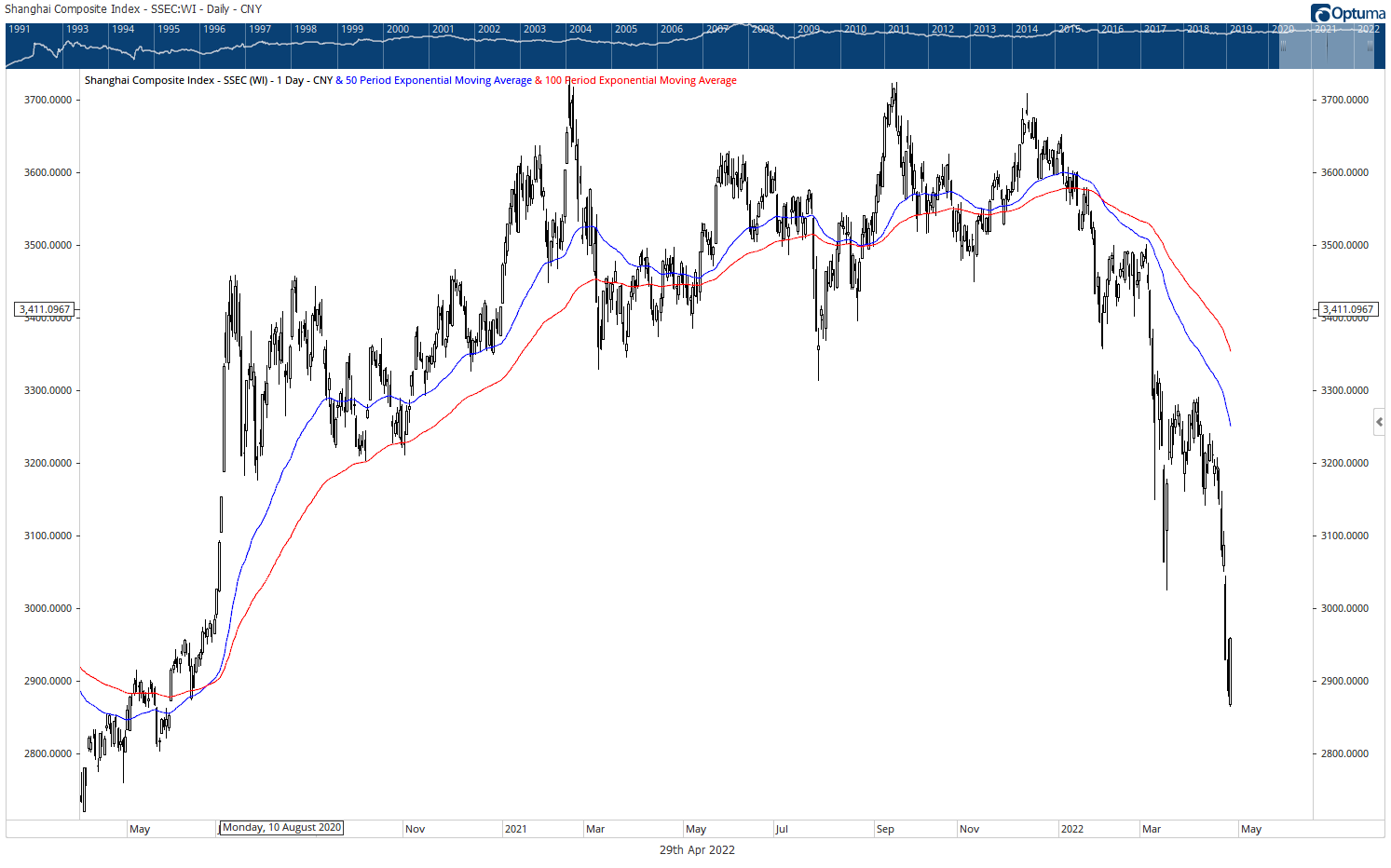

I mean, have a look at the performance of the Shanghai Composite Index lately…

It’s down around 20% from its December peak.

China is suffering in the short term from COVID restrictions. Longer term though, it is under threat from a weak property sector, slowing western economies, and poor demographics. It has plenty of challenges.

On top of that, there are no supply side issues with iron ore. So weakening demand and plentiful supply should keep pressure on prices this year.

And while energy stocks sold off heavily earlier in the week too, this commodity is facing a different supply side issue. That is, years of underinvestment has created a situation where high prices won’t bring about a meaningful increase in supply for years.

In other words, you’re looking at a structural bull market in energy. The chart below shows the ASX 200 Energy index.

In March 2020, it hit the lowest level since 2004. It rallied, then revisited that level in October 2020. Since then, it’s been grinding higher. Thanks to the Russia/Ukraine situation, energy stocks have had a very good past few months. In my view what you’re seeing now is just a correction within a longer term bullish trend.

It’s a buy-on-weakness sector.

It’s a similar situation with gold. While the sector didn’t get as beaten up as energy, it has had a rough past few years. Again, this is a buy the dip sector in my view. Here’s how the chart of the ASX Gold index looks:

It put in a low last September and a higher low in late January. Since then it’s rallied strongly, and is in the process of correcting some of those gains now. Despite the recent selling, the chart continues to look good.

The ASX 200 Financials index (dominated by banks) has outperformed resources and the broader market. But as you can see in the chart below, the index ran into resistance at the October 2021 high.

This suggests the rally is done for now. The performance of the banks is really in the hands of the RBA. How much are they willing to raise rates? With this week’s inflation numbers, perhaps more than initially thought. Soon after the inflation numbers release on Wednesday, Financials were down 1.25% compared to the 0.6% move lower for the broader market. So there’s some nervousness in the sector.

With rising rates and lower fiscal stimulus this year, the consumer discretionary sector (below) is in a down trend. This tells me that inflation is biting, rather than feeding into wages growth. In general, I’d avoid the sector for now.

The ASX All Technology index is also trending down and best avoided for the time being…

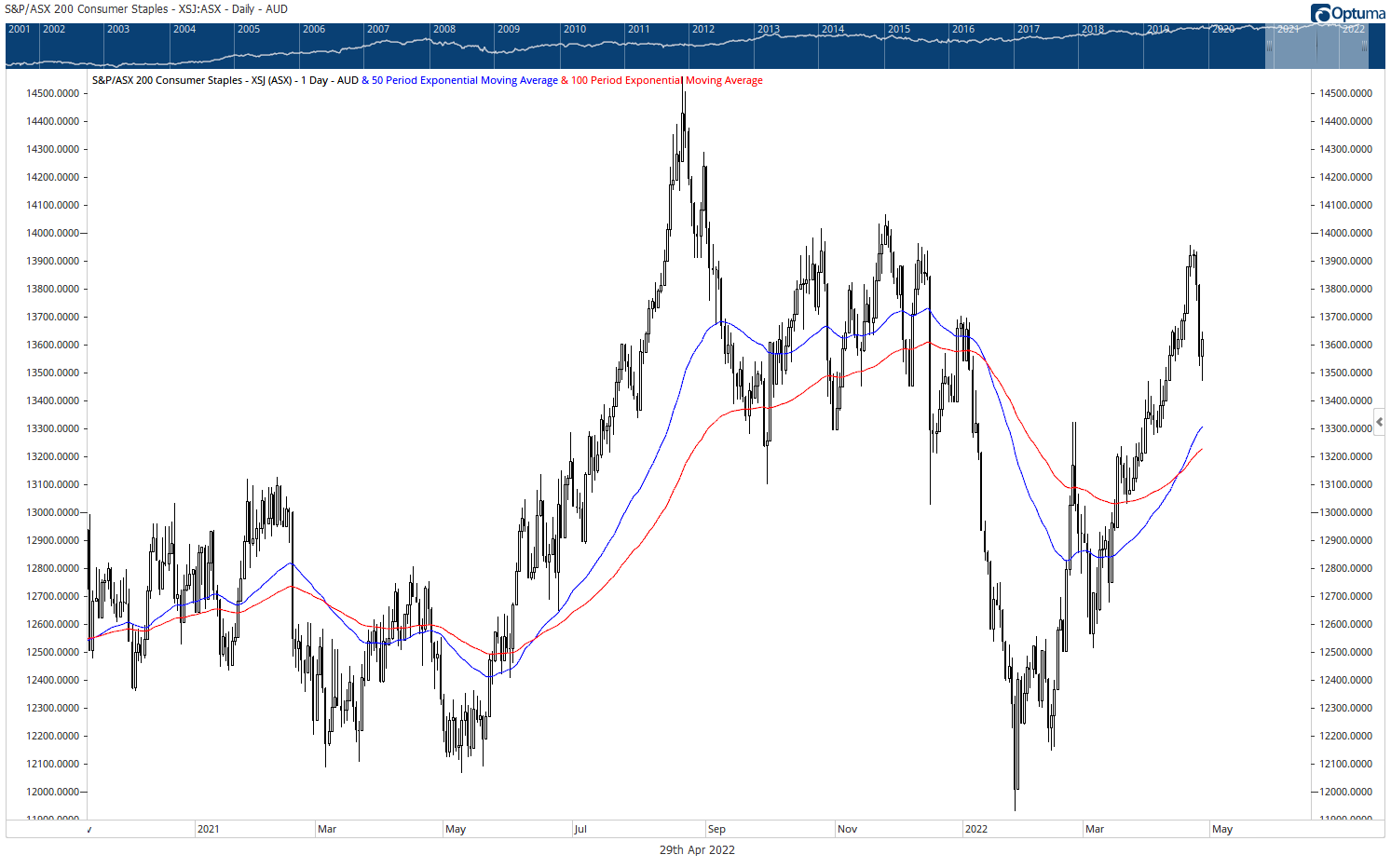

Where’s the money flowing then? Into your classic defensive sectors, consumer staples…

…and utilities…

I’ve never been keen on the idea of ‘hiding’ in defensives though. I’d prefer to sit in cash and wait for the really ripe opportunity.

One such opportunity I like right now is in bonds. Yes, I know it’s unpopular. But that’s where good value hides. Bond funds have been absolutely smashed in recent months. The Australian Government Bond ETF, the ishares Treasury ETF [ASX:IGB] is down 15% from its 2020 peak (that’s a lot for a bond fund) and near it’s lowest point since 2013.

Following this week’s ‘higher than expected’ inflation numbers, this ETF is actually up slightly. That tells you a lot of bad news is already priced into bond funds. When an asset rallies on ‘bad news’ it is often a bullish sign. As I said, ‘peak inflation’.

One of the sharpest economists in the world, Dave Rosenberg, made the case for bonds (in the context of the US market) in a recent research report:

‘Rare has been the time that we have been in such a pernicious cyclical bear market in treasuries with the likes of utilities, REITs and consumer staples hitting or approaching record highs, and when you look at the relative strength of each one of these yield-centric sectors, they are back to where they were in the summer and fall of 2020... when the 10-year was sitting below 1%.

‘I’m not saying we’re going to 1%, but I am saying that the gap between the spot 10-year T-note yield, at 2.79%, and the 200-day moving average, at below 1.7%, represents a 2-standard deviation event, and you always want to invest in a 2-sigma event, in any asset class.

‘Indeed, if you had invested in that 2-standard deviation move from the trendline in the S&P 500 in the fall of 2008 after Lehman failed, you would have ended up doing well even though the market lows didn’t get established until March 2009.

‘If you could ride out the 26% plunge that year to the March lows, you were ultimately rewarded with a 23% positive price return for the entire year.

‘The very same oversold condition was evident in the CRB index back in April 2020 when the mantra was all about COVID-19 instead of today’s narrative of secular inflation, and if you bought into the 2- sigma event and shunned the consensus chatter, you made 45% in your long commodity trade a year out. That’s how I view today’s bond market — with that lens of a dramatic oversold and where we go from here.’

Bonds are unpopular and boring right now. No one likes them. Which is why they just may turn out to be a decent investment for a portion of your portfolio here.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

2 topics