The naked truth about short selling

Schroders

The Emperor’s New Clothes is a classic children’s story first published in 1837 which espouses several life principles that can be applied to investment markets. These principles include the danger of hubris and self-deception, and how herd behaviour can drive irrational decision making. The story is about a pompous emperor who is tricked by two weavers promising him the finest clothes in the kingdom. The charlatan weavers boast the cloth used would become invisible to anyone unfit to serve the ruler or anyone stupid, playing on the emperor’s arrogance.

When presented with the finished garment, the emperor is shocked that he cannot see the clothes. Overcome by hubris, he puts on the non-existent clothes, thereby approving the weaver’s work. His ministers and nobility also obediently complement his new outfit for fear of being labelled stupid or unfit to serve. When a child calls out “The emperor has nothing on at all!" during a public appearance, the emperor realises he has been tricked.

The tale is a fitting analogy for the long-short investor, who seeks to short companies with ‘no clothes’, while purchasing companies with solid fundamentals. Short selling is done by borrowing the stock from a lender, selling it on the market, and buying it later at a lower price before returning it to the lender. Like the child in the story, a long-short investor must stand back, rationalise the security price using a logical framework, and not let the fear of going against the crowd dictate decision-making.

The best short sales are securities where hysteria has inflated the company’s market valuation beyond any realistic earnings prospects that would provide an investor with an adequate return. The market eventually recognises which companies are parading around naked as a security’s valuation is ultimately anchored by its free cashflow, discounted by the cost of capital. If the expected cash flow does not materialise, the crowd can stampede out the exit, driving down the company’s price and enabling the short seller to profit handsomely.

Short opportunities exist in both bull and bear markets

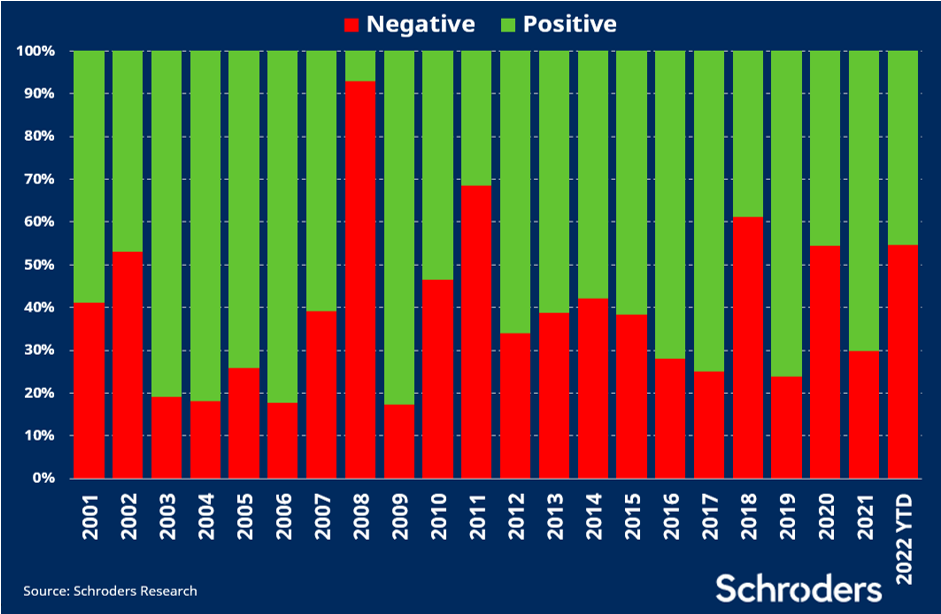

While short selling is typically associated with bear markets, there are plenty of opportunities in bull markets too. An analysis of the ASX300 index from 2001-22 highlights that almost 40% of stocks on average will deliver investors a negative return. The negative return from these stocks is obfuscated by a market capitalisation-weighted index, with returns weighted toward larger capitalised companies. Within the construction of the index, there is fertile hunting ground among the medium to smaller-sized companies for the short seller.

A long-short investor can capitalise on this index structure by constructing a portfolio of short securities to generate returns above the index. Short-sale opportunities exist in bull markets as specific industries and companies can face idiosyncratic challenges, independent of the economic or market cycle. These companies can be uncovered by thorough research such as forensic analysis of financial statements, speaking with industry experts, and monitoring proprietary data sets, a process adopted by the Schroder Australian Equity Long Short Fund.

ASX 300 returns by stock count

How to spot a short sale opportunity

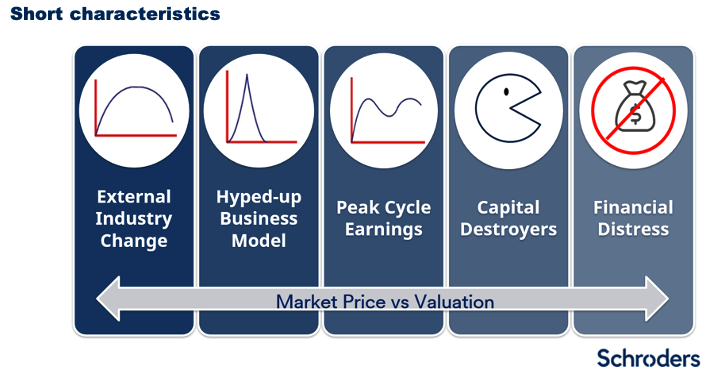

Companies that make attractive short sale candidates can be broadly clustered into the following categories:

- Hyped-up valuations of fad businesses with unproven economics.

- Cyclical companies at peak earnings and valuations.

- Capital destroyers through low returns or poor M&A.

- Distressed or challenged companies with high levels of debt.

Companies can enter and exit these categories as change is constant, which requires ongoing monitoring. Above all, the investor needs to weigh up the price of a security compared to an estimate of intrinsic value, as this will dictate the level of expected return. As short selling does have an asymmetric risk profile, a high degree of confidence is required, which needs to be supported by an evidence-based approach.

The ASX is full of examples of great short-sale opportunities!

In the late 1960s it was the Poseidon nickel bubble. In 2000, it was the dot.com crash; in 2008 it was the sub-prime bubble, and in 2022 it was the bursting of the growth bubble. Recently, growth companies falling out of favour include Domino’s Pizza Enterprises (ASX: DMP) and Fisher Paykel Healthcare (ASX: FPH), down 40% and 42% over six months. Like some of the Nifty Fifty in the USA, these are good businesses run by astute management teams, but they have faced challenges not anticipated by exuberant investors when the securities traded over 55x forward earnings in 2021.

Companies can also fall victim to secular change. An example is A2 Milk Company (ASX: A2M), down 73% over three years from a collapse in its channel markets. A close eye on data from A2M’s eCommerce channels alerted the short investor of deteriorating industry sales before equity markets de-rated the stock. Technological disruption is another example. In 2015 Netflix launched in Australia, challenging the viewership of Nine Entertainment (ASX: NEC) and Seven West Media (ASX: SWM). In response, the networks embarked on an updated content strategy, overpaying for sports rights in an effort to sustain content differentiation. This decimated profits and share prices over the next four years.

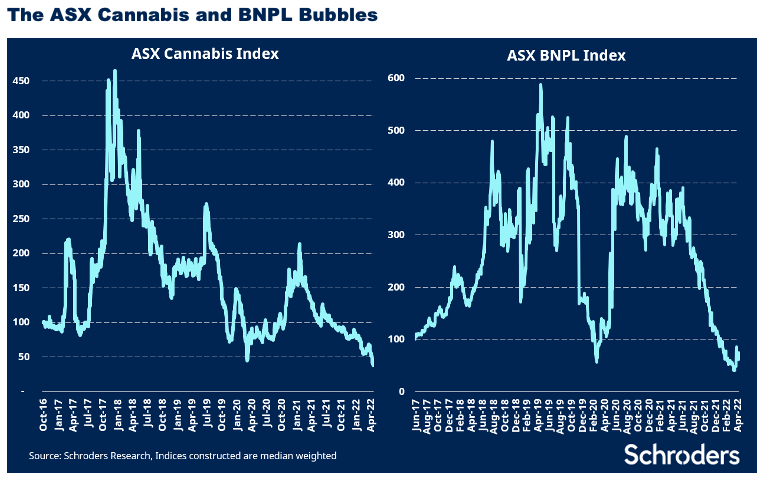

The hyped-up category is where investors drive up valuations of start-ups touting the latest crazes or fads to speculative bubble levels. Social media is playing a significant role in this today. Hyped-up companies include the buy now pay later (BNPL) sector, first championed by Afterpay (ASX: SQ2), followed by many cash-burning imitators. The bubble burst in 2021 as reported losses blew out from bad debt provisions. Several of these imitators are now scrambling for lifelines.

Another example is the 2017-18 ASX cannabis stock bubble. After the Government passed legislation to allow the use of cannabis for medicinal purposes, investor excitement grew, and market size estimates ballooned. Today these cannabis companies are loss-making, with prices down more than 85% from their peak. In 2022, this film is starting to repeat among ASX-listed battery technology start-ups.

The benefits of adding a long-short strategy to your portfolio

Adding a strategy such as a long-short fund to your portfolio has the following benefits:

- Alpha extension: Long short funds are actively managed by shorting overvalued companies facing operational headwinds and reinvesting funds from short sales into undervalued durable companies.

- Hedging idiosyncratic risk: Short positions can be used in pair trades with long positions to offset specific industry risks, such as commodity price movements and or regulatory changes.

- Portfolio diversification: A long-short fund extends the investable universe and provides some diversification from traditional long-only portfolios.

Hans Christian Andersen’s timeless tale of the Emperor’s New Clothes is a reminder that decision-making can be plagued by self-deception and hubris. Andersen’s story also highlights that groupthink can proliferate irrational outcomes, as the desire for acceptance can suppress independent thinking. These human biases are responsible for the boom-and-bust cycles repeatedly witnessed in security prices. Like the child in the story, the short seller can take comfort that logical reasoning and research based on empirical data will prevail over emotion when investing in markets. Because these tendencies exist, there will always be opportunities for the short seller.

Learn more

The Schroders Australian Equity Funds are actively managed portfolios of Australian equities focused on investing companies with attractive valuations, characterised by sustainable earnings and competitive advantage. To learn more about Schroders please visit our website.

5 topics

6 stocks mentioned

Expertise