The next 10 bagger won't be cheap

In 2020, the long debate of growth versus value still rages. Detractors of the style will argue that with interest rates so low, these companies are mere beneficiaries of the economic conditions. The success stories of Amazon, Netflix and Atlassian don’t happen simply because interest rates are low.

There have been five areas of interest that we increased our portfolio exposure at Munro Partners in a post-COVID world. These are areas which are seeing a meaningful acceleration of spending and earnings even with a backdrop of short term cyclical rotations and market uncertainty.

1. Innovative health. The largest position in the fund, this area will experience significant structural growth in the long-term. Not only will companies in this sector benefit from the present struggles with COVID-19, but from preparation for pandemics of the future.

2. Cloud computing and digital enterprise. The corporate transformation to accommodate remote working and as teams become more disparate around the world, cloud computing becomes a necessity. A fast-growing trend now rapidly accelerating, companies in this area will be beneficiaries of this shift.

3. E-commerce & digital payments. The shift to e-commerce and digital payments is another area that drew interest pre-COVID and is now undeniable. We see several innovations in this space coming in to win market share.

4. Climate. Our society is at the start of a de-carbonisation of the planet. We are increasing our investments in this area, with incumbents facing significant disruption.

5. High-performance computing. The exponential growth of semi-conductors in the war of technology will drive this area forward. We believe the expansion of this area irresistible, driven by Moore’s Law.

Short term multiples don’t win in the long term

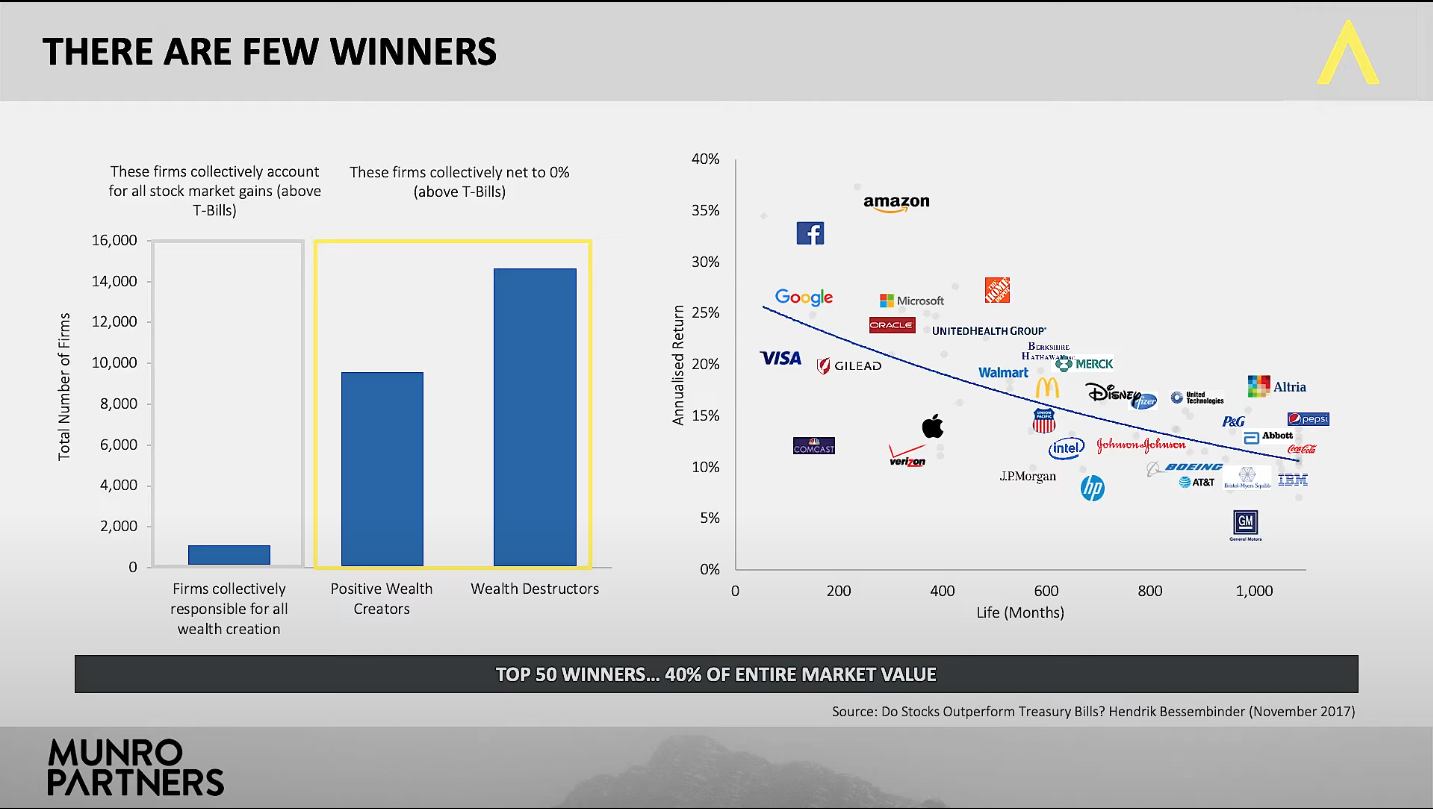

Finding growth stories over the long term is a game of very few winners and thousands of losers. When reflecting on those companies that have created wealth for investors, the fund identifies that the top 50 companies listed in the US are responsible for generating 40% of market value.

Looking for the growth companies of the future will inevitably take you to the tech sector. Here, we see the exponential growth of computing power drive new companies to disrupt the incumbents.

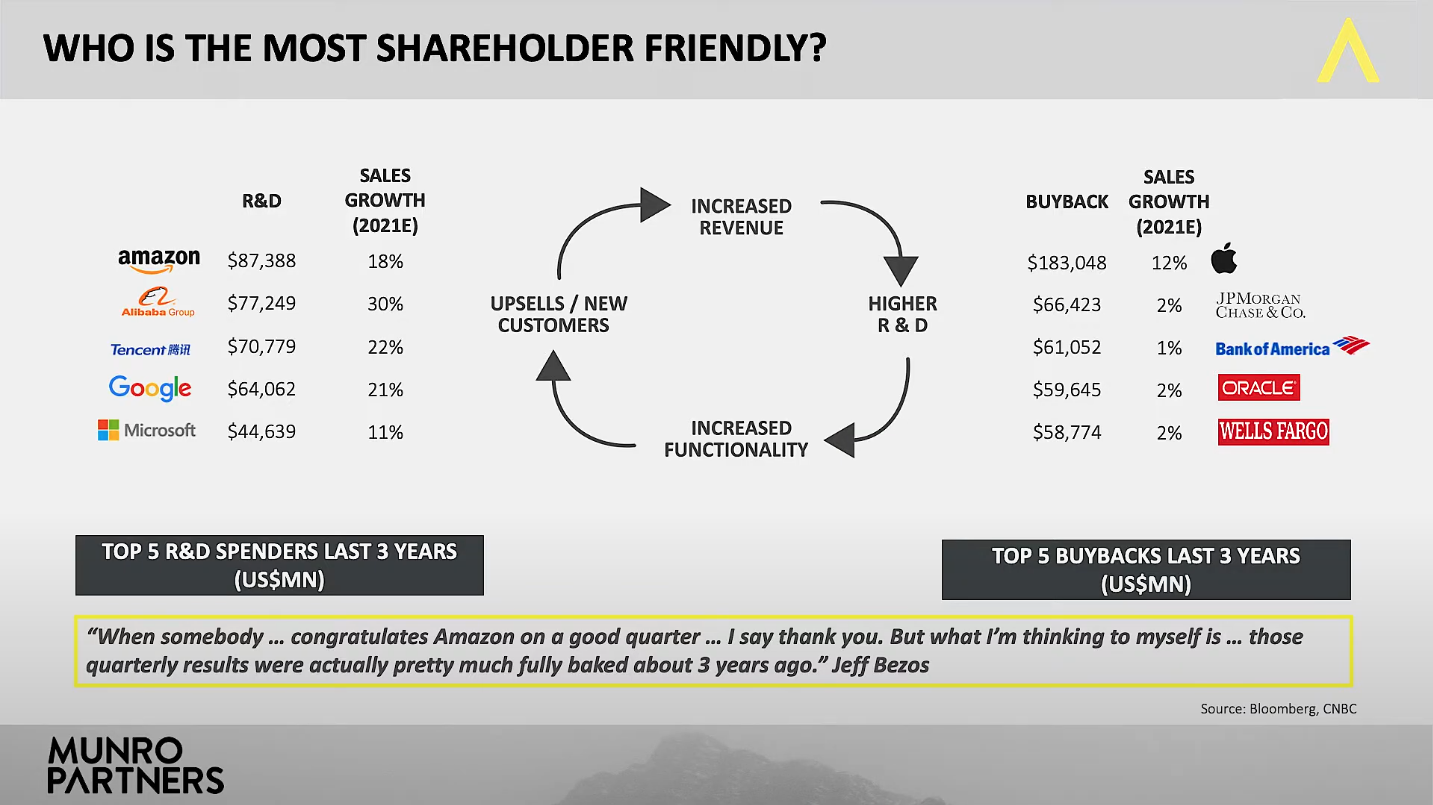

To

remain innovative, firms need to spend aggressively to improve their product

and disrupt their peers. Reinvestment has a cyclical effect.

Earnings invested in the business increases functionality and innovation,

allowing the firm to up-sell and obtain new customers, leading to increased

revenue.

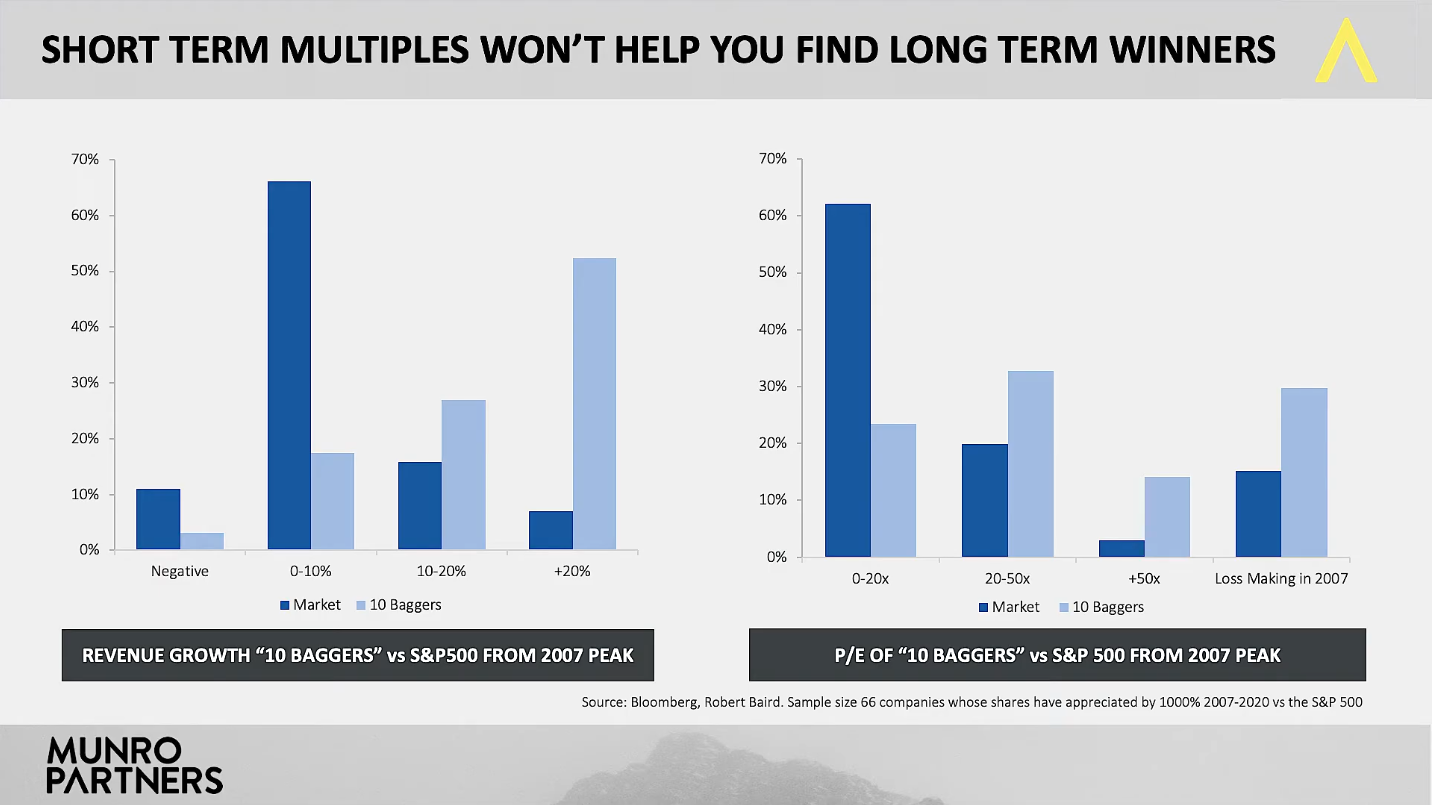

This theory holds true when we consider the ten baggers from the highs of 2007 to the highs of 2020 - the companies that were able to win no matter what. When considering the companies that grew 10 times over that period:

- more than 80% of 10 baggers had over 10% sales growth with the vast majority having over 20% revenue growth.

- majority of 10 baggers had P/E ratios higher than the market with majority trading at multiples of 50 times earning or even loss-making businesses.

When taking a long view, the last thing an investor should be looking at is the short term multiple.

If disruption is accelerating and firms must spend to win, the success stories are not for sale at market average ratios.

Learn more

Click here to visit the Munro Global Growth Fund Profile to learn more about the fund, fees and performance.

3 topics

1 fund mentioned