The one data point investors must not ignore right now

For the first time in four years, the world's most consequential central bank, the US Federal Reserve, has cut interest rates. Unusually for the Fed, the cut was double the regular size of an interest rate move. As a result, different asset classes had different reactions.

For equities, which are priced for a soft landing/Goldilocks scenario, the move was met with cheers. The S&P 500 has since clocked its 41st and 42nd record highs in quick succession. Meanwhile, bond markets were left disappointed as the Fed signalled there will likely only be another two regular (25bps) sized rate cuts this year. But then again, bond investors have a unique way of strong-arming central banks into their view. If you need any proof of that, check out how the Reserve Bank of Australia tried to get out of yield curve control in 2022 (spoiler alert: It was messy.)

So what happens from here on out? How quickly will the Fed and other central banks cut interest rates? How will markets react? And how are Australian investors likely to be affected given the RBA may not cut the cash rate until February next year at the earliest?

To find out, Signal or Noise presents its latest episode - an episode aptly sub-titled The first Fed rate cut has come... Now what?

Joining me and our resident economist Diana Mousina of AMP are two leading investors:

- Cameron McCormack, Portfolio Manager at VanEck

- Sally Auld, Chief Investment Officer at JBWere (and former Chief Economist for Australia at JPMorgan)

Note: This episode was taped on Wednesday 25 September 2024. You can watch the video, listen to the podcast, or read our edited summary below.

Other ways to listen:

Edited Summary

Topic 1: Is the first rate cut a signal to make asset allocation decisions?

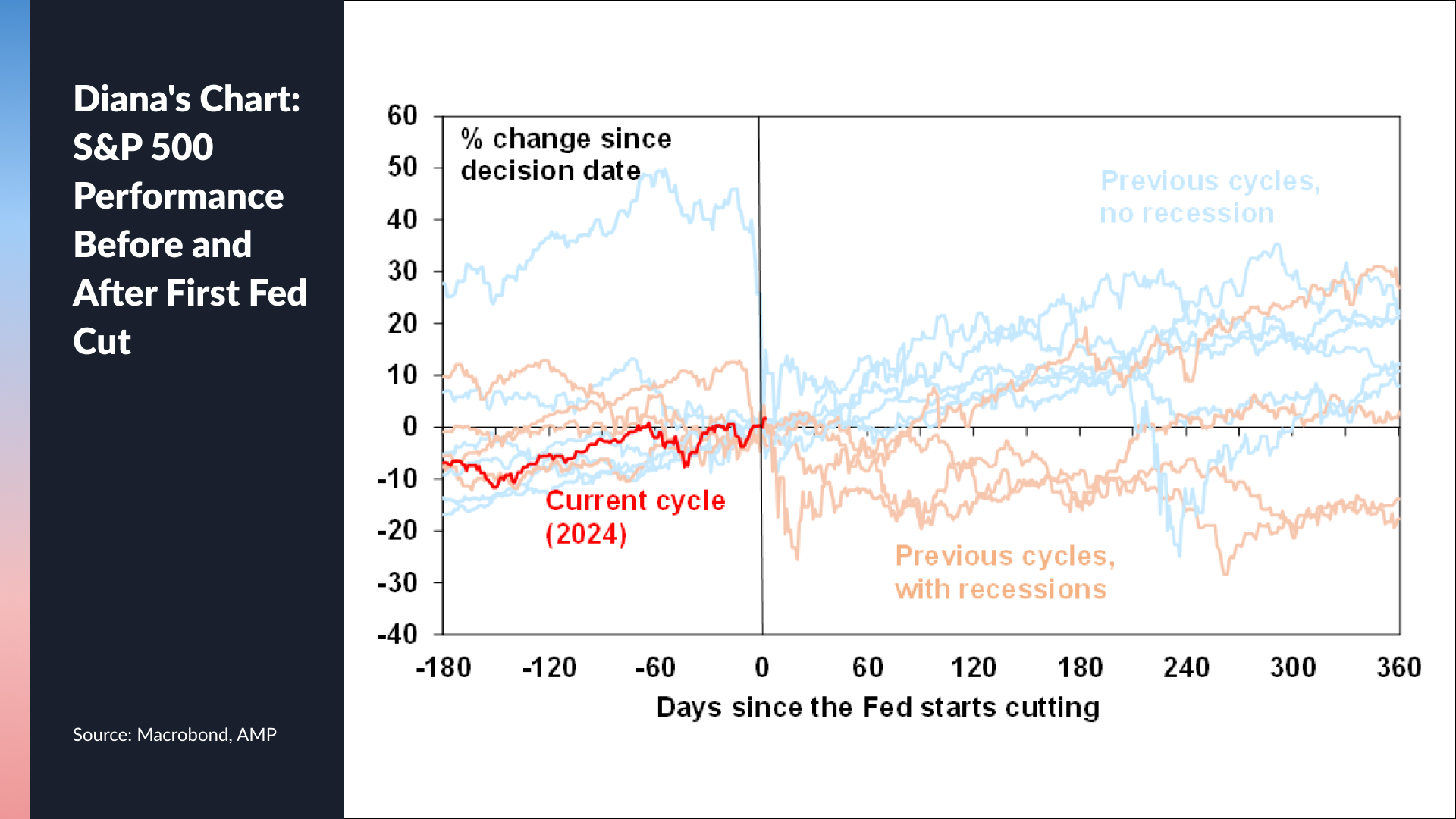

Diana: SIGNAL - The signal this provides is that more rate cuts are coming. But at this point in the cycle, when September is usually seasonally weak and recession risks remain high, rate cuts have given shares a very welcome boost.

Diana's Chart: S&P 500 performance following Fed rate cuts

Cameron: NOISE - The markets have been anticipating a soft landing and although there was a strong performance post-rate cut, valuations are stretched.

Sally: SIGNAL - The Fed made it very clear that the economy needs a less restrictive policy stance. The Fed knows rates need to be lower and quickly at that, so they should just get on with it (as they have.) For markets, this cut comes at an interesting juncture given the Fed has forecast for inflation to be near 2%. growth to remain above 2% and for unemployment to not move materially in 2024/2025. Equities have taken this "hook, line and sinker" but bonds are not so sure. And clearly, both can't be right.

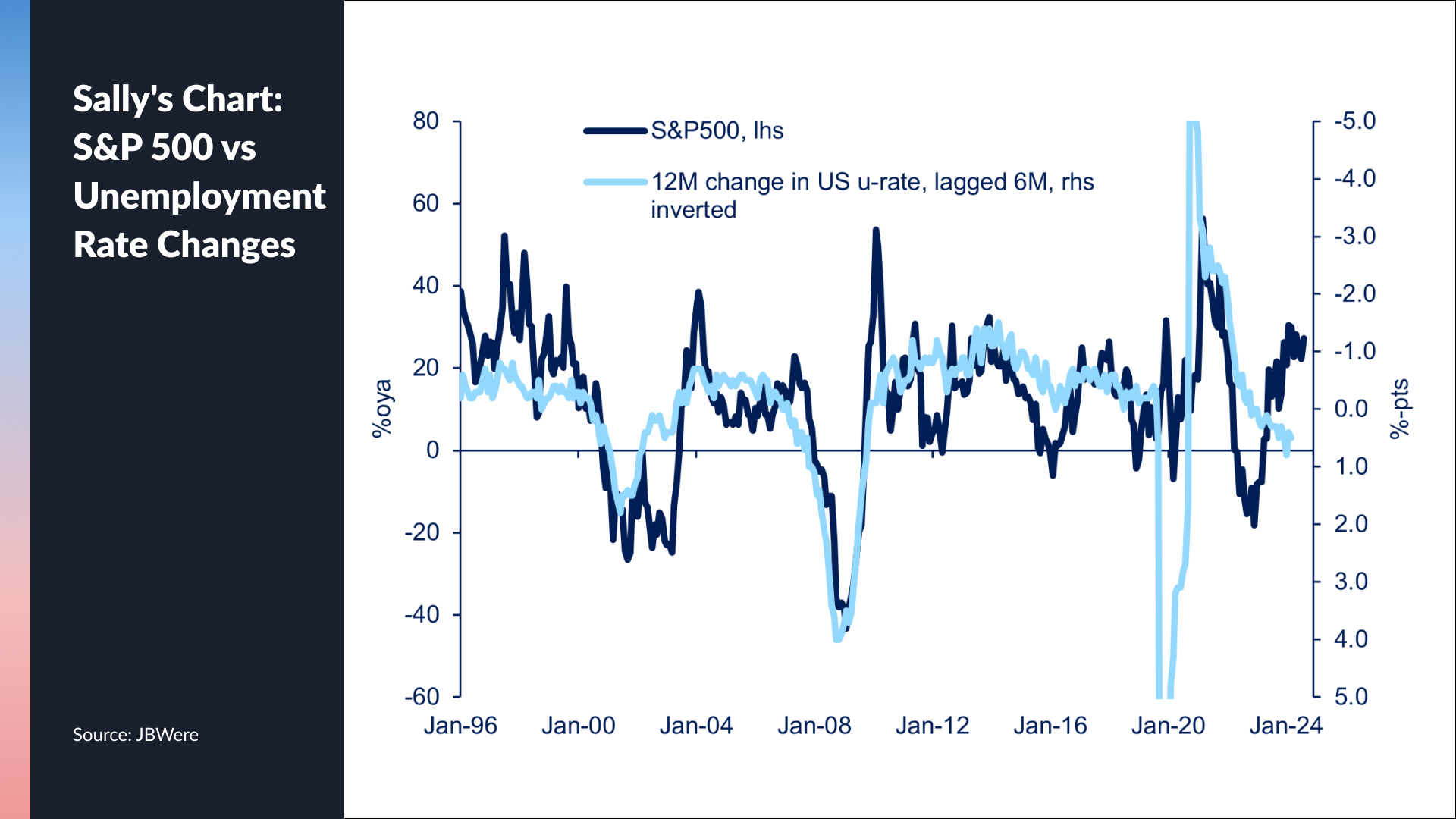

Topic 2: The one economic data point investors cannot ignore right now

Everyone on the panel agreed that the labour market will be the key to finding out whether future jumbo rate cuts are on the table. They also all agreed that if you see a US unemployment rate of above 4.5%, then you should expect to see bigger cuts coming. Diana also added that high-frequency data like weekly jobless claims and job market confidence are also worth a close look.

Sally's Chart: The S&P 500 vs the unemployment rate

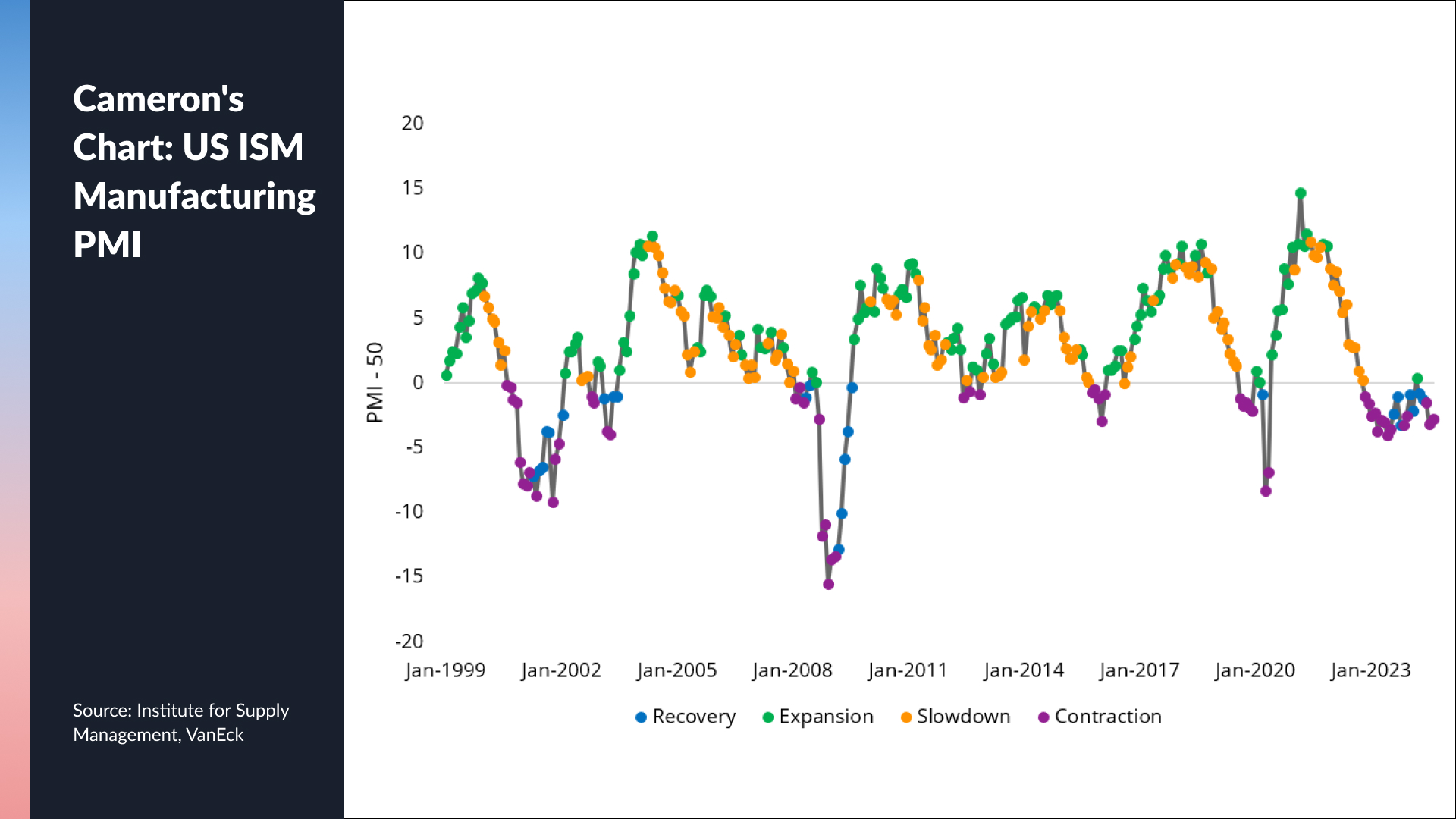

Cameron's Chart: The US ISM Manufacturing PMI

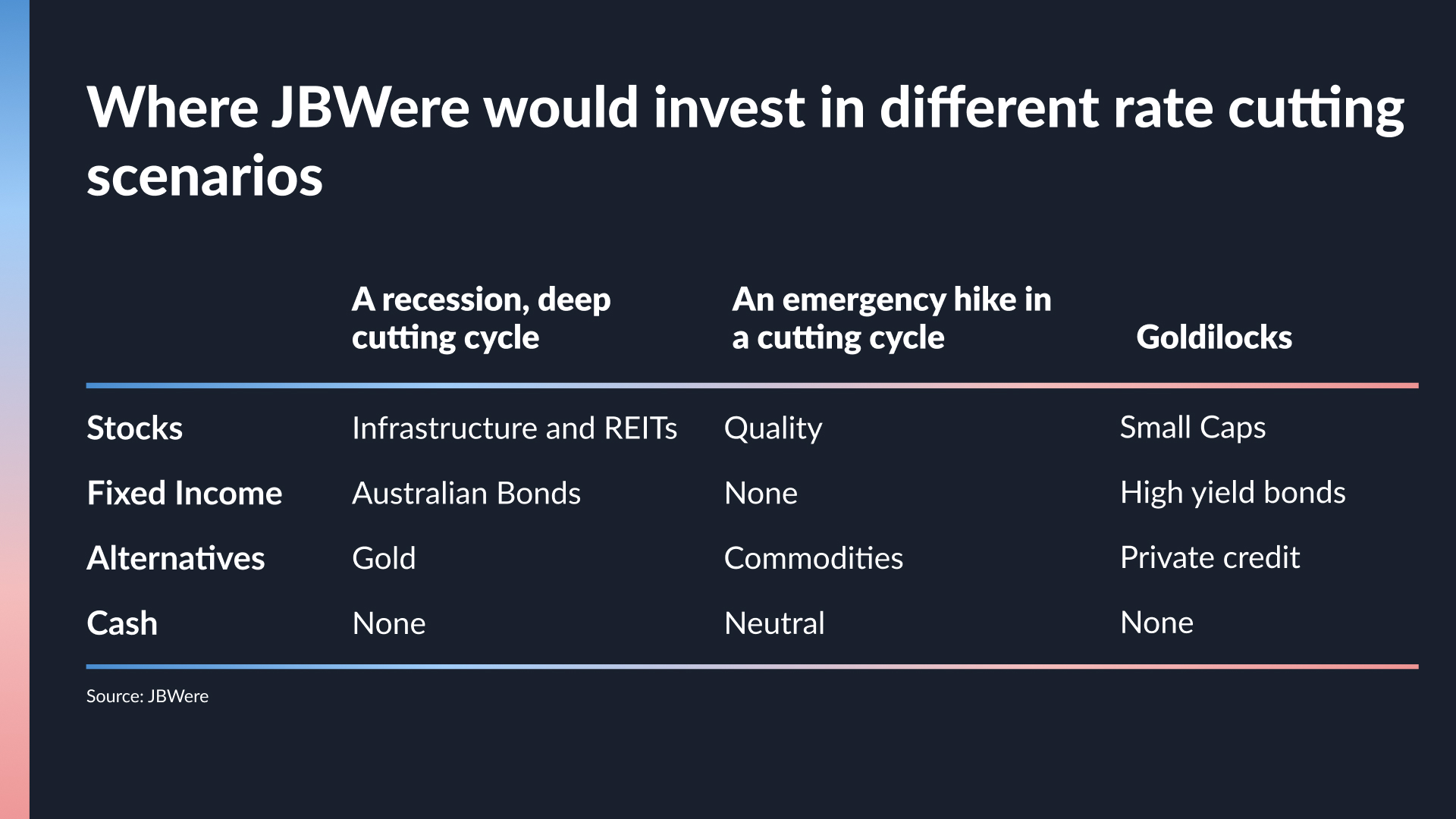

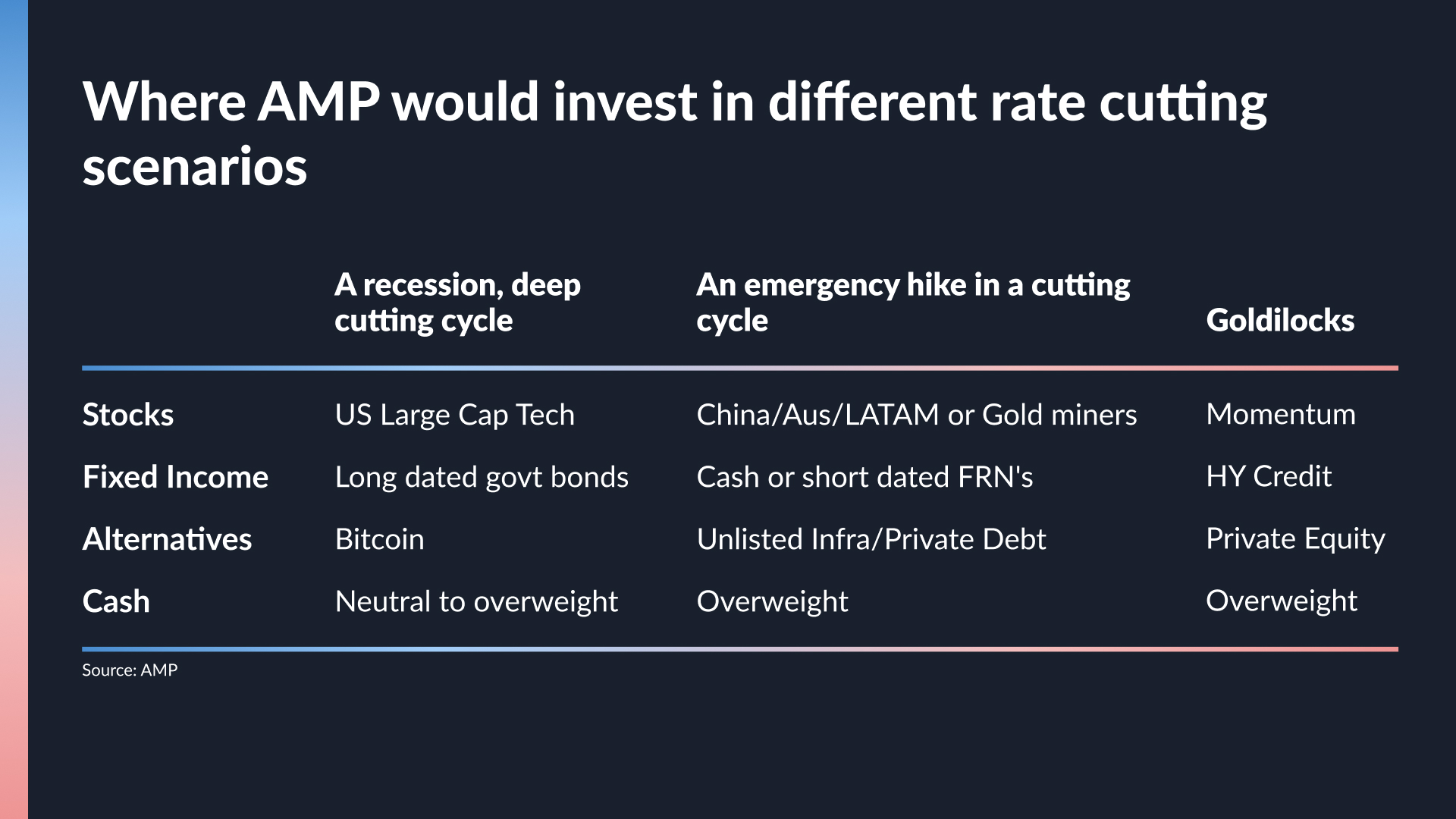

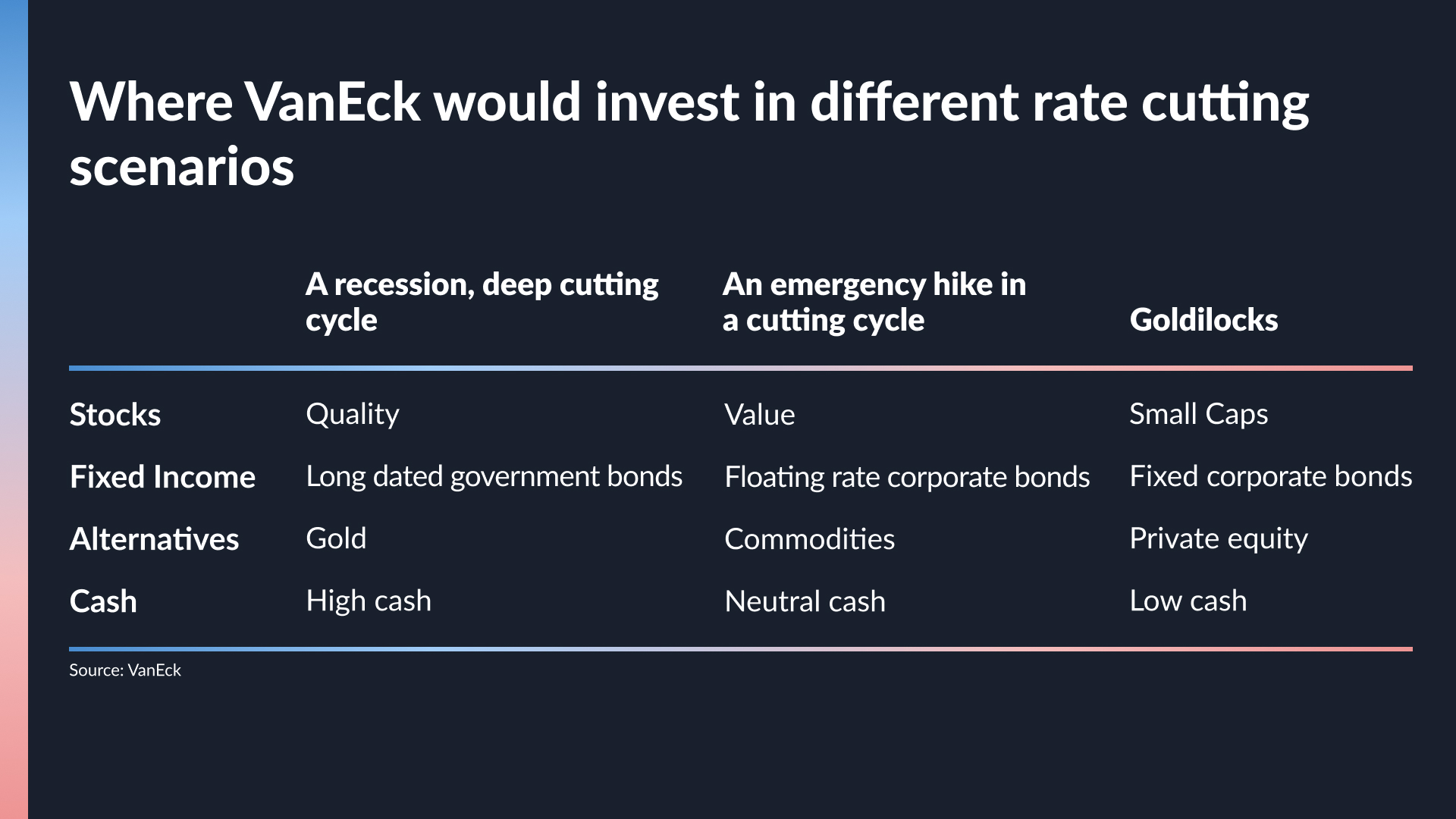

Topic 3: Asset Allocation Matrices

Signal or Noise returns in one month with our annual all-educational special called "Back to Basics".

5 topics

2 contributors mentioned