The pressure points facing EM policy makers

Rate cuts by emerging market central bankers may hold back any rebound in these countries’ currencies as the global economy recovers. But monetary policymakers across emerging markets have felt compelled to soften the economic blow from COVID-19. This response has reduced the historically wide gap between rates in emerging and developed markets.

In this Collections piece, we ask emerging markets managers Rasmus Nemmoe, FSSA Investment Managers; John Malloy, Jr, RWC Partners; and Alex Duffy, Fidelity Investments whether emerging markets are on the brink of a financial crisis due to tightening financial conditions and the factors that will affect their recovery.

Recovery must be underpinned by credible policy responses

Rasmus Nemmoe, FSSA Investment Managers

While there were some dark days back in March and early April, currencies and credit spreads have actually behaved quite well since the Federal Reserve stepped in, and I don’t think a rising dollar is the key thing to worry about at the moment. The main risk as I see it, is the rising inequality which has been underway for years but accelerated because of the pandemic. If we don’t get some credible policy responses that can create more inclusive growth – not just in emerging markets but frankly in key developed markets too – I think we will be in for a rough ride in coming years.

Fortunately, we have seen some larger emerging markets move in the right direction – Indonesia for instance will likely pass the much-discussed Omnibus Law later in the year. This will make many of its over-regulated industries more attractive from an investment perspective, which should create new job opportunities for the young population. Similar initiatives are being fast tracked in India where the government is aiming to end its monopoly in many large sectors and instead incentivise private sector involvement. This should make the Indian economy more efficient in the long run and ultimately more competitive which should be good for growth potential and thus job creation.

EM remain ‘under-owned’ as company fundamentals improve

John Malloy, Jr, RWC Partners

Since the extremities of COVID-19 this year, the US dollar has weakened a remarkable 10%. The US is facing social unrest while embarking on the most aggressive monetary and fiscal easing program in history. As the Federal Reserve and other developed market central banks keep interest rates at zero or even negative, emerging market hard and local currency fixed income offer an attractive yield pick-up. Additionally, emerging market corporates offer a compelling yield pick-up at lower leverage and higher growth in cash flow.

At this point, we believe that most emerging market currencies are attractively valued, as are equity valuations. Emerging market assets have been out of favour, but that is on the cusp of changing. These economies are benefiting from technology disruption and the asset inflation that we are starting to see in hard commodities such as gold, copper and energy prices.

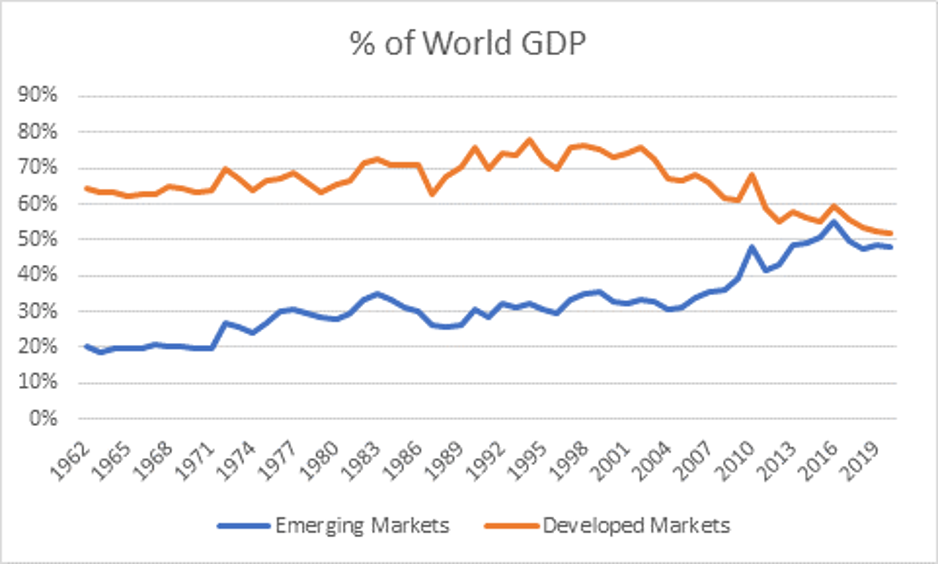

Chart 2: Emerging Markets as % of World GDP are converging with Developed Markets

Source: RWC Partners

Emerging markets are home to 85% of the world’s population and have young and increasingly well-educated populations. As key drivers of global growth, these economies possess some of the world’s most innovative companies and will soon surpass developed markets from a nominal GDP standpoint. Nominal GDP should continue to rise as rural populations decline. Valuations are at attractive levels, especially relative to developed markets. Emerging markets remain under-owned and under-represented while company fundamentals are improving.

History has shown that the expansion of developed market central bank balance sheets has led to large capital flows into emerging markets. Despite recent outflows during the COVID-19 outbreak, we expect a continued recovery in flows across asset classes.

But there are various risks to our thesis, the biggest being the threat of a major US-China confrontation. Although US President Donald Trump has forced China to start to consider opening its economy and normalising trade, the process has been and will continue to be volatile. Lastly, further trade tensions and the upcoming US Presidential Elections have the potential to disrupt investor sentiment towards emerging markets.

Currency movements crucial to EM country exposures

Alex Duffy, Fidelity Investments

In general, the countries most vulnerable to this backdrop are those with current and capital account deficits. In order to address this potential risk/vulnerability, these countries could increase interest rates or rebalance their trade surpluses/deficits by creating domestic demand and more exports. Doing so would require investment, the cutting of red tape, and further structural reforms.

This situation is not all that different from what we have seen in the past. The way we navigate this backdrop is by managing currency risk composition – at stock level – and single country exposure – at portfolio level. We work closely with Fidelity’s risk groups to construct the portfolio in such a way that it isn't overly vulnerable to any single event. It is worthwhile mentioning that, in Q2, for example, we have taken steps to reduce our exposure to Brazil, reflecting our view on the challenging domestic economic as well as political backdrop and the pressure these can exert on the currency. Other key developments we are currently following closely are:

- More recently, the dollar has again been in the spotlight and we continue to monitor its direction: the weakening USD is a positive for the asset class but there are puts and takes depending (again) upon which countries you focus on. In general, the deficit countries stand to benefit the most, although there is a mixed benefit here given the counter weighing domestic considerations. North Asia (the surplus) economies will see indirect benefits as the USD weakness leads to a, likely muted, global economic recovery. India is relatively better positioned as it benefits from a weaker USD and a lower oil price.

- Trade wars, de-globalisation and the unpicking of supply chains and subsequent implications for the Asian export economic model.

- The big debate of deflation versus inflation: we believe medium term both the monetary stimulus and the effects of de-globalisation may prove to be inflationary, with the time it takes for markets to realise this and for the consumer to feel it remains to be seen. Ex Asia, EM is a producer of resources. It is important to remember this in the long term as there is an implicit inflation hedge in these regions as a result.

Conclusion

Many EM central banks have traditionally maintained high interest rates to help fund their current account deficits by making their currencies’ more attractive to investors. But the COVID-19 pandemic has forced policymakers to reconsider this position, as countries went into lockdown and global trade was disrupted. Initiatives to boost domestic demand like lowering interest rates and launching bond-buying programmes to support sovereign debt markets have been widely praised but will be closely watched by investors.

Like this wire? Let us know by hitting the 'like' button to the left.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

3 topics

2 contributors mentioned