The price action behind Cryptocurrency

Cosmos Asset Management

It is no secret that the cryptocurrency asset class is volatile; however, it has proven to provide investors with outsized returns not seen in decades. Investors with the right analysis and appropriate risk tolerance can incorporate cryptocurrency within their portfolio asset allocation.

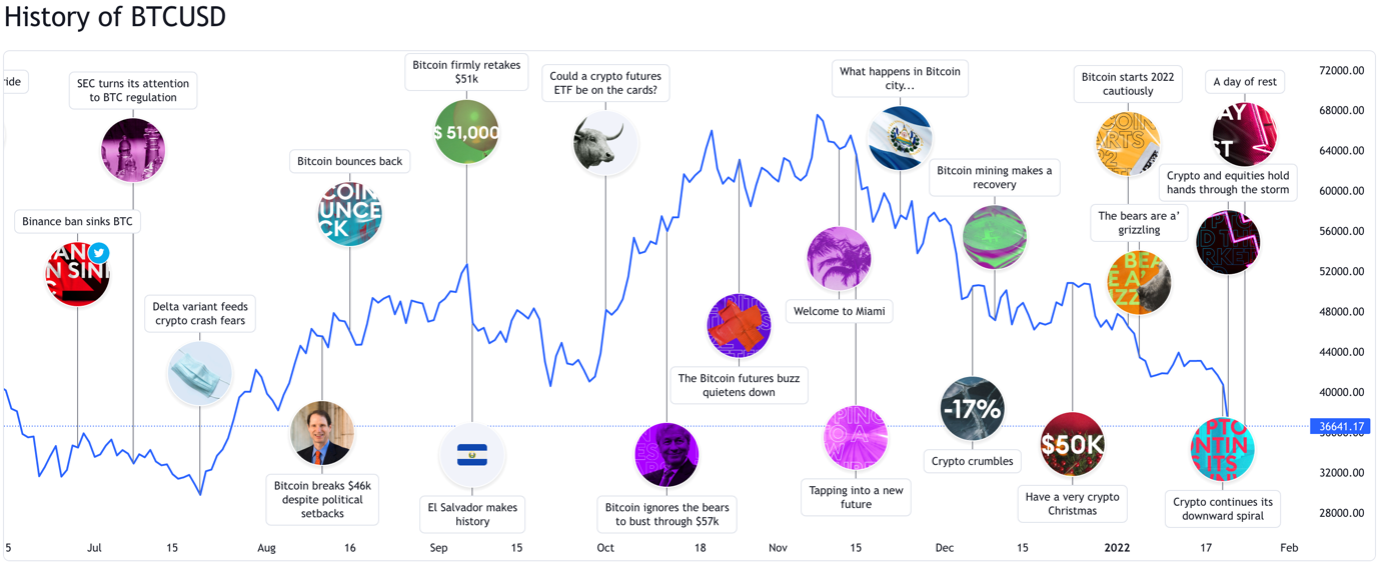

Crypto selloff

The recent volatility in cryptocurrency markets was felt across most risk assets, including the stock market. US small caps were down 20% from November 2021 highs and many individual stocks retrenched down 50-80%. In fact, price movements in Bitcoin over the past few months have been correlated 93% to price changes in the US Russell 2000 index. Most of this driven by the inflation risk and potential rate hikes by central banks—the US Federal Reserve.(1)

Despite its volatility, investment in cryptocurrencies continues to increase exponentially. Importantly, the amount of money in the stock market (estimated at $125 trillion)(2) dwarfs the dollar value of the crypto market, and as a result it will only take a small movement out of stocks into crypto to achieve rapid price rises in Bitcoin along with other crypto assets.

It is also worth noting that most Bitcoins are owned by long-term “hodlers” (hold on for dear life) and liquidity in the Bitcoin space represents a small portion of mined Bitcoin. Faced with low liquidity, a rapid price rise for Bitcoin can be expected as demand picks up, particularly as institutional interest increases.

The market is long overdue for a technical correction and the prospect of raised interest rates is fuel for that fire.

Indeed, we live in a period of enormous market uncertainty, and it is increasingly apparent that excessive central bank liquidity has driven the largest asset bubble of our lifetime. Leading investors and economists are coming to the view that the result of this liquidity in the financial system must ultimately lead to high interest rates and long-term currency debasement.

That is why we believe, despite its recent volatility, long-term movement to Bitcoin as method of inflation hedge will continue.

Many investors view Bitcoin as digital gold, and as the data shows, it makes sense to maintain a small portion of your investments in this digital asset class. After all, in the current market environment, where else might you put your money?

Bonds? No thanks, not with rising interest rates.

Stocks? Hard to make the case for further gains.

Real estate? Depends on how far you think that market can rise considering future interest rate rises. So, at least a small investment in the cryptocurrency asset class can be appropriate for the investor with the right risk tolerance. Moreover, as an investor it is prudent to not pay attention to price, but to focus on your asset allocation and long-term goals. Price is one part of the equation and is of concern in the absence of value (i.e. it is the value that matters). This is how renowned investors like Warren Buffet and Benjamin Graham view their investments.(3)

Bitcoin represents incredible value in the current market environment. Last year, surveys showed that 25% of US households now own Bitcoin, demonstrating absolute adoption of Bitcoin as a megatrend. Estimates are that on the current rate of adoption by 2029 90% of US households will own Bitcoin.

Source: Trading view

What is Bitcoin worth?

This is one of the most debated questions in the market. One way to value an asset is to use what is called the dollar denominated stock-to-flow model. Stock-to-flow models are used to value commodities like gold, silver, and diamonds. Currently, if you throw Bitcoin into this valuation method, it shows that gold is the scarcest asset on earth today. It has a stock-to-flow ratio of 60 to one. So, the stock is the amount of gold that has ever been mined, that is above ground, and the flow is the amount of new gold that gets mined every year.

Bitcoin's stock-to-flow ratio is 45 to one. However, in 2024 the next halving of Bitcoin occurs, reducing the amount of Bitcoin that can be mined. At that point, Bitcoin’s stock-to-flow ratio will move to 90 to one, which will cement Bitcoin as the scarcest asset on Earth.

Today, the total value of gold is valued at around $US10 trillion whilst the total value of Bitcoin is a little bit more than $US1 trillion. Using this model estimates that by the end of 2025, one Bitcoin could be worth approximately $US1 million(4). Note that this model is 95% correlated to the historical price of Bitcoin over the past 12 years.

Remember, price is a minor part of the equation, its value that counts. With this in mind, each investor should assess their risk tolerance, consider their asset allocation and the capital at risk for the upside potential.

Notable happenings in the crypto asset class

Some of the largest institutions in the world, including financial and technology giants like Bain Capital and Intel, are directing huge resources towards the crypto space(5). In fact, institutional interest is booming, which is a critical factor in the building of the robust decentralised financial infrastructure capable of supporting crypto use by the masses.

Just this week, Warren Buffet’s Berkshire Hathaway disclosed it had increased its interest in the world’s largest Neobank, Nubank, to the tune of $1 billion worth of stock(6). While Buffet has been vocal about not wanting to invest directly in crypto, this most recent move demonstrates his willingness to continue to increase his exposure to companies involved in the emerging crypto sector.

Walmart, the multinational retail corporation, and the largest company in the world by revenue, has recently indicated that it is getting deep into crypto with plans for its own cryptocurrency and Non-Fungible Tokens.(7)

Coinbase, the largest US cryptocurrency exchange has just struck a deal with MasterCard to enable crypto payments.

Adding to the list is the latest from BlackRock, who is planning to offer crypto trading its investor base.(8)

If there is one thing that is certain in the cryptocurrency asset class, it is that blockchain technology is here to stay and is attracting investors across global markets from retail to institutions. The technology is rapidly changing the face of business and finance as we know it, and cryptocurrency and digital currency infrastructure underpins much of this change.

(2) Research Quarterly: Equities - Research Quarterly: Equities - SIFMA

(3) Grayscale finds that over 25% of US households surveyed currently own Bitcoin (cointelegraph.com)

(5) Digital Currency Group - Bain Capital Ventures; Intel Wants to Be a Bitcoin Player. It Won't Move the Needle for the Stock. | Barron's (barrons.com)

5 topics

Dan is the CEO of Cosmos Asset Management and is responsible for leading the business operations and strategic direction. He has extensive experience in the local and global funds management industry, with over 15 years dedicated to Exchange...

Dan is the CEO of Cosmos Asset Management and is responsible for leading the business operations and strategic direction. He has extensive experience in the local and global funds management industry, with over 15 years dedicated to Exchange...