The RBA could increase its QE program at any time...

In the AFR today I write that financial markets overlooked a potentially profound exchange last Friday that pierced the Reserve Bank of Australia’s impenetrable intellectual edifice to garner important insights into the distribution of possible outcomes apropos its current quantitative easing (QE), or bond purchasing, program. Click on that link to read the full column. Excerpt enclosed:

In a revealing interview with Bloomberg on Thursday, RBA board member Dr Ian Harper hammered governor Phil Lowe's point home further, stressing that “the bank can continue to buy bonds for as long as it likes—there’s no obstacle to that”. And there is nothing stopping them upsizing the program!

Yet like a pit-bull locking its jaw on a target, Dr Andrew Leigh would not give up: “But surely your own MARTIN model [used to produce forecasts of the economy] would suggest that, if you had doubled the size of QE, inflation would be higher, wages would be higher and we'd be closer to full employment?”

“It could,” Lowe agreed. “By that logic, though, you would just keep going and going and going. If $200 billion would do that, you could make the same argument for $300 billion, $400 billion or $500 billion.”

“Until eventually you're in your target band and achieving your mandate,” Leigh interjected. “It's not obvious that this is a bad thing.”

Here the forthright deputy governor Guy Debelle entered the fray. “So, yes, you're right,” he remarked in what was becoming a tautological debate. “The issue is: at what point do you start not getting the transmission through to those prices that you might expect? We don't know what that point is.”

Debelle reiterated Lowe's message that QE's transmission mechanism through to the economy remains uncertain. The RBA started this experiment in November, and believes that QE 1.0 has been valuable insofar as it has helped keep long-term interest rates and the trade-weighted exchange rate lower than they would otherwise be. Every day Martin Place accumulates new information on the efficacy of QE, which should allow it to be recalibrated over time.

While it is perfectly reasonable for the RBA to keep the base-line at $100 billion every six months for the first year, there will also presumably be a point where there is a case for varying this base-line to some larger number, say $125 billion or $150 billion, to study the relationship between policy changes and economic variables. Or, as Leigh might put it, to simply help stimulate extra employment and wage growth through a lower real exchange rate.

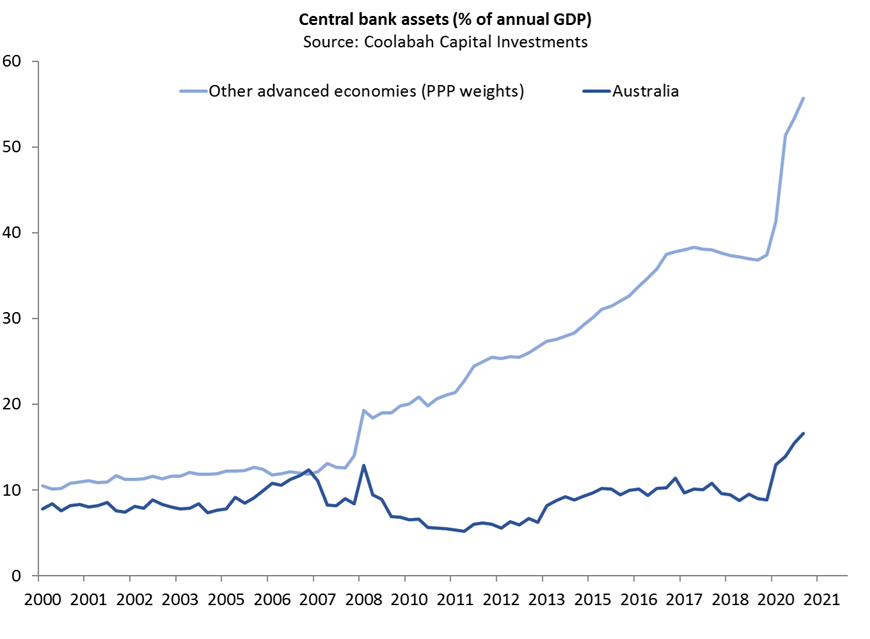

Debelle did also warn of the potential for dysfunctions in the bond market if the RBA ends up being too large a part of it. Yet the RBA owns a much smaller percentage of the Aussie government bond market than peers overseas. It holds about 15 per cent of all Commonwealth government bonds and just 7 per cent of state government bonds. Central banks in New Zealand, Japan, and the UK own over 40 per cent of their government bond markets. The ECB is on track to control a similar share of all German bonds. And the US Federal Reserve holds 23 per cent of the massive treasury market.

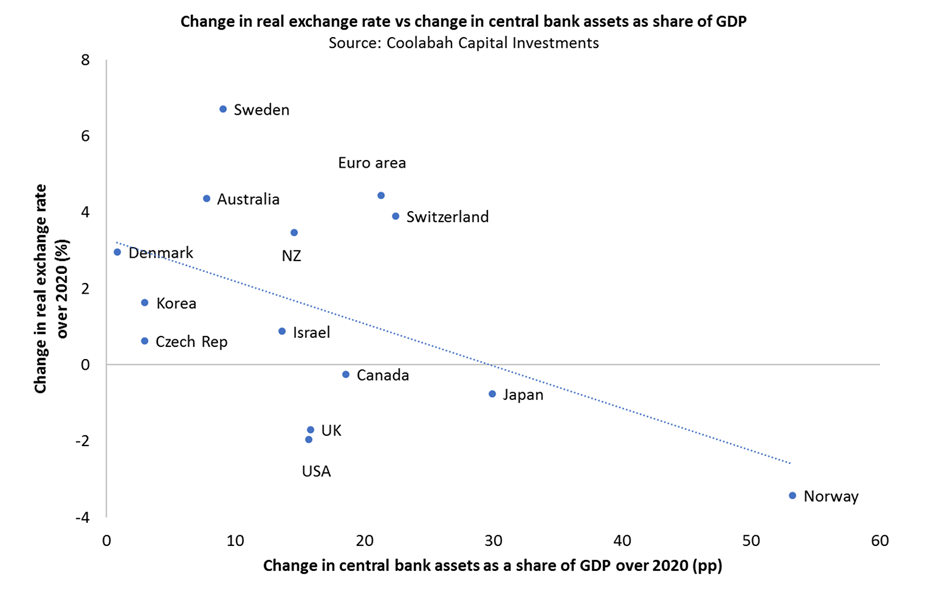

The RBA is the first to acknowledge that its slower balance-sheet expansion vis-à-vis foreign central banks is one reason why our long-term interest rates and exchange rate are higher than they need to be. This is borne out by global data suggestive of a negative relationship between central bank asset purchases as a share of GDP and the change in a country’s real exchange rate.

When all is said and done, the RBA will only know the limit of its QE program once it actually reaches it. With little in the way of downside risks or opportunity costs (buying long-dated bonds has no direct impact on mortgage rates), there is value in exploring where that ceiling lies. I would not, therefore, be surprised if the RBA once again shocks market participants by recalibrating its QE commitments upwards somewhat.

While the analyst community believes the RBA’s QE program is fire-and-forget, every board meeting is, in fact, live and there is nothing stopping the RBA tweaking the size of the program at any time, just as they did with the Term Funding Facility in September 2020.

Access Collabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 13 analysts and 5 portfolio managers. Click the ‘FOLLOW’ button here and never miss our updates.

3 topics

1 contributor mentioned