The RBA holds interest rates again - but does more need to be done?

The Reserve Bank of Australia kept interest rates on hold at its first meeting of 2024 - a decision that was all but sealed following last Wednesday's softer-than-expected inflation report. Markets had more or less priced in this pause - and it shows in the price action:

The ASX 200 had a slight dip but recovered shortly after. Overall, a non-event as far as price-action is concerned.

The Australian government 3-year yield experienced a small spike. But it was already trending higher in the prior two sessions.

The Australian/US dollar also experienced a small uptick at 2:30 pm AEDT, up from near two-month lows.

While the perfect mix of softening inflation and low unemployment is still in play, financial conditions have tightened dramatically over the last 18 months, with more pinches likely to come as rate hikes slowly take effect throughout the economy.

Recent commentary from the International Monetary Fund (IMF) may have the Board raising an eyebrow. The Fund's economists argue that the RBA has not increased interest rates enough to defeat inflation by its target of the end of 2025. At the same time, many market economists argue that interest rate policy is already restrictive - that is, it is doing its job to slow down the economy. Any more, some argue, could dramatically increase the chances of Australia going into a recession.

So is Australian monetary policy tight enough - or as ex-RBA economist Jonathan Kearns suggested recently - does there need to be more rate hikes given how low our real rate is?

In this wire, we'll analyse the RBA's latest monetary policy decision and its latest set of economic forecasts and ask the titular question to Governor Bullock herself - is the Australian cash rate high enough?

Key Quotes from the RBA's Decision

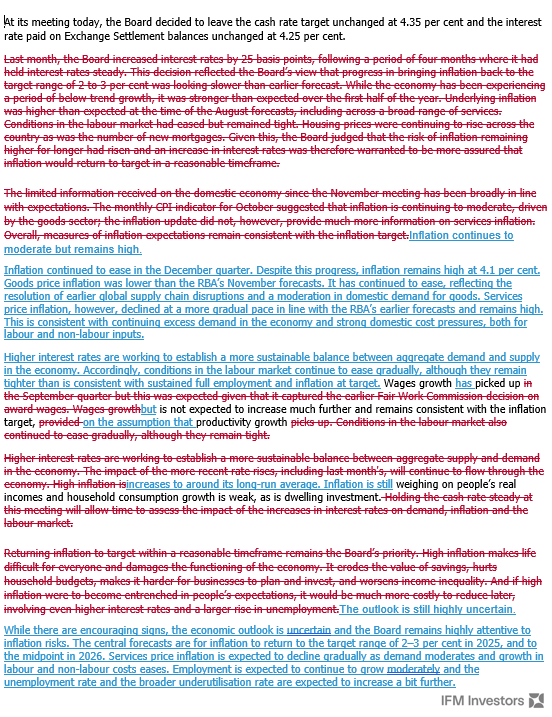

The first quote of note is what's missing. As this Bloomberg readout provided by IFM Investors Chief Economist Alex Joiner shows, a lot is missing from the new statement, which was in the previous statement.

"The central forecasts are for inflation to return to the target range of 2–3 per cent in 2025, and to the midpoint in 2026. Services price inflation is expected to decline gradually as demand moderates and growth in labour and non-labour costs eases."

This is an important line in the RBA's statement as it emphasises the key issue the RBA has to deal with. Yes, goods inflation is coming down but services - the products and services we all use day-to-day, like electricity and water, are not. We talked about this in our wrap-up of the December quarter inflation report.

"Higher interest rates are working to establish a more sustainable balance between aggregate demand and supply in the economy. Accordingly, conditions in the labour market continue to ease gradually, although they remain tighter than is consistent with sustained full employment and inflation at target."

A small increase in unemployment would be a sign that rate hikes are working and are delivering an intended effect. Australia is not hiring at the same pace that the US still is, suggesting our transmission effect (i.e. the time it takes for rate hikes to hit the real economy) is faster than it is stateside. But a more severe uptick than the one the forecasts suggest (see below section) could put the RBA in a spot of bother.

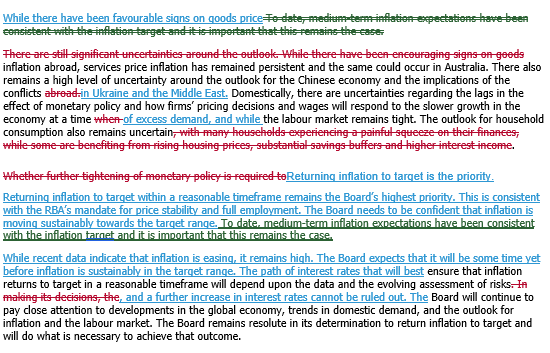

"The path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe will depend upon the data and the evolving assessment of risks, and a further increase in interest rates cannot be ruled out."

The RBA Board is clearly joining some of its overseas counterparts and is doing its best to push back against the latest moves in the rates market.

In a prime-time interview just two days ago, US Fed Chair Jerome Powell reinforced the “danger of moving too soon is that the job’s not quite done and that the really good readings we’ve had for the last six months somehow turn out not to be a true indicator of where inflation’s heading." Those lines caused the big move in the bond market we have seen for the last few days.

Immediately before this meeting, rates pricing in Australia still suggests there will be two 25-basis point rate cuts by the end of 2024.

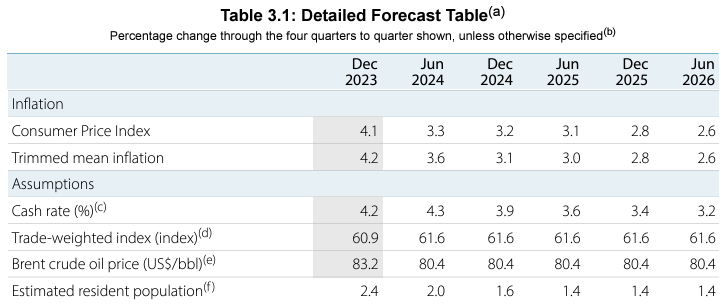

The new economic projections

The newest economic projections from the central bank suggest a material trimming in the Bank's inflation forecasts, offset by upticks in the unemployment rate and a material slowing in GDP (economic growth) by mid-2024.

While inflation will likely decelerate faster than expected by the June quarter print, the real devil in the detail is how slow it will be to get from June 2024 to June 2026 - a whole two years to fall just 0.7%. Is this too much caution? One could argue that persistent services inflation also suggests the RBA may have good reason to be this cautious. After all, the last mile in the fight against inflation tends to be the hardest.

In all numbers, we've highlighted the new projections in bold and the previous number underneath. All numbers are in % and the source for all data is the RBA's February Statement on Monetary Policy.

| QUARTERLY FORECASTS (%) | ||||||

| Dec 2023 | June 2024 | Dec 2024 | June 2025 | Dec 2025 | June 2026 | |

| GDP growth | 1.5 | 1.3 | 1.8 | 2.1 | 2.3 | 2.4 |

| (previous) | 1.6 | 1.8 | 2 | 2.2 | 2.4 | – |

| Unemployment rate | 3.8 | 4.2 | 4.3 | 4.4 | 4.4 | 4.4 |

| (previous) | 3.8 | 4 | 4.2 | 4.3 | 4.3 | – |

| CPI inflation | 4.1 | 3.3 | 3.2 | 3.1 | 2.8 | 2.6 |

| (previous) | 4.5 | 3.9 | 3.5 | 3.3 | 2.9 | – |

| Trimmed mean inflation | 4.2 | 3.6 | 3.1 | 3 | 2.8 | 2.6 |

| (previous) | 4.5 | 3.9 | 3.3 | 3 | 2.9 | – |

| YEAR-AVERAGE FORECASTS (%) | ||||||

| 2023 | 2023/24 | 2024 | 2024/25 | 2025 | 2025/26 | |

| GDP growth | 2 | 1.6 | 1.5 | 1.9 | 2.2 | 2.3 |

| (previous) | 2 | 1.7 | 1.8 | 2 | 2.2 | – |

The new cash rate projections

Is policy restrictive enough?

With the above figures in mind, Livewire asked Governor Michele Bullock the following question:

Does today’s decision to hold rates and the assumptions around the cash rate suggest that monetary policy is restrictive enough? And how much risk is there that you may be forced back into tightening mode over the coming months?

This is how Bullock responded:

The evidence is that monetary policy is restrictive and it's working. We see that in a number of things - Inflation is coming down, the labour market is easing ... households are curbing their consumption and focusing on essentials. The evidence is that it is restrictive and the challenge for us is, 'is that restrictive enough to bring inflation back down, within a reasonable period, that means inflation expectations don't get out of hand?" We think we're on that path, that's our central forecast but we're alert to things that might go either direction."

We don't think about market pricing as being a forecast of our own cash rate. Markets will make their own decisions and they're putting their money where their mouth is. We're not driven by market pricing. What's important for us is looking at the economic data. We want to see that inflation continues to decline. We've had encouraging news so far but its still got a four in front of it.

The Statement of Monetary Policy expects China's growth to "slow over the next two years as the post-pandemic rebound in services consumption fades and the property sector remains weak." In addressing China-related risks, Bullock said:

The slowdown in China is built into our forecasts. They are experiencing difficulties, particularly in their property sector ... The way that impacts us is through commodity prices and our export of commodities. We are very focused on it ... If circumstances change in China, we'll have to relook at our forecasts. But at the moment, I think we're comfortable that we've something built in there that's realistic for China.

With thanks to Kerry Sun for his assistance.

2 contributors mentioned