The real scandal about LICS/LITS in 2020

2020 started with controversy over stamping fees paid on LICs/LITs at IPOs. I did not have strong views on the stamping-fee issue but was critical of the quality of some of the arguments and analysis/data being used (including from ASIC) to paint a generally negative view of LICs and LITs generally, and particularly the recent IPOs.

Adding to the controversy around early 2020 there was growing misinformation on, and misunderstanding of, the dynamics of listed closed end funds helping to foment an increasingly consensus view they were “structurally flawed” primarily because of their inherent characteristic to trade on market at a price different than their underlying NTA.

In mid-2020 the Treasurer banned stamping fees on LIT/LITs IPOs to retail investors, although not on IPOs of other listed closed end vehicles such as REITs and infrastructure funds or other listed investments also used by retail investors such as hybrids and shares generally.

In my view the real scandal involving LICs/LITs in 2020 was not the 1-1.5% stamping fees that had been paid in IPOs (which were usually paid for by the manager, not investors, and rebated to investors in many cases). The more important issue for 2020 involves monetary amounts many multiples of these. This relates to the enormous amounts of money lost, and opportunity cost borne, by investors who haphazardly dumped their “structurally flawed” LICs/LITS at massive discounts to NTA around the early 2020 market turmoil, encouraged by poor analysis/advice and flawed commentary, some by industry participants actively promoting alternative product structures.

Discounts/Premiums a feature not a flaw

The characteristic that the trading price differs from NTA is a feature, not a flaw, of listed closed end investment vehicles such as LICs and LITs. That feature, common to all listed closed end funds traded across many global markets over decades, even centuries, brings with it advantages and disadvantages.

Properly understood and assessed, investors can position themselves to benefit from the advantages of this discount/premium dynamic, or at least limit major negative impacts. Lacking knowledge or easily persuaded by misinformed commentary and poor analysis and advice, investors will likely bear the full brunt of those disadvantages. Rarely have these dynamics been so starkly displayed as during 2020, generating big losers and winners in the process.

The “structurally flawed” thinking on LICs/LITs is particularly problematic when one considers that the primary initial impetus for any large discount to NTA is the actions of investors themselves. A LIC/LIT cannot trade at a large and persistent discount without sufficient investors being willing to sell, and transacting, at those discounted prices. Investors seeking explanations for large discounts should therefore start by looking in the mirror at their own actions and those of their co-investors. Only from that perspective can they properly understand the dynamics of discounts (and premiums), their implications for the risk/return profile of funds and what can be done to remedy large discounts.

Discounts provide opportunities

Of course, the extreme moves in the first half 2020 environment has provided some exceptional investment opportunities for value-oriented and non-emotional investors prepared to be objective and contrarian. I was certainly an active participant in many of these opportunities although I am not suggesting taking advantage of them is easy.

It is difficult to go against the consensus especially when price weakness seems relentless, and the surrounding commentary is overwhelmingly negative. Jeremy Grantham’s description of “Investing while terrified” comes to mind.

However, the losses experienced by those investors who gave up on LIC/LIT vehicles in the first half of 2020 has done considerable damage to many portfolios and to their perception of LICs and LITs as valid investment vehicles. The volume numbers and shareholder changes suggest that many of the investors who bought LICs/LITs at IPOs (and probably only in the IPOs) sold during the first half of 2020 (especially around the late March lows) and have taken big losses as a result. Yet it was almost certainly the way they approached (or were advised to approach) listed, closed end funds that caused the problem, not the structure itself.

As I show below, investors who held on through 2020 have generally done fine. Investors who had the courage to add to their holdings as discounts expanded sharply have done considerably better. Investors who had approached IPOs cautiously but were prepared to buy heavily into significant weakness and higher discount opportunities in LICs/LITs have likely done extremely well.

Some massive moves produce big winners and losers

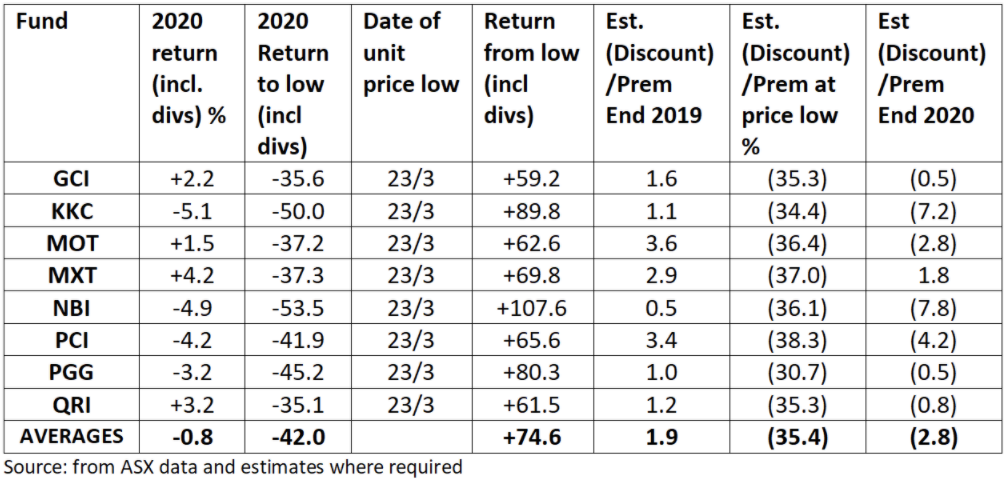

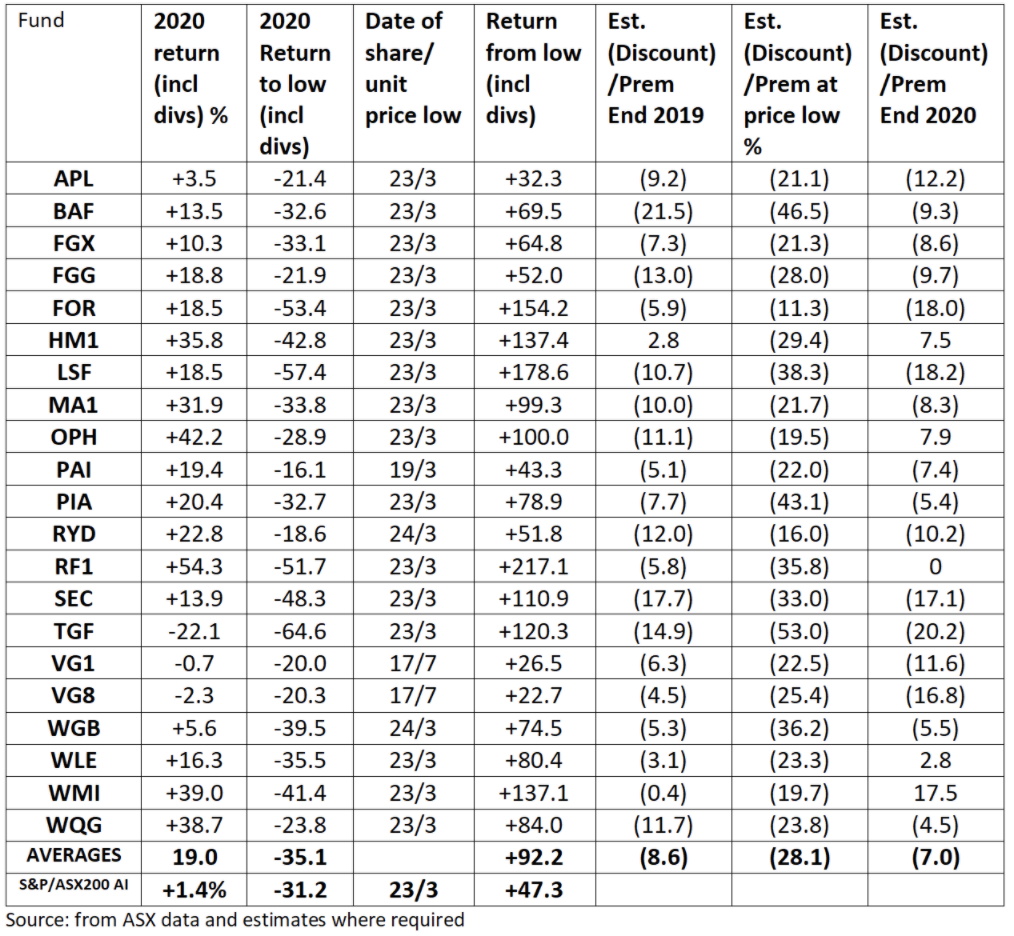

Table 1 below shows 2020 returns and estimated discounts to pre-tax NTA on the debt LITs that floated in recent years. Table 2 does the same for a selection of the more prominent equity LICs/LITs that floated in recent years.

Table 1 – Debt LITS (click on image to enlarge)

Over full year 2020 debt LITs (which operate several different investment strategies) have produced slight negative or slight positive returns (average -0.8%) and far from the disaster some have painted. (these numbers understate returns as they assume no reinvestment of income during the year). Interestingly, returns faced a headwind because all funds were trading at small premiums to NTA as the year began, something LIC/LIT investors should be cautious about.

At 2020 year end most debt LITs were trading at small single digit discounts to NTA. These seem appropriate in the circumstances and those with slightly higher discounts correlate to those that had slightly more negative returns (albeit still small) in 2020. However, the full year assessments miss the full picture of the massive drama within the year.

Panic, disgust and crazy discounts in March

As the March turmoil hit listed unit prices fell dramatically and total returns in the period to the market and unit price lows of 23 March were all worse than minus 35% with an average of minus 42% and the worst at minus 53.5%. This result was clearly about a dramatic expansion in discounts. Discounts to NTA at the low point for unit prices (all 23 March) were between 30% and 40% with an average of 35.4%. (Note the date of the low in the unit price is not necessarily the peak of discounts on individual funds).

Table 1 also shows the dramatic recovery in total returns from those lows/large discounts. Returns from the March 23 low to 2020 year-end ranged from 59.2% to 107.6% with an average of the 8 funds of 74.6%. These were extraordinary returns for debt funds. Even the equity market as represented by the S&P/ASX 200 Accumulation Index returned less than all of these at +47.3% for the period from 23 March to end 2020.

How did we get to those crazy 30-40% discounts and large capital losses (if realised) in late March? I would suggest panic, disgust and a major misunderstanding/miscommunication of LIC/LIT pricing dynamics.

Obviously, the economic and market environment was extremely uncertain at the time.

Some might argue that if central banks and governments had not come to the rescue underlying NTA performance of these funds could have become much worse so justifying these moves to massive discounts. There is some small truth in this (especially for those funds holding illiquid/untraded assets) but to the extent many of these funds invested in listed or traded securities their NTA already fully or largely reflected these concerns so the NTAs had already moved, the extreme 30-40% discounts on top of this made little rational sense.

At the time there was a clear panic to "get out at any price." Volumes exploded through this period to the highest levels since floating. It seems many LIC/LIT investors, particularly through this period, judged a fund mostly by the falling share/unit price not by its NTA performance or outlook, and by selling in response to these price moves they accentuated the large discount and added to price weakness, inspiring further selling by others.

Extreme moves from some equity LICs

Table 2 shows similar metrics for a selection of more prominent equity funds that floated in the few years prior to end 2019. The picture is a somewhat less coherent than that for the debt funds but sees similar overall conclusions and some quite stunning individual numbers.

Note that as with debt LITs I am understating returns somewhat because I have assumed dividends are not re-invested as received but effectively received at period end. Nor have I accounted for the generally higher franking credits on many LICs compared to the market/ETFs/unlisted funds.

I could be accused of selection bias here in the funds covered but have aimed to include many of the equity LICs that floated (or converted from unlisted status) over prior years including many that ASIC referred to in its June 2019 analysis and where reasonable estimates of end 2020 NTA could be made (given some have not yet provided Dec 20 NTAs).

Table 2 – Equity LICs/LITS (click on image to enlarge)

The equity related returns for full year 2020 have been strong overall with only three negative returns (only one significant) and an average of the selected funds of 19.0% which is impressive in a year when the S&P/ASX 200 Accumulation Index returned just 1.4%. (albeit noting some of the funds have a global focus).

However, the full year 2020 returns hide a dramatic ride within the year for most funds.

Most equity LICs/LITs started the year at discounts ranging from small to reasonably elevated. Discounts on almost all funds blew out markedly in the lead up to their share price lows which were mostly, but not all, around 23 March. Note again that the discount at the lows does not necessarily equate to the peak discount as some funds lagged their NTA recovery and some discounts blew out further into mid-year (perhaps accentuated by tax loss selling). Discounts have since reduced dramatically for most into year-end with most now trading around NTA or single digit discounts, albeit with a small subset of funds where discounts remain stubbornly high around the mid-high teens.

That combination of expansion of discounts into late March and then generally narrowing into year-end led accentuated poor returns to the lows but helped provide some exceptional recoveries. Returns to the individual share/unit price lows were typically worse than the market overall with an average -35.1% (S&P/ASX 200 Accumulation Index was down 31.2% to 23 March). Yet returns from the lows (fuelled by strong NTA recovery and discount narrowing) were almost all better than the market and some spectacularly so. Almost half this selection of funds returned over 100% from the lows with RF1’s 217.1% the highest of these (average recovery return +92.2%).

Clearly, investors that experienced much of the decline and dumped their shares around the bottom and even through June have generally worn a nasty loss (typically more than the overall market) and more importantly missed out on a dramatic recovery which would, in most cases, have seen dramatic outperformance of market indices and more than made up prior losses and produced good returns over 2020.

To those investors who thought they were bailing out of LICs/LITs to invest into other “better” investments it would have been extremely difficult to achieve higher returns if they were switching those proceeds into other unlisted funds or ETFs. Of course, some of those who bailed out are geniuses who instead bought Afterpay or other hot stocks instead of a portfolio or the broader market. (Although this raises the question of why they invested in a listed managed fund in the first place). The tables indicate that in many cases a large part of the return from the low has been the narrowing of the discount itself.

The combination of strong NTA performance and a significant narrowing of the discount demonstrates that powerful “double whammy” that only listed, closed-end funds can offer. Investors typically misunderstand or underplay these dynamics. For example, most investors instinctively think that if a discount to NTA moves from 40% to 10% such a move (without any NTA change) has added 30% to the return but in fact it has added 50% (30/60).

Of course, investors saw the downside of these discount dynamics on the way to the market lows. But their investment experience will depend on how they responded as it played out.

Even doing nothing over 2020 produced a much better result. Being proactive and looking for opportunities, even just reinvesting income, could have added significantly to return. Indeed, one of the benefits of being able to ride through big discount cycles is your distributions/dividends can be reinvested at the same big discounts either explicitly as part of a DRP or informally by using cash from accumulated distributions/dividends to add to attractive , discounted opportunities. Avoiding a haphazard or emotional response was key as was better understanding the positive and negative implications of LIC/LIT discount dynamics and cycles.

Volumes and shareholder changes suggest many gave up

Some might say that the absolute price lows in many LICs/LITs were quite fleeting and not many shares/units were sold (and therefore bought) at around those extreme low prices and high discounts. It is true that for most of the funds the worst of these returns (and largest discounts) typically occurred over relatively few days/weeks around late March and early April.

However, this period is exactly when the volumes traded on many LICs/LITs exploded to the highest levels in their entire histories. Some of this trading may be repeated buying and selling by the same parties. Still, comparison of the top 20 shareholders in 2020 annual reports compared to 2019 for many LICs/LITs suggests major turnover of ownership. (Many investors obviously ignored the fact most of these vehicles talked about investment time frames of at least 3-5 years in their Prospectus).

Further, while discounts were only at the most extreme at the market lows, in many cases they did stay elevated for many months (and in some equity funds as indicated above are still relatively high).

The truth is most LIC/LITs dramatically underperformed markets generally on the downside and dramatically outperformed on the upside. Did it need to be this way? I would suggest if we had not gone into this cycle with such widespread scepticism and misunderstanding of LICs/LITs, and particularly the dynamics around discounts/premiums we would not have seen such a pronounced discount cycle, even with challenges markets have faced.

Understanding LIC discounts and cycles

Of course, at the individual level there are all sorts of reasons investors sold. Some needed liquidity. Some looked at the falling share prices and panicked. Some got poor advice. Some were sure they had better places to put the money. Some were easily convinced by the “structurally flawed” arguments (and this belief was further “confirmed” by the high discounts and falling prices).

Few did an objective assessment of what other investments needed to deliver compared to the ones many were selling at a 30-50% discount to an already depressed NTA.

Many fell for simplistic and backward-looking analysis, and simple emotion. Misperceptions around the mathematics of discounts and a general backward-looking focus are what blind many investors to the opportunities that large discounts can provide and the speed with which large negative returns that have been significantly contributed to by rising discounts can be recovered.

Some may point out that returns from IPO on some LICs since inception are still relatively poor for those that have held on. That is true in a few cases. But you must play the ball in front of you and judge your investment from the price and fundamentals today not the price you paid.

LICs/LITs – not flawed, just different

There is a significant change currently going on in the LIC/LIT space currently and I do not suggest there are not some major issues with some LICs/LITs. Some funds are too small, some fees are too high or poorly structured. Governance could be improved in some funds. The investment strategy and quality of investment people of some is lacking.

Shareholders and boards of several funds have felt that the only way to remedy the discount situation was to convert to an alternative structure. It is important that there is the flexibility to consider such structures (or even wind-ups) for long underperforming or persistently heavily discounted LICs/LITs. However, I wonder whether much of the discussion around LICs has become polluted by poor understanding of their dynamics and particularly what drives discounts (and premiums).

LICs are not a flawed structure they are just a different structure with different characteristics - some of these characteristics provide advantages and disadvantages over other structures. Depending on how they are approached LIC and LITs can be extremely good contributors to a robust investment portfolio.

Towards a better understanding of discounts and premium

Significant money is made and lost in markets when there is a wide gap between the fundamental reality and the perception of a large proportion of industry participants. 2020 in LICs/LITs was a textbook example of this.

Those investors, brokers and advisers who had previously enthusiastically embraced IPOs of LIC/LIT (but typically never bought existing listed funds), then later complained those vehicles were “structurally flawed” as discounts grew (but did nothing proactive about them) and finally dumped their shares/units in disgust at large discounts (that their own selling helped bring about and accentuate) have demonstrated lazy, naive and emotional investing at its worst.

Meanwhile, for those more patient investors with a curious, intelligent and objective perspective, these reactive and emotional participants have provided invaluable lessons on “what not to do” and set the groundwork for an area fertile with interesting and attractive investment opportunities.

The author holds shares/units in a number of the funds mentioned in this article. (I have a small consulting role with LICAT aimed primarily at helping to educate investors about the nature of LICs/LITs - however, the views in this article are my own.)

A second article on LIC/LITs will be available on Livewire in coming weeks and will attempt to better explain the psychology and dynamics of LIC discounts/premiums and some lessons on how to better approach these to make money and lower risk.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

29 stocks mentioned