The retailers to watch as the economy opens up

In just a few short months, the COVID-19 pandemic and associated lockdown have triggered seismic shifts across the retail landscape. Some changes are likely to be temporary; others may accelerate previous structural trends. As we emerge from hibernation, I thought I’d try to identify the businesses that should prove to be better investments in the years ahead.

Government enforced restrictions have dramatically altered consumer behaviour and retailers have had to quickly react and adapt to many unforeseen challenges, including supply chain disruptions, panic buying, wild category swings, surging online sales, store closures, staff layoffs, rent negotiations and a murky macro outlook as we emerge from isolation.

Household consumption typically accounts for around 60 per cent of domestic output so expect the retail industry to remain a central focal point for stimulus policies and getting the economy back to work. Recent spending data shows record low interest rates and helicopter money have had some early positive impact, but will it be enough to meaningfully awaken the economy from hibernation? As more stores around the nation begin to reopen, we thought it would be worthwhile exploring some of the key retail issues investors need to consider and which players appear best positioned to navigate, and even prosper, through the prevailing turbulence.

Small cap retailers have bounced hard off their lows but overall remain well behind the market, year to date. We will continue to look out for compelling investment opportunities within a sector bound to be volatile over the next twelve months – these are precisely the market conditions in which securities are frequently mispriced and good businesses are sold down below intrinsic value. Our current investments include a mix of structural growth stocks (Kogan (ASX:KGN), City Chic (ASX:CCX) and Adairs (ASX:ADH)) and good value plays (Super Retail Group (ASX:SUL) and Nick Scali (ASX:NCK)).

- Supply chain – a major concern for discretionary retailers earlier on in the virus crisis as China shut down its economy; however, industry feedback suggests factories are now back up and running towards full production capacity with only minimal supply chain disruptions experienced. Principal risk here would be a powerful second wave of infections in China (need to monitor closely);

- Category swings – initially the sector experienced heavy falls in shutdown affected categories like cafes and restaurants, gyms and travel; with sharp spikes seen across categories benefiting from working from home and ‘nesting’ behaviour, such as supermarkets, food delivery, home furniture and appliances, electronics, and home fitness. Households effectively bought an extra week’s worth of groceries during March – supermarket turnover was up 25 per cent on the prior year, driven by panic buying, pantry stocking and a resurgence in home cooking. Another example was Super Retail Group which saw its Rebel stores cleared out of most home fitness equipment within days of shutdown. We would expect some of these early category swings to normalise somewhat as restrictions are gradually eased over the coming months;

- Online – social mobility restrictions have accelerated online penetration significantly, particularly food (doubled to around 10 per cent), e-commerce marketplaces and discretionary categories which have properly invested in digital capabilities. Online pure-plays, Kogan and Temple & Webster (ASX:TPW), both recently provided positive trading updates confirming these trends – KGN’s sales doubled in April while TPW second half turnover is up 74 per cent. The debate here will be if online sales have merely been pulled forward while physical stores have been shut or if the rate of structural migration has indeed stepped up a gear with new customers enjoying the digital experience and sticking. Although we anticipate the current surge in online sales to taper, we do see scope for COVID-19 being a catalyst for faster online migration trends in Australia considering we remain well behind other developed nations and many domestic players have been building out their omni-channel strategies, significantly improving the overall appeal of e-commerce;

- Data – an interesting theme related to online and digital trends – the ability to collect, mine and leverage customer data to capture more wallet share is a real competitive advantage for savvy retailers. Super Retail Group, Kogan and Adairs stand out to us as operators with particularly strong data analytics capabilities;

- Store openings – the gradual easing of restrictions has encouraged an increasing number of retailers to reopen their physical stores across the country and test the discretionary consumer pulse. Accent Group (ASX:AX1), Adairs, Lovisa (ASX:LOV), Nick Scali and Premier Investments (ASX:PMV) have all commenced the process of reopening. Some retailers have indicated that they will take the opportunity to reassess their bricks and mortar network with the weakest performing sites without long lease commitments unlikely to make the final cut. Foot traffic data shows discretionary spend in shopping centres is down around 80 per cent on last year, however is rapidly improving by the week as store openings gather pace and consumers feel more comfortable venturing out post isolation. Importantly, conversion is strong which implies shoppers appear to be heading out with a purpose;

- Gross margins – although many retailers have strategically been targeting gross margin dollars over comparable sales growth (less discounting), reason for caution around sector gross margins exists given pressures from a weak Aussie dollar and the likely fragile consumer environment as the economy recovers. Seasonal and fashion related goods are most at risk of heavy discounts as retailers seek to avoid carrying over excess aged stock, maximising their cashflows. June sales are nearly upon us so we will get a chance to see how deep and widespread discounting will be;

- Wages – the government’s generous JobKeeper assistance package which subsidies wages for eligible businesses (revenue decline test) has been an important economic backstop for the retail sector during the shutdown period and a key enabler for retailers to reopen physical stores. The rescue package is due to expire at the end of September, however it remains unclear how and exactly when it will be wound back. This will likely depend on how quickly the economy snaps back; a materially weaker macro environment may indeed require an extension or alternative stimulus measures;

- Rent – the government’s shutdown guidelines have called for landlords to share some of the economic pain with tenants suffering from material sales declines. Many retailers have not been paying rent whilst closed for business and have engaged landlords into reportedly ‘robust’ negotiations over rent relief packages ranging from 3 to 18 months duration. High profile retailers like Solomon Lew’s Premier Investments have been campaigning for a structural shift towards percentage of sales-based leases to better match variable sales with variable costs. Landlords will understandably push back on this considering the potential negative valuation implications for their properties. Interestingly, UBS analysts recently called out the potential for a material re-rating of retail sector valuations if operators were to successfully convert high fixed rent costs into a variable cost structure, reducing operating leverage in their business – profits become less sensitive to minor top line movements when a higher proportion of costs are variable and these businesses attract higher multiples;

- Competitive landscape – the global retail sector has been under enormous economic pressure for a number of years with increased competition from online and declining foot traffic in malls. Shocks like COVID-19 will likely drive more of the weakest retailers into the ground while the strong may get even stronger, emerging from the crisis in an improved competitive position. Consolidation opportunities should continue to emerge; last week Kogan acquired struggling furniture retailer Matt Blatt for just $4 million;

- Balance sheets – liquidity remains a big focus for investors right now. Overall, balance sheet positions appear relatively solid. While discretionary sales are well down in aggregate, sector cashflows have been supported by wage subsidies, rent relief and improved supplier terms. Boards have also been quick to defer or cancel dividend payments to further preserve balance sheet liquidity. As a result, retailers have generally avoiding being forced into highly dilutive, emergency capital raisings. Risk of future equity injections certainly exist, however we expect they will be conducted on better terms as the trading outlook becomes less uncertain; the market remains open to fund quality businesses with sound longer term prospects;

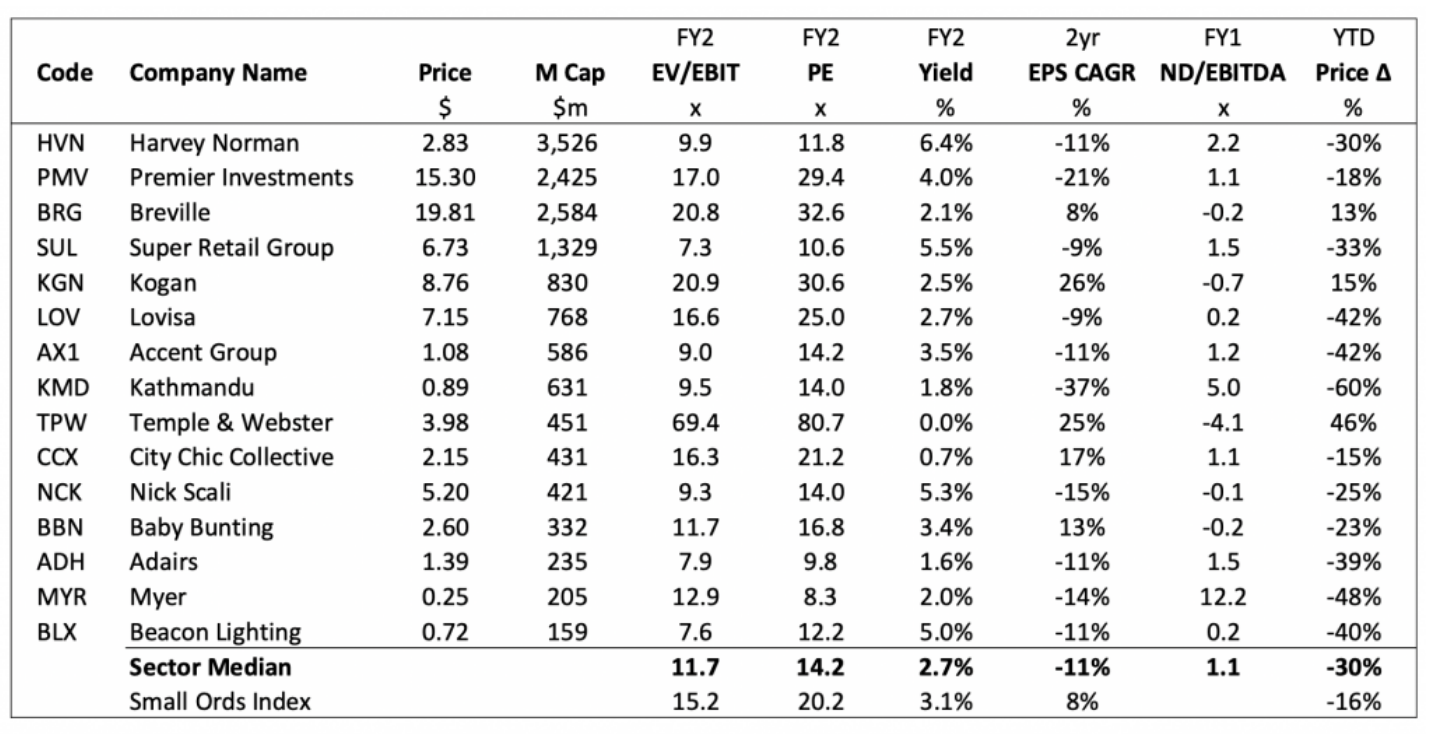

- Valuation – the small caps retail sector has fallen 30 per cent year to date, underperforming the Small Ordinaries Index which is off 16 per cent. Although valuation looks attractive (retail trading on 14x FY2 PE vs 20x for the broader market), earnings uncertainty remains high which warrants a discount. Additionally, a significant disparity exists between growth retailers and more mature players – if you want growth in retail, you need to pay up for it.

Peer sector comparison

Get investment ideas from industry insiders

Liked this wire? Hit the follow button below to get notified every time I post a wire. Not a Livewire Member? Sign up for free today to get inside access to investment ideas and strategies from Australia’s leading investors.

3 topics

15 stocks mentioned