The revenge of value

Buying ‘value’ companies, the go to active manager investment strategy prior to the global financial crisis could once again be the dominant factor for generating alpha over the medium term as ‘sticky’ inflation persists.

Value investing is simply buying cheap companies with the hope that the share price will reach its intrinsic value in the near term, outperforming the benchmark.

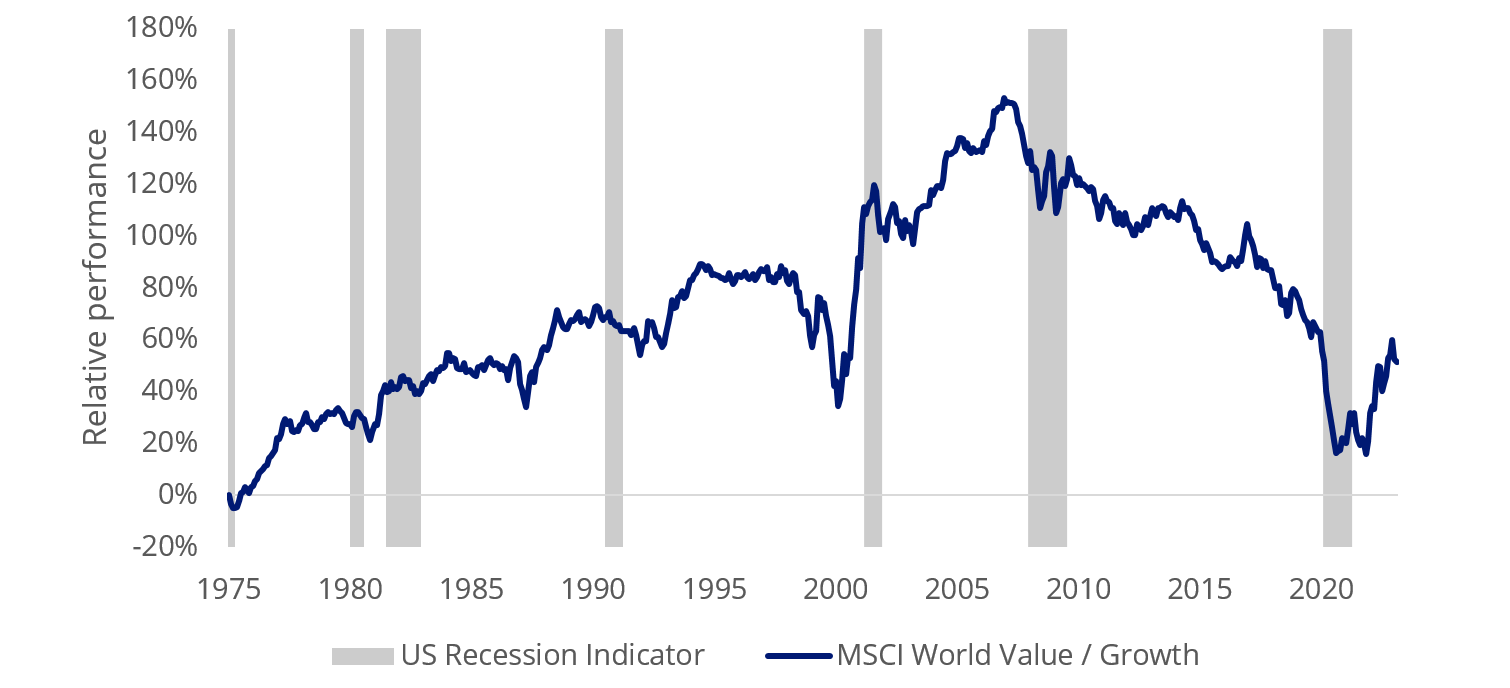

Cumulative relative performance of MSCI World Value versus MSCI World Growth

Source: Bloomberg, MSCI.

The latest data points in the US highlight the resilience of the labour market despite rapid increases in the Fed Funds rate. The unemployment rate dropped to 3.4% in January unexpectedly, lowest since May 1969 despite trending up late last year and headline CPI YoY printed higher than expected at 6.4% with US services inflation continuing to accelerate. The Fed knows secretly that significant labour retrenchment is required to break services inflation which contributes more than 60% to total CPI and is a function of record low unemployment and high wage growth. The rapid rate rises have failed to provide cut through so far, the wave of layoffs announced across the US technology sector have been absorbed by employment growth in other sectors.

US unemployment rate

Source: Bureau of Labor Statistics

US Services Inflation YoY versus Wage Growth

Source: Federal Reserve Bank of Atlanta, Bureau of Labor Statistics

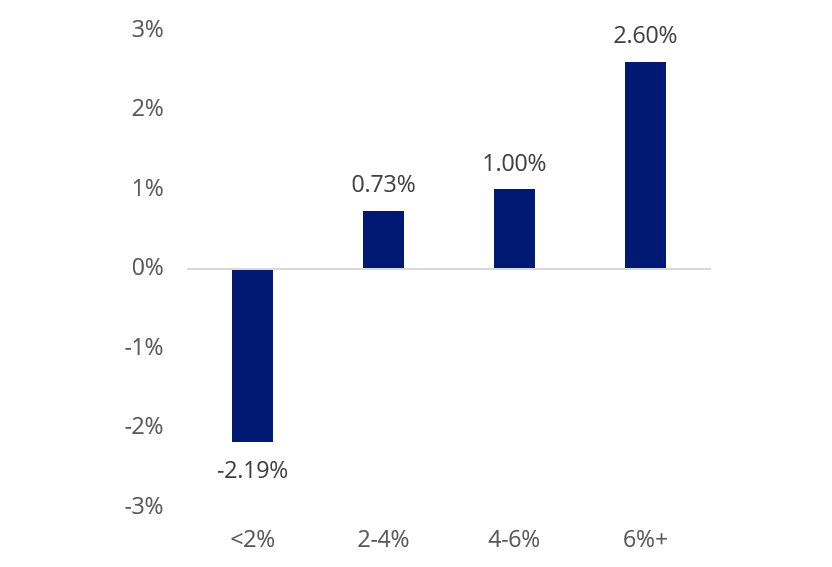

Labour market resilience downplays the likelihood of a Fed ‘pivot’ in the second half of this year particularly so if China’s economic resurgence triggers a second wave of inflationary pressures, which ultimately would be positive for value companies. The market is hooked on the ‘hopium’ of a Fed pivot, pricing in lower long dated yields, benefiting the valuations of growth companies in recent months. However, this will likely be short lived once the market realises the extent of inflation ‘stickiness’, increasing long dated yields - the environment where value thrives.

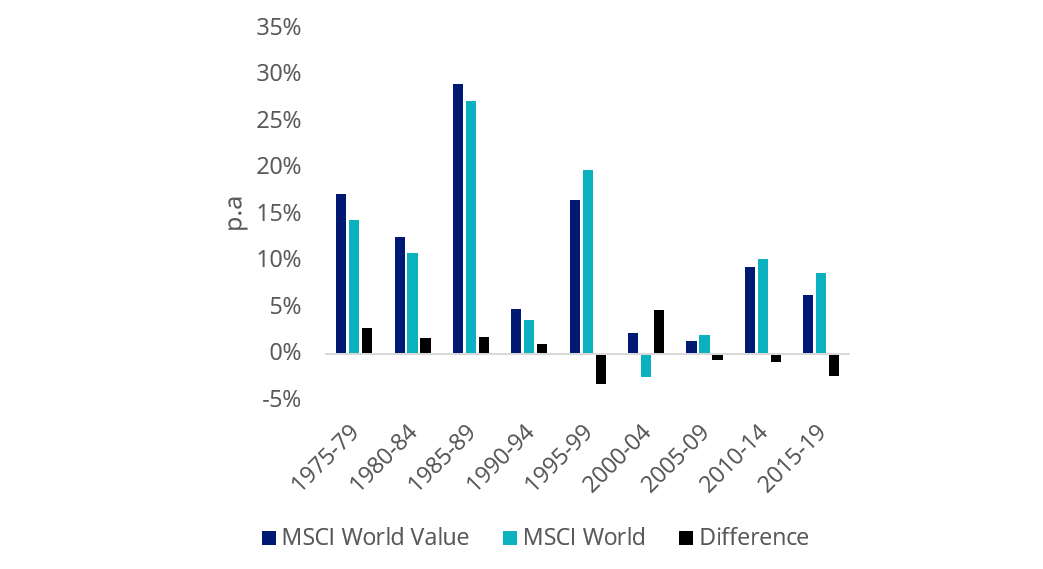

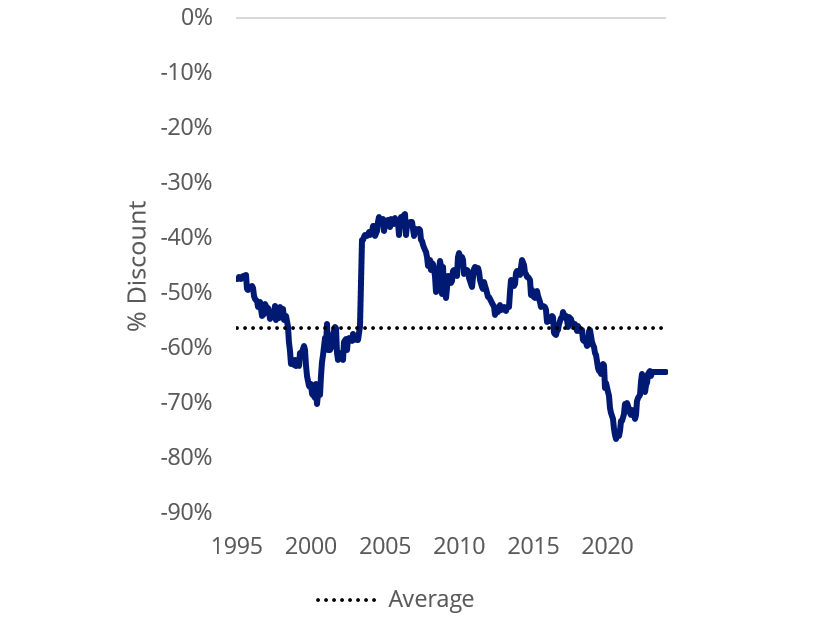

Value companies are considered ‘short duration’, valuations are tied to current and near terms earnings, where earnings are typically linked to inflation. This means interest rate increases typically have less of an impact relative to growth companies where valuations are tied to the prospect of long-term future earnings. Periods of sustained inflation has been where value companies have consistently outperformed for example during the 1970s, early 1980s and 2000s following the dot com boom.

Performance comparison over 5 years p.a

MSCI World Value outperformance by Inflation buckets

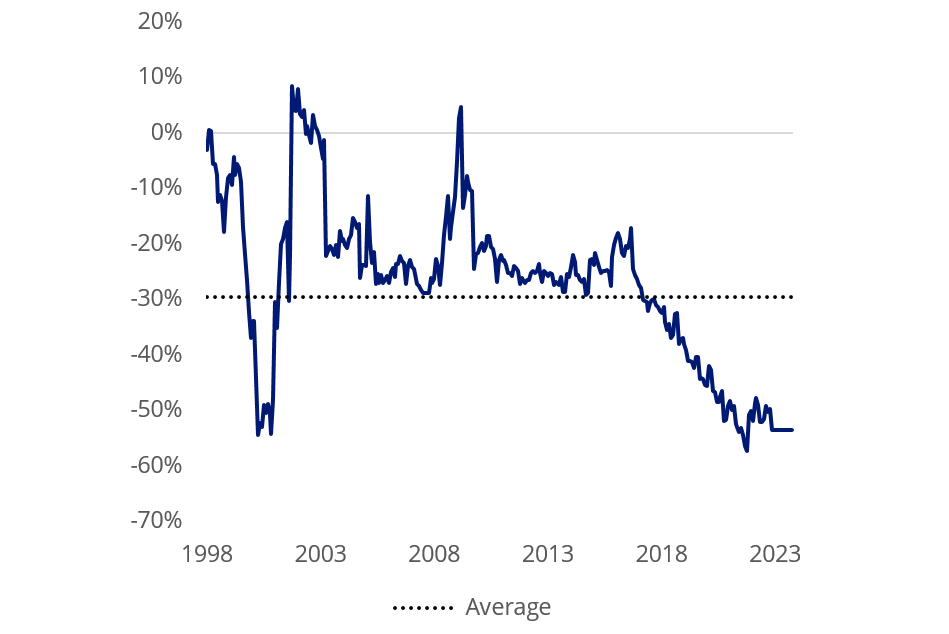

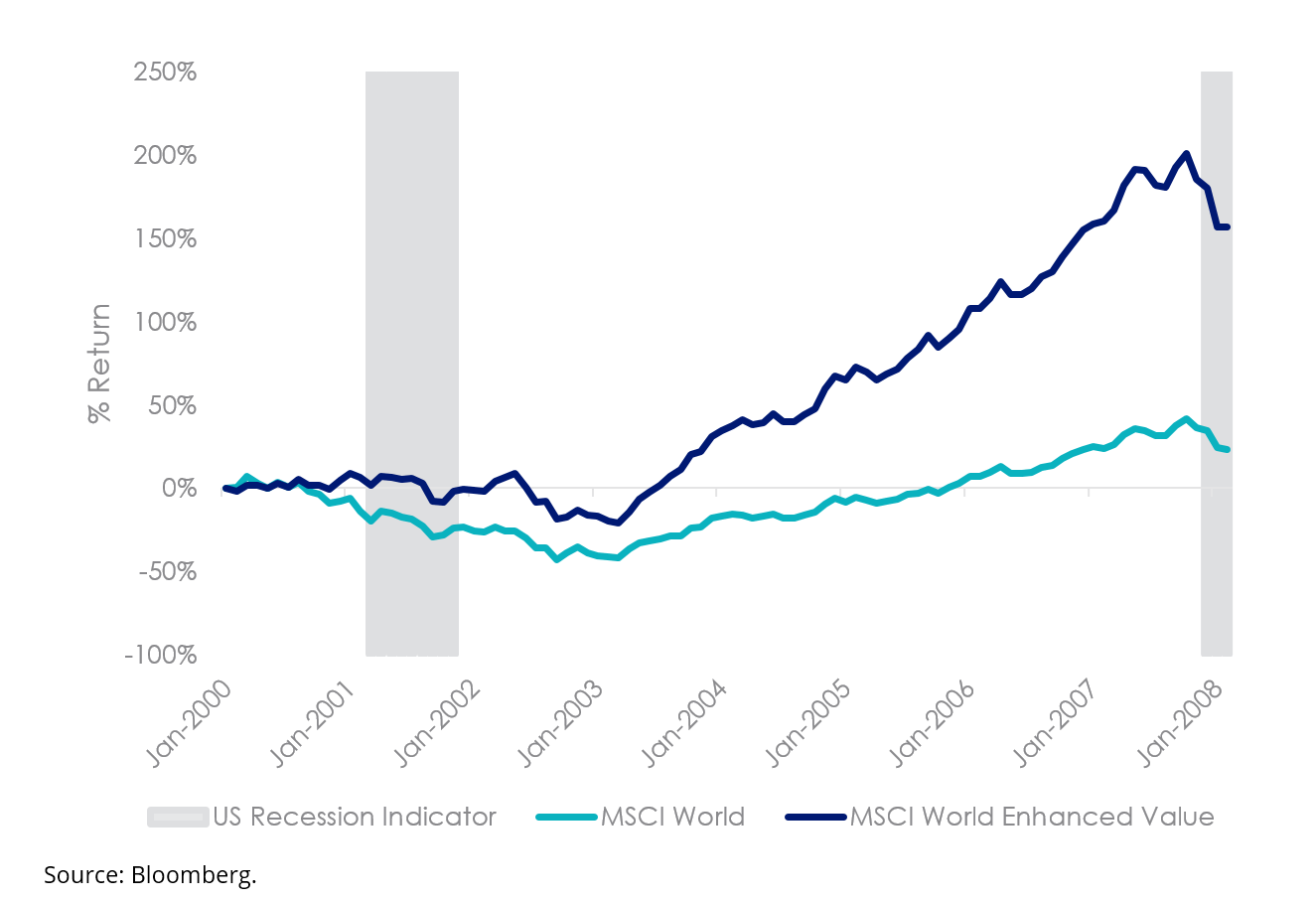

The current macroeconomic environment could echo the period following the dot com boom fallout where economic weakness is primarily contained to the technology sector and value companies consistently outperformed, lasting 7 years between 2001 and 2007. First, investors are now seeking companies that have delivered sustainable earnings and dumping speculative growth companies. Secondly, the rapid increase interest rates have resulted in an asset deflation bear market contributing to the compression in valuations between growth and value companies but likely has further room to go. There could be further compression if US technology companies announce subsequent rounds of layoffs to save balance sheet positions, like the dot com boom fallout.

12m Forward PE: MSCI World Value versus Growth

12m Forward PB: MSCI World Value versus Growth

Investors spooked by the dot com drawdown of tech shares sought the margin of safety provided by value companies which further benefited from the fact that aftermath saw sustained economic growth and inflation until the global financial crisis. Average US CPI was 2.8 percent, sustainably above US Federal Reserve inflation target of 2 percent. US 10 year government bond yields steadily increased over this period, reflective of strong economic growth. A repeat event could be on the horizon.

Cumulative performance of MSCI World Enhanced Value versus MSCI World between recessions.

5 topics