The rise and fall of Droneshield. What happened, what lessons can investors take away?

My first rule of investing is: The future is unknown. Anything can happen.

For this reason, I believe that regardless of which method you use to identify investing opportunities, it’s important to have two systems in place to ensure that you’re not left holding the bag long after the speculative frenzy has moved on.

1. A clear set of guidelines specifying your exit triggers

2. A risk management regime that ensures you don’t risk too much on any single trade

What happened to Droneshield (ASX: DRO) yesterday is the perfect example of why each of these elements is vital for investors to incorporate into their investing methodologies.

Let’s unpack what happened, if you could have predicted the massive share price plunge, and what are the fail-safes professional investors use to protect themselves in the event of unforeseen scenarios like the one that occurred yesterday.

The rise and fall of Droneshield

Droneshield provides bespoke counter drone & electronic warfare solutions to government, law enforcement, and critical infrastructure like airports. It has found itself in a geological sweet spot over the last two years since Russia’s Invasion of Ukraine, drone strikes on US interests in Yemen, and the conflict in the Middle East.

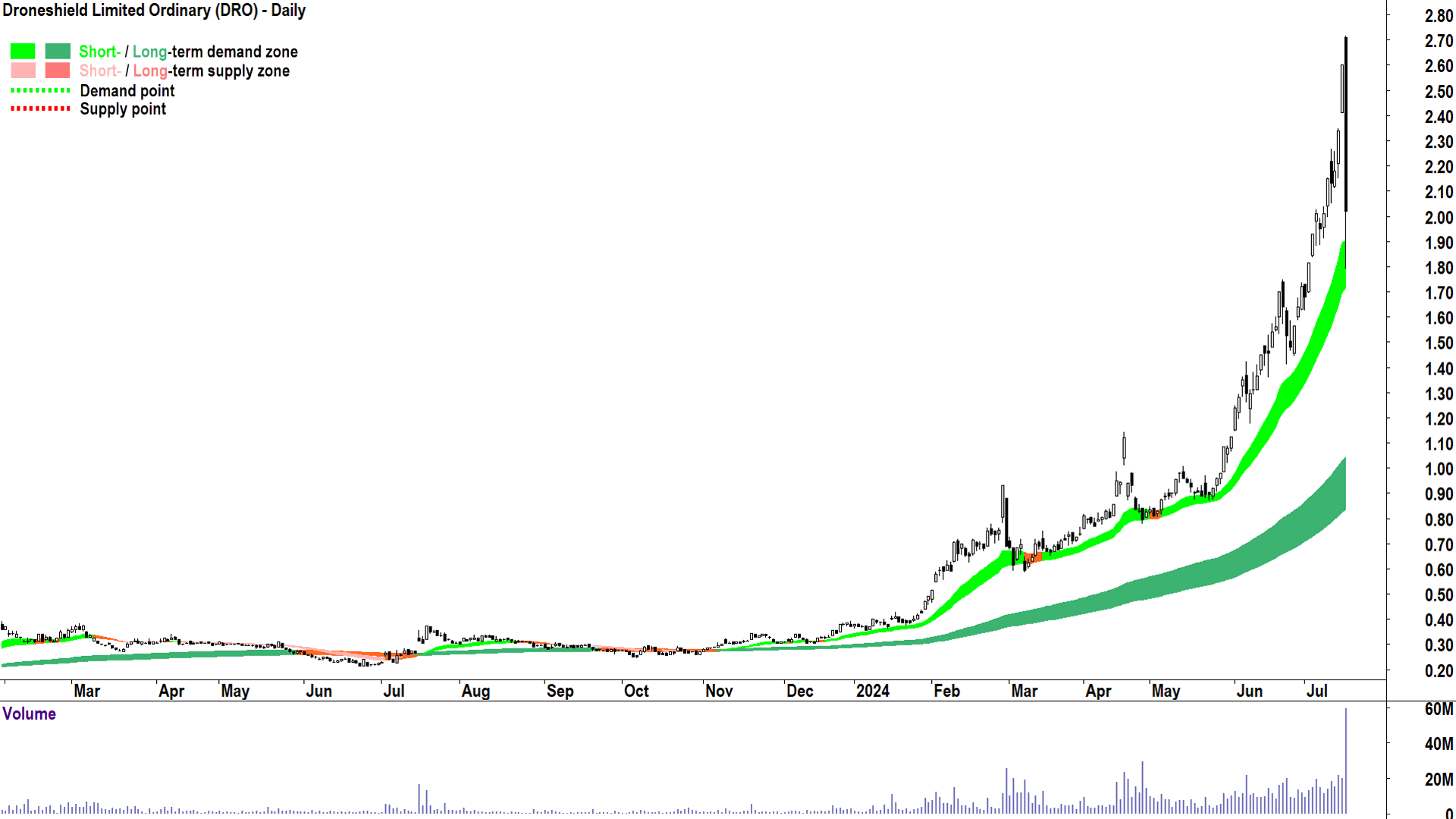

War is big business, and it’s been good business for Droneshield which has seen its shares rise from around 25 cents back in October last year, to $2.72 at yesterday’s peak. The proverbial 10-bagger if you were clever enough to hold on the whole way!

Yesterday, Droneshield found itself at the centre of what was easily the biggest move and biggest story on the ASX. It’s shares opened around 4% higher at $2.71, nudged up to $2.72, and then levelled off just above $2.50 by mid-morning, down around 8%. Then, mysteriously, just after midday, Droneshield’s share price started to drop…

%20intraday%20chart%2016%20July%202024.png)

And drop, until it hit a low of $1.79 around 1:48pm – just before the company called a trading halt. The extent of the fall from top to bottom was a whopping 34%. All without explanation.

Eventually, the company released this statement, noting the only explanation it had for the plunge was (possibly) related to an article on a media site published earlier in the day (you can check it out but it's behind a paywall), which included views from two fund managers and two analysts that Droneshield was potentially overheated, or overvalued, or words to that effect.

I’m not here to debate the right or wrong, I only care about the charts, but I will say that it is not uncommon for fund managers to present a view about a stock that is consistent with their current positioning.

I suggest that the existence of the article wasn’t the sole cause of the decline, but it may have contributed to the early reversal which put momentum traders on the back foot and also put many latecomers to the Droneshield party in an uncomfortable losing position. Both factors likely crimped fresh demand and created nervous latent supply.

This probably explains the initial drop to the mid-$2.50’s – but I propose it doesn’t explain the big break at midday. In situations like these, at some point tipping point, selling creates more selling. Stops get hit, margins are called, hot money gets liquidated – with indiscriminate efficiency by brokers. I put to you this caused the break.

We also shouldn’t underestimate the influence of short sellers, they are part of supply, and likely contributed to the downside momentum once begun. For the record, I have nothing against short sellers – everything is fair in love, war and the markets as far as I am concerned.

Once the ball was rolling, and in the absence of any news or explanation from the company during that phase, the market assumed something bad was in the offing and simultaneously bailed and refrained from trying to buy the dip. It was a wall of supply vs a demand vacuum sort of stuff.

The result on the daily chart is that massive black candle. I’ve been doing this for over 30 years, and I can tell you that’s not a normal candle. Yes, strong uptrends often end in large black candles, and I expected we were going to see one eventually on Droneshield, but I suggest what we saw was an outlier.

Outlier or not, this kind of move is always within the realms of possibility. So, as a trader we must be prepared for it. This means having those two key items I mentioned at the start of this article in place.

A clear set of guidelines specifying your exit triggers

In my experience, getting out of an investment is the hardest part of the whole investing process. This is because it is where our money is made or lost.

Making or losing money makes us emotional – and we don’t make optimal decisions when we’re emotional.

This is exactly why investors should have a strict set of criteria to inform them when an investment is not performing as originally planned.

This definition is crucial – “as originally planned”. It implies the exit is specific to your entry methodology, and it makes sense the trigger for an exit should be the absence of, or occurrence of the opposite of, your entry criteria.

This is a catch-all for all entry methodologies (or philosophies) i.e., both fundamental and technical. If a strong balance sheet, good dividend yield, earnings growth, and a moat are your thing – then if one of these factors should at some point no longer be present – doesn’t it require you to reassess whether you continue holding that position?

As you know, none of those things have any relevance to me! I want to see short- and long-term uptrends, good price action, and a predominance of demand-side candles before I enter a trade. So, for me, if any one of these factors begins to change – I must reassess my position.

I think this makes sense, and I’m sure you agree, but this concept only works if you have explicitly defined your entry criteria. What makes you buy a stock? Do you actually know? Is it the same thing each time, or does it chop and change around a bit? Can you write your entry criteria down as a series of clearly defined bullet points?

(BTW, chat room rumours, social media posts, “something I read in the media”, and hunches should not be on your list! 😁)

Once you’ve defined your entry criteria clearly, your exit criteria should become just as clear.

A risk management regime that ensures you don’t risk too much on any single trade

You can have the best exit criteria in the world, and it wouldn’t make a lick of difference if you don’t get this part right. I believe that position sizing, and capital management as a broader topic – are the most important factors in determining an investor’s long term success.

How you get in and how you get out pale in comparison to how much you risk when you do.

The concept of risk of ruin is well known in both trading and professional gambling circles. Yes, there’s a great deal of cross-over between the two! Both the professional investor and the professional gambler understand that if you bet too big on any one investment/hand, you risk not being able to participate next time.

If you can’t participate, if you are busted and out of the game – then you can’t possibly win. This is to be avoided at all costs!

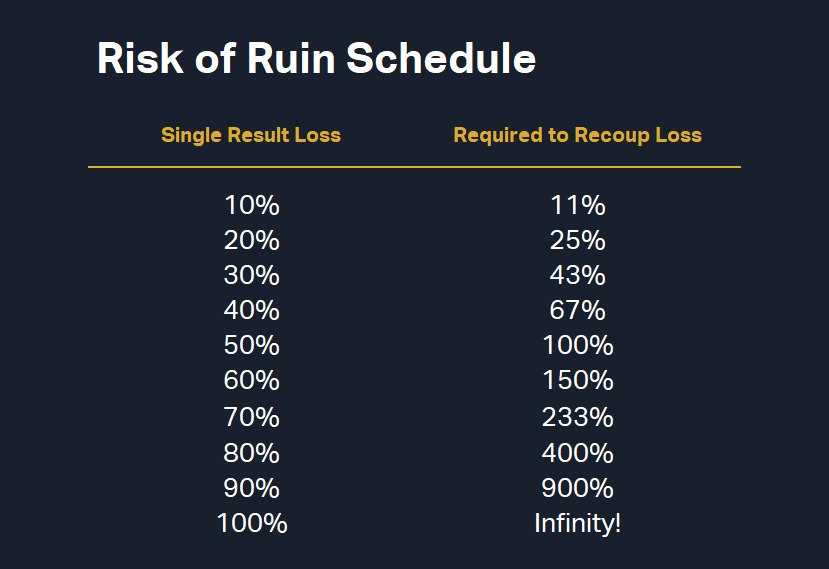

The above table is often referred to as a Risk of Ruin Schedule. We all know that if you risk more, you stand to gain more – and because the ultimate goal of investing is to gain – risk is therefore a required part of the equation.

But if you risk too much – you stand to lose an amount that could make it nearly impossible to ever gain. Note how as the size of each individual loss gets bigger, the future gains required to recoup them increases at an exponential rate. You quickly get to the point where it could take a very long time, plus the most incredible string of winners, to ever get back to break even.

You don’t want to be there. I have. It’s not fun.

Professional investors have been known to risk no more than 5% on any single outcome. Of course, the future is unknown (that little chestnut again!) and it is possible that due to unforeseen adverse news, the price moves so quickly that a greater than 5% loss occurs. This is an accepted risk.

The goal is that over the long run, individual losses are held to an average of 5%. The professional investor also understands that several losses may be incurred in a row, and this has its own implications for capital management…

If you fail to plan, you are planning to fail

But that’s a topic for another day! I just wanted to whet your appetite for these concepts that ultimately contribute to a comprehensive investing plan. Such a plan should define exactly how you intend to behave in the markets, from entry, to exit, to risk per trade and overall capital management, to routine.

I’ll explore more of these concepts in future articles, so stay tuned!

This article first appeared on Market Index on Tuesday 17 July 2024.

5 topics

1 stock mentioned