The sectors you want to be invested in ahead of the next economic regime change

Note: This video was taped on Wednesday 2 October 2024.

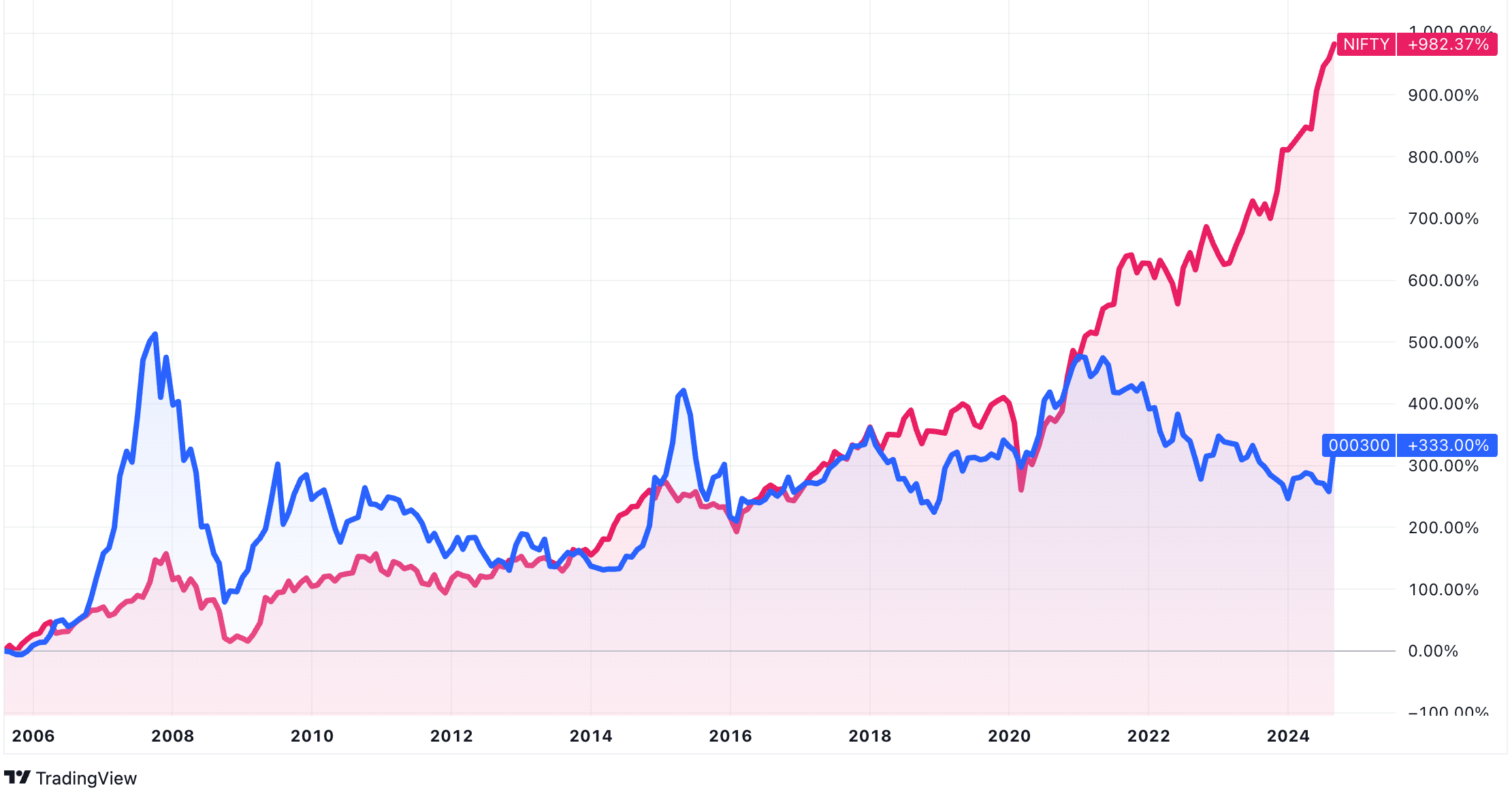

Long-time observers of the Asian stock markets will know that country leadership has generally been dominated by two countries for some time now. The battle for supremacy between the Chinese stock market (measured here as the Shanghai Composite Index) and the Indian stock market (measured here as the Nifty 50 Index) is a sight to behold.

India vs China: Stock market performances since 2006

Currently, we are in the midst of a historic bull run in Indian stock markets. The Nifty 50's performance since 2021 has made it, at times, the top-performing ex-US stock market in the world. And while many stock jockeys think this bull run can continue, Man Group's Andrew Swan is not as sold on the idea.

"I think it poses some risk in the short term when you have high expectations, whether you talk about multiples or earnings expectations at a time when liquidity in the economy is slowing down because that tends to put pressure on corporate earnings," Swan says.

This thesis is the foundation for why Swan and his team have moved money out of India and into China, Hong Kong, and Taiwanese stocks. To find out where he is finding idiosyncratic (individual) opportunities right now, read the edited summary or watch the video.

edited transcript

LW: China and India are on markedly different trajectories. Can you break that down for us?

Swan: They are big economies that are at different stages of development. I think there's a cyclical element and there's a structure element. I think the long-term outlook for India as we see it today remains fairly healthy. I mean, we don't really see bubbles in the economy, but it has done well in the last few years.

Corporate profit growth has been strong and that's occurring at a time when cyclically liquidity is slowing down a little bit. I think it poses some risk in the short term when you have high expectations, whether you talk about multiples or earnings expectations at a time when liquidity in the economy is slowing down because that tends to put pressure on corporate earnings.

The flip side is China is at the end of an economic model, growth is slowing. We have a deflationary setting which is always bad for corporate profitability.

And now we've seen, as a result of that, earnings expectations or corporate profits being under pressure, earnings expectations have been revised down and the market trades very cheaply to reflect those problems. The key question is, can China do something both cyclically and structurally at this point to improve the outlook for both economic growth and corporate profit growth?

We do think China is on the verge of both in that we've seen the cyclical enhancements coming. But also, I think there is some really interesting structural stuff coming, which means the risk-reward favours China over India.

LW: Where are you still finding individual opportunities in India?

Swan: I think from a stock-specific point of view, there are still some really good interesting companies in India. We do tend to find pretty high-quality companies up there. We do think the macro overall means a lower allocation today because of the risk to growth. But within that, there are some really interesting higher growth stories.

Whether it's talking about healthcare companies, transport companies, consumer companies, or even financial services firms, there's always opportunity inside that market.

LW: How do you avoid the landmines in the Chinese equity market?

Swan: The first step is that everything moves here. This is a very big liquidity injection that the government is promising for both monetary policy and fiscal policy. And I think it's important to recognise why it's happening. Chinese policymakers have prioritised currency stability above everything else this year. The way you do that is by keeping real interest rates high relative to the currency or the country that you're trying to stabilise your currency against, and that is the US. Now, the problem for China is the US has a very different economic setup. They've got higher growth and higher inflation, and therefore tight monetary policy. But to keep the currency stable in China, up until recently, they've had to run US monetary policy even though their economic situation is the opposite.

Through the course of this year, the policymakers have been tightening policy when in fact many people have been arguing they should be loosening, but that's because they've prioritised currency stability.

Now, the Federal Reserve has started to cut interest rates, and that has put the power back in the hands of many central banks around the world, but in particular, China. It's no coincidence that China has eased monetary policy almost immediately after the US started the same process.

On the other hand, fiscal policy has actually been quite restrictive. Again, it's not well understood, but China's fiscal deficit has been contracting this year versus last year. So, you've had tight monetary policy and tight fiscal policy in a weak economy with deflationary forces. It's understandable why the market is so cheap and why it has performed so poorly and the economy has done so poorly, but we are now changing. Monetary policy has shifted and fiscal policy is about to shift, and then I think we move from cyclical policy to structural policy, which I think is another leg that this market can potentially develop in the coming months.

LW: Where are you finding idiosyncratic opportunities in China?

Swan: Ultimately, what we're talking about here is a shift in the economy from deflationary forces to reflationary forces by boosting demand in the economy. Now, obviously consumer [stocks] benefit. If we get this boost, we're working through who benefits the most in the consumer space, but it really moves beyond that. It can impact financials positively - things like housing and insurance stocks. It can also benefit industrial companies as they start to produce or increase their utilisation of the plant and get some pricing power, which is always good for profitability and share price performance.

4 topics

1 fund mentioned

1 contributor mentioned