The small cap stairway to heaven

When Robert Plant sat down to write the legendary rock song Stairway to Heaven 50 odd years ago, we’re pretty sure he didn’t have investing in mind. But it’s a phrase that quickly comes to mind when reviewing the earnings charts of some of Australia’s best quality small caps. In this note, we discuss why earnings matter, before turning our attention to seven small cap compounders.

Earnings matter

Today’s world of investing is awash with mountains of data, commentary and noise. While some of this information is useful, much of it ultimately distracts long term investors from focusing on what matters. And in the eyes of some of the world’s greatest investors, it’s earnings that matter most. Renowned investor Peter Lynch perhaps best summed it up in his legendary book, One Up on Wall Street (Chapter 10, ‘Earnings, Earnings, Earnings’, page 161):

“What possible assurance do you have that any of the stocks you own already, will go up in price? What you’re asking here is what makes a company valuable, and why it will be more valuable tomorrow than it is today. There are many theories, but to me, it always comes down to earnings and assets. Especially earnings.”

Earnings stability and quality

When it comes to the notion of business quality, there are several common threads that can be gleaned from both industry and academia. These typically include measures of profitability such as return on equity (ROE) or return on invested capital (ROIC), balance sheet strength and earnings stability. Those companies that exhibit these characteristics are generally deemed to be high quality in nature, an important distinction given its correlation with long term investment outperformance.

Benjamin Graham got the ball rolling on the importance of earnings stability decades ago. The concept was incorporated into his portfolio policy, as outlined in his famous book The Intelligent Investor. In Graham’s view, a company worthy of investment consideration would exhibit earnings stability, as measured by at least 10 consecutive years of positive earnings. For the purposes of this paper, we have used this as a baseline consideration for inclusion.

In the years since, volumes have been written about earnings stability and its importance as a cornerstone of quality. According to MSCI, “Quality growth companies are characterised in the literature as companies with durable business models and sustainable competitive advantages. Quality growth companies tend to have high ROE, stable earnings that are uncorrelated with the broad business cycle, and strong balance sheets with low financial leverage.”

Prominent US manager GMO, co-founded by Jeremy Grantham, has for many years proffered the benefits of an investment strategy focused on quality. GMO’s quality strategy has outperformed the MSCI World Index over all time frames since its 2004 inception, and remains based on three key factors: low leverage, high profitability and low earnings volatility (reflecting strong consistency in terms of earnings generation).

Seven small cap compounders

The idea for this note came while updating our small cap models during the August reporting season. The consistency of earnings per share (EPS) growth jumps off the page for this cohort of compounders, and its little surprise all have performed well over many years.

As all stocks sit outside the S&P/ASX100, and therefore don’t typically garner much attention from mainstream media, we suspect many investors may not have heard of some of the following. So we thought it would be useful to provide an introduction to each company, cover off on their recent results, and then present our view on the long term prospects for each business.

The importance of assessing long term prospects cannot be emphasised enough. While a sound track record of execution is a positive sign and forms part of an informed analysis, it provides no guarantees for future investment success. The world changes and so do companies. While risk goes hand in hand with investing and never disappears, it can be mitigated by matching sensible, probability-based views on the way the world may develop with a sound fundamental framework.

With that noted, let’s take a look at seven small cap compounders that readers might find worthy of further research.

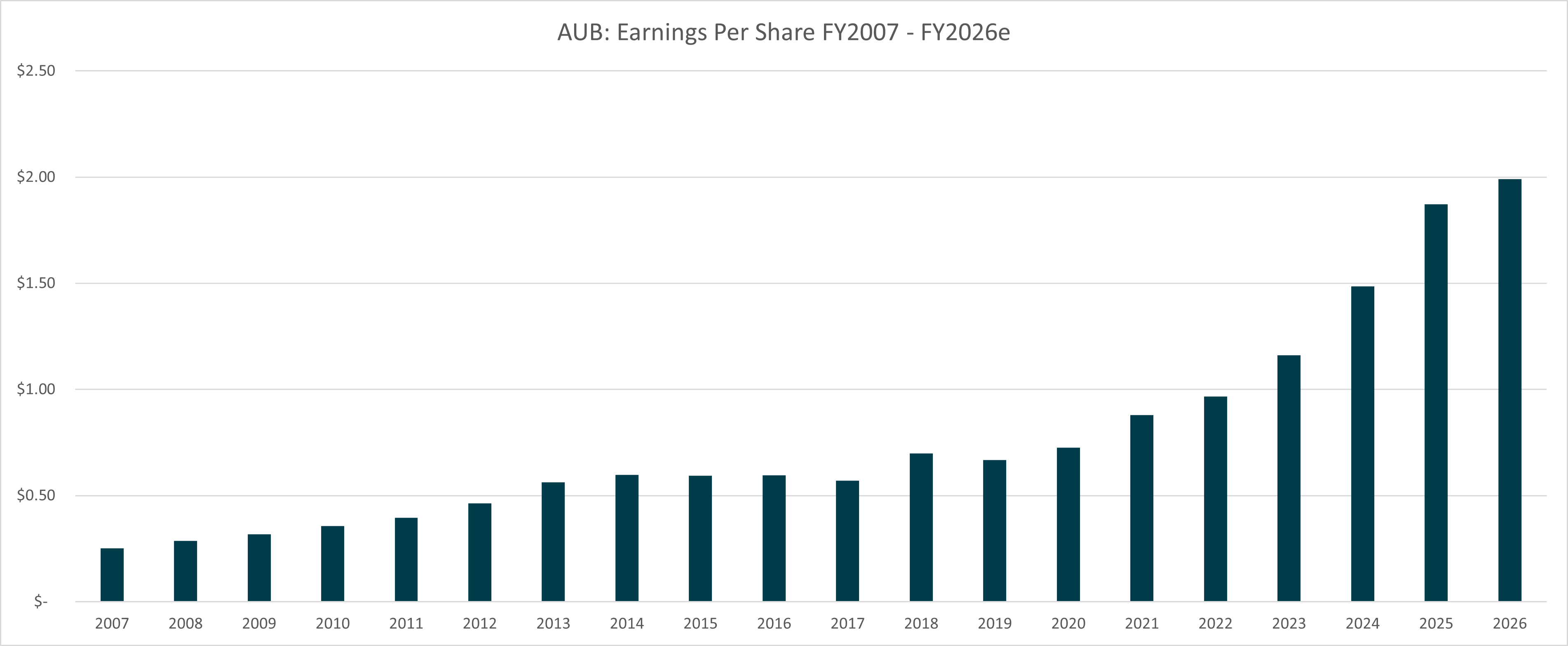

AUB Group (ASX: AUB)

Formerly known as Austbrokers, AUB comprises insurance broking and agency businesses operating in over 500 locations across Australia and New Zealand. Incorporated in 1985 and listed on the ASX in 2005, the Group today operates through four key business segments; Australian broking, New Zealand broking, Agencies and Support Services.

AUB’s core revenue is derived from arranging insurance policies, and related services, for business clients across Australia and New Zealand. The amount of revenue earned is determined by premiums placed, sums insured and the general level of economic activity. Premium rate growth has been positive in recent years, and AUB has been a solid beneficiary of this trend.

As is probably obvious from the below chart, AUB’s revenue and earnings profile has been far more consistent than the major Australian insurers over a long period of time. This is largely because AUB operates a broking model, and thus takes no underwriting risk. AUB forms a valuable link between business clients seeking guidance from an insurance specialist and the actual providers of the insurance.

Like most in the insurance broking sector, the FY2022 result was ahead of expectations. Underlying NPAT of $74m was up 22% on the prior corresponding period (on an underlying basis), with the Australian broking and Agencies divisions the key drivers of outperformance. This built further on an impressive track record of consistent growth in earnings and dividends.

Looking ahead, the single largest driver of earnings growth for AUB is the imminent closing and subsequent integration of the acquisition of UK based Tysers. It’s a material acquisition for the group that management believes will be ~30% accretive to earnings. While the partial debt funding of the deal heightens the risk profile, the value to be realised from successful execution is immense. Excluding the impact of Tysers, management remains confident, commenting:

“AUB Group sees evidence of the FY22 momentum across the Group continuing into 1H23. We anticipate Underlying Net Profit after Tax in FY23 of between $86.0mn and $91.0mn, representing growth of 16.2% to 23.0%, excluding Tysers.”

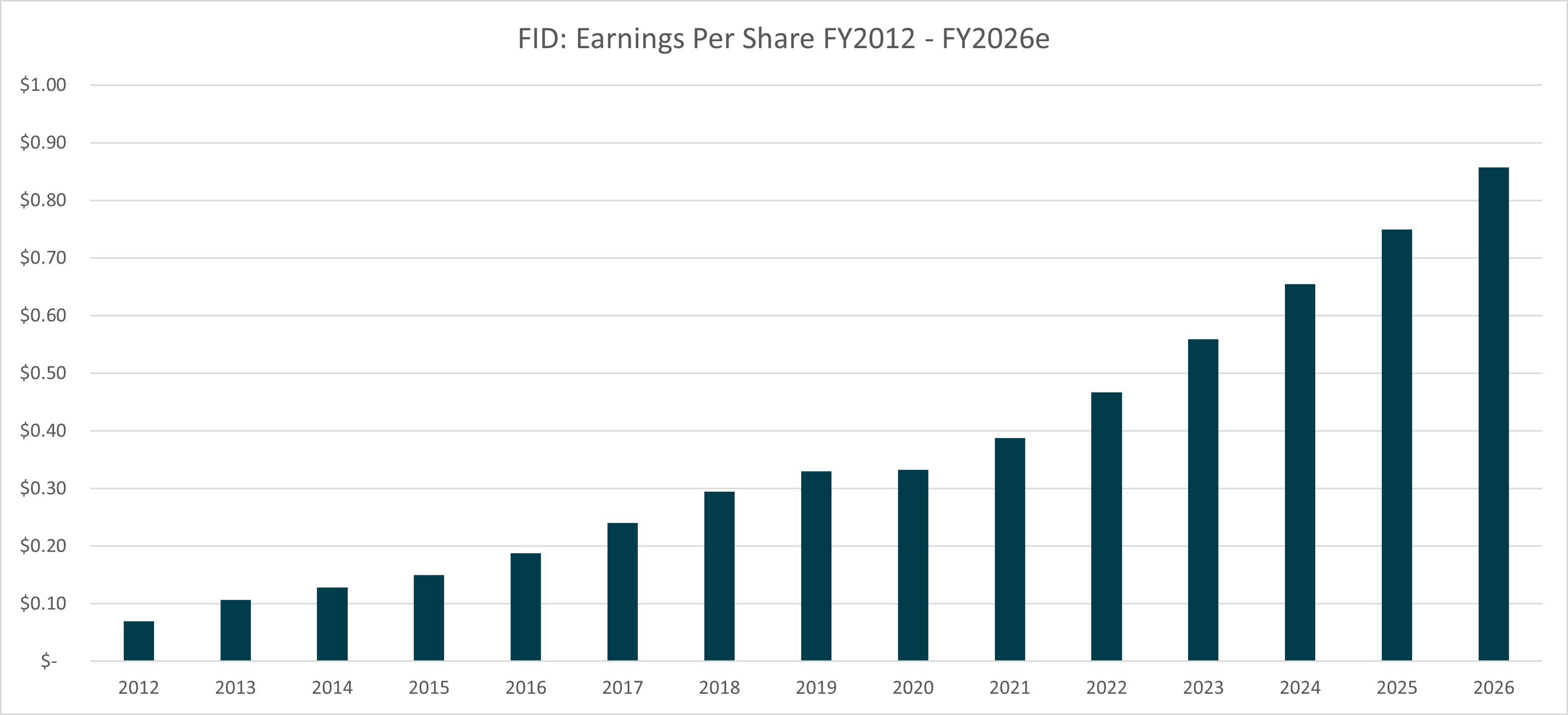

Fiducian Group (ASX: FID)

Continuing with the Peter Lynch flavour of this note, we were reminded of FID when reading the following excerpt in One Up on Wall Street (page 136):

“If you find a stock with little or no institutional ownership, you’ve found yourself a potential winner. Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you’ve got a double winner. When I talk to a company that tells me the last analyst showed up three years ago, I can hardly contain my enthusiasm.”

Incredibly, given its impressive track record, FID fits the bill in that it currently has no broker coverage. FID is an integrated financial services provider with three key operating divisions; Financial Planning, Platform Administration and Funds Management. It was founded in 1996 by Indy Singh, who remains today as a substantial shareholder and Executive Chairman.

Fiducian’s financial planning business unit acts as an enabler of flows to its high margin Platform Administration and multi-manager Funds Management divisions. It’s a powerful model that combines a strongly performing, diversified funds management group with a high margin platform business, all within the one operating structure. The efficient operating model has delivered positive long term outcomes for Fiducian’s clients, its advisers and shareholders for many years.

Recent results have been solid and we think FID can continue growing earnings at double digit rates in the coming years. A big driver of our forecast earnings growth relates to the transition of funds under advice (FUA) from the recently acquired financial planning arm of People’s Choice Credit Union. This added $1.1bn in FUA, while management’s due diligence indicated that the majority of clients would benefit from the transition to FID’s platform.

While resilient, FID is market linked and a severe market downturn would hamper profitability in the near term. Given high insider ownership, it’s also relatively illiquid. With that noted, it’s a business that is founder led, has a strong net cash balance sheet, is highly profitable and a consistent generator of cash.

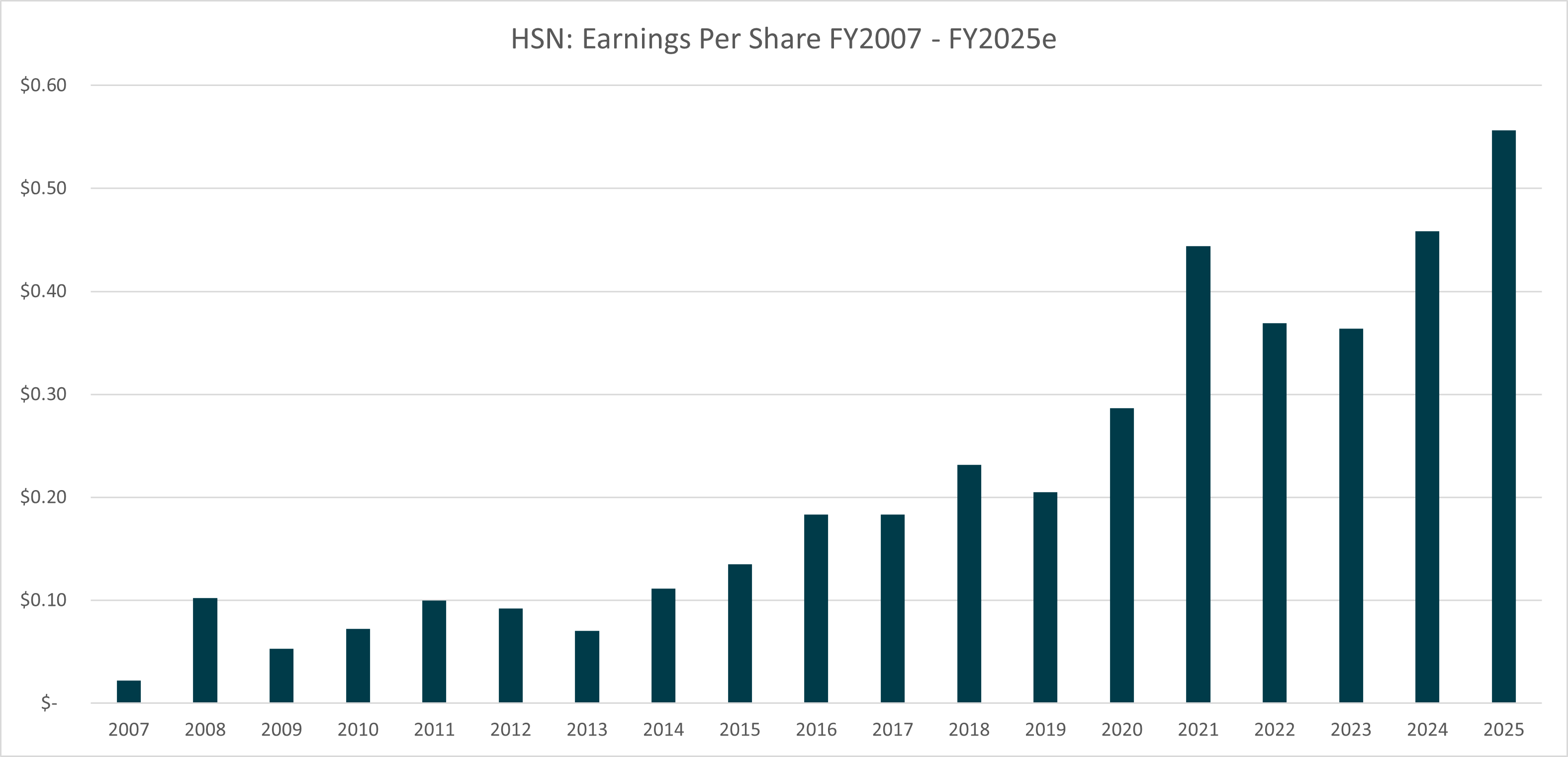

Hansen Technologies (ASX: HSN)

For those seeking a small cap technology thrill ride, HSN is probably not for you. Steady, reliable and a consistent generator of cash, HSN is a global provider of software and services to the energy, water and communications industries. Deeply integrated with customers as a provider of mission critical billing software, HSN’s recurring revenue is high while its churn rate is low.

Founded in 1972 by Kenneth Hansen, the business has been led by Andrew Hansen for many years. The owner manager mentality of ‘spend company money like it's your own money’ permeates an organisation where EBITDA margins now consistently exceed 30%, and EPS has compounded at about 20% over the past 15 years.

HSN’s FY22 result was in line with expectations but the outlook appeared to disappoint investors, with slightly lower margins and modest topline growth flagged. However, history suggests HSN excels in executing value accretive acquisitions. With a strong balance sheet, more realistic vendor expectations, and a 7% free cash flow yield on offer, we remain optimistic on HSN’s long term prospects.

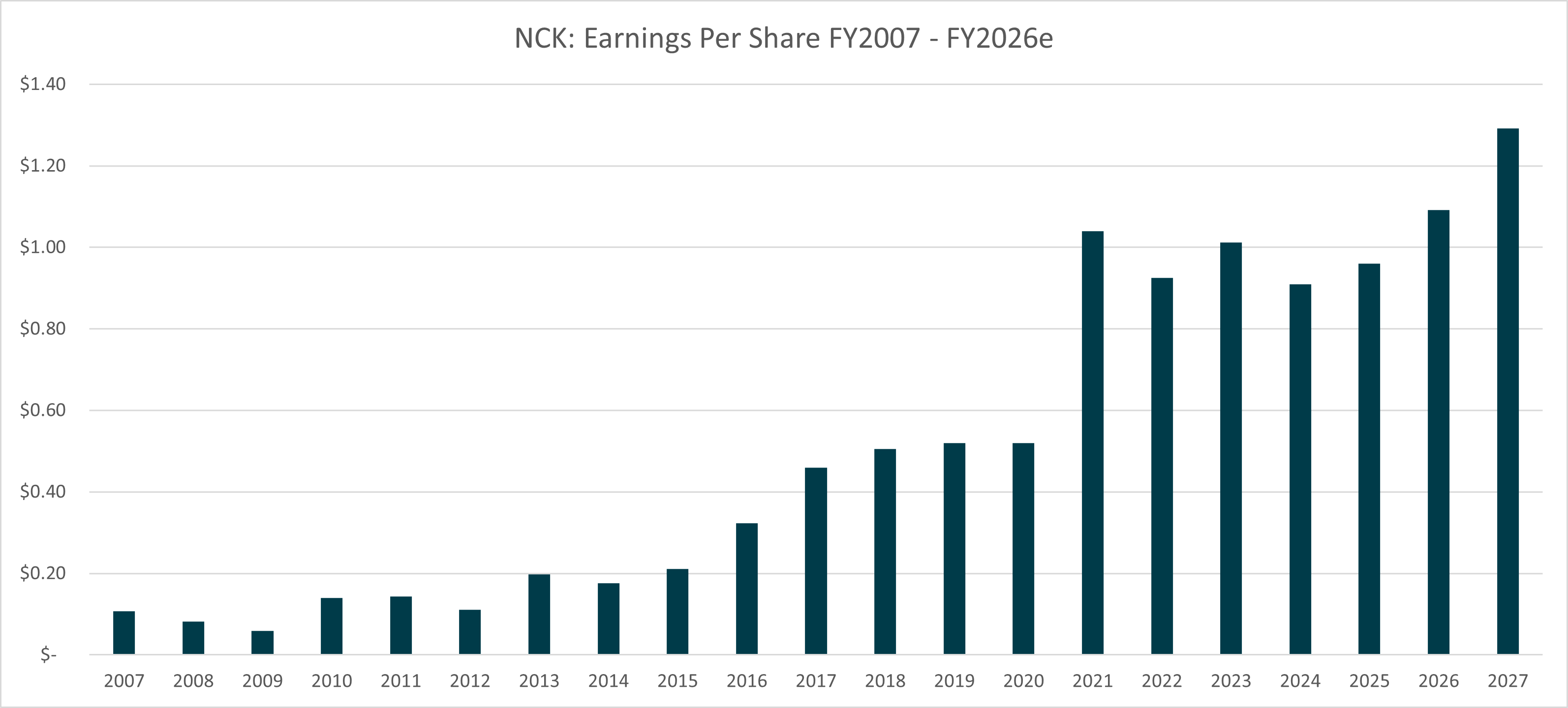

Nick Scali (ASX: NCK)

NCK is a leading retailer of premium furniture across Australia and New Zealand. Like HSN, NCK has family origins and an operating history that spans decades. Founded in 1962 by Nick Scali, the company is today run by Anthony Scali, another owner manager with considerable skin in the game.

Management has built and refined a business model that has delivered both efficient and highly profitable outcomes for shareholders over many years. In a nutshell, NCK designs furniture that is manufactured in South East Asia. Products are then shipped in bulk to a network of centralised distribution centres in Australia and New Zealand, before being shipped to the end customer. Gross margins are high, management of working capital remains sound and cash generation has been consistently strong.

Another interesting feature of the NCK business is its property portfolio, with the company selectively acquiring a number of strategically important large format retail properties over the years. This provides a hedge against lease escalations, secures prime locations, and represents a degree of latent value sitting on the balance sheet.

A more obscure but important note on the numbers is that NCK is one of the few businesses listed for over a decade that has never issued any further stock. It’s an analyst’s dream. We just roll forward our models with the 81 million shares that have been on issue since 2005. More importantly for the investor, however, is the clear message that all growth to date has been self funded.

As the earnings chart below illustrates, the pandemic has provided a remarkable tailwind for the company. Despite supply chain difficulties, NCK delivered record sales and profits as a landlocked consumer set about beautifying the home base. NCK enters FY23 with a record order book but faces a weakening housing market and end consumer. It’s for this reason that many investors are approaching the retail sector with some caution. If investors are seeking to add high quality retail exposure in the year/s to come, we’d argue NCK would sit high on the list of potentials.

Long term, we expect growth to be driven by the ongoing store rollout, an increase in online sales penetration and incremental growth in product breadth. Having recently acquired Plush, the company’s store network totals 114, which compares to a longer term target of about 185 stores.

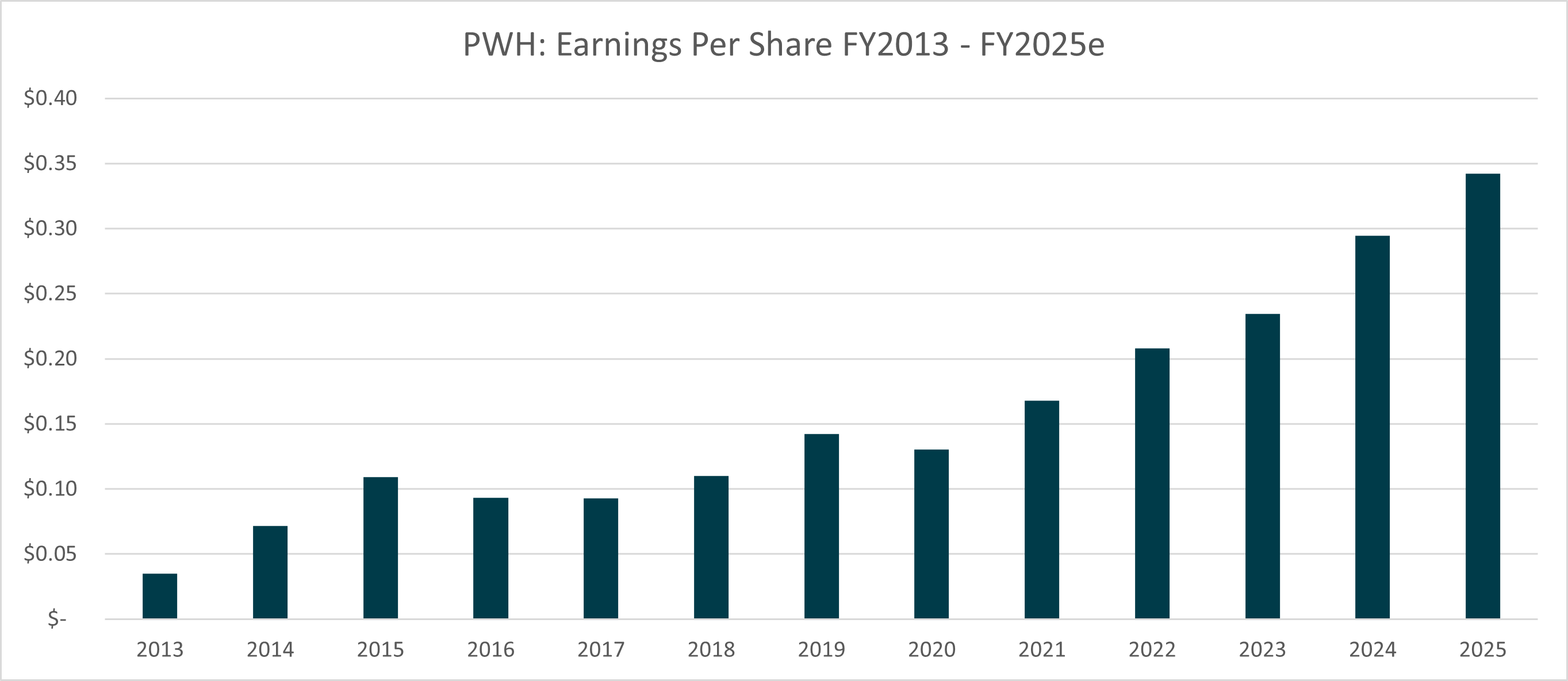

PWR Holdings (ASX: PWH)

PWH is a wonderful story of Australian ingenuity. In 1997, Kees with his son Paul Weel saw an opportunity to invest in a new segment of the automotive cooling market. The demand for high quality, light weight, high performance aluminium cooling products was growing and Paul Weel Radiators was created to meet this demand. PWH subsequently listed on the ASX in 2015 (note: two years of pre-IPO earnings were included in the below chart), with founder and major shareholder Kees Weel remaining as CEO since.

Today, PWH is recognised as a world leader in high performance cooling, with motor sports enthusiasts suggesting it is effectively a monopoly within its niche. PWH provides world class cooling solutions to leading race categories across F1, NASCAR, V8 Supercars, and the World Rally Championship.

The company delivered an excellent FY22 result. Revenue was up 27.6% to $101.1m, while profit increased by 24.1% to $20.8m, which was well ahead of consensus expectations. But with FY22 in the rearview mirror, we look ahead to an outlook brimming with opportunities, especially with PWH’s ‘Emerging Technologies’ division. Already profitable, this division is tapping into demand from the Electric Vehicle, Aerospace and Defence sectors, each representing a potential step change in future earnings potential.

The main challenge for investors appears to be valuation, with its strong long term outlook matched by premium pricing. Post result, PWH has rallied strongly to now trade on a forward P/E multiple of close to 40x.

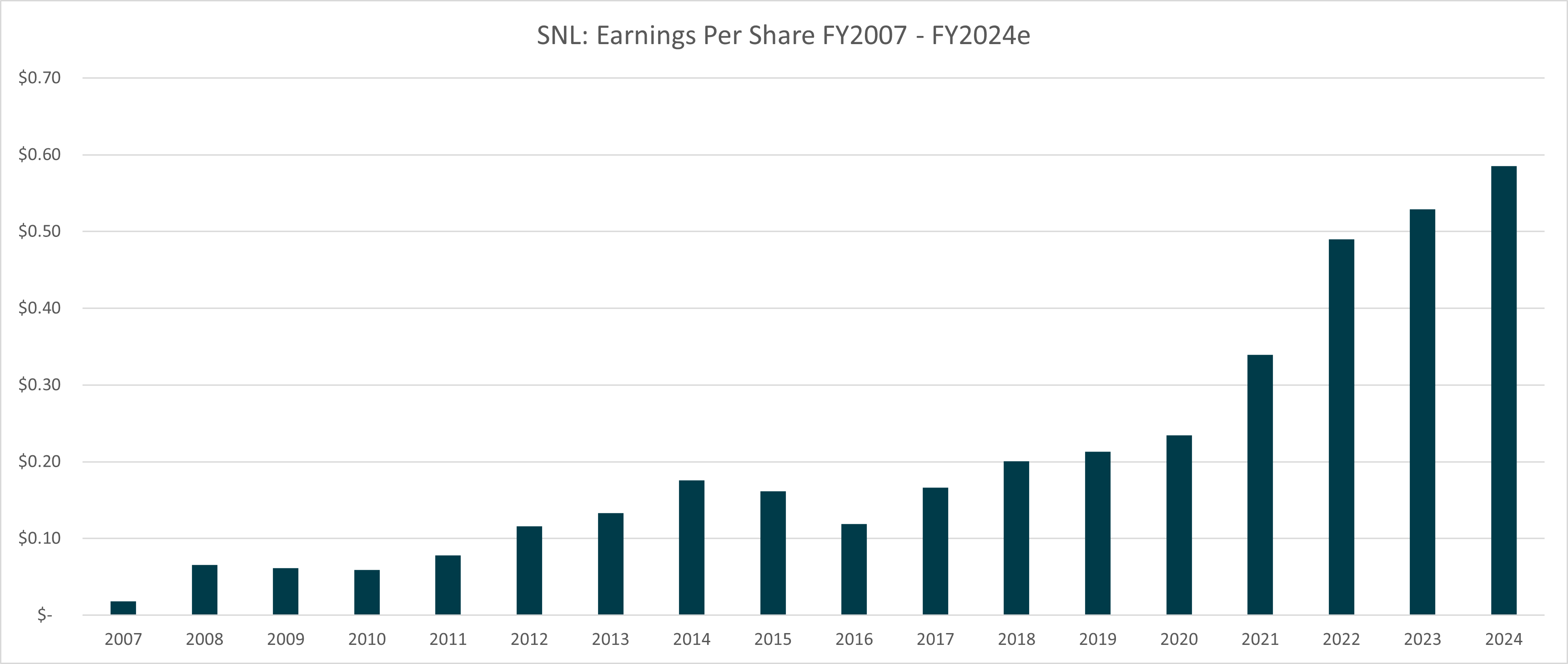

Supply Network (ASX: SNL)

SNL would have to be one of the ASX’s greatest quiet achievers, having delivered exceptional returns to a small cohort of investors over the past 15 years in particular. The business was founded by Harry Forsyth in 1976 and listed on the ASX in 1987. Operating under the brand name Multispares, SNL procures and sells truck and bus parts via a national network that has been scaled incrementally over decades.

SNL’s strategically located branches are supported by a number of warehouses and distribution centres, matching depth of product with a strong industry reputation for reliability and delivery. As one would expect for a trucking parts company, this isn’t a company that indulges in slick marketing campaigns. More importantly for shareholders, the numbers have done all the talking in recent years. Off a small base, SNL has delivered growth in earnings per share of about 24% per annum since 2007.

Recent results have been particularly strong. FY22 revenue was up 22.1% to $198.5m while profit increased by 44.6% to $20.0m. Management attributed the exceptional result to ‘strong economic growth, positive industry trends and a solid business performance.’ Looking ahead, SNL expects revenue growth to moderate back towards its ‘long-term average of around 12% p.a.’ over the next two years.

Despite the positives, a premium valuation and limited liquidity profile may give investors some pause for thought. Although SNL’s tight liquidity profile means reduced institutional investor appetite, this may present a window of opportunity for more nimble self directed investors in the years to come.

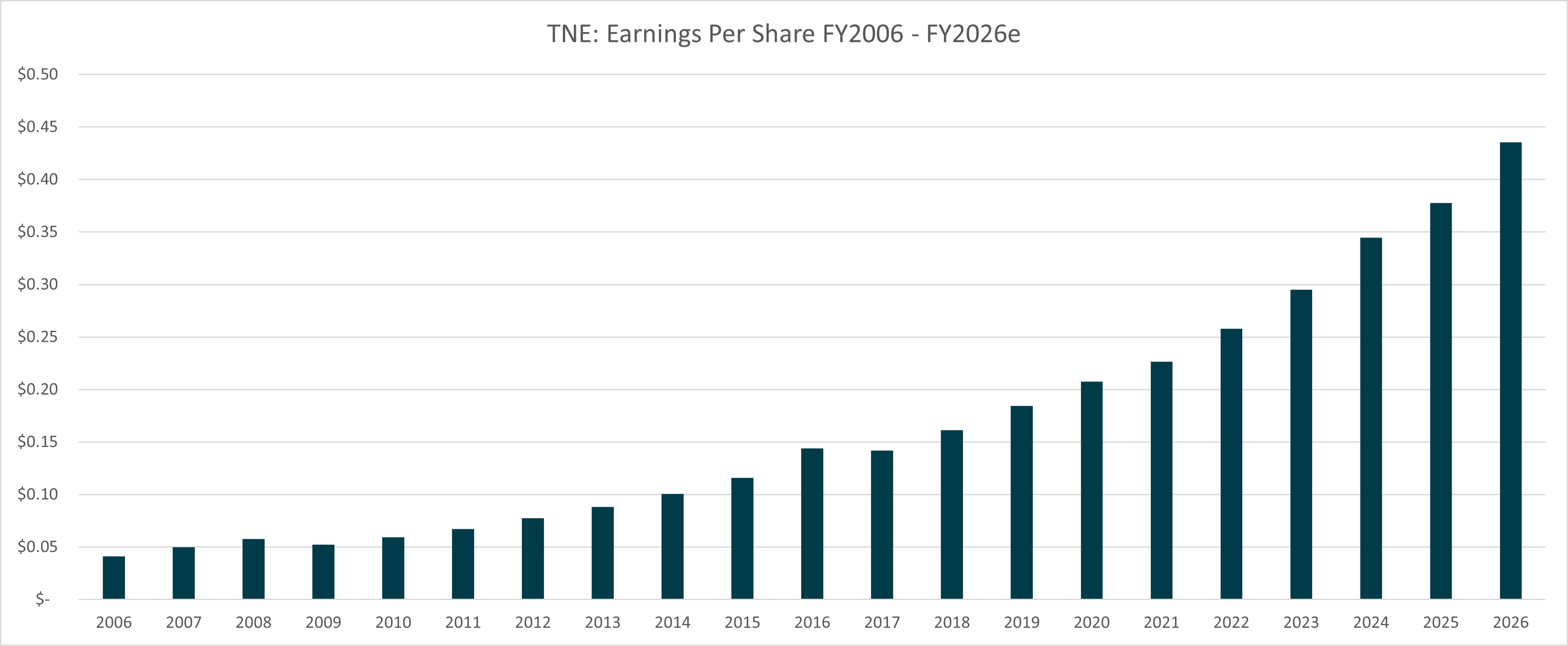

TechnologyOne (ASX: TNE)

Although presented in alphabetical order, we have arguably saved the best EPS chart for last. TNE was established by Adrian Di Marco in 1987, listed on the ASX in 1999, and has grown exponentially since. TNE is focused on the development, sale, implementation, and support of integrated enterprise business software solutions across Australia, New Zealand and the UK.

With an impeccable track record, TNE has long been viewed as a pioneer on the Australian technology scene. The company services customers across a range of sectors including local government, education, health and community services, and corporate and financial services.

TNE has a non-traditional balance date, and as such its financial year ends on 30 September. We can therefore look forward to reviewing its full year result when released in November. The first half result was encouraging, with revenue up 19% to $172.5m and profit up 18% to $33.2m. TNE has been on a steady path of transitioning its business model from legacy licence sales to subscription sales (SaaS), which continues to add depth to its recurring revenue base.

Management remains steadfast on its longer term target of delivering $500m+ of annual recurring revenue by FY2026, from its current base of $288m. According to TNE CEO Ed Chung, ‘the economies of scale from our global SaaS ERP solution will also see continuing Profit Before Tax margin expansion to 35%’. Revenue growth combined with margin expansion is a great recipe for strong future earnings growth. When coupled with a sound track record of delivery, this probably explains why TNE trades on a premium multiple of about 39x FY23 earnings.

We currently have TNE on the part of our watch list reserved for high quality companies trading at premium prices. These are the types of companies we like to look at during market wide sell-offs, where indiscriminate selling can provide the entry opportunity.

Marching Higher

Another investing legend, Warren Buffett, is no stranger to a growing stream of earnings. We provided our take on the factors that drove Buffett’s investment success here, but the following excerpt best summarises why a focus on earnings is paramount for long term wealth creation:

“Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio’s market value.”

It is our hope that this note helps investors refocus during a time of economic uncertainty and market volatility. There are no silver bullets, but maintaining a focus on what matters most during times of stress is a great first step.

---

Adrian Ezquerro is a Principal of Elvest Co Pty Limited (ABN 65 657 018 614), Corporate Authorised Representative number 001296195 of Fundhost Limited, and a Portfolio Manager of The Elvest Fund. Disclosure: Adrian is exclusively invested in The Elvest Fund. Elvest holds shares in AUB, FID, HSN and PWH.

3 topics

7 stocks mentioned