The strategy finding the 'sweet spot' over many years, through many cycles

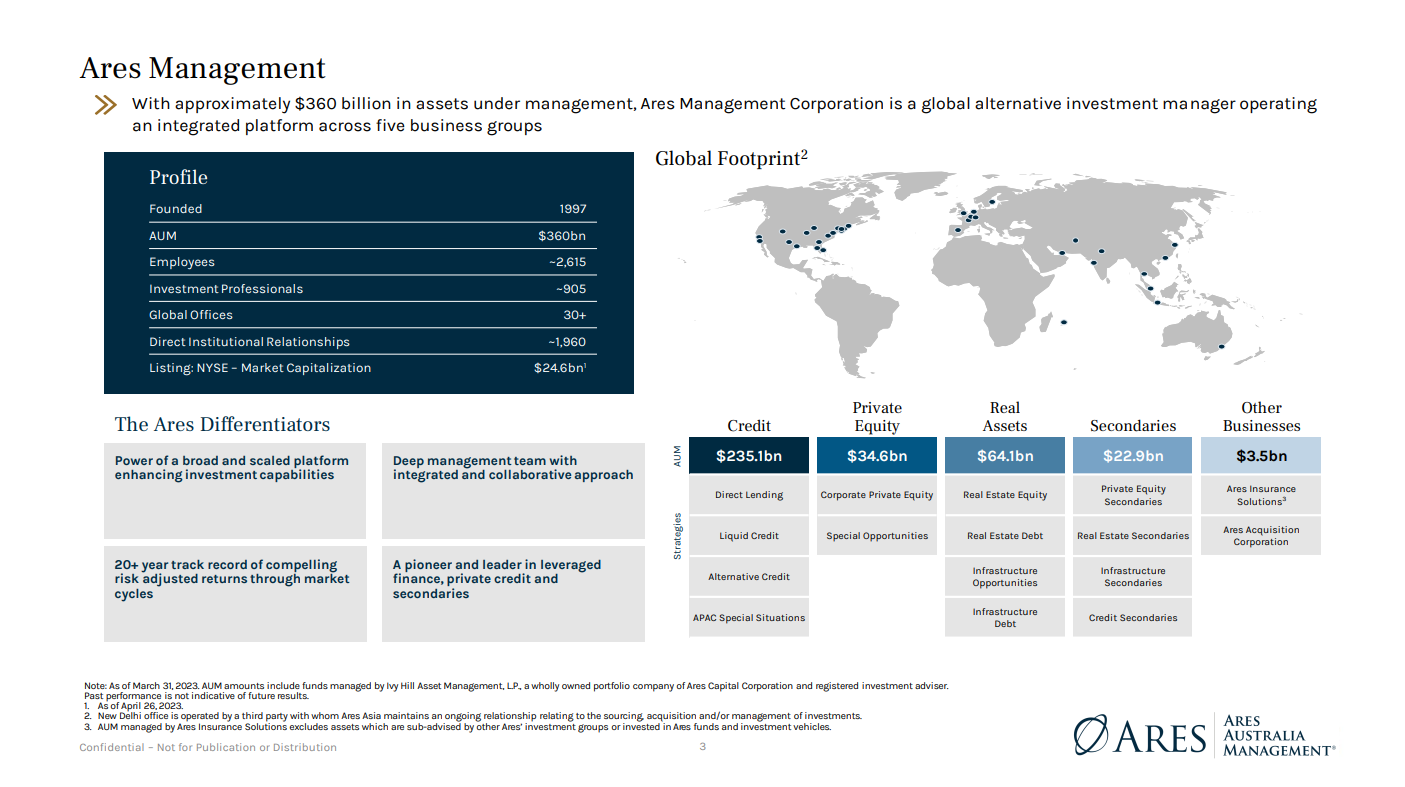

The Ares Global Credit Income Fund (“the Fund”) employs a strategy that is all about finding the 'sweet spot' of credit markets. More specifically, Ares is focused on credit asset classes that, over the years, have exhibited what we believe are attractive risk-adjusted returns.

Their main characteristics are high levels of income, being senior secured in the capital structure, generally being floating rate, or being short duration.

These are characteristics that we find quite attractive and provide diversification to investors' portfolios. In the Ares Global Credit Income Fund, we dynamically invest across these asset classes, seek the best relative value opportunities, and deliver enhanced yield for our investors.

In this Fund in Focus presentation, Teiki Benveniste provides an overview of the Fund and discusses Ares’ approach to investing. Teiki also explains the opportunity set right now, highlighting which areas of the market he finds particularly attractive.

Click on the player to watch the presentation or read an edited transcript below.

Edited Transcript

Hi, my name is Teiki Benveniste. I'm the head of Ares Australia Management, and today I'm here to talk to you about Ares Management and the Ares Global Credit Income Fund.

Ares is a global alternative manager that's been around since 1997 with credit in its DNA. What we believe differentiates us is our scale and our culture of collaboration, which over the years and through many cycles, has allowed us to deliver attractive risk-adjusted returns for our investors. Today, we're going to be focusing on our credit capabilities and, precisely, the tradable private and public credit universe, which we call Liquid Credit.

Across our Liquid Credit platform, we're able to invest in what we call the sweet spot of credit. Credit asset classes that over the years have exhibited attractive risk-adjusted returns. Their main characteristics are high levels of yields, being senior secured in capital structures, generally being floating rate, or being short duration. These are characteristics that we find are quite attractive to provide diversification to investors' portfolios. Hence, in the Ares Global Credit Income Fund, we combine those asset classes, to find the best relative value opportunities on offer, and deliver enhanced yield for our investors.

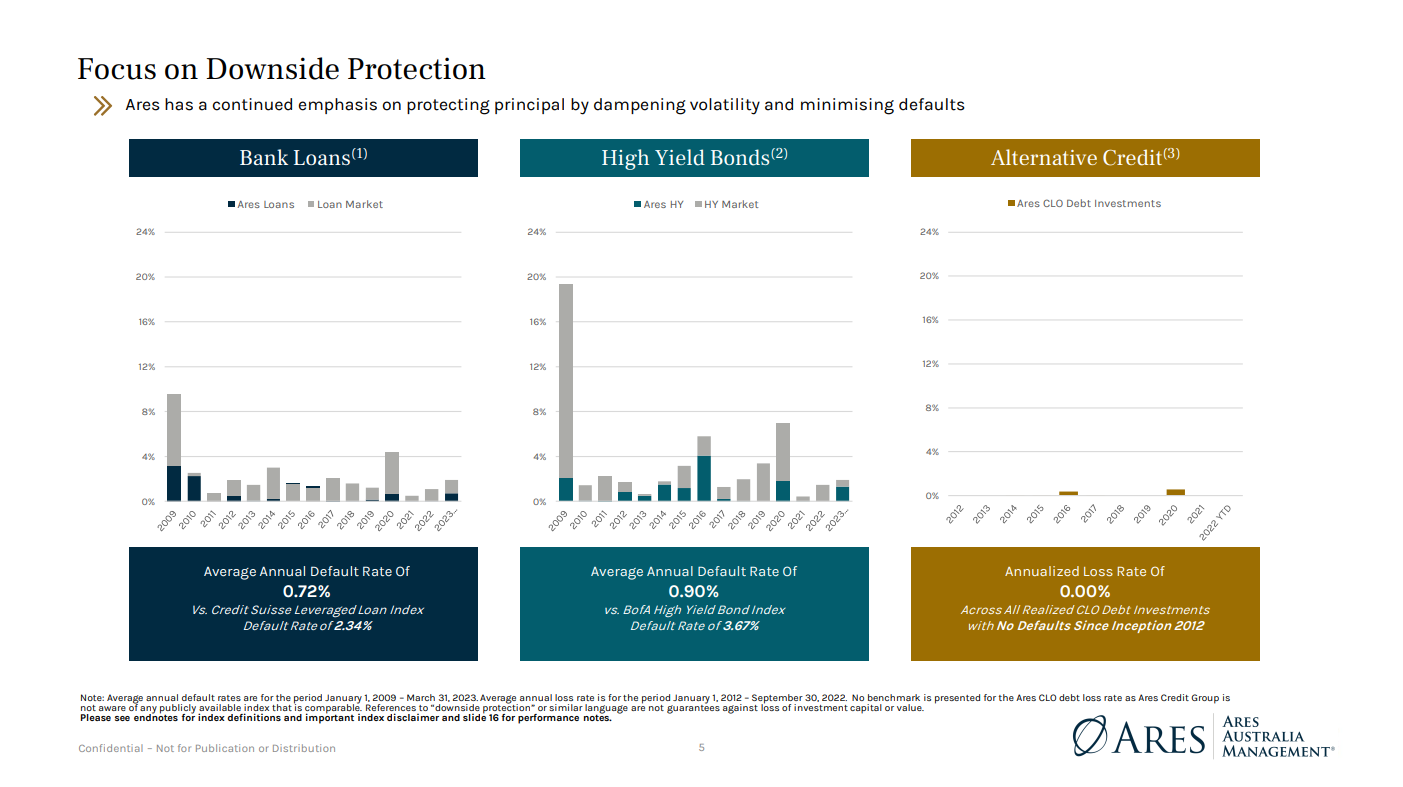

The reason the higher yield is available is credit risk. And one of the key factors of success in those asset classes is being able to deliver superior credit selection - avoiding defaults. Through the years, Ares has a long track record of delivering just that in the syndicated loan market, the high-yield bond market, and within Alternative Credit, where we've experienced zero defaults.

What's the opportunity set right now?

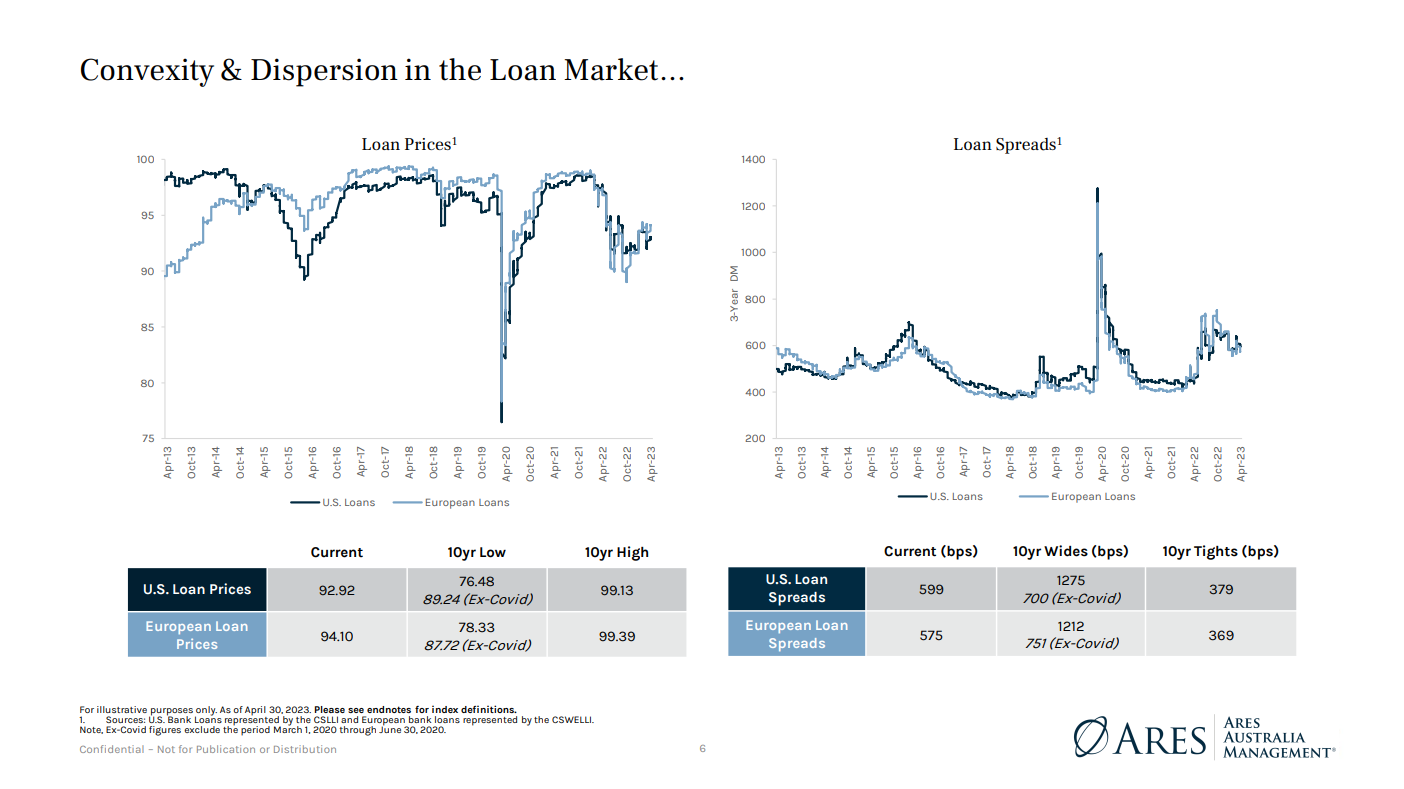

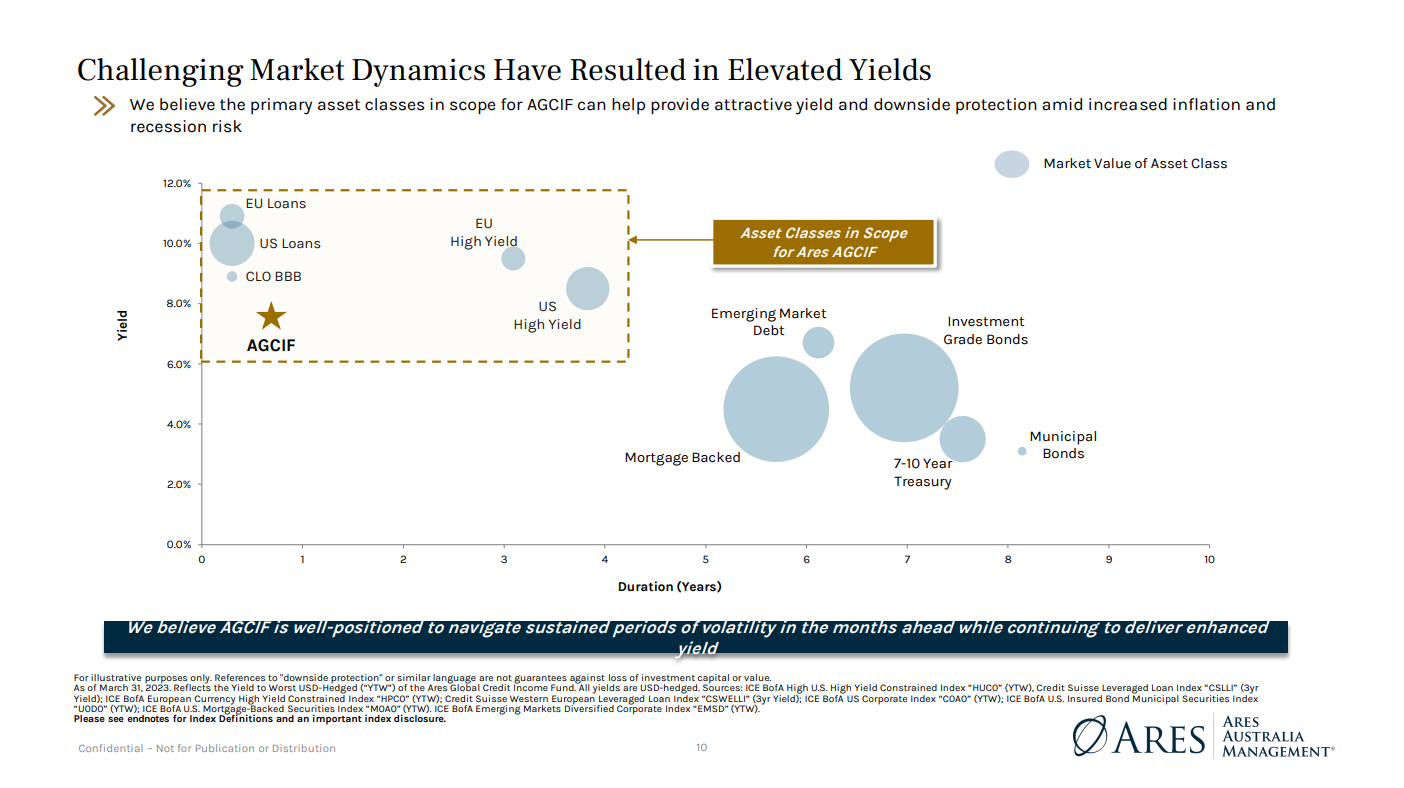

On this page, what you can see is that in the syndicated loan market, you have high levels of spreads. Spreads are wide compared to historical levels, which results - combined with high base rates - in very attractive all-in yields for investors. These all-in yields are mostly cash yields, which are a very stable source of potential income. So in an income-focused strategy, being able to anchor your returns in high income generating asset classes, we find, is looking attractive.

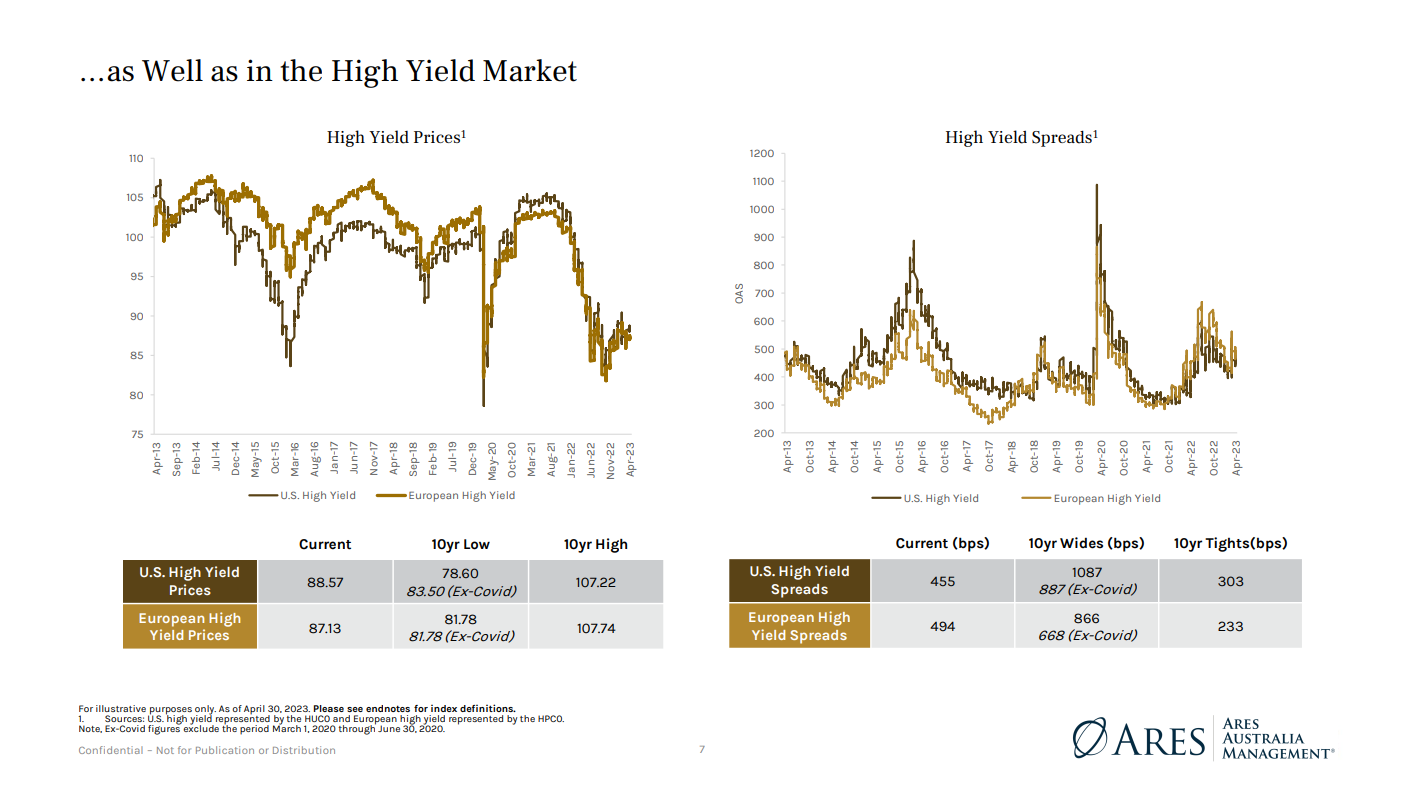

The other part of the market which we believe is quite attractive, is the high-yield bond market. Not so much from a spread perspective, but from a price perspective. What you can see here on the left-hand side of the chart is that high-yield bonds are trading at historically low levels in terms of price. That means that there is convexity in the market and there is potential for capital gains on those fixed interest securities.

What are the risks in the market?

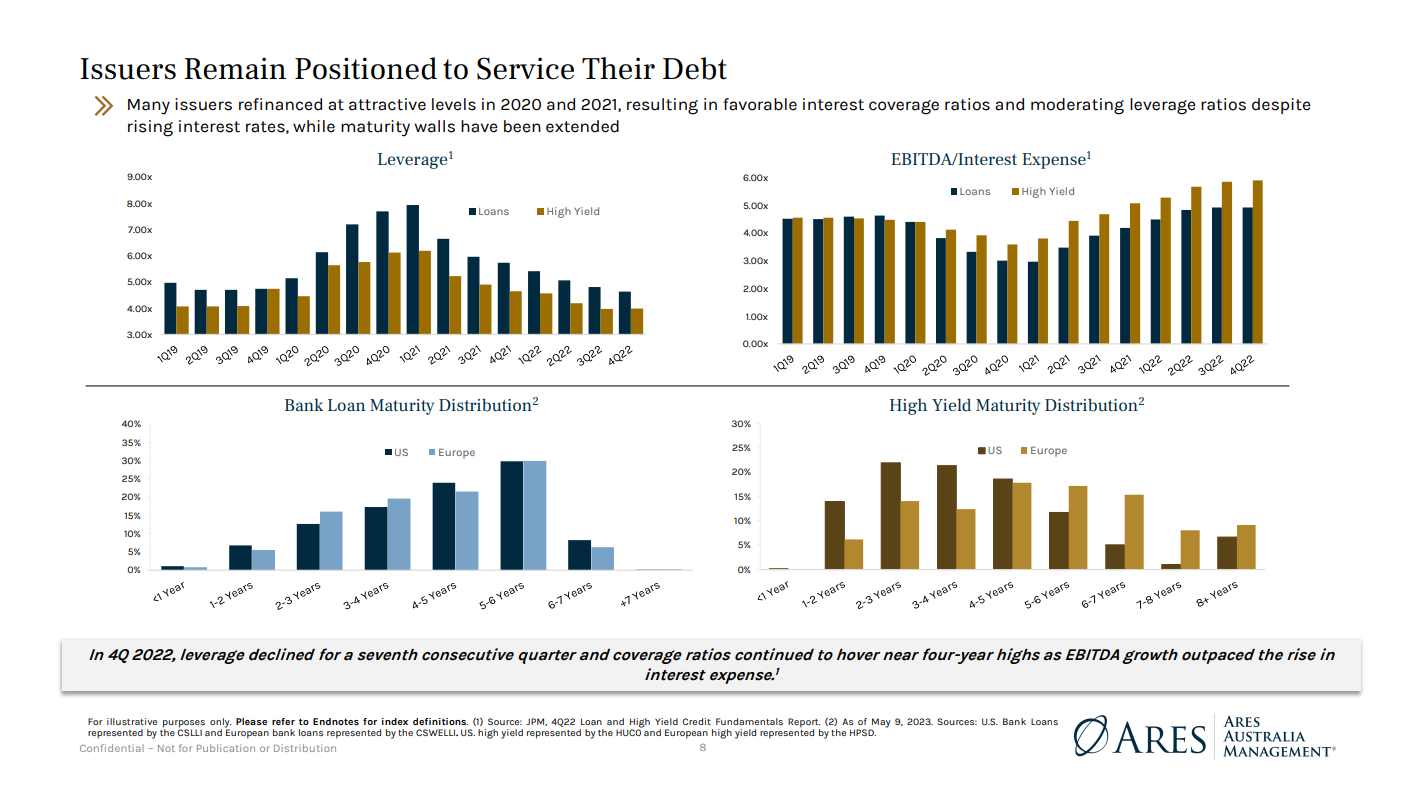

As I said earlier, these are credit asset classes and therefore default risk is the main risk associated with those investments. The fundamental picture right now, painted on this slide, shows you that the average level of leverage in those companies, in those markets, is looking reasonable compared to historical levels.

Interest cover ratios, which are the ability of those corporates to service their debt, have been holding up quite well as well. And if you look at the lower part of this slide at maturities and when those loans and bonds are expected to come for refinancing and repayments, those walls of maturities have been pushed into the future, as corporates have refinanced right after the COVID period.

This points to an environment where fundamentals are holding up, despite the broader economy slowing down.

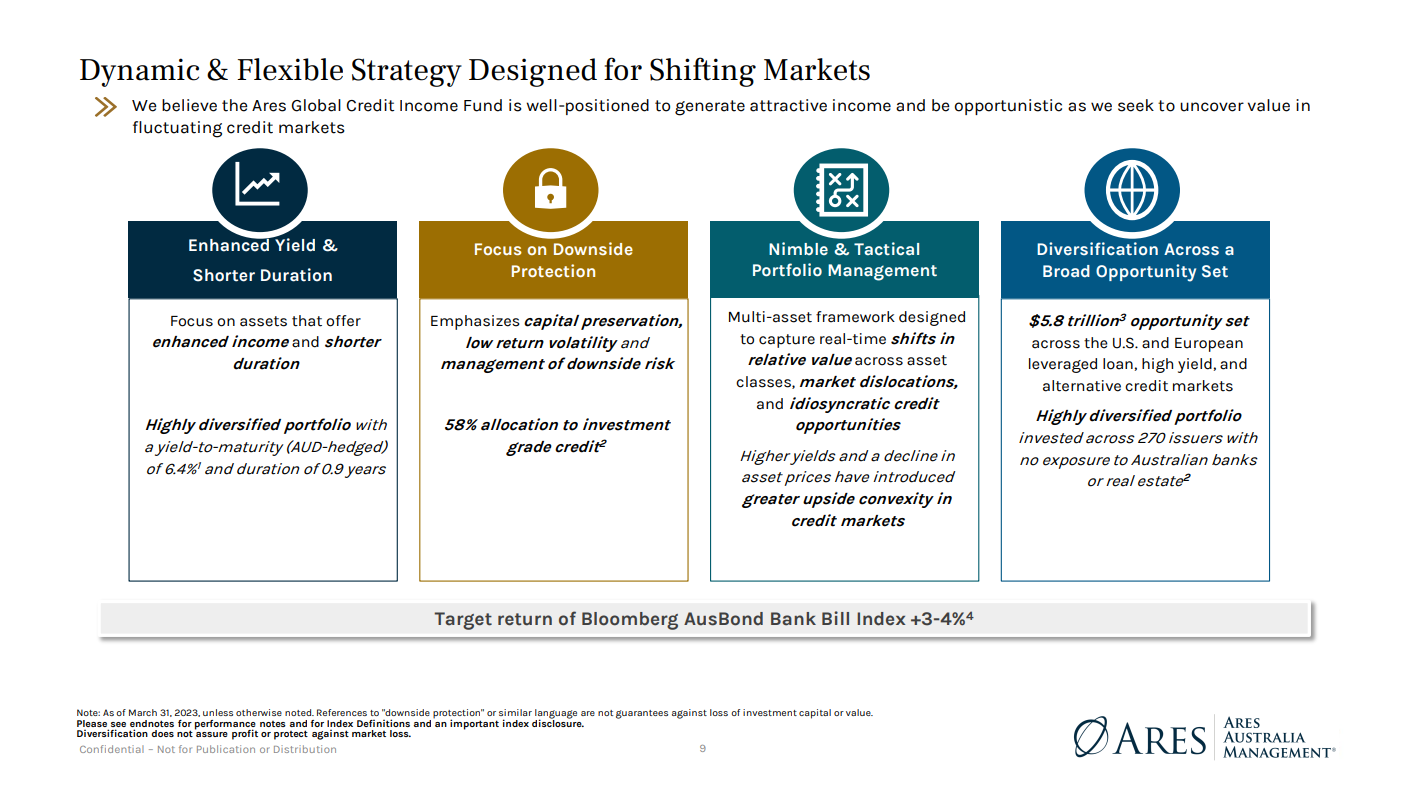

In order to take advantage of this opportunity set, in the Ares Global Credit Fund, we employ a dynamic, flexible strategy that looks at the best relative value opportunities across those asset classes. What the fund aims to deliver is yield enhancement, downside protection with that nimble, flexible strategy, and diversification to Australian investors' portfolios. All of that targeting a gross return of Bloomberg AusBond Bank Bill Index plus 3-4%.

Looking at the first benefit of the fund, right now, the Global Credit Income Fund is able to deliver a yield-to-worst of close to 8% with less than a year of duration. We believe compared to other more traditional asset classes, like investment grade bonds and treasuries, this is an attractive proposition in an uncertain inflation and rates environment.

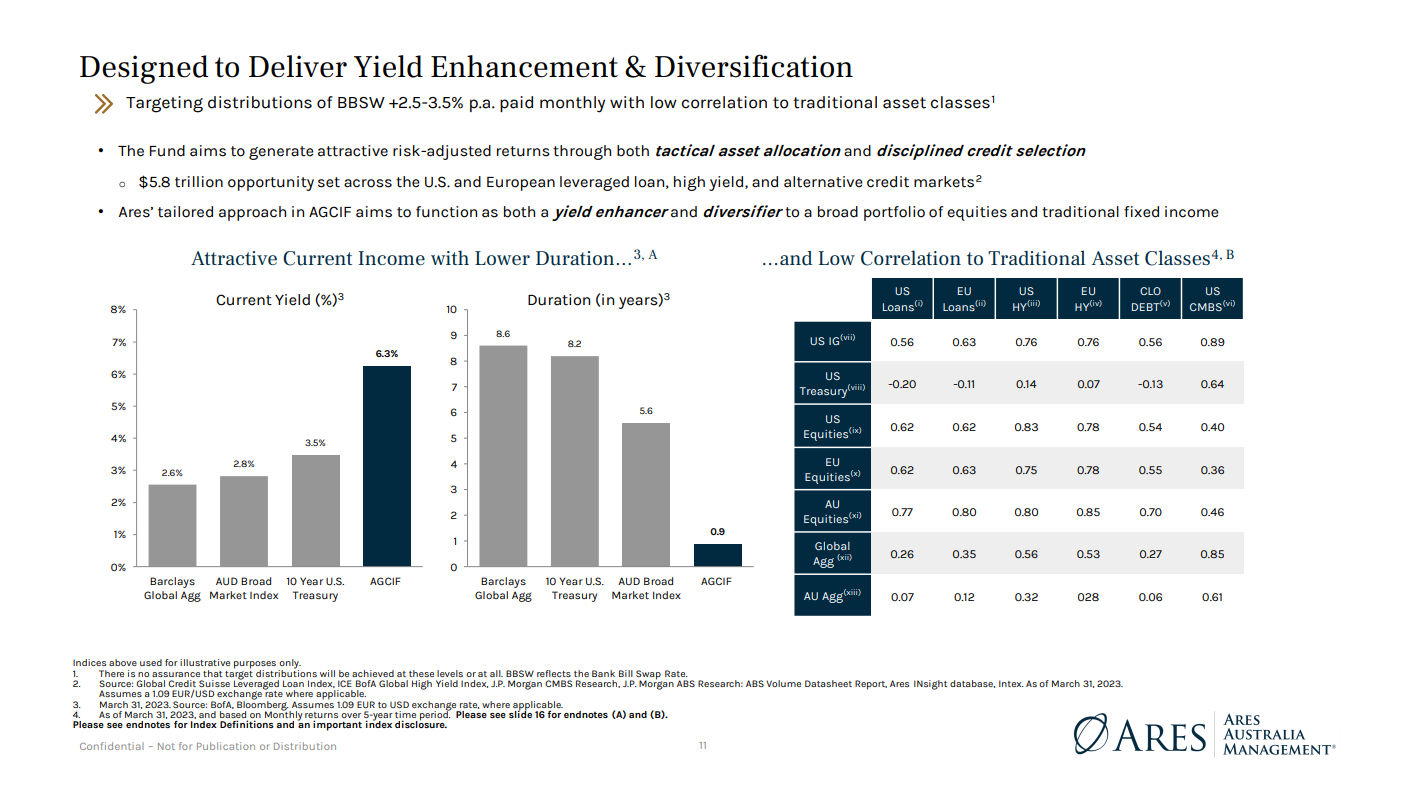

When you look at the current yield generation of the fund, it sits at 6.3%, again comparing very attractively to more traditional fixed income asset classes, such as treasuries and the AusBond Broad Market Index, which are sitting below 3.5% and 2.8%.

Highlighting the duration levels that you're taking with those asset classes, those more traditional asset classes, you are above five years and eight years when it comes to global, while in the Global Credit Income Fund, you are below one year of duration. Then on the right-hand-side, you can see a matrix that shows you that from a correlation perspective, the asset classes we invest in actually exhibit low levels of correlation compared to traditional asset classes over the years.

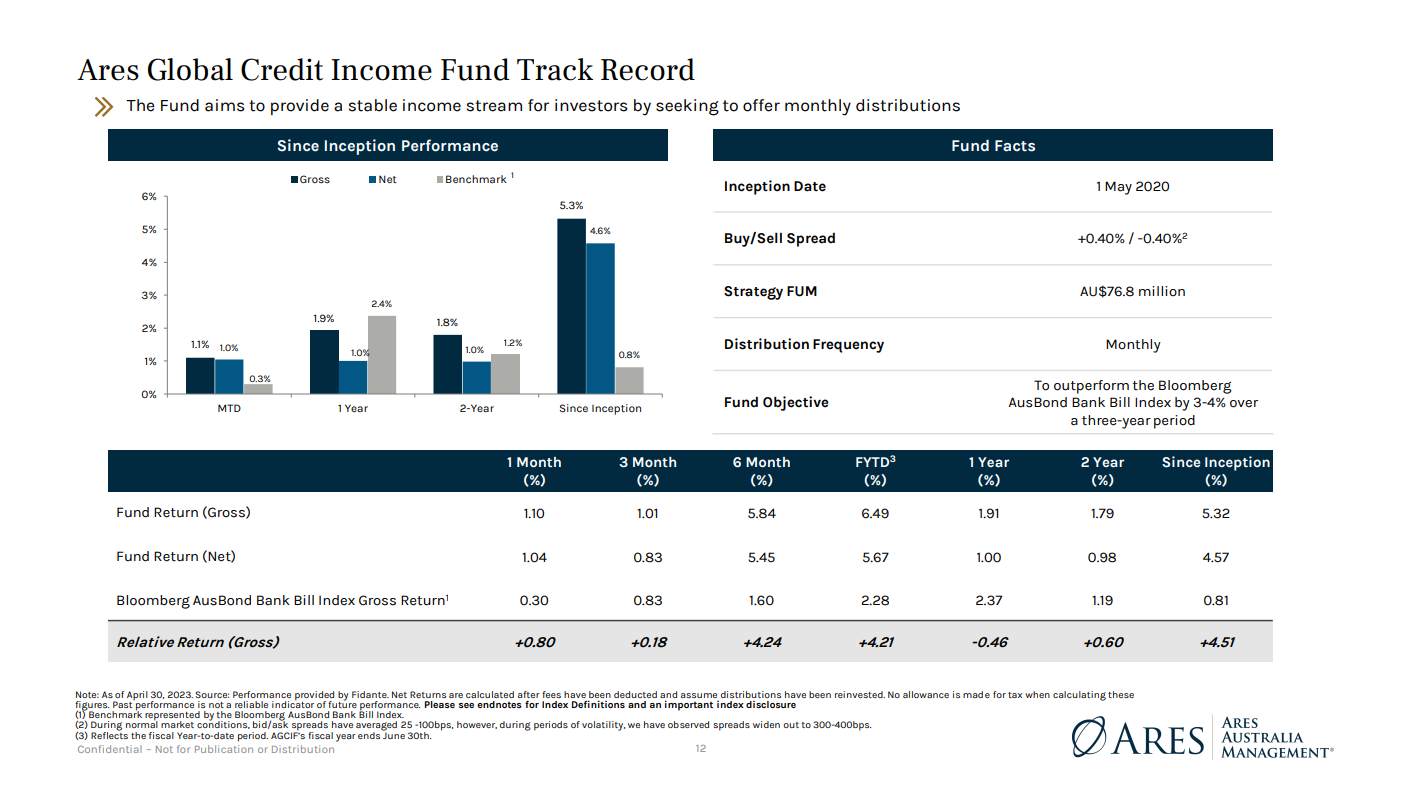

Finally, the Ares Global Credit Income Fund has delivered, since inception, net return of 4.6% in line with its current income levels, and over the last year a net return of about 1% when most traditional fixed income asset classes experienced negative returns. Again, importantly, most of those returns came from income generation - the current yield generated by the assets held in this fund. Finally, testament to the credit selection capabilities of Ares, this fund since May 2020 has experienced no defaults in this portfolio. A characteristic that we believe will continue to be key for the fund to deliver on its target returns.

Thank you very much. If you want more information, please visit our website or contact us on the details that are coming up on your screen now.

Consistent income throughout market cycles

To learn more about how Ares Australia Management navigates inefficiencies in the market to generate attractive, income producing portfolios please visit our website.

5 topics

1 fund mentioned

Mr. Benveniste is the Head of Australia for Ares Asia Wealth Management Solutions and acts as a client portfolio manager for Australian investors. Prior to joining Ares Australia Management in January 2020, Mr Benveniste spent six and a half...

Mr. Benveniste is the Head of Australia for Ares Asia Wealth Management Solutions and acts as a client portfolio manager for Australian investors. Prior to joining Ares Australia Management in January 2020, Mr Benveniste spent six and a half...