The straw that could break the market's back

Despite the fastest and most aggressive rate hiking cycle since the reign of former US Federal Reserve Chair Paul Volcker - who is largely credited with ending the crushing levels of inflation seen in the US through the 1970s and early 1980s - nothing appears to have managed to break the market's back.

The S&P 500 has lifted north of 23% over the last 12 months - while the tech-heavy NASDAQ 100 has nudged slightly higher at 28%. The ASX 200, in comparison, is up 8% over that same period.

So why has nothing broken, at least, for now?

According to Schroders' Sebastian Mullins, the US economy has three main pillars: the consumer, corporates and the government.

Unlike in Australia, the majority of consumers in the US have fixed-rate (not floating-rate) mortgages and debt (only 11% is floating).

"If you go back in time to 2007 before the last big recession, floating rate debt was 25%. In the 80s, it was 40%," Mullins explains.

"Since the GFC, not only have US consumers fixed their debt, but they've de-levered as well. So as a consumer, your debt has come down and you've fixed your home loan at around 3-4% - so they are not feeling the pinch as much as you'd expect."

In fact, Mullins argues that household debt payments are the lowest they've been in 40 years (excluding the COVID period).

Interestingly, the same goes for corporates - with Mullins arguing that businesses are now paying far less to repay debts than they're receiving on their cash.

"Think about Apple (NASDAQ: AAPL) as a company - it's not representative of all of America, but it's a big company. They issued a bond in 2020 for 2.5% for 40 years," he explains.

"Apple's current debt is US$100 billion. They have US$160 billion sitting in cash earning 5.5%. They make more money on their cash than they pay out on their interest and that's true for 35% of the tech companies in the S&P 500."

So, which pillar of the economy is suffering most from higher rates? Surprisingly, Mullins believes it's the US government - which did not "lock in" low rates and issued bills back in 2020.

"They're in a situation now where their interest expenses on debt is higher than defence and Medicaid - it's the highest expense they pay," he says.

"The Fed is very, very cognisant of liquidity in the system. So they might have to cut to stop that liquidity suck from the government. So consumers are fine, corporates are fine, the government may not be, and if they do cut rates to help the government when inflation is high, ask Milei in Argentina, typically that's a bad sign."

All this means that inflation is likely to stay higher for longer - and could just be the straw that breaks the market's back.

In this wire, I'll outline what this means for private and public equities - with the help of Schroders' Claire Smith and Martin Conlon.

Note: These quotes are taken from a financial adviser event on Thursday 30 May 2024.

.jpg)

Australian Equities: Expensive compared to bonds, cheap compared to gold

The era of globalisation and deflation is over, Conlon says, arguing that the status quo is changing. For instance, nearly every asset class, including Australian equities and property, currently looks expensive relative to bonds. Compared to gold, however, they look cheap.

"I think there's a message in there about government bonds and the risk risk-free asset that we're used to them being," Conlon says.

"Obviously, the last decade or so has been a lot about injecting money into the economy, rescuing it every time a cycle's rolling over and we're really starting to think about whether there are any consequences of that."

One consequence, according to Conlon, is that we are unlikely to return to surplus ever again - particularly in an environment where governments need to invest more to support ageing populations.

To complicate matters further, the Aussie consumer is heavily indebted - meaning those who would like to spend money (typically 30-50-year-olds) can't, while the older cohort can but won't.

"We take that to mean that the government is probably going to be more of an engine for the economy than it has been in the past. That's got some ramifications for stocks, but it's going to mean that in modern economies, where we're very reliant on growing credit, the government's probably going to be the one that has to fill that role," Conlon says.

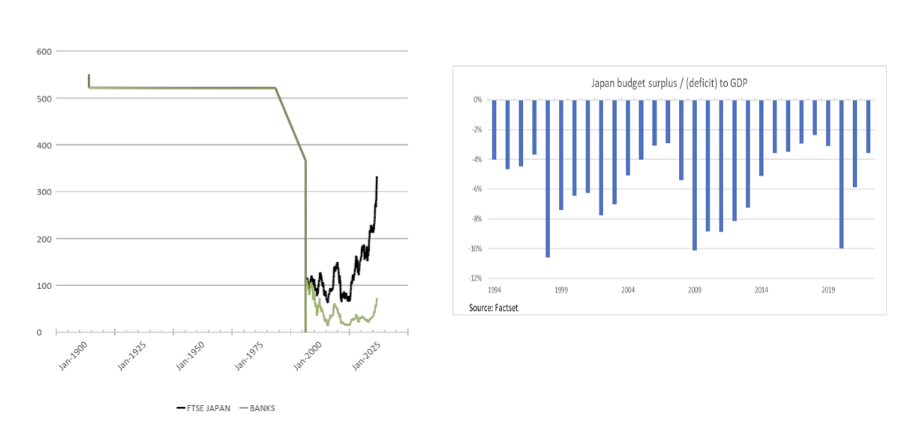

So what typically happens when an economy faces demographic challenges? Let's take a look at Japan, for example. Japan's budget surplus position looked pretty similar to Australia's, Conlon says, and they haven't seen a surplus in "recent memory." In fact, the deficits have generally been large.

"The government spends money, issues bonds and the central bank buys them effectively. It's the modern way of taxation. You're just taxing the value of people's money rather than explicitly taxing them," Conlon says.

This has ramifications for Australia's banks - which make up 20% of the local index. Japanese banks, as seen in the chart above, have heavily underperformed the broader market since the end of Japan's asset bubble.

"In very simple terms, the way we characterise it is that the volume growth being credit for banks disappears. If the net interest margin doesn't expand, then they end up with pretty flat revenues," Conlon explains.

"Unless they can cut their costs, their profits go backwards - and that's assuming you don't have a bad debt problem. So the headwinds for banks without that volume growth and with the government being the spender in the economy, make the banks' outlook pretty challenging."

Undervalued areas of opportunity

Schroders believes that equity valuations are "astonishingly unsustainable" and "challenged" - and is avoiding the AI and tech winners that the rest of the market is flooding towards.

Take WiseTech Global (ASX: WTC) for example, which boasts a market cap of $32 billion.

"For any mature company, we'd be looking to get a 9-10% return, which means you want to buy it at about 10 or 11 times EBIT operating profit. Let's do those maths on WiseTech Global. I'd need about $3 billion profit forever to get a 9-10% return on the price I'm paying for that stock today," Conlon explains.

"The difficulty is, last year WiseTech Global made about $1 billion in revenue and about $200-300 million in profit. If things go pretty swimmingly for WiseTech Global and the revenues go up six-fold to $6 billion and they make a 50% margin forever and therefore make $3 billion of operating profit, you'll currently be buying that stock at 10 or 11 times EBIT, which means you expect a return of zero because that's what you've already paid today."

While some investors may argue that WiseTech should not be valued this way - Conlon argues that this is the "epicentre of the madness in tech".

"There's always something left behind. We are looking for opportunities that other people haven't seen. And there are some out there," he says.

For example, while the rest of the world is looking at copper, Schroders is searching for value in aluminium.

"Aluminium is one of the next most conductive metals. It is used in high-voltage power cables, etc, and given that there is not enough copper in the world, our take would be people are going to have to work out ways and technologies to use things like aluminium to solve those problems," Conlon says.

"Higher copper prices won't create more copper. We're going to have to find other ways. Interestingly, the aluminium price hasn't moved in 20 years. Surprise, surprise, given that generally commodity stocks chase commodity prices, most of the aluminium stocks have hardly moved in 20 years."

Conlon points to Alumina (ASX: AWC) and South32 (ASX: S32) as examples of how Schroders is playing this opportunity. Alumina has seen its share price rise more than 100% year to date, while South32 is up 17%.

Schroders is also seeing value in healthcare players - particularly unloved pathology and radiology companies - like Sonic Healthcare (ASX: SHL), Ramsay Health Care (ASX: RHC) and Healius (ASX: HLS). He's not as much a fan of the ASX's healthcare darlings - those with "pricing power", which he argues, is just inflation in action.

Private market opportunities

While Conlon and the publicly listed equities team are avoiding tech, Smith and the private equities team are exploring this area of the market for opportunities - as well as healthcare.

This is because these businesses are typically "asset light", meaning it is easier for the Schroders team to come in and improve these businesses substantially.

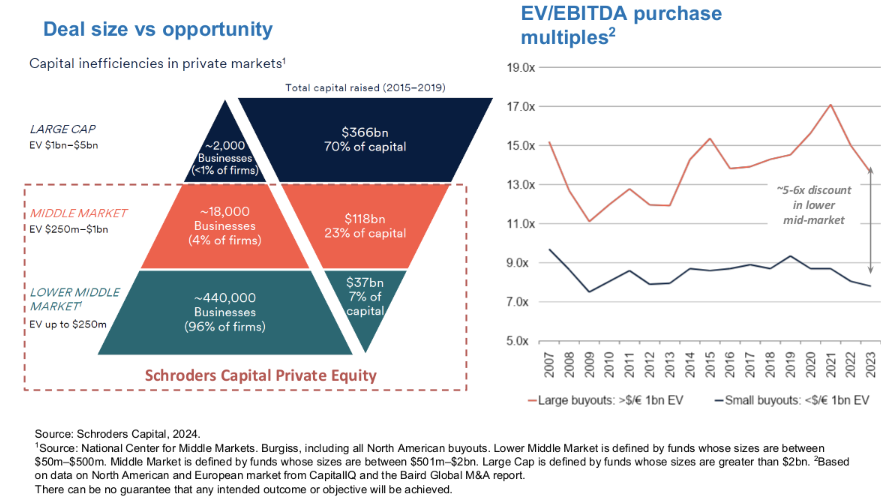

"We don't think all private equity is treated equally, and a lot of the time in the news they really focus on the large-cap part of the market... When we look at private equity, we focus on the small to mid-cap part of the market," Smith says.

As seen in the first image above, 70% of all private equity capital flows into large-cap companies - which only make up less than 1% of the global universe. Smith believes this part of the market is efficiently priced, while the small to mid-cap part of the market - which makes up around 99% of businesses and receives around 30% of private equity capital.

"We particularly like markets where there's more fragmentation around language and cultural barriers to investing. So areas like Europe and Asia. There you really need to have that sort of boots-on-the-ground mentality and you can find really attractively priced opportunities in markets that Martin thinks are overpriced like tech," Smith says.

"We take those companies, we grow them, we professionalise them, transform them and sell them to a bigger fund - which will pay you a higher multiple because you have taken a company, grown it and professionalised it. We call it 'buy low, sell high'."

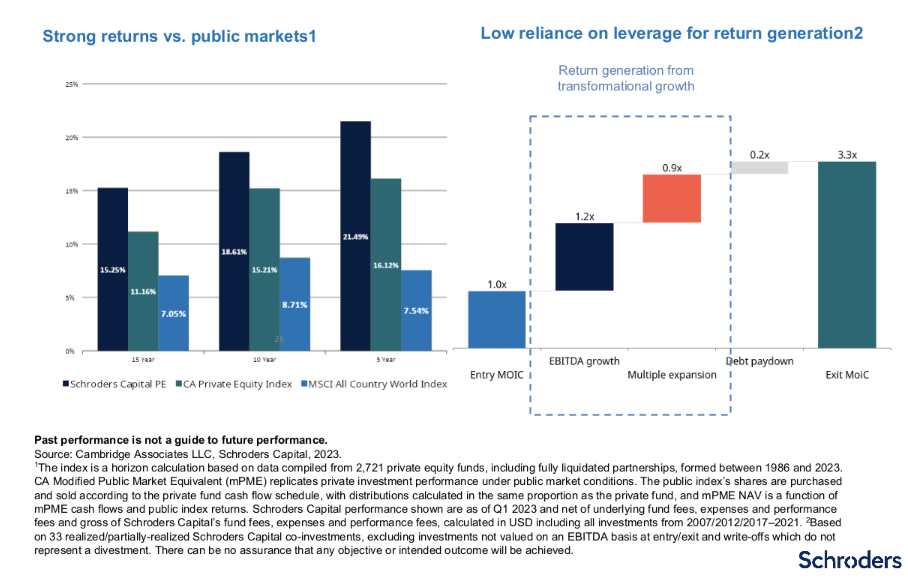

Interestingly, despite the majority of private equity funds investing in large-cap opportunities, the majority of top-quartile performers play within the small-cap arena. This strategy has worked well for Schroders, which has outperformed both the private equity benchmark and the listed equity market over 15, 10 and five years - mostly, with returns generated through EBITDA growth compared to leverage.

Most of the businesses Schroders' private equity team invests in are founder-led or previously family-owned businesses - many of which have been in business for decades and are well-regarded in their sector or sphere.

For example, a company may not have team members in place across sales and marketing, or with employees with expertise in operational efficiency, M&A, or expanding into new geographies or supply chains.

"Often with these family-owned businesses, there's a lot of quite easy levers for value creation that you can implement," Smith says.

When it comes to sectors, Smith and her team are focused on companies with pricing power - that can pass on inflationary pressures. She likes businesses in the healthcare and technology sectors, particularly those that operate at the intersection of the two. In Asia, however, Schroders is focused on cyclical businesses to benefit from GDP growth.

"Importantly, across all these verticals within our private equity sphere, we like asset-light companies. So we don't do real estate, we don't do infrastructure... and even in our industrials bucket, we prefer asset-light companies," Smith says.

For example, in 2016, Schroders bought into TP Aerospace - a leading European aircraft brake servicing company.

"When we made our first investment, originally it saw 22% year-on-year growth. It is a really fantastic company, a real leader in its field, great management team, all the things we wanted to see - and quite asset-light, their real skill is in their equipment and people," Smith says.

"When COVID hit, they needed more capital... And we thought COVID was a short-term structural problem rather than something more nefarious for the company. And for transparency, we said no to other companies which asked for money during COVID."

Schroders re-invested but paid the same price they did in 2016 when they made their first investment, with Smith noting that there is room for negotiation in private markets - unlike their public counterparts where investors are price takers.

"That company's now being valued three and a half times higher than the price we paid in 2020," Smith adds.

All of this is to say that Smith is looking for opportunities with strong fundamentals, that can survive and thrive in inflationary pressures and pass on costs to their customers. Like Conlon, she's searching for value in areas that aren't currently crowded - unlike Conlon, who invests in listed equities - there are still compelling opportunities available in high-growth sectors like tech and healthcare.

4 topics

7 stocks mentioned

3 contributors mentioned