The surging US Dollar is tanking global currencies. Here's what that means for your portfolio

The US Dollar (USD) has had a year like no other, tanking the value of every currency paired with it. That's good news for US citizens travelling abroad but, as we'll find out in this wire, bad news for equity markets.

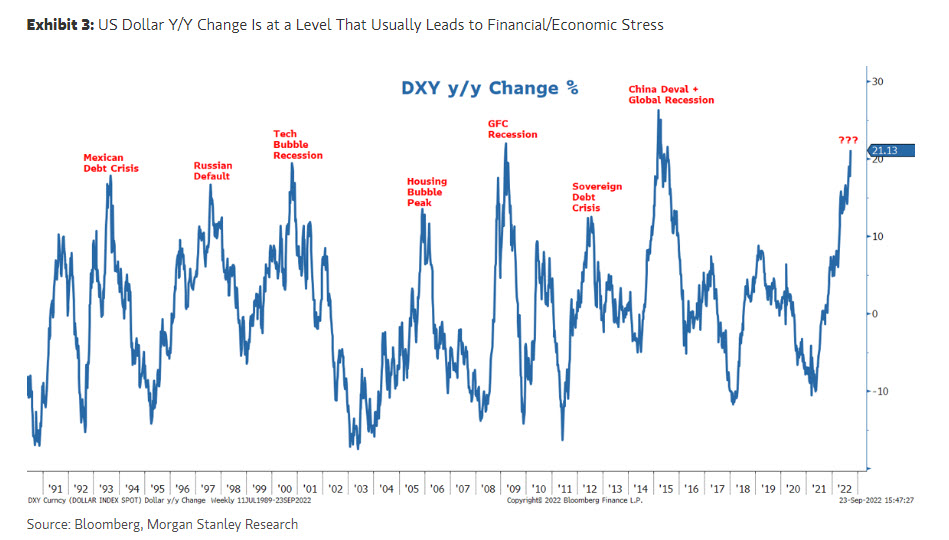

The US Dollar Index (DXY), which tracks the performance of the dollar against 6 of America's largest trading partners, is currently at 113.72. To put the move into perspective, it's been two decades since it's been that high - in January 2002.

"According to the Bank of International Settlements’ Real Effective Exchange Rate model, the dollar looks more expensive than in all but two events in the last 51 years – the levels in 1971 that signified the end of the Bretton Woods Agreement and the mid-1980’s dollar bubble that led to the Plaza Accord," says Ben Inker, Co-Head of Asset Allocation at GMO.

But markets aren't static - especially currency markets. Where the dollar goes from here will directly inform the earnings of every company with international exposure.

In this wire, I'll identify the factors that have pushed the dollar this high and what it means for asset values now and, importantly, in the future. As you'll read below, a sideways, upwards, or downwards moving dollar can have starkly different impacts on equities. Spoiler: some Aussie equities even stand to benefit!

Why did it happen?

According to Harvard economist Jeffrey Frankel, the strength of the US dollar is down to three main things:

-

US economic growth is higher than its major peers;

-

other countries are more sensitive to high commodity prices (remember, the US is a net energy exporter); and

- the US Fed is tightening faster than most other central banks.

It's also probably been helped along this past week by yet another currency own goal from the UK, following Brexit, with British Chancellor of the Exchequer Kwasi Kwarteng's announcing that the United Kingdom would introduce the biggest tax cuts in 50 years while also increasing spending. Not exactly an orthodox thing to do when your country is swimming in inflation.

There might also be some carry-trade speculation going on. For context, carry trades are one of the most popular strategies used by FX traders. These are designed to take advantage of a high-yielding currency (i.e. the US Dollar) and fund the trade of a low-yielding currency. The difference in these rates is the profit.

"The Federal Reserve has been more aggressive in raising rates than other developed central banks and currency speculators do like betting on carry," says Inker.

Why does it matter?

In general, the US dollar historically goes gangbusters when the global economy is struggling. Global growth, emerging economies that hold debt in dollars, market liquidity, and capital inflows all point down when the dollar is up.

"The nominal exchange rate of the dollar is a prominent correlate of global financial conditions, with a stronger dollar implying increased financial stringency globally," add Maurice Obstfield (University of California, Berkeley) and Haonan Zhou (Princeton) in a Brookings Institution paper released this month.

"... heightened risk aversion in world markets tends to appreciate the dollar as investors everywhere seek safety, implying another channel of negative correlation between dollar strength and emerging and developing economies (EMDE) macroeconomic performance."

Credit markets also get hit.

"... in “risk off” episodes where global risk appetite declines, investors’ flight to safe assets simultaneously raises the foreign-currency price of dollars and constrains the lending of financial intermediaries," add Obstfield and Zhou.

The surging dollar also compounds problems for the US Federal Reserve.

"In the near term, the stronger dollar may bolster the purchasing power of companies and consumers when it comes to imports, thus helping ease inflationary pressures," according to Lisa Shalett, CIO (Wealth Management) at Morgan Stanley.

"But the dollar’s strength can also hurt U.S. exports and the translation of overseas profits by U.S companies, posing headwinds to growth. Longer term, the currency’s strength may help further tighten financial conditions, just as the Fed is shrinking its balance sheet and international flows into the U.S. market could be slowing in line with recoveries elsewhere."

Where to from here?

Currencies are not static things. The dollar will move, eventually, and it's here where things get really interesting for equity markets.

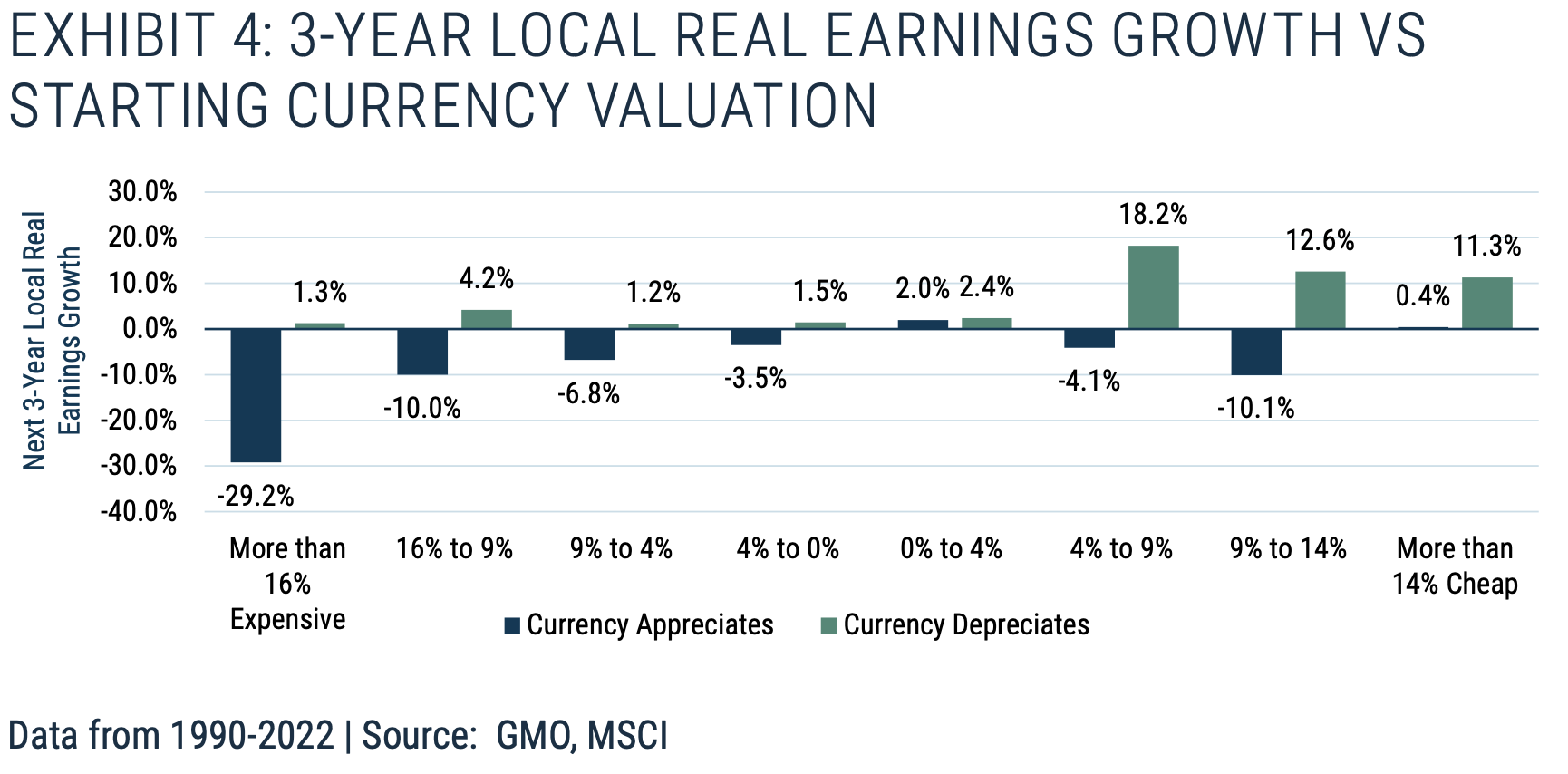

Let's game out three scenarios based on what GMO's chart above is telling us.

-

If the US dollar remains expensive, earnings growth in the US will be well below average.

-

If the US Dollar appreciates further still, earnings growth in the US will be disastrous - about 7% worse than the average country over the last 30 years.

-

If the US Dollar depreciates then US earnings will enjoy a +7% impact versus average.

Point 1 is backed up by other analysis, too.

"On a year over year basis, the DXY is now up 21% and still rising. Based on our analysis that every 1% change in the DXY has around a -0.5% impact on S&P 500 earnings, 4Q S&P 500 earnings will face an approximate 10% headwind to growth all else equal," according to Morgan Stanley CIO Mike Wilson.

That said, the surging USD isn't just a story of American equities. The above dynamics can be inverted in other countries.

Negative headlines are smashing the UK and Europe amid their tanking currencies. But the 24-hour news cycle pushing these headlines has, well, a 24-hour time horizon. Successful investing has a much longer time horizon. And on that account, the UK and Europe may be among the better investment destinations.

"The Euro area and Japan... have currencies that are sufficiently cheap that it should be a real help to their markets. The simplest way for that to play out would be for the cheap currencies to appreciate and the overvalued ones to fall over the next few years. But even if that doesn’t happen, Europe and Japan look poised for stronger earnings growth than the dollar group," says Inker.

Some Aussie stocks, meanwhile, could be beneficiaries of a strong Dollar.

"The real positive is going to be for the magnitude of translation you'll see for our offshore earnings," says Todd Hoare from LGT Crestone.

"A lot of our healthcare companies generate their revenue overseas, as do tech companies like Altium (ASX: ALU), even the miners print in US dollars."

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

1 topic

1 stock mentioned