The tech opportunity that no one's paying attention to

Francyne Mu, portfolio manager for Franklin Templeton, manages the Franklin Global Growth Fund, a concentrated portfolio of Franklin Templeton's best ideas for high-quality companies exposed to long-term secular growth drivers.

In this Rapid Fire, Mu discusses some of the biggest growth opportunities in the market today, one she thinks no one is paying attention to, along with three companies she believes have the biggest future potential.

.png)

What's one area of the market that has huge potential but no one's paying attention to?

The market has obviously been very concerned about inflation, interest rates, whether or not we're heading for a soft or hard landing, and then ultimately, how markets respond to that over the near term. From our point of view, there's still huge potential for fundamental analysis to identify companies, which can set up very strong alpha generation over the next three to five years and over the longer term.

Within that, one of the areas that currently interests us is simulation.

That's simulation of product or engineering design which can speed up the time to market, or help companies save. It's still very much in the early stages, however application is already occurring in the design process in industries like aerospace and defence, the auto sector and semiconductors.

For example, before a car comes to market, simulation can help with optimising passenger comfort, ensuring that the system operates the way it should. You can simulate battery performance in electric vehicles to see how they work in certain environments and the efficiency of those batteries and to simulate radar and camera design development before a car goes to production. It's a huge cost saving before you spend the CAPEX dollars to go out and manufacture the car.

We believe the industry leader is Ansys (NYSE: ANSS) which is a company that specialises in engineering simulation software. It's well positioned, very profitable and over time, we think that simulation will take off in other industries as well.

How do you see the interest rate environment playing out in growth sectors in the coming year? What will it mean for funding and M&A activity?

High interest rates can be challenging for the growth sector. Companies with longer-tail growth opportunities may see lower valuations. There are implications for M&A deals, particularly in terms of what people are willing to pay. We think the best positioned companies are those with strong balance sheets which have that war chest and are able to add to their capability at more attractive prices. Growth companies with strong competitive positioning tend to be more resilient and can generate high free cashflow. These are the types of companies we tend to like and they are not in great need to tap the debt market. There are opportunities to build a portfolio with some resilience, even in the face of higher interest rate environments.

Healthcare is a significant sector holding in the Franklin Global Growth Fund. Can you discuss some of the growth themes you see in this space?

Healthcare is interesting to us because it's very diverse. It encompasses biotech to medical devices, drug development and healthcare management companies.

One of the areas we're excited about is in robotic surgeries. It combines innovation on the technology side as well as healthcare. If you think about it, robotic surgery has many benefits, obviously lower blood loss, smaller incisions and better recovery time. It also helps extend the operating life of surgeons.

Intuitive Surgical (NYSE: ISRG) is a company we like and it's the market leader. The next closest competitor is still a couple of generations behind in terms of their operating platform. We're now starting to see elective surgery come back in a more sustainable manner post-covid, and this should result in strong adoption growth in robotic surgeries. This should be a positive driver for the company, providing strong growth over the longer term.

Cybersecurity is a rapidly growing space, with huge investment expected now and in the future. Zscaler (NASDAQ: ZS) is one of the holdings in your portfolio. What makes this company interesting compared to its competitors?

There's an estimated $8tr in costs for cybercrime forecasted by cybersecurity benchmarks. If we measure that as a country, then cybercrime would be the third largest economy after the US and China.

Cybersecurity damage is forecast to grow at 15% per annum over the next three years. Obviously areas of critical infrastructure face very high risk, as well as banks, telecommunications, chemicals, energy and transport.

In the context of increasing cyber-risk, we hold Zscaler. We like the business model, as it has a recurring revenue stream and has done a great job in gaining market share from incumbent players like Cisco (NASDAQ: CSCO) during the COVID period.

When everyone was working from home, corporates were finding that their old security architecture was inadequate in their defences which provided a good opportunity for Zscaler with their zero-trust architecture to gain share. They continue to win business in key industries, essentially plugging gaps in security, in the cloud. This is crucial when you have employees accessing company networks on different devices and in different locations.

Zscaler basically provides a safe perimeter to keep bad actors out of the system and is our main exposure to cybersecurity. We do follow other players in the industry to get a feel for competitive positioning and industry development. We look at names like Palo Alto Network (NYSE: PANW), Fortinet (NYSE: FTNT) and SentinelOne (NASDAQ: S).

Which three stocks do you think hold the biggest potential for the future?

-

Intuitive Surgical (NYSE: ISRG)

With robotic surgery still in early innings of adoption, this company is set to benefit. It's one of those stocks where you can sleep at night. They're many generations ahead of competitors for its operating platform. It's one of those companies with good steady growth and you can track how robotic surgery penetration is going relative to other surgery types. -

MercadoLibre (NASDAQ: MELI)

MercadoLibre is an ecommerce platform in Latin America. Penetration of ecommerce in Latin America is still low relative to the rest of the world. We think there are good secular growth drivers underpinning the growth of this company over time. It is doing all the right things to build a strong ecosystem around its offering, whether that's in payments, logistics, fulfilment or even marketing capabilities. The profitability of the core business is very strong. The take rates you see in Latin America are very profitable compared to other geographies. We believe the platform will be ubiquitous with ecommerce in Latin America. -

Synopsys (NASDAQ: SNPS)

We can't fully know the shape that AI technology will take in terms of development or monetisation, but what is clear to us is that we're going to need more computing power. We're going to need more complex chips to enable new applications and functionality. Synopsys provides software, Electronic Design Automation (EDA) to chip companies, so it will sit at the heart of this development. It's tied to R&D so it's less cyclical than companies which are tied to deep CAPEX spend over time.

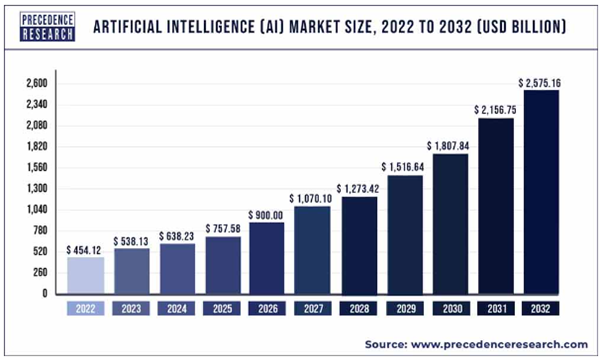

The chart: The growth of the AI market to 2023

The growing AI and automation space has propelled recovery in the tech space this year. What are some of the opportunities and risks you see in this trend?

The rally to date has been a function of the momentum we've seen in AI. Nvidia (NYSE: NVDA) reported strong results and continued uptake of their GPUs and data centre revenues.

There has been concern in the market that the rally has been fairly narrow and limited to mega-cap stocks like Nvidia, Meta (NYSE: META), Tesla (NASDAQ: TSLA) and Amazon (NYSE: AMZN). We're still in the early innings of AI and the opportunity brought about by the development of the large language model and the applications of this going forward. It's fair to say that the financial impact so far has been somewhat limited, with demand for GPU a key driver.

If you break AI down into two broad areas, there are the enablers and the adopters.

The enablers being the companies which create or enable the technology, whether it's through infrastructure, through chips or data storage and software.

The adopters use the technology to drive efficiency through their businesses, be it on the revenue line or cost line. There are a number of opportunities in the medium term.

We're running a highly concentrated portfolio and tend to like those stories which benefit structurally from AI.

We see opportunity in companies like Synopsys (NYSE: SNPS) which provide software to chip companies in the design of more complex chips. As AI gains more traction, we're going to need more complex chips and computing power to enable its broader applications.

Data is also important for training these large language models. We like MongoDB (NASDAQ: MDB) which provides software in database management. The more we can effectively compile different pieces of information and data, the more efficiently we can build and develop these applications.

The risk, as with all new forms of technology and adoption, is we're still in the early stages of AI. The adoption and monetisation could be slower than what we expect. To mitigate this risk, we think it's best to position ourselves in companies with a clear competitive positioning, are self-funding and generate strong cashflow, with development potential.

Fun question - what would your dream investor in the fund be?

Someone who has a long-term time horizon, understands that there are cycles in the market but knows that active management is the key to sustaining good returns over the long term. They would also know you're getting a portfolio of future winners, not the index, in the Franklin Global Growth Fund.

For more information on the Franklin Global Growth Fund, select below:

.png)

4 topics

15 stocks mentioned

1 fund mentioned

1 contributor mentioned