The three reasons why the bear market for equities will continue

In a normal market environment, Longview Economics is traditionally the glass half-full research house in the room. As late as June 2022, founder Chris Watling told me that he was cognisant of the chance of a global recession but that it wasn’t a certainty. Then, the May US inflation print hit the wires and it far outpaced economist expectations.

Watling then told me that his base case had shifted seemingly overnight from “mid-cycle slowdown” to inevitable recession.

Inflation has peaked stateside, but is still coming down slowly. Corporate earnings are coming to the fore but the impact of all these macro headwinds is still to be decided. All this and a plurality of leading indicators suggest that a recessionary trend is intact.

But what’s priced into the markets? Not a recession, says Longview senior market strategist Harry Colvin.

In this wire, I’ll take you through Longview’s updated base case which includes a new (and much lower) year-end target for the S&P 500. I’ll also show you what has changed in the team’s asset allocation recommendation.

When will this recession come?

If it’s not already underway, Colvin argues that a US-led recession will arrive in the first half of 2023. That is far earlier than the current consensus of Q4, and certainly what equity markets are not prepared for in their view.

The crux of this base case is in the timing, which in turn is supported by the economic data.

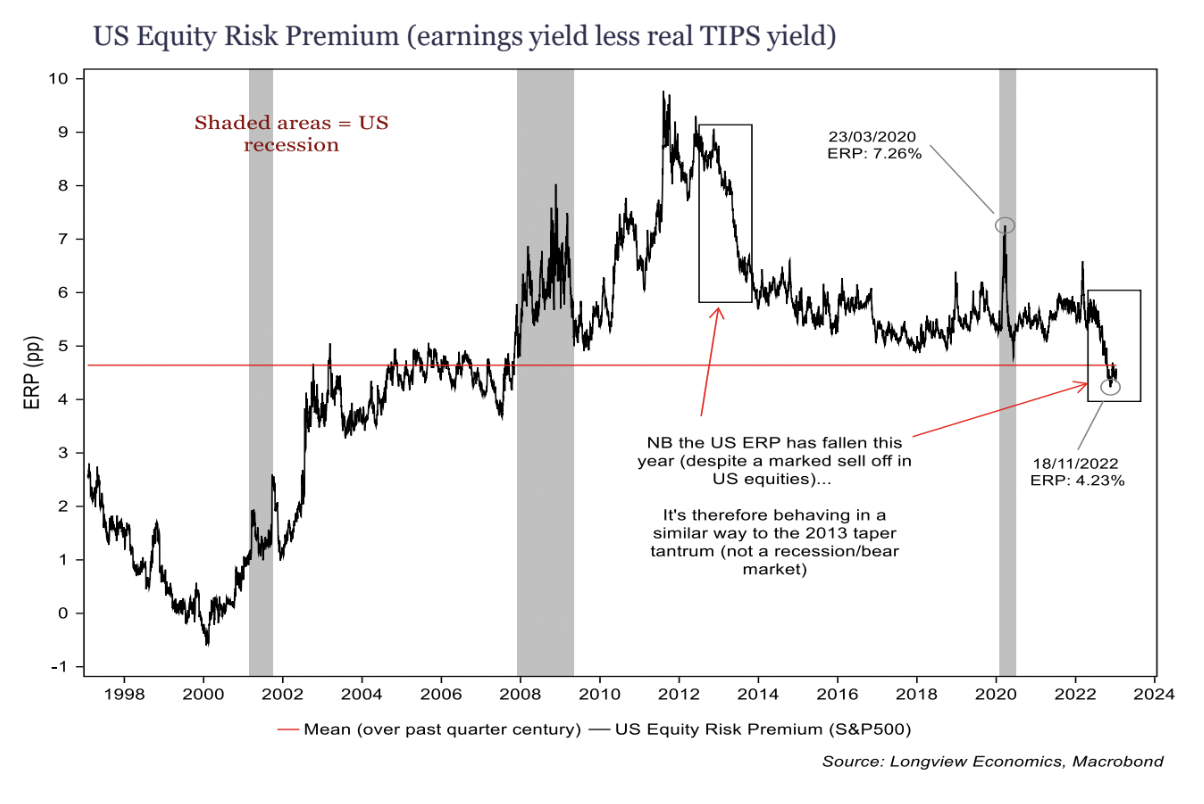

“Year one [2022] is an initial unwinding of the excessive bubble like valuations in parts of the equity market,” Colvin says.

The best way to see how that unwind worked out, apart from the equity market’s obvious falls, is in the bond market where US Treasury yields (nominal and inflation-protected) both surged to above 4%.

That’s what the professionals call a “taper tantrum”, sparked by the data and spurred on by central bank rate hikes which caused investors to sell almost everything. Those rate hikes are what the Longview team calls the “policy normalisation” phase - an era that ended when equity risk premia fell back to long-term averages.

So what will happen this year?

“Year two [2023] is the pricing of recession and rotation amongst key areas/sectors of the equity market,” Colvin argues.”We’re into chapter two of this bear market and there is no soft landing coming.”

Three reasons why the bear market will go on

In addition to the existing data, Colvin and his team have three historical reasons for why they think this bear market in equities will deepen.

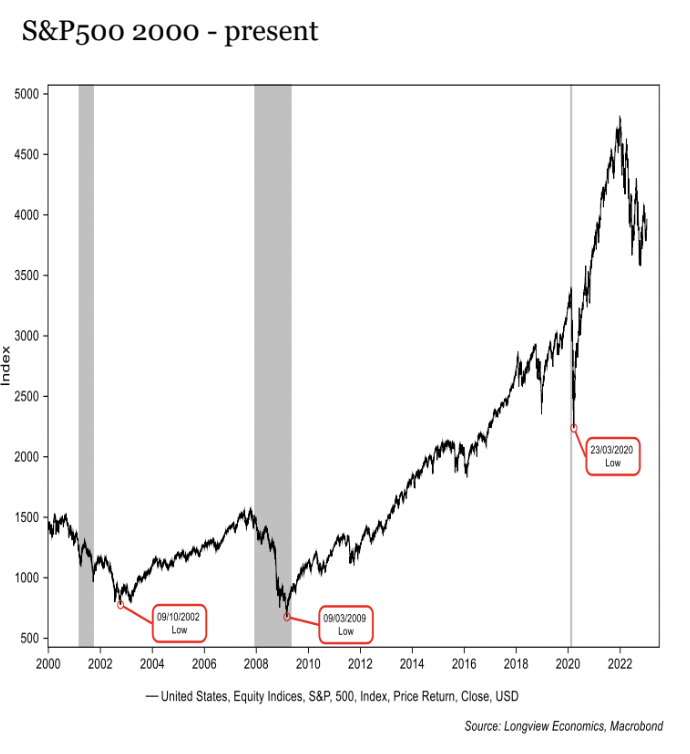

US equities have (almost never) bottomed before a recession.

Since 1929, the S&P 500 has officially been through 15 recessions. Of those 15, 14 of them saw an equity market which met its trough either during the official time period of a recession or after the recession ended. Recessions are declared by a separate economic body in the United States and don’t always follow the traditional “two consecutive quarters of negative economic growth” rule.

The only exception to this rule was 1945, where the equity market troughed at the end of World War II. How different will the 2020s be? Well, see for yourself.

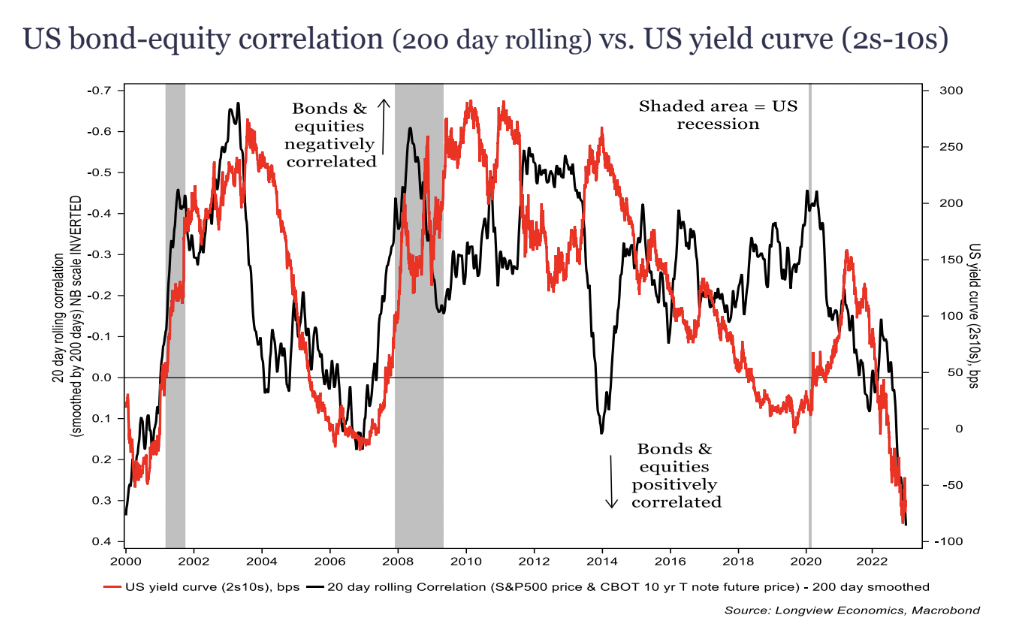

Curve steepening happens before recessions start

The 2s/10s curve in the United States is one of the most reliable recession predictors around. Every time the returns have turned negative, a recession has usually turned up within the following two years. In the current case, the 2s/10s curve most recently inverted mid-last year and it’s never even come close to positive since.

From an asset allocation perspective, this makes buying risk assets like equities even more difficult to justify. When you put the bond-equity correlation and line it up with the 2s/10s curve, an eerie trend occurs as the following chart demonstrates.

Earnings bottom with equities

Longview’s own base case suggests equities will get cheaper as the threat of a recession finally sinks in. But that’s not the only asset class that may find itself in a valuation de-rate, with Colvin saying neither crude oil nor credit markets are priced for a deep downturn.

“Typically, nominal yields move lower in a bear market anyway but we need equity markets to price in weaker earnings,” Colvin says.

This US earnings season, the Factset composite estimate suggests earnings will decline by 3.9% across the board on a year-on-year basis. If this comes to fruition, it will be the first year-on-year decline since Q3 2020. More importantly, Colvin says it will mark the first step towards a long run of earnings downgrades.

This in large part explains why they believe the S&P 500 could hit as low as 2,700 points - 30% less than Thursday 19th January’s closing levels. If earnings downgrades are hit hard (their base case is a 20% peak-to-trough decline), then there will be more pain to come in that pain trade.

“Housing is the business cycle”

And if you wanted one other indicator to prove how close we might be to a recession, take a look at home building activity both locally and in the US. One of the key caveats to a bullish investor’s case is that a “soft landing” occurs - that is, interest rates are hiked to dampen inflation but can be done so without raising unemployment dramatically.

If this next chart is anything to go by, a huge wave of job cuts and hiring freezes may be about to hit.

Here in Australia, ANZ tracks two sets of data in the housing market including housing lending and building approvals. The former data set looks at consumers’ ability to take out mortgages while the latter looks at companies’ financial ability to construct new homes. In both cases, the data is on a downtrend. Housing lending is down 26% since its May 2022 peak (when the Reserve Bank first hiked interest rates) while building approvals fell sharply at the pointy end of last year.

Colvin also noted his concerns about the housing market in Australia and how sharp price falls could offset the gains made from China’s reopening.

Asset allocation changes

Given all we’ve said, you shouldn’t be the least bit surprised about what’s coming in this next table.

| Risk-On Assets | Risk-Off Assets | ||

| Equities (EM and DM) | 18% | Developed market fixed income | 40% |

| Commodities | 5% | Cash | 12% |

| Corporate debt (High yield) | 1% | Corporate debt (High grade) | 13% |

| Emerging market fixed income | 5% | ||

| Total | 35% | Total | 65% |

The biggest change since I last looked at this table is the bond buying - specifically, that 40% of the Longview model portfolio is now in US Treasuries. Bonds are, after all, the traditional safe haven of choice during a recession. But it’s also a buy for several other reasons:

Bond buying works best when you know inflation has peaked.

If sentiment is poor, be a contrarian

If Jeremy Grantham’s bubble bursts, the equity markets will struggle.

And… if the Federal Reserve has/or will break something, bonds are the place to hide.

There are other more nuanced notes in this asset allocation strategy as well.

“Commodities will likely roll over as we go into a recession, and are only held up for now by China's reopening. The oil price may head significantly lower - towards $50/barrel possibly,” Colvin says. He also added that gold may be under threat in the short-term because a surge in the US Dollar may be coming.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

I'll be in charge of asking the questions to Australia's best strategists, economists, and fixed income fund managers. If you have questions of your own, flick us an email: content@livewiremarkets.com

4 topics