The top 10 income shares, funds and ETFs in 2022 as voted by Livewire readers

In our latest Income Series survey, we invited you to talk all things income with us.

Returns, asset classes, concerns, and what investments you are using.

Our smart young interns have spent the past week meticulously tallying up the 834 submissions from Livewire readers who nominated their go to 'income' investments.

The results are in, and a few things are clear.

- Three fund managers dominated the income space (in a good way).

- Old adages about stocks to invest in for income are changing.

- Lots of investors are keeping it simple with low-cost ETFs

And yes, dividends of the fully-franked variety are still high on the list of go-tos.

In this wire, we reveal the top 10 shares, funds and ETFs that our savvy readers are turning to.

But before we dive in... a few interesting stats!

Income investments by the numbers

- $91.18bn - the average market capitalisation of the top 10 stocks.

- 19.636x - the average PE of the top 10 stocks.

- 7.19% - the average yield of the top 10 stocks.

- 82% - the portion of the top 10 fund votes directed to three fund managers.

- 60% - the proportion of the top 10 funds votes that went to LICs.

- 57% - the proportion of votes for the top 10 ETFs that went to Vanguard.

- 86% - the proportion of votes in the top 10 directed to Australian shares ETFs.

Important disclaimer: The lists presented below are based on responses from Livewire readers to our 2022 Income Series survey. These lists are not and should not be construed as recommendations or advice.

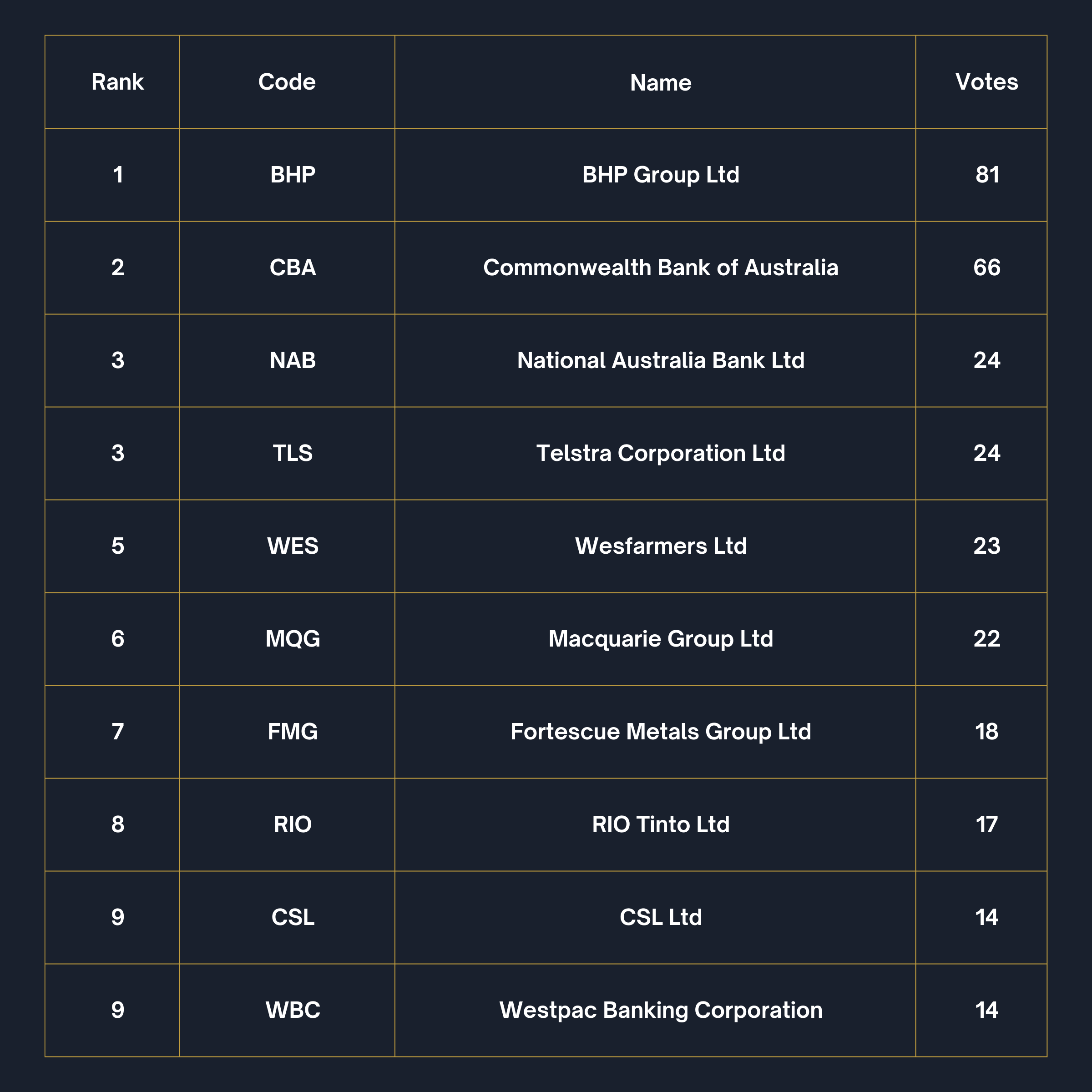

The top 10 income stocks in 2022

.png)

Earlier this year, Plato’s Dr Don Hamson and Dr Peter Gardner said that two-thirds of all dividend stocks paid from the ASX would come from just 7 stocks. All of these stocks were in Livewire readers’ top picks, bar one ANZ (ASX: ANZ).

The inclusion of three of the four big banks was to be largely expected. The banks have consistently offered franked dividends for their entire history – in fact, Westpac (ASX: WBC) is one of the longest dividend paying stocks in the world. It was surprising to see that ANZ didn’t make the list as it delivered dividend yield of 6.11% for the year according to Market Index. Macquarie (ASX: MQG) – fast becoming the fifth big bank – was an interesting inclusion but has offered solid returns over the past few years and even increased its dividend payment in the last reporting season.

Growth stocks made up 50% of the top 10, in a break with traditional wisdom for income investing. Of particular note is the inclusion of 3 mining stocks – a sector typically considered high risk and one to avoid for income due to volatility in commodity prices. In fact, over a quarter of the votes for the top 10 stocks were directed to BHP (ASX: BHP).

Looking at the returns paints a clearer picture on the why our readers have chosen these stocks. According to Market Index, BHP’s dividend yield over the past year was 12.50%, Rio Tinto’s (ASX: RIO) was 15.32% and Fortescue (ASX: FMG) offered 16.89%.

Wesfarmers (ASX: WES) and Telstra (ASX: TLS) both fall under the realm of traditional income picks, but also have shown great prospects for coming years of late. Wesfarmers holds a number of resilient brands – with Kmart and Bunnings strong performers across a range of markets.

"The brands they own, particularly Bunnings and Kmart, provide a lot of value to the customer and in an inflationary environment we expect those brands to outperform. They are real destination, highly resilient type businesses." Vinay Ranjan from Airlie Funds Management

Telstra has long been held as a dividend pick but has really turned its fortunes in recent times. It lifted its dividend 3.1% in the latest reporting season and is benefiting from our dependence on mobiles. In fact, Geoff Wilson AO recently called it the new “recession-proof”.

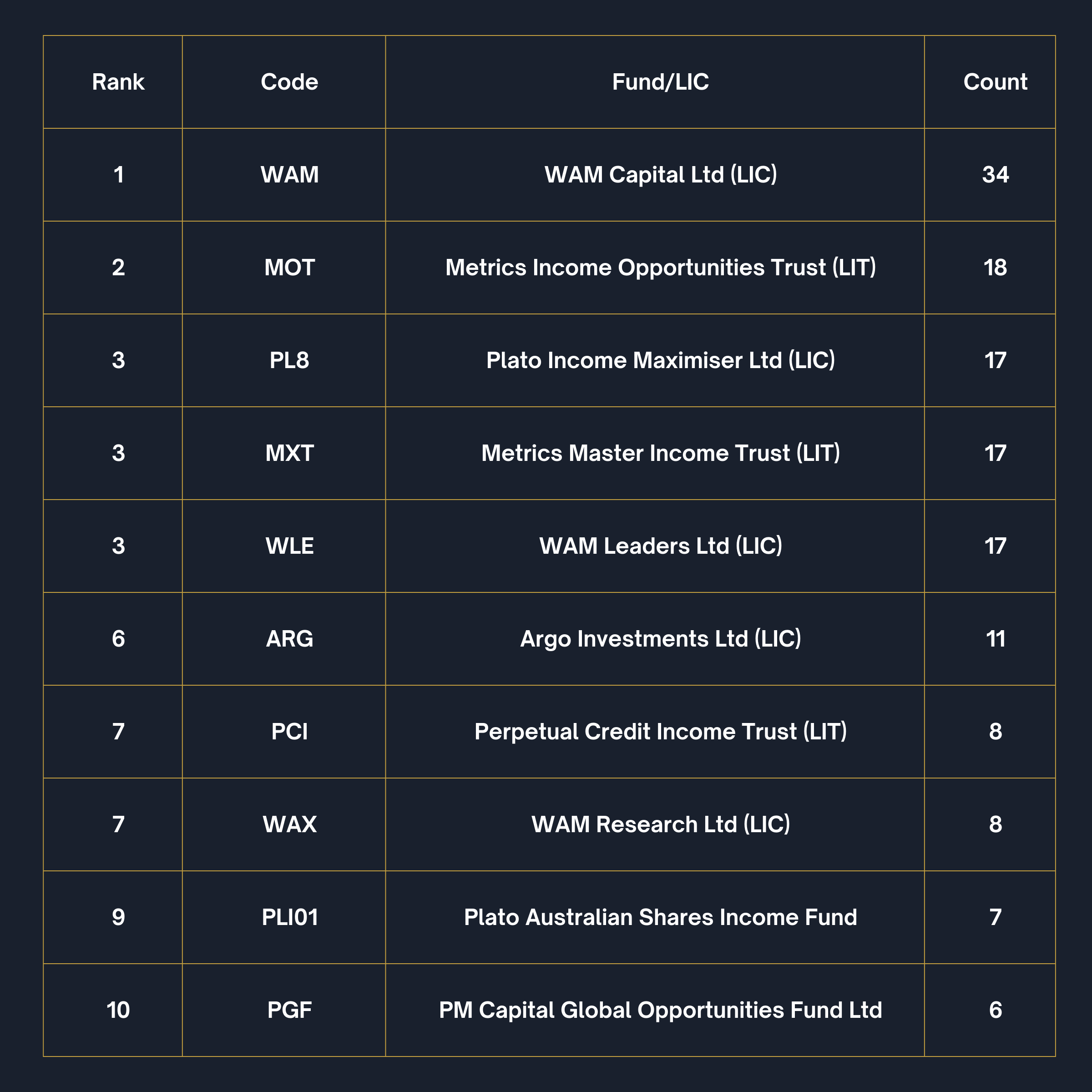

The top 10 income funds in 2022

.png)

Of the top 10, 82% of votes were allocated across three fund managers: Wilson Asset Management, Metrics Credit Partners and Plato Investment Management. It’s fair to say these managers must be doing something right!

The top choice which took out 24% of the top 10 votes was WAM Capital Ltd (ASX: WAM). It offered a fully franked dividend yield of 8.5% for the year to 31 August 2022. WAM Leaders (ASX: WLE) and WAM Research (ASX: WAX) also featured in the top 10 list.

41% of votes in the top 10 went to listed investment companies run by Wilson Asset Management

The second most votes went to the Metrics Income Opportunities Trust (ASX: MOT), one of two listed investment trusts from Metrics Credit Partners. MOT offered a yield of 6.78% over the past 12 months and provides some diversification away from Australian equities.

The list was dominated by Listed Investment Companies (LICs) which represented 60% of votes in the top 10. Listed Investment Trusts (LITs) were also popular. Some of the popularity of these vehicles came from the ability to offer regular distributions to investors. You can find out more information on investing in LICs in this guide from Affluence Funds Management’s Daryl Wilson.

Two major themes appeared in the asset mix.

- Dividend income (particularly franked income)

- Diversified outside of listed equities via fixed income or private credit markets.

Around 30% of the top 10 funds were focused on fixed income and credit markets (including private credit). These were the Metrics Income Opportunities Trust ( ASX: MOT), the Metrics Master Income Trust (ASX: MXT) and the Perpetual Credit Income Trust ( ASX: PCI).

Private markets are a growing area and are tipped to reach a value of $30 trillion by 2030. Private debt in particular could be a beneficiary of the rising rates environment, as it typically uses floating rates rather than fixed. As investors increasingly look for opportunities for growth and income in a challenging environment, it will be interesting to see how the top 10 changes in coming years.

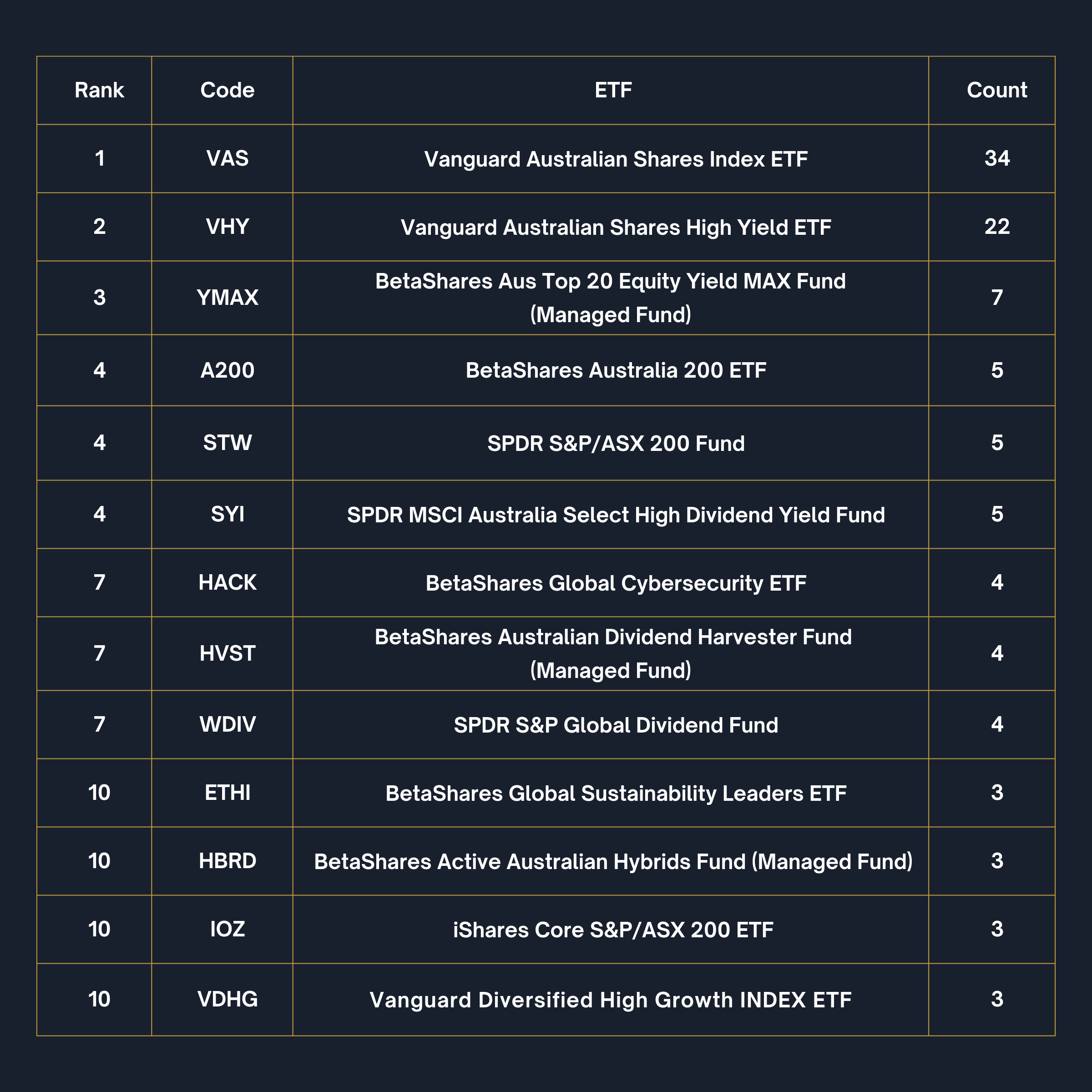

The top 10 income ETFs in 2022

.png)

There’s something to be said for general Australian equity exposure, with four of the top 10 ETFs focused on vanilla index exposure to the ASX. Of this, a third of the top 10 votes were directed to the Vanguard Australian Shares Index ETF (ASX: VAS). It’s a low-cost option with management fees of 10bps and has offered 1 year distribution yield of 6.43% (as at 31 August 2022). In fact, this is the same distribution offered by the next top contender – the more tailored (and more expensive at 25bps) option of the Vanguard Australian Shares High Yield ETF (ASX: VHY).

Vanguard products took out 57% of the votes in the top 10, with the next top issuer being BetaShares at around 25% of the votes.

Australian shares were a primary focus of the top 10, representing approximately 86% of the votes. There was only one diversified option – the Vanguard Diversified High Growth Index ETF (ASX: VDHG) – in the line up. The remainder were tailored global indices.

One thing to note was the inclusion of the BetaShares Global Sustainability Leaders ETF (ASX: ETHI). ESG investing has become increasingly prominent in recent years. A recent survey from Investment Trends found that 46% of investors were consciously considering investing this year. It follows that Livewire readers are also conscious of, and actively using such options in their investments generally – let alone their income generating selections.

The only surprise in the list which largely focused on either high yield or broad Australian access, was the inclusion of one thematic ETF, the BetaShares Global Cybersecurity ETF (ASX: HACK). The ETF primarily invests in the US, with the bulk of sector allocation towards systems software and communications equipment. It has management fees of 57bps and has generated a 1-year distribution yield of 8% (as at 31 August 2022).

A final word

The top 10 stocks, funds and ETFs are typically quality investments with consistent track records. Many of the funds have performed over a number of market cycles and deserving of their selection by Livewire readers. That said, changing times may result in tweaks to how investors approach income. For example, fixed income has been a challenged sector in the past decade, but the coming market would typically see it benefit. Will we see more fixed income funds appear in next year’s survey? Or are you veering towards private markets which can access floating rates?

What did we miss? Let us know in the comments below if you have a favourite income investment that didn't make the top 10.

4 topics

32 stocks mentioned

8 funds mentioned

6 contributors mentioned