The top questions on fund managers' minds - as described by a former fundie

In a former life before becoming Livewire's managing editor, I was an equities analyst and fund manager. Subsequently, I know what it is like to sit in the chair and have the market heaving around you, as you try to navigate your portfolio through the storm.

To lay it all out, I managed two portfolios – growth and income. They were long only, Australian equities portfolios. Fairly vanilla stuff. Certainly not as ingenious or intelligent as some strategies. But the task was no less onerous - beat the ASX 300 Accumulation index by 2% per annum over a rolling five-year period for the growth portfolio, and beat the ASX 200 Industrials Total Return index by 2% per annum over a rolling seven-year period.

For further context, I was involved in a complete ground-up rebuild of the funds – from investment beliefs to the investment process, building factor models, stock screening, qualitative research, portfolio construction, risk management, and governance. I was helped on this journey by my good friend Isaac Poole from Oreana Portfolio Advisory Service, who was a consultant for the fund. (Isaac is now a Livewire contributor).

At the peak, I was responsible for $100 million of retail client money. Small fry when compared to the amounts that some of the fundies who contribute to this platform manage, but not small fry to our investors. Or me. It was also enough to keep me up at night when markets went sideways.

Why do I tell you all this? Because I can offer you some insights into what fund managers might be thinking right now – or at least the questions they might be asking, how they will likely be leaning on their process, and how they will be making their decisions.

And while I don’t know every fund manager’s process, there are some similarities across all investment processes that are worth sharing. The other key benefit is that I am not trying to sell you anything, so I have permission to speak freely.

Where to begin?

The obvious question right now is where to begin unpacking markets, because they are heaving.

Equities were recently back at their June lows. The US dollar is a problem, causing ripple effects in currency markets and weighing on earnings and valuations. Yields are doing things they haven’t done since the early ’90s, inflation is doing things it hasn’t done since the ’70s, Europe is a basket case, China is pumping stimulus, we’re (still) in a pandemic, there is an energy crisis, the post-GFC monetary policy experiment that the world undertook is being unwound by central banks, property prices are tanking, and traditional safe-haven relationships have broken down.

Did I miss anything? Yeah, probably a few things. There is a bit on. So how do fundies make sense of it all?

Go back to your process. Control what you can control.

The process we built would dial it all back to three major data points, to encapsulate everything that is going on – inflation, interest rates, and GDP. These are the major drivers of markets. How fast are prices moving, what is the price of money, and how much growth is there?

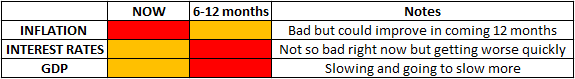

The purpose is to have a handle on where these factors are now, and where they will likely be in 6-12 months. For those playing at home, this is not particularly difficult information to obtain. The RBA provides inflation and GDP forecasts, whilst the market will tell you where it thinks interest rates are headed via bond yields. Once gleaned, rate the factors on a traffic light system. It might look a little something like this;

Obviously, there is not a lot a not of green to be seen. And like or not, these are quite possibly some of the worst macro conditions an equity manager could hope for – don’t worry, all is not lost. There are other levers that can be pulled to protect capital and generate alpha, via sector weightings, stock selection, and risk management.

It does raise an interesting point, however. There is no strategy that will outperform in all market conditions. And anyone who tries to convince you otherwise either has delusions of grandeur or is using some form of sorcery. The best fund managers lean into telling investors when their strategy could underperform rather than hiding from it. It's full disclosure so that the client knows exactly what they are signing up for - but I digress.

Where do I want to play?

The next stage of the process is connecting the macro view with the sector analysis. Slowing GDP growth is a killer for most sectors but in varying degrees. Utilities with stable cash flows will hold up better than growth-sensitive sectors like tech and consumer discretionary. Higher rates help financials to an extent but punish high-growth names with low/no earnings and nosebleed P/Es. And inflation hurts just about every company that doesn’t have pricing power via margin compression – it costs more to produce something or provide a service and you can’t pass all of those higher costs on. I would humbly submit, that for those funds that are index aware (measure themselves against a benchmark), this would be a critical question right now. Getting your sector weightings right over the next 6-12 months will be crucial.

How do I identify my opportunities?

This question can be answered a few different ways but building a stock screening process, that filters companies for the fundamental qualities that you desire, is the most common. And that is because it's the most efficient way to take the 500 companies that might be in your investable universe down to the 40-60 you might have either in your portfolio or on the reserve list.

Upon those 40-60 stocks, qualitative research and a deeper dive are conducted. Right now, this would also be a critical part of the process. Whilst they don't change dramatically, factor models are living, breathing things. They can be adjusted to the prevailing market conditions – i.e. stricter parameters when conditions are challenging, and less restrictive when the market is flying.

How do I manage my risk?

Every fund manager would have a risk budget. If index aware, the question is 'how much am I going to stray from the benchmark to generate the returns that my investors are paying me for?' I have to earn my fees. The key is to have a risk budget big enough to allow you to generate an excess return, but tight enough so that you can't blow yourself up completely. It's a balancing act, no different than any other risk/reward scenario.

It is a relative game when you are benchmark aware. The good thing is that you have something to compare yourself to, a north star to help guide your decision-making. The bad thing is if you are lagging your benchmark. Rightly or wrongly, you will have some explaining to do – and this will come back to how forthright you were at the start about when your strategy will and won’t perform.

The other thing to worry about is benchmark hugging. No fundie wants to be accused of it but there are periods when you have to do it - in order to minimise the damage through a rough period of heightened uncertainty. You can't do it all the time though, otherwise your investor might as well just buy the index instead via a low-cost ETF. To generate better-than-average returns, you have to take greater-than-average risk. There is no escaping it. And again, you have to earn your fees.

But being index unaware is also a double-edged sword. No benchmark to worry about but nothing to compare yourself to if you are winning. And if you are losing, like it or not, investors will still anchor your performance to a benchmark and play the "I could have got this return" game.

***

There you have it, some insight into the big questions fund managers are ALWAYS asking themselves as they grapple with markets, and how they lean on their process to protect capital and generate alpha.

In these volatile times, I and the Livewire team will be asking fund managers these questions over the coming weeks and we look forward to bringing you some powerful insights. You will see a series from Ally Selby on her favourite subject - Australian equities. David Thornton is in charge of global markets, and Hans Lee is taking the global bond market to task. Sara Allen is in charge of the two E's - ETFs and ESG. Glenn Freeman gets the job of putting all this research and analysis together - looking at the lessons for asset allocation and portfolio strategy. And finally, I will be asking fundies about their cash allocations and positioning.

We hope you'll stay with us for the ride.

1 topic

6 contributors mentioned