The video game market is larger than you think, and FAANNG is the best way to play it

Global X ETFs

With the announcement that Netflix is moving into video games, the crucial role of the US technology giants known as the FAANNGs – Facebook, Apple, Amazon, Netflix, Nvidia, Google – in supporting gaming is coming under the spotlight.

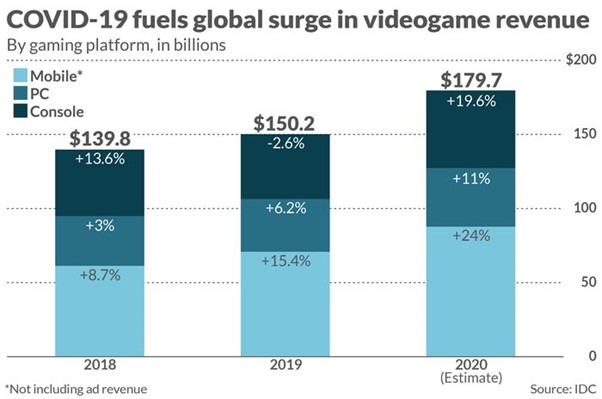

Investors are often surprised to learn how large the video games industry is. According to data from research house IDC, the video games industry now generates more revenue than movies and North American sports combined. What is more: the video games industry is growing faster than film and sport, with help from both covid-19 and the uptake of smartphones.

The FAANNGs are some of the most important companies in the video games industry, forming a surprisingly large part of their businesses. Below we go through each.

Facebook has recently allowed gamers to stream their games on Facebook Live. According to the company, each month more than 700 million people play, watch or engage in gaming groups on Facebook.

Amazon

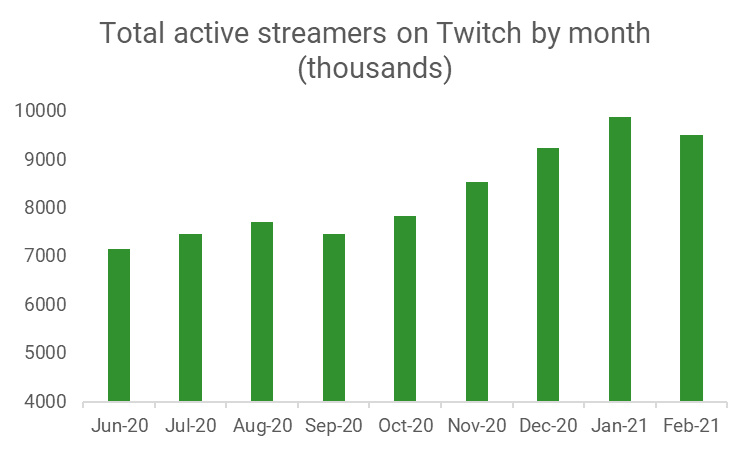

Twitch, from Amazon, is the main video games streaming platform, which allows professional video game players (“esports”) to monetise their audiences. Meanwhile, Amazon’s online shop sells more video games than almost anything else.

Source: Business of Apps, March 2021

Apple

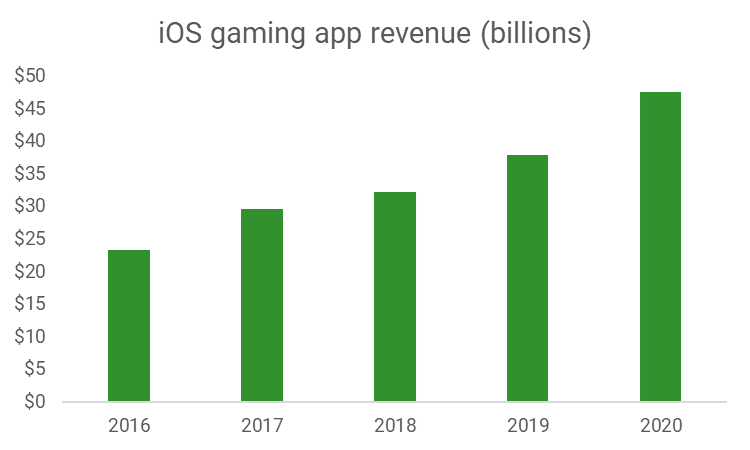

Apple makes 70% of its app store revenue from video games. As more gaming moves onto smartphones Apple is well-positioned to capture a larger market share.

Source: Business of Apps, July 2021

Nvidia

Nvidia’s graphics cards are the engine behind gaming consoles and PCs. The company started out in the 1990s building graphics cards for gamers. It has become a larger and more diversified business since, but video games remain the core of its business.

Netflix

Netflix has made producing video game-related content a core part of its strategy. To this end, it has created TV series based on video games such as The Witcher, Dota and Castlevania. Mass Effect is reportedly on the way. The company recently announced it was adding video games to its platform.

Google, like Apple, makes two-thirds of its Android app store revenue from video games. In addition to smartphones, Google also runs YouTube, which holds a vast repository of video gaming guides and eSports highlights. It also runs Stadia, a large video games platform and potential competitor to Steam.

More diversified than game developers

It is sometimes suggested that the best way to invest in video games is to buy video games developers, or funds that focus on them. The big-name developers include Nintendo, (Zelda, Mario, Smash Bros), Sony (God of War, Spider-Man, Unchartered), Activision Blizzard (Overwatch, World of Warcraft, Call of Duty), Take Two Entertainment (Grand Theft Auto, Red Dead Redemption) and Electronic Arts (The Sims, FIFA, Star Wars).

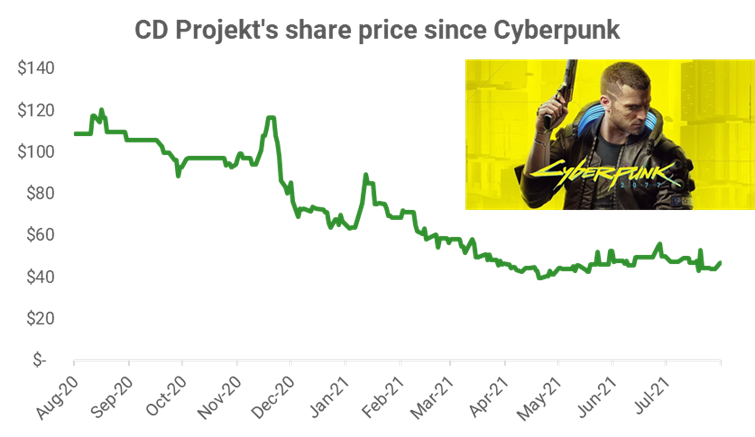

Source: Bloomberg, as of 16 August 2021

There is certainly some logic for buying games developers as making games come with high-profit margins.

Successful titles can be easily franchised. Nintendo has been remaking Mario Kart and Zelda for three decades. Popular games also open other revenue lines which can be built for low or no cost. Nintendo famously did this with Pokemon cards. While Valve has been doing this with gaming ‘skins’, some of which on Counter-Strike sell for $50,000.

However, investing in video game developers comes with the risks that the games go wrong. While Nintendo, Sony, etc. focus group test their games prior to launch, dud titles are still released. The most recent example of this is Cyberpunk, from the Polish game studio CD Projekt. For whatever reason, CD Projekt released the game before it was finished, infuriating gamers who bought it. The move caused CD Projekt’s share price to drop 60%.

The alternative to investing in video game developers while still benefiting from the uplift of the industry is through the FAANNG stocks.

This can provide a diversified exposure to different parts of the video game supply chain from graphics cards to store purchases. As they run the major streaming platforms, they are arguably best positioned to monetise the nascent eSports industry.

The FAANNGs can easily be accessed through the ETFS FANG+ ETF, all companies listed above are held in this ETF.

Access a range of opportunities

ETF Securities offer a range of ETFs across asset classes, regions, sectors and themes for your investment portfolio. Click the 'CONTACT' button below to get in touch with us.