There are 20 stocks with yields higher than 10% on the ASX... Here's why this fundie hasn't invested in a single one

In an inflationary, rising rate environment, it's easy to see why many investors would be desperately on the hunt for yield. Currently, there are 20 S&P/ASX 300 stocks boasting arguably enticing yields (trailing, that is) higher than 10%. So that would be a great place to start, right?

Oh, my friend. Not so fast.

According to value investor Steve Johnson, of Forager, there are reasons to question the sustainability of the dividend yield on every single stock.

"The market is pretty efficient," he says.

"So if you see hundred dollar bills lying around on the pavement, there's something wrong in terms of that not being real. And I think that's generally quite true when you go through this list of stocks."

After all, we are currently in a particularly strange investment environment, where "past profitability and past dividends are not necessarily indicative of what a company is going to be able to or will pay in future."

Of course, that doesn't mean you can't build a portfolio right now that can earn a healthy yield. But it's important to be sceptical of the sky-high yields, particularly from some of the market's largest companies, Johnson says.

In this wire, you'll learn about these 20 stocks, how you can distinguish the difference between sustainable yields and dividend traps, as well as why a trailing yield above 10% should be approached with a healthy dose of scepticism.

And just because I know you love a stock pick, I asked Johnson to name the few stocks that he believes can deliver sustainable income to investors well into the future.

So what is a dividend trap?

Johnson defines any business that is incapable of paying its historical dividend in the future as a dividend trap.

"You're looking at a yield that is a fantasy or ephemeral, it's just not going to be there in the future," he says.

"On this list, there are lots of them where that is already obvious. And then there are others where I think the market is asking questions about what the future of profitability looks like."

For those companies, Johnson recommends investors ask themselves these two questions:

- Earnings sustainability: Does the business have the earnings capacity that it had historically? Or does it have the profits to pay dividends out into the future?

- Dividend payout ratio sustainability: Is the proportion of those profits that are being paid out to shareholders sustainable? Are these dividends a one-off or shrinking? And is the company paying out 100% of its profits to shareholders?

After all, you can have a business that is only paying out 40% of its profits, and while those profits could shrink, the business still has the capacity to pay out dividends in the future as it's only paying out a small percentage of those profits, Johnson says.

Why anything above 10% (and even slightly under) is a red flag

The average return of the stock market is around 8% per annum, so if yields are higher than 8% the market is telling you that it doesn't believe these yields will be sustainable (as it's higher than the average market return), Johnson explains.

"Usually, an efficient market would arbitrage that away," he says.

"So it's probably not a bad rule of thumb to say people are really sceptical about how sustainable these dividends are. But I do think that is true even below that level as well."

Even if investors are receiving an 8% fully franked yield, the market could be telling you that the company won't be able to maintain that, he adds.

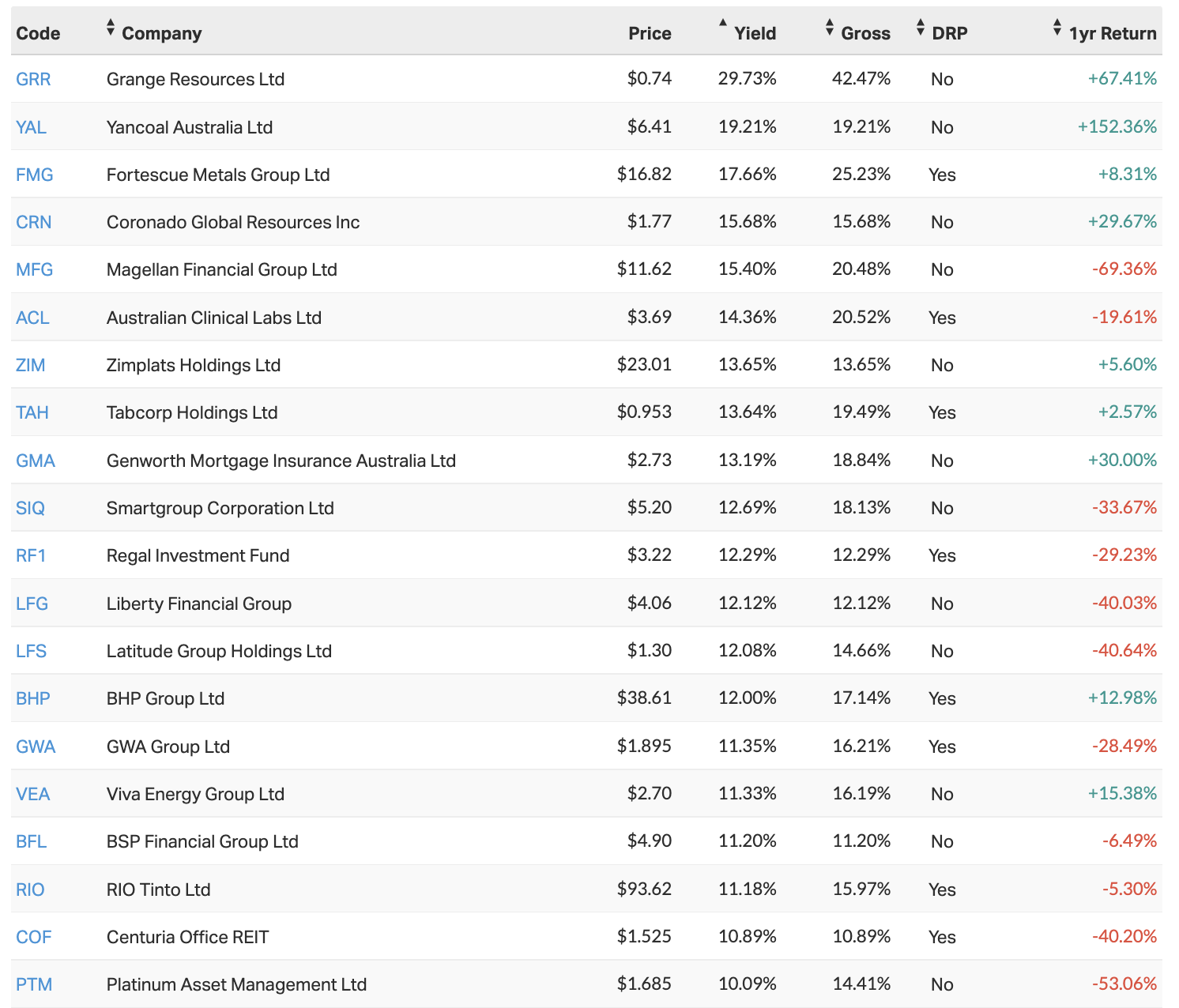

The 20 stocks with yields above 10%

Three stocks that aren't going to be as profitable in FY23

There are three stocks on this list where the business model has already been impeded or where earnings capacity is already dramatically lower than it was a year ago, Johnson says. Thus, investors can be certain that the dividends for these three businesses are not sustainable at current levels. These businesses are:

- Magellan Financial Group (ASX: MFG) - This business has lost a significant amount of FUM and will not be able to generate the same profits it did a year ago.

Australian Clinical Labs (ASX: ACL) - This business was a major beneficiary during COVID-19, and with testing volumes shrinking, it will likely come under pressure in FY23. However, Johnson notes that even if this yield halved, investors could still receive an adequate income from this stock.

Platinum Asset Management (ASX: PTM) - While nowhere near as severe as MFG, this business has also seen its FUM levels drop below last year's average, and may also struggle to maintain its dividend yield over the year ahead.

Iron ore miners are unlikely to continue to pay out these lofty dividends

It's a bit more difficult to assess the longevity of the miners' dividends, Johnson says, as commodity prices remain relatively high today.

The four stocks below are highly leveraged to the iron ore price. With prices substantially lower than they were 12 months ago, as well as headwinds such as an economic slowdown in China, Johnson believes the dividends from these players could come under the knife.

- Grange Resources (ASX: GRR)

- Fortescue Metals Group (ASX: FMG)

- BHP Group (ASX: BHP)

- Rio Tinto (ASX: RIO)

Of these four stocks, GRR is the most exposed to the iron ore price - and is also the higher-cost player on the list, Johnson explains. Thus, it is the most likely to see its profitability take a hit from falling iron ore prices.

"Grange Resources is a good example of a high dividend yield but not reflective of current commodity prices or people's expectations about the future," he says.

Meanwhile, FMG, BHP and RIO are lower-cost operators, and while they will continue to be significantly profitable at today's prices, they are not going to be as profitable as they were last year, Johnson says.

Expect higher dividends from coal companies in FY23

Meanwhile, he points to the coal companies on this list as examples of "actually really low payout ratios."

"If you'd use current spot prices, they are generating almost their whole market cap every year in cash flow. So when you look at that yield, if they wanted to pay it all out, it could be a 50% yield at the current price. So the payout ratio is actually quite low."

These companies include:

Current yields suggest the market assumes coal prices won't stay this high forever, Johnson said. However, dividends are likely to rise for coal miners, and management teams are likely to introduce capital management initiatives like buybacks to return cash to shareholders.

He prefers Whitehaven (ASX: WHC) and New Hope (ASX: NHC) as coal plays (however, he discloses that Forager doesn't own either of these).

"I would expect in the short term that these yields are going to go up and not down," Johnson said.

Proceed with caution on housing-related stocks

With many market commentators predicting a house price crash of up to 30%, housing-related stocks could come under "severe financial distress" if the market does indeed drop dramatically.

However, Johnson doesn't think these falls warrant the current level of investor panic.

"We're going to go back to where we were when interest rates were at this level at least," he says.

"But a business like Genworth Mortgage Insurance (ASX: GMA) has been through that environment before, it has managed and navigated its way through it. It's just highly sensitive to that particular part of the market."

With that in mind, he believes GMA "looks interesting" in terms of the current yield and the business' earnings capacity, which has not yet been dramatically stunted as other players have.

"But it's one that you need to be really careful with, just because it's singularly focused on providing house price insurance and people are very worried about that," he says.

Similarly, the yields for Liberty Financial Group (ASX: LFG) and GWA Group (ASX: GWA) may be sustainable, as the market is currently pricing for a severe recession and downturn in housing.

"If it's not as bad as people think, you'll find these yields will be more sustainable than is currently priced by the market," Johnson says.

Read between the lines with funds

There are two listed funds on this list, including the Regal Investment Fund (ASX: RF1) and the Centuria Office REIT (ASX: COF).

"Investment funds are a really interesting category because the dividend is usually reflective of the fund's mark to market on its profitability," Johnson explains.

"In our own funds we pay our bucket loads in years where we have really good years and then when markets are down or negative, the distribution tends to be very low. So I wouldn't look at those businesses as yield-type investments but as capital growth. It's just that some of your return comes out as dividends every year."

Non-bank lenders "look interesting"

Johnson believes the non-bank lending space currently looks interesting, as many names have been sold off in the face of a possible recession.

"I actually think Latitude Financial (ASX: LFS) is a pretty interesting stock. I just wouldn't buy it for the dividend," he says.

Steve Johnson's 3 sustainable yield stock picks

While it is nowhere near the highest, Johnson believes that Dalrymple Bay Infrastructure (ASX: DBI) is one of the "most sustainable" yielders in the market.

"This is a really predictable, reliable infrastructure asset that is generating a properly regulated return that you're going to get year after year. It's about as low risk as they come," he said.

"And then Aurizon (ASX: AZJ), with its rail assets can produce a similar type of reliable, predictable income."

He also believes that Tabcorp (ASX: TAH) could continue to pay out sustainable yields over the next year.

"Tabcorp has split and investors need to recognise that it doesn't have the lottery business anymore. The old dividend was the combined business, not the current business," Johnson explains.

"That yield that you see is not sustainable, but they have guided to a 7% yield, and there is a sustainable business there left behind that I think is probably at least a 7% return and maybe prospects for a little bit of growth too."

While Johnson and his team do not own them, he argues investors cannot deny the cash flow yields on coal stocks.

"There are a lot of people jumping on the bandwagon now, but coal is very, very interesting," he says.

"From a value perspective, you're going to get 60% or 70% of your investment today back in cash in the next 12 months if prices stay where they are."

That said, people shouldn't see coal stocks as long-term, sustainable dividend payers.

"These are not stocks for someone to go, 'I'm just going to buy this because I think the yield's going to be huge for the next 20 years.' You buy it because you've got a view that the price is going to stay high long enough for you to get today's price back, which would be 18 months or around that," Johnson adds.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

20 stocks mentioned

1 contributor mentioned