There's a multiple re-rate to be had in small caps. Here's a way to take advantage of it

- Name of the fund: Tyndall Australian Small Companies Fund

- Asset Class: ASX-listed small caps

- Inception: March 2023

- Description of strategy: The Australian Small Companies Fund invests in a diversified portfolio of Australian small cap companies that are undervalued with the aim to deliver consistent risk-adjusted returns and strong capital growth

- Investment objective: The Fund aims to outperform the S&P/ASX Small Ordinaries Accumulation Index (Benchmark) over the long term before fees, expenses and taxes

- Link to fund page here

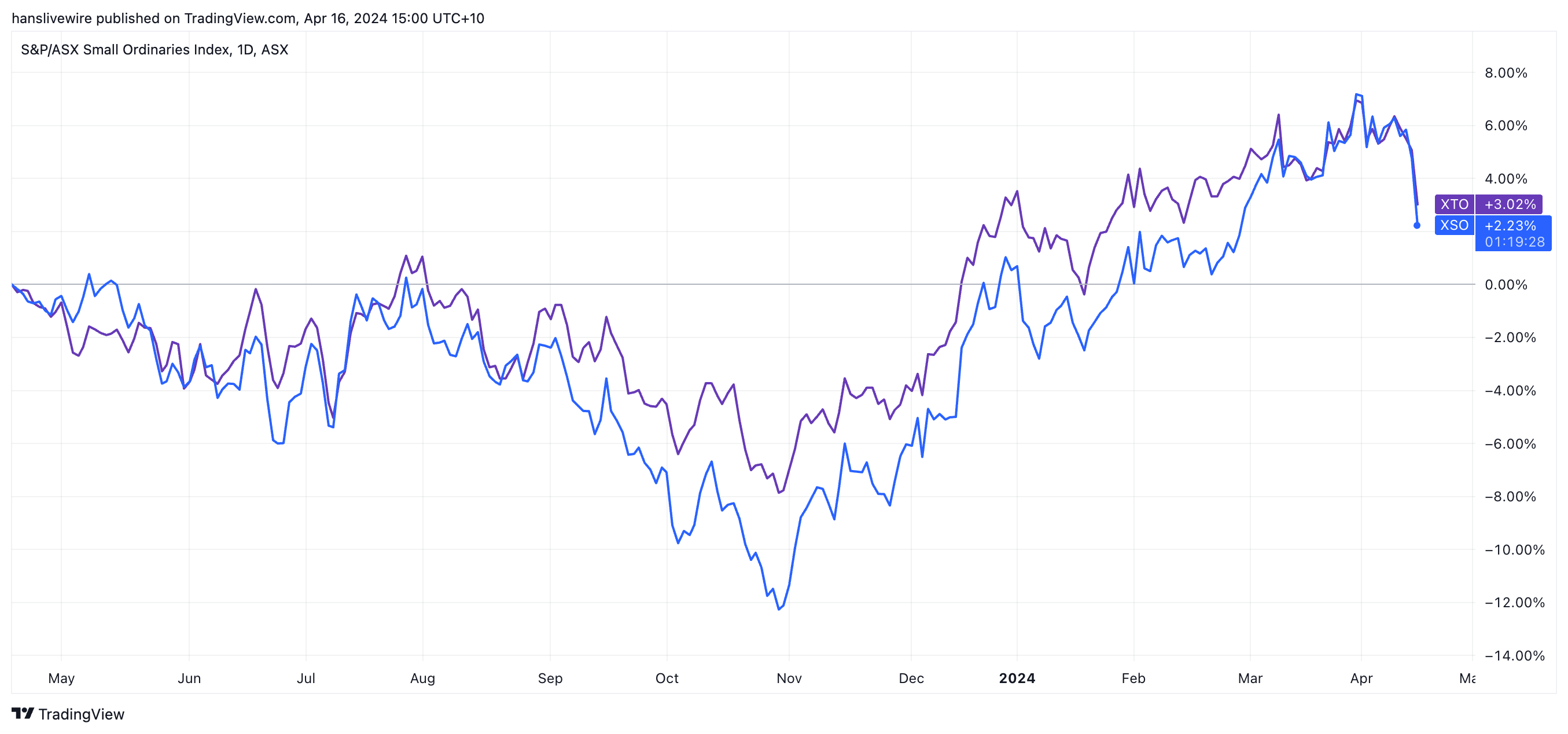

Small caps are a naturally more volatile part of the market - a fact that has been more apparent in the last 12 months than at any other time in recent memory. Rampant inflation followed by the fastest interest rate hiking cycle for decades caused an almighty shock in the Small Ordinaries index. It's safe to say that if you set up a small caps fund 12 months ago, you were setting it up amid a difficult backdrop.

But over the last six months, something remarkable has happened. The gap between small caps and large caps has reduced significantly. A broadening in earnings quality, depressed valuations, and the expectation for a measured rate-cutting cycle have all created an environment ripe for small caps with quality earnings and attributes.

And stock pickers like Tyndall AM's Deputy Head of Australian Equities and Australian Small Companies Fund Co-Portfolio Manager, Tim Johnston, are betting the rally will continue.

"There's a multiple re-rate to be had in the small-cap universe," Johnston told me. "There is a lot of ground to recover, and as a consequence, there is a very strong return outlook for small caps."

Johnston, and his co-portfolio manager James Nguyen, only set up the Australian Small Companies Fund 12 months ago as a product of increased resources and piquing client interest.

And while the index numbers suggest it's been a rollercoaster, the fund has beaten its benchmark thanks to an all-sector approach and a tilt toward quality stocks:

"We're investing across the entire market spectrum and we know a lot of small-cap managers don't do that and specifically, they exclude the resources sector," Johnston said.

"With that capability and the expectation that we are in the early part of a commodity super-cycle, we think it is an important part of the market to take an interest in because the returns there will be quite significant," he added.

As part of Livewire's Undiscovered Funds series for 2024, I sat down with Johnston to discuss the outlook for small caps, how he finds quality, why the fund doesn't need rate cuts to outperform, and two of the fund's most interesting holdings - AUB Group (ASX: AUB) and new addition WA1 Resources (ASX: WA1).

The small cap that identifies long-term winners

The Tyndall Australian Small Companies Fund invests in a diversified portfolio of Australian small cap companies that are undervalued with the aim to deliver consistent risk-adjusted returns and strong capital growth. Find out more below or by visiting their website.

2 stocks mentioned

1 fund mentioned

2 contributors mentioned