These 12 ASX stocks are leading Australia’s AI revolution

This is the question posed by Morgan Stanley research analysts in their latest deep dive into how ASX listed companies are (or are not yet) embracing artificial intelligence.

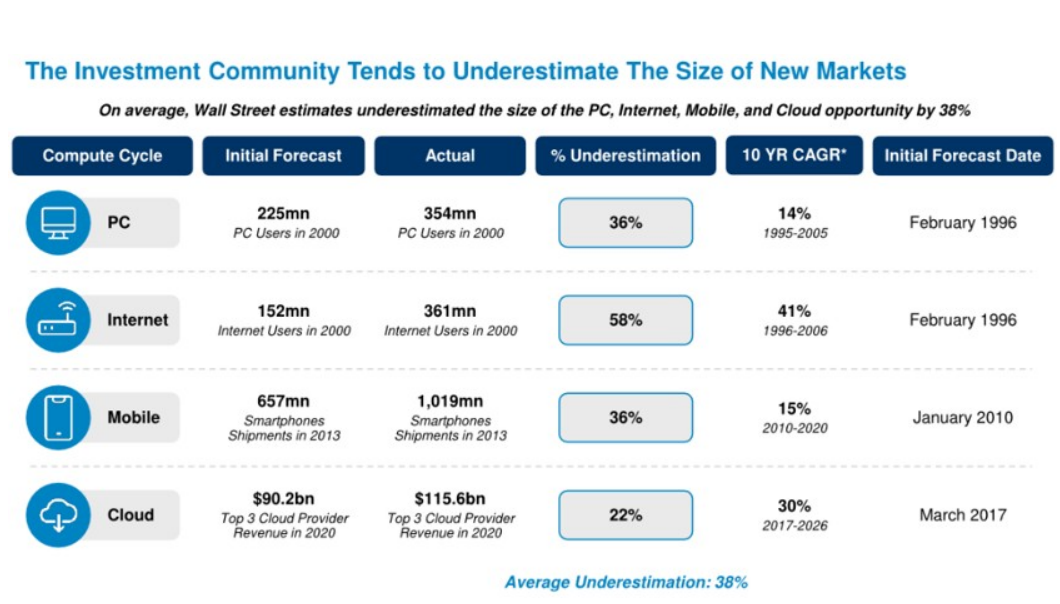

On this point, Morgan Stanley likens the future adoption of AI technologies as akin to the adoption of the internet back in the 1990’s. Just as it was “hard for investors to envisage a super-connected world” back then, the broker believes “the speed of change and relentless penetration of new use cases” for AI could make it just as impactful.

Despite the fact that investors are clearly thinking about these impacts, history suggests that the structural changes from AI are likely not priced in.

How can ASX companies benefit from AI adoption?

1. Enablers

2. Proven Innovators

3. Data owners

More broadly speaking Morgan Stanley believes that data, that is, own, customer, and industry based, “can help companies make better decisions on their own or in their customers' business”.

4. Labour savers

“We expect a step change in labour efficiency across sales, customer success, support and engineering”, says the broker.

With the right data, AI tools can drive automation and help customers on a greater scale. In labour-intensive industries we expect material divergence in performance between effective AI adopters and peers.

What are the barriers to entry for ASX companies looking to adopt AI?

Want to start an internet business? This can be done by a very average person (i.e., you and I) in a few hours for little-to-no cost. Want to start a revolutionary AI company that’s going to change the world? I think you get my drift.

- Access to capital – “Ability to invest in capital intensive compute”

- Ongoing costs - “We see significant variable compute costs associated with generative AI innovations”

- Access to data – Preferably “proprietary data”

- Organisational experience – “Ability to retain and hire specialist engineering talent”

Which ASX companies are most likely to benefit from AI adoption?

Let’s look at Morgan Stanley’s top picks across each of the major AI adoption categories.

ASX Enablers

As for our “limited depth”, the ASX stocks most highly rated as Enablers by Morgan Stanley include: Data#3 (ASX: DTL), Dicker Data (ASX: DDR), Macquarie Technology Group (ASX: MAQ), and Nextdc (ASX: NXT).

DDR & DTL

- The broker notes “generally positive outlooks” for each company, and that each is “supported by resilient (and in some instances accelerated) IT demand from thematics like digital transformation and now AI”.

- They will play a “key role in enabling the adoption of AI in Australia” as suppliers of hardware and software (DDR), and services to assist in implementing AI tools and functionality (DTL).

- These are Morgan Stanley’s key data centre options, with the broker noting they will also play a key role in enabling the adoption of AI in Australia.

- “Demand drivers behind the AI theme are robust, setting the stage for a multiyear structural growth cycle”

- “our bottom-up analysis suggests the Australian market will require up to +1.5GW of incremental power for data centres by 2030…this is our base case and CAGR of +13%”

ASX Proven Innovators

ASX Data Owners

360

- “We see Life360 as having access to huge volumes of user data, from personal details to daily habits, driving patterns and behaviours…We expect the data insights to become more granular over time”

- “Life360 is also already leveraging its data in AI applications”

- “Longer-term we see significant potential in terms of both monetisation and user experience of consumers being served compelling offers.”

- “SDR has visibility into every product that its customers put into the market”

ASX Labour Savers

TPW

- “Most areas in TPW will be materially disrupted by AI including customer care, operations,

- product development, tech, back office”

- “Offline retailers have limited opportunity to leverage AI given a large percentage of their cost base is in store staff and lease costs. As a result, we think TPW’s competitive advantage and value proposition will extend over offline peers”

- Further ongoing investment in AI will enhance WTC's core international freight forwarding market and also extend its reach into key adjacent markets such as customs, compliance, warehousing, and landside logistics”

- “Harnessing AI will be key given the many complexities in the freight forwarding industry”

- “We expect AI to assist with sales, support and customer success automation and analytics…improve developer productivity and result in more rapid product iteration at the same level of headcount.”

This article first appeared on Market Index on Wednesday 29 May 2024.

5 topics

12 stocks mentioned