They’re cheap, high-returning, low risk – and they aren’t stocks

It's a relatively unknown asset class locally, but convertible bonds, which combine characteristics of both equities and bonds, held up remarkably well during the coronavirus downturn. Better yet, they also captured the upside from the recovery.

Convertible bonds – so called because holders can convert them into equity at a later date for a predetermined price – hit their sweet spot when they reduce risk without slashing returns. The “tech wreck” of 2000 to 2001; the GFC of 2008-2009; and the market rout of late 2011 into 2012 are recent historical examples of this, as explained below by Lazard Asset Management's Arnaud Brillois.

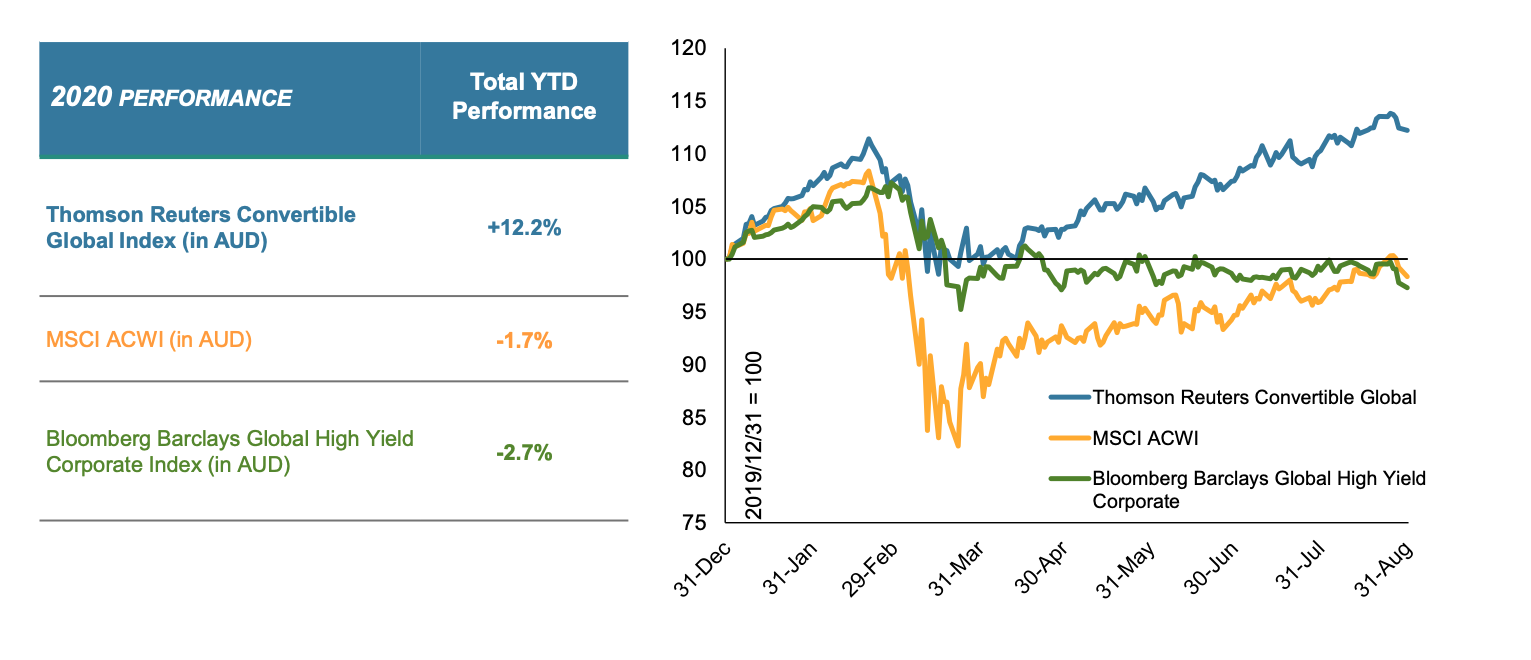

He also looks at how convertibles held up during the eye of the ongoing COVID storm. An index of convertible global bonds – as shown in Figure 2 below – performed almost 50% better than an equities index during the worst of the pandemic sell-off and returned more than 12% for the year to 31 August. By comparison, the stocks returned an on-paper loss of 1.7 per cent.

In the following wire Lazard’s Brillois explains what convertibles are, how they work and why he believes they’re more appealing now than in a long time.

What is a convertible bond?

First and foremost, it is a bond. It has a maturity, a coupon and a reimbursement at maturity, all organised in a normal prospectus. But there is something extra in the prospectus: the holding can convert into stock at a predetermined price.

If the underlying equity has been rising, it will be more attractive to convert into equity. On the other hand, if the underlying equity has fallen, the security acts as an ordinary bond with the benefits of a bond floor.

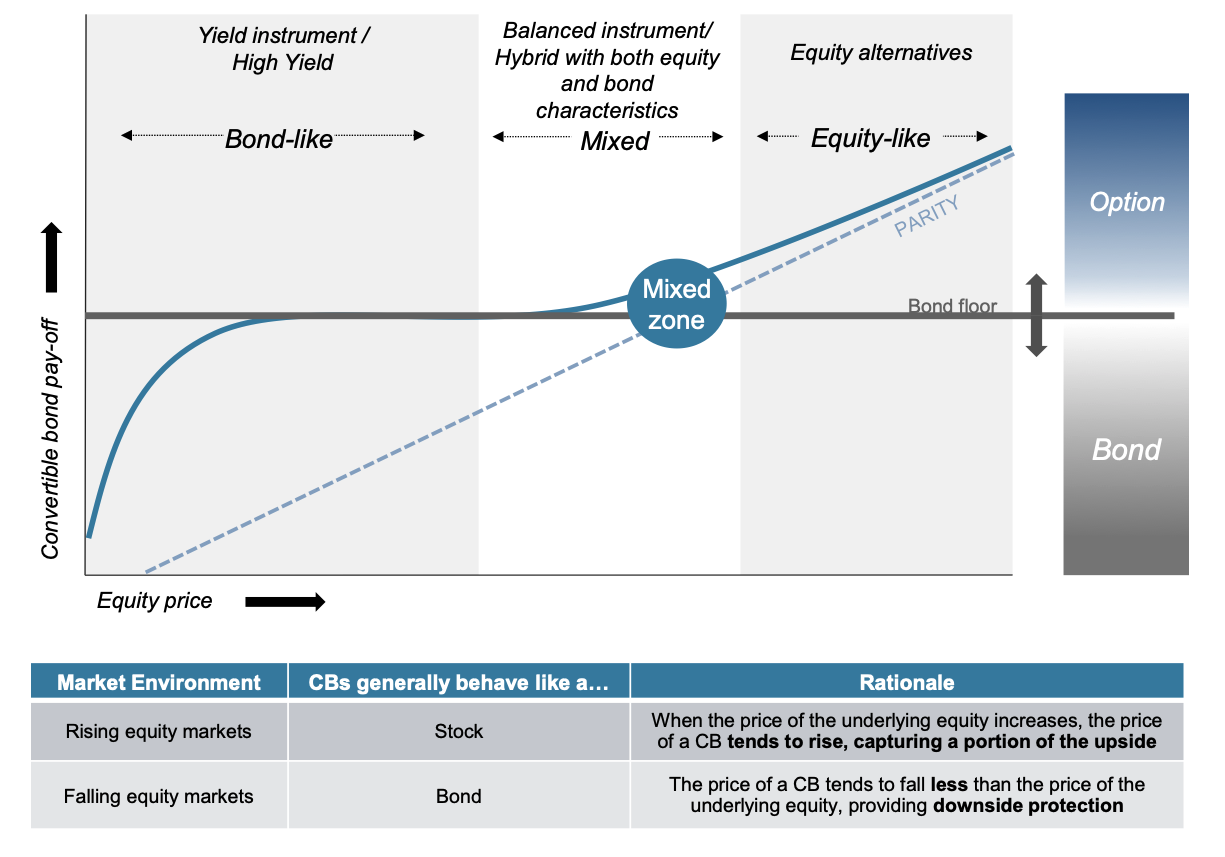

This creates a very specific payoff profile. The combination of the bond floor and the equity option can create an asymmetric return pattern. The potential for gain exceeds the potential risk of loss because of a differentiated payoff when the bond’s return profile falls in what we call the “mixed zone.”

The graph of the convertible’s return illustrates this:

Figure 1: The mixed zone for convertible bonds

Source: Lazard Asset Management

Convexity is a key aspect of investing in convertible bonds. While it may sound technical, it is actually a simple concept.

As the underlying equity of a convertible bond rises, the security becomes increasingly sensitive to the equity price, its value increasing accordingly. But when the reverse occurs, the convertible bond becomes less sensitive and behaves more like a traditional bond, offering potential for downside protection.

The mixed zone, where a convertible manifest its dual qualities, is the sweet spot for this type of security. When in the mixed zone, a convertible bond is balanced. It offers both equity participation and bond characteristics, allowing its equity sensitivity to rapidly react to the underlying equity price movements.

While it's a new offering locally, I understand that your fund has been running since 2000 overseas. How do these assets usually perform in a volatile economic environment?

Because it was a credit event, I view the global financial crisis as one of the worst possible conditions for this asset class. But convertibles still strongly outperformed equities during the time. Between 2008 and 2009, the MSCI World All Countries fell by 24% in Australian dollar terms. By comparison, the convertibles index dipped by just 10%.

During the “tech wreck” between 2000 and 2001, convertibles performed in a similar manner: they fell in absolute terms, but much less than equities. This is the sort of return profile we would expect from these assets in a crisis – they’re correlated with equities, but with much lower drawdown.

This year has proven another volatile year, and the asset class has really thrived.

During the first part of the year, until the end of February, convertible bonds captured the upside in global equity markets, even outperforming the MSCI AC. As the selloff started from the end of February to mid-March, convertible bonds became increasingly defensive, boosting their outperformance relative to equities but with a lower drawdown. When the rebound started in late March, convertible bonds quickly became more sensitive to equity prices and captured the rebound, maintaining a considerable outperformance relative to global equities.

The net result has been a strong period of outperformance for the asset class (see chart).

Figure 2: Convertibles versus US stocks in 2020 so far

(1) Performance period from 31 December 2019 to 31 August 2020. The indices shown are unmanaged and have no fees. One cannot invest directly in an index. Source: Lazard, Bloomberg, MSCI, Thomson Reuters

What was it like investing in this asset class through the GFC?

The GFC really hammered home the importance of fundamental research in this asset class. In this kind of environment, credit research is particularly important. This is because the bond properties themselves obviously comprise the real value of a convertible bond in a stressed environment.

It’s also clear that default risk was key, with markets reaching a post-depression high of more than 15% default. We had no defaults in the crisis and in fact, have never had any in our portfolio.

A big part of our risk management approach is centred around bankruptcy risk. We ensure company accounts are representative of the company’s financial health. We do this by

- analysing the quality of each company’s business model

- gauging issuers' cashflow

- measuring financial flexibility.

These assessments help identify financially sound entities, which is particularly important in times of financial market stress.

A lot of convertible issuers are sub-investment grade. Does that mean that they're unreasonably high risk?

It is true that the majority of convertibles are sub-investment grade; but investors shouldn’t confuse this with unreasonably high risk. In global convertibles, there is a lot of mid-cap issuance, so on size alone a lot of these companies would not meet investment grade criteria.

In terms of seniority, better than four out of five outstanding convertibles rank as senior unsecured debt, falling in right behind secured debt on the corporate capital stack.

And since many convert issuers refrain from issuing other forms of debt, they tend to have cleaner balance sheets than high yield and even investment grade issuers, as measured by risk ratios like free cashflow-to-debt and debt-to-earnings before interest, taxes, depreciation, and amortisation.

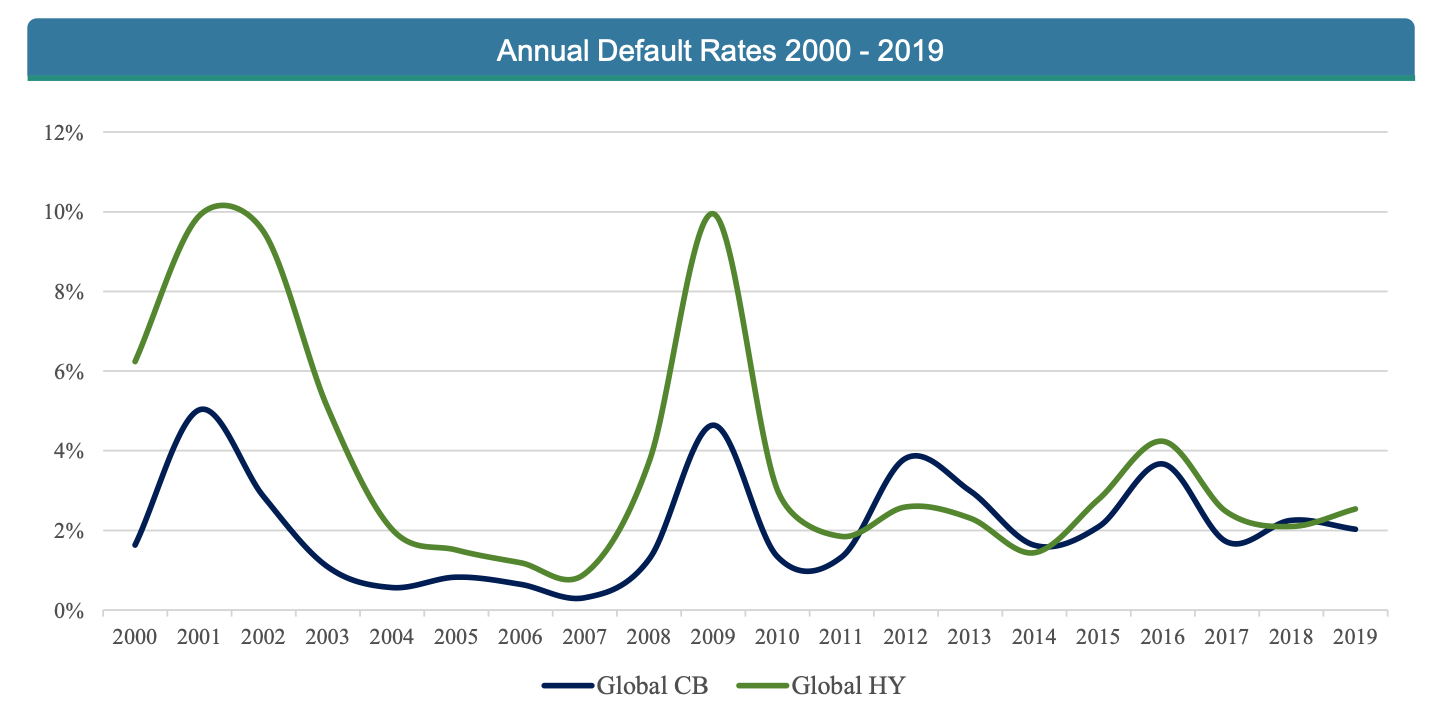

In fact, since 2000, similar rated convertible bonds have exhibited 45% fewer defaults than high yield bonds (2.1% average default rate versus 3.8%). And the default rate among convertible bonds are also much lower during times of global crisis (2001, 2008) as shown below.

Figure 3

Like any return seeking portfolio, convertibles do carry some risk. But when you consider that the asset class has delivered equity-like returns with much less risk, we believe it offers a compelling risk/return proposition.

What attributes are you looking for in a great convertible bond investment?

Investing in this asset class requires simultaneous consideration of two sets of fundamentals that affect convertibles:

- The security’s growth prospects as an equity

- Its defensive qualities as a fixed income credit, plus how the idiosyncratic clauses in every convertible bond might affect both.

Additionally, the investor needs to weigh this analysis against the convexity I explained earlier, determining the sensitivity of the delta – a ratio that compares the change in price of an asset against its derivative, in this case a convertible bond – and also the reliability of the bond floor. Ratings agencies can’t offer guidance for the majority of the market in that regard, and the issuer’s capital structure may call for a nuanced view of the risk.

So really, our process relies primarily on fundamental analysis of each individual security. That analysis includes:

- a direct assessment of each issuer’s creditworthiness

- the characteristics of the convertible’s bond component, such as duration

- the relative valuation of its equity component

- its position against environmental, social and governance principles

- consideration of how various clauses in the prospectus may affect returns.

A bit like the asset class itself, you have elements of both the debt and equity portfolio manager role.

Like a lot of bond asset classes, it is very difficult to play this passively. You really have to understand what is driving the company to issue the convertible. While in aggregate, the asset class of convertible bonds make a lot of sense, some of the individual bonds may make very poor investments. You need to avoid those securities where default risk is possible and tilt the portfolio towards securities when you think conversion to equity is likely.

It is also worth noting what we don’t do. This is not a convertible arbitrage strategy, which is typically a hedge fund offering that your readers may have heard of. We also don’t deploy leverage using options, invest in hybrids or invest in distressed convertible bonds.

What are the opportunities in the convertible bond market like today compared to history?

The high level of new issues that we observe this year, on track to make 2020 a record year in terms of new issuance volumes, does not only come from sectors that have been negatively affected by the COVID-19 pandemic.

We also observe a high level of issuance from companies that have performed particularly well in that environment and use improved refinancing conditions to manage their balance sheets. Overall, this very active environment in terms of new issues is bringing new potential investments, increased convexity (the newly issued bonds are usually very convex), and attractive terms at issue in terms of coupon and premium. This greatly benefits the asset class as a whole.

This active primary market gives us new companies to invest in and importantly increases the overall convexity of the market. It also allows us to have access to sectors at different stages of the recovery and articulate our positioning.

Finally, the valuation of the asset class is currently at a record low, despite its solid performance since the beginning of the year. In particular, convertible bonds in the dominant market of the US are still trading at a significant discount compared to their theoretical value, a phenomenon that tends to be corrected relatively quickly and should support the performance of the asset class in the short term.

Could you take us through an example of a recent investment?

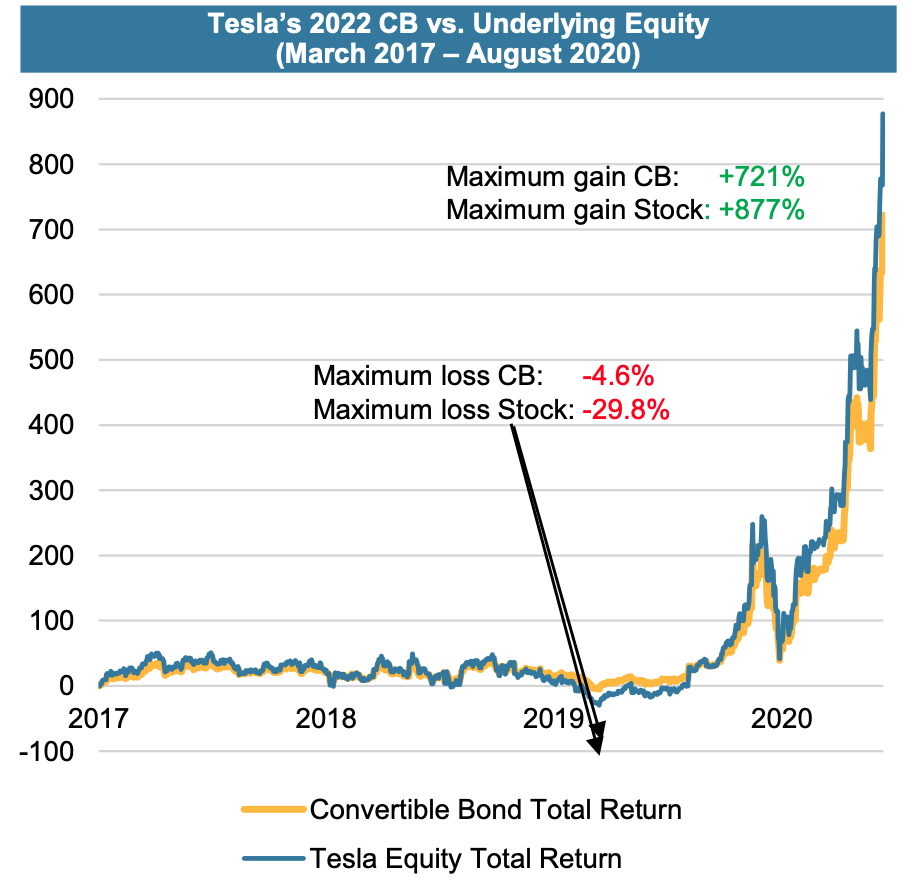

Tesla is an interesting example, and while the equity may be too volatile, controversial and overpriced for many at this point, its history as a convertible bond is an example of why this asset class can work.

Tesla is actually the typical type of issuer where convertible bonds work very well.

The chart below compares the performance of the convertible bond since it was issued, with the performance of Tesla equity.

Figure 4: Tesla shows how convertibles can work

As you can see, from 2017 to mid 2019, the stock fell by close to 30% but the convertible protected, dipping just 4.6%. Since then the stock has rallied significantly, and the convertible bond participated: the convertible bond has returned 721% so far. Similar performance patterns can be seen if you look at each convertible bond that Tesla has issued.

Obviously, Tesla has been an extraordinary success story, so this level of return is highly unusual, but it is the pattern that is most important. Convertibles usually protect when the equity falls and participate in most (but not all) of the upside.

Learn more

The Lazard Global Convertibles Fund is an actively managed convertible bond portfolio that typically holds 60 to 80 convertible global bonds selected from a universe of approximately 1,000 securities. For further information, please visit their website, or use the contact form below.

3 topics

1 contributor mentioned