Think global tech is overheated? Think again, says T. Rowe Price

Global markets currently sit in Goldilocks territory, with conditions occupying a middle ground where asset prices are neither "too good nor too bad". That’s the view shared by the T. Rowe Price investment team at its mid-year market outlook.

“It’s quite clear that we’re now heading towards a ‘no landing’ scenario so recession isn’t a base case,” said Thomas Poullaouec, T. Rowe Price’s Head of Multi Asset Solutions, APAC on Tuesday.

This increases the emphasis markets place on inflation, which he believes will remain a key topic in the second half of calendar 2024 and into 2025.

He envisions three potential scenarios for inflation. At their extremes, these involve either a “growth scare” driven by softer labour data and more tightening of fiscal policies or strong reflation occurring if job growth accelerates beyond what is broadly forecast already.

“We are also in an election year in the US, where you could see fiscal stimulus being more generous than anticipated,” Poullaouec said.

“Today we are in that middle, which is still a Goldilocks scenario…not too good, not too bad.”

The latest jobs data from the US further supports this base case, with wages still rising but tempered by an employment rate that has moved above 4%, from 3.4%, over the past six months.

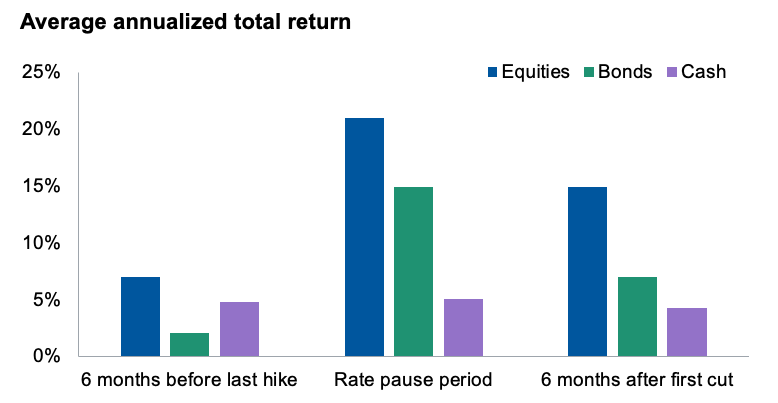

Fed pause signals potential opportunity

As of November 16, 2023. Past performance is not a reliable indicator of future performance.

At a market level, this is reflected in the high cash holdings across both institutional and retail investment portfolios. Poullaouec believes this scenario is typically “a good time for asset prices when you have central banks either on hold or even easing”.

He pointed to previous examples of equity market performance both before and after a shift in central bank policy: “There are better opportunities to invest when you are in an environment where the Fed is pivoting …that bodes well for equity markets and that's why we have an overweight in equity relative to bonds."

Are markets overpriced?

While noting equity valuations are elevated and have pushed higher still as 2024 has progressed, Poullaouec doesn’t regard them as being at extreme levels currently.

“You need to be cautious about valuation…but you don't want to base all of your decisions on valuation,” he said.

How is T. Rowe Price positioned?

Across asset classes, the multi-asset team is

- overweight stocks

- underweight bonds

- overweight inflation-hedged assets including real assets.

Across equities more broadly, Poullaouec expects to see a further broadening of demand beyond the very concentrated pool of growth stocks that have dominated more recently.

“We see better earnings forecasts for value sectors and we have a slight tilt towards value in our portfolio," he said.

Within the developed world, the earnings forecasts from companies in the US and Japan make these some of the most appealing to T. Rowe Price’s equity team currently.

“Zooming in on Asia Pacific, we are quite cautious on the Chinese equity market and on Australia because of earnings risk. We see more opportunities in Korea and even in frontier markets like Vietnam, where we have overweight positions in some of our portfolios,” Poullaouec said.

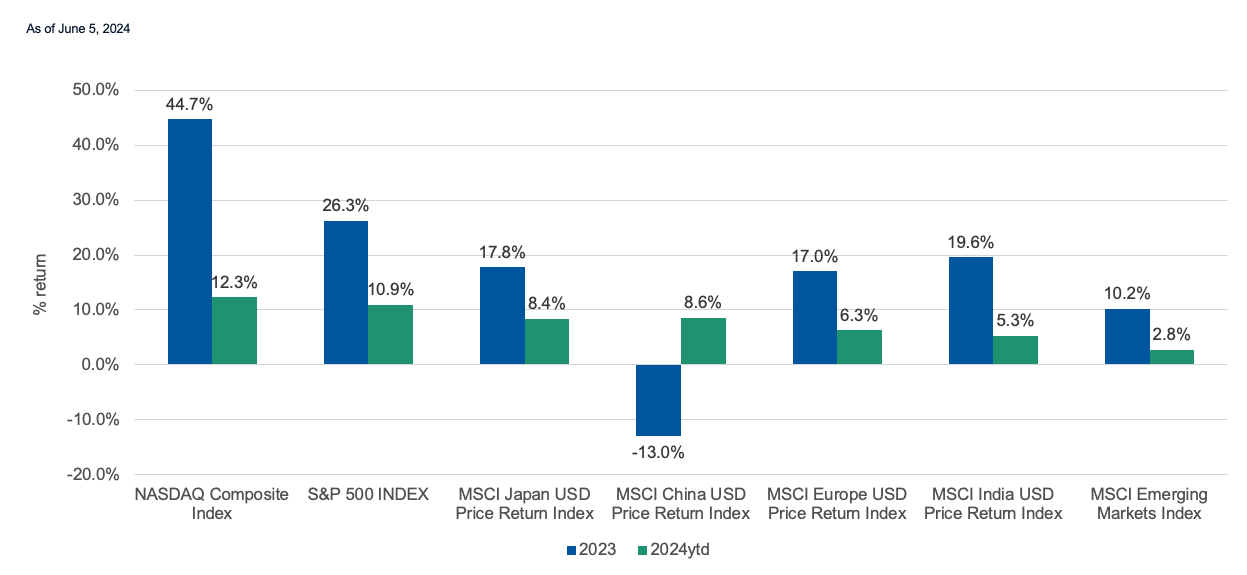

Focusing on global equities, establishing the key differences in the breadth, depth and concentration of markets in 2024 versus 2023 has been a key topic of discussion within the team, according to T. Rowe Price’s Global Equity Portfolio Specialist, Rahul Ghosh.

2024 market returns have broadened beyond the US

Past performance is not a reliable indicator of future performance. Source: data from Bloomberg LP. NASDAQ, S&P, MSCI..

He noted the prevalent view that it is primarily growth companies, and specifically a few technology sector names, that have been driving equity market returns. While conceding this is the case in the US, to at least some extent, Ghosh pointed out a swing towards Value away from Growth in global markets outside the US.

“It’s not just a growth market any more,” he said, noting that Value stocks in Europe and Japan performed at least in line with Growth companies during 2023.

While the US was the exception, Ghosh said this divergence between Growth and Value has contracted.

“Some of that is linked to what's happening with rate cycles in the US and emerging markets. Some of that is linked to what's happening in different economies like India and China, driving demand for materials that are technically more value supportive,” he said.

“But again, that is something that we expect to continue to occur and unfold over the course of 2024 and most likely in 2025.”

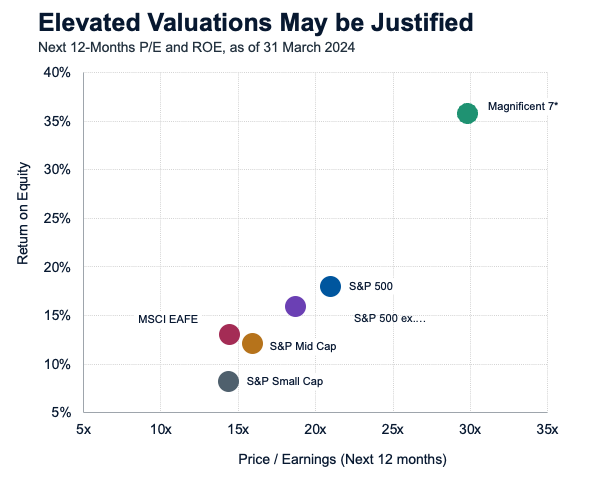

Focusing on the Magnificent 7, Ghosh argued the story is increasingly becoming less about the companies themselves and more about the underpinning AI technology.

“You look at the fact that roughly 40% of all global returns have been provided by the mag seven stocks, that is largely Nvidia (24%) with the rest coming in at 15%,” he said.

Instead, he focuses on the semiconductor sub-industry, led by NVIDIA (NASDAQ: NVDA) but with several other companies that are responsible for more than one-third of total market returns in 2024 so far.

“So again, I think this goes to the discussion around market concentration versus market breadth and depth, where we are seeing returns coming out from more sectors and more stocks outside of the Magnificent Seven,” said Ghosh.

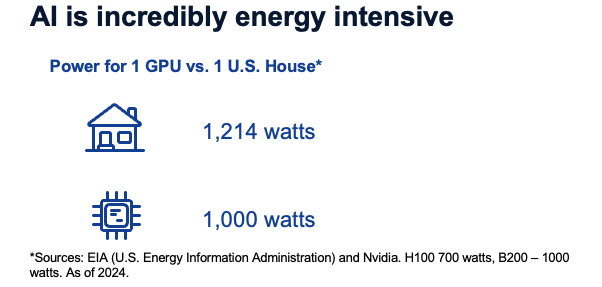

He also pointed to the energy implications of the AI revolution – perhaps most starkly illustrated when you consider that one new GPU produced by NVIDIA consumes the same amount of power as a house.

“So when you hear about the new data centres being built, the new GPU clusters, imagine that we are essentially building a new Las Vegas every few months and imagine what that does for power consumption. Imagine what that does for demand for materials, copper wiring,” Ghosh said.

“We need an entire supply chain network of capital equipment companies, industrial goods companies and technology companies to put all this together. And what's really interesting is when you look at market performance year to date, the market has clearly paid attention to this.”

He pointed to two separate baskets of companies in Europe and the US that are linked to providing hardware and materials around building and maintaining data centres – including copper cabling and cooling solutions. They have “significantly outperformed the Magnificent Seven as well as semiconductors.”

“So, when someone tells you that the market's too concentrated, there's no breadth on diversity, tell them to look at the data. The data shows you that the market is broadening and there are things to invest in outside of the Magnificent Seven,” Ghosh said.

“A map and guide” to other ideas

“Yes, the Mag Seven and related companies have been expensive, but the question really is what are the returns that they've been driving?”

He argued the higher returns justify the high valuations, pointing to the chart below.

“This is something that applies not just to tech and the US markets, but is something we can use as a map and guide globally to identify other areas that are worth looking at."

Looking at earnings growth forecasts for the next couple of years, “for the first time in a long time, we're seeing markets outside of the US pick up the trajectory to a high level, whether it's China, EM, India, Vietnam.

“We have a confluence of factors that suggest the earnings growth trajectory as well as the relative valuations of markets outside the US put them in a good position to have significant performance over this year and the next year," Ghosh said.

Why Japan?

Finally, Ghosh emphasised the importance of the Japan themes such as the AI semiconductor supply chain – a trend he believes will continue.

This is bolstered further by changes inside Japan, including improving corporate governance, “companies initiating new share buybacks, capital return divestments, that is showing up in high multiples”.

Elsewhere in Asia, he called out economies such as India, Korea, and Vietnam where structural factors including government incentives, coupled with large consumer bases, make them increasingly appealing.

“That lays the platform for them to improve both returns, valuation and ultimately…the road to stock price returns or improved returns on a country and stock basis,” Ghosh said.

“The stage is set for a continued performance of secular themes like AI, but we will get that breadth and divergence across other sectors and other markets and regions as well.”

2 topics

1 stock mentioned