This commercial property titan just upgraded its EPS guidance by 13.5%, but is it all priced in?

Industrial property has been one of the blessed sectors of late. As inflation has taken hold of the economy, industrial property landlords have been able to maintain pricing power and pass the costs on through by lifting rent.

What's more, many industrial property tenants have experienced sales above 2019 levels - so they've been able to shoulder increased rents.

Goodman Group (ASX: GMG) today posted a lift to operating profit of 11.5% to $877 million.

“Goodman Group’s continued strategy – to focus on high-quality properties in high barrier to entry infill locations – has produced strong results for 1H23," Group CEO Goodman stated.

"Despite the volatility in the global economic environment, we delivered a strong operating performance and financial results, and we expect this to continue into the second half of FY23. We’ve seen continued rental growth in our markets which has underpinned strong cash flows."

To break down the results, I reached out to Ashton Reid, a portfolio manager at Martin Currie. As you'll read, Reid thinks the results reflect a company in a good position, with some tailwinds to boot. They also increased their guidance, but it should be noted that they have a history of low-balling.

The problem, as Reid sees it, is less about the health of the company and more about the price he's willing to pay for it. In short, the stock is getting getting expensive.

They're continuing to execute, they're high quality and conservatively managed.

But it's about the price you're willing to pay for that exposure.

Goodman Group (ASX: GMG) H1 Key Results

- Operating profit up 11.5% to $877 million

- Statutory NPAT of $1.09b, down from $2.00b last year

- Total revenue of $1.02b, down from $1.03b last year

- Operating EPS of 46.4 cents, up 10.7% on 1H22

- Upgraded full-year EPS guidance by 13.5%, having previously guided EPS growth of 11%

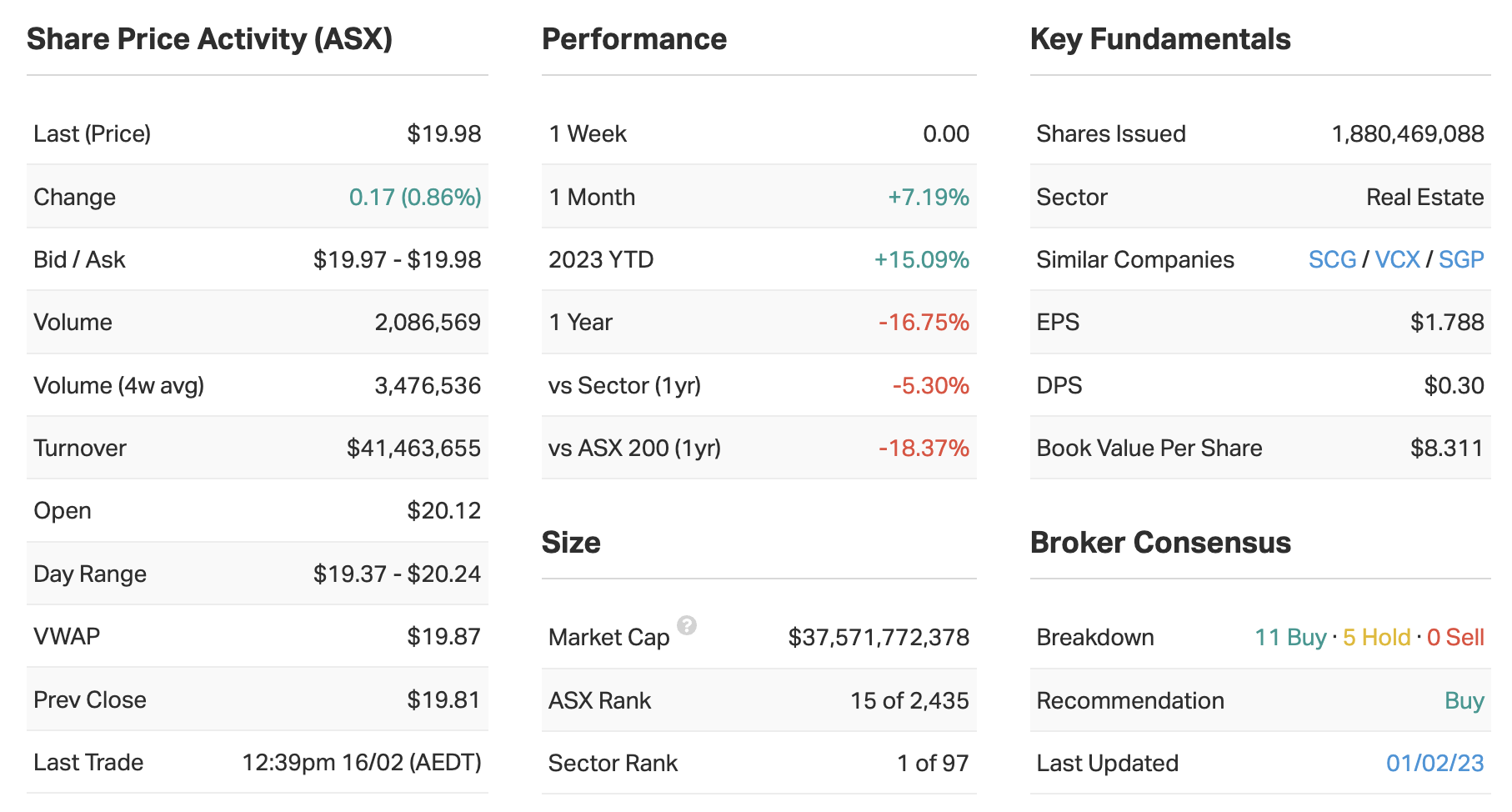

Key company data

MarketMeter

GMGwas ranked ninth by Market Meter among ASX 100 companies with Sustainable Competitive Advantages. For more information on MarketMeter, please click here.

What was the key takeaway from this result?

The key takeaway is that Goodman's had two tailwinds, and one of them has become a headwind. One of them is the need for global logistics and the other is interest rates, and the interest rates have become a headwind.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

Fairly muted, neutral reaction. There's an expectation for them to do better than they're saying. They've been conservative in their guidance. On the flip side, the outperformance is well priced.

There's an element of uncertainty from their performance fees, which they tend to underquote. They've had that tailwind of falling rates helping their returns and development margins. So that's been a big driver of their conservative guidance.

Were there any major surprises in this result that you think investors should beware of?

One interesting components is the pivoting away from the Europe and the UK. And that's due to the economic cycle. But their activities are pivoting to Australia and the US.

Second, the returns coming out of their co-investment in finished properties is trending down. They explain it away as those investments being more focused on the capital gain rather than rental income. That's a bit surprising given what we're seeing from other pure rental owners like a Prologis (NYSE: PLD).

You've had this reversal of the tailwind of falling rates. So the cap rates on finished rent has started to go up having fallen for a decade. So that's the headwind. The offset of that is what's happening to the income line, and that's accelerating. In industrial property, there are issues around supply. So strong demand remains and rents have accelerated. That's offsetting some of the cap rate impact.

Would you buy, hold or sell GMG on the back of these results?

Rating: SELL

We're a SELL, just because of valuation and risk. They're continuing to execute high quality, are conservatively managed, all those things. But it's about the price you're willing to pay for that exposure. The economic risk remains high for slowing demand. They do a lot of new developments, and that requires tenants, and that has come off in the UK and Europe. There are risks there, so our preference is for rents over development given rates over this cycle.

What’s your outlook on GMG and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

For Goodman, the outlook is still strong because there's still a lot of tailwind in the need for industrial space. So that continues. The second tailwind of interest rates has turned and that will take time to come through, but that hasn't happened yet so the outlook remains robust. Particularly if you have that rental story. But Goodman make more money from development rather than rental, so they're more exposed to a change in tenant demand for new.

For the sector more broadly, we've seen the impact of higher interest costs in debt, and that's impacted cashflows and dividend outlooks. Goodman has been less impacted by that because they have low gearing. The key is whether you have pricing power - can you raise rents in this environment. That's why we do like industrial rent, broadly, because they do have pricing power. You have power to accelerate rents in an inflationary world.

It's the same across the suburbs - convenience, retail and shopping malls. Sales are all still way above 2019 levels. So tenants have done well when it comes to a new lease; they can afford higher rent. Contrast that with the CBD where you've had working from home, tenants are allocating more people to the same space. That means it's harder to raise rent. So you lack pricing power in the cities.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious on the market in general?

Rating: 2

Broadly the market's a two on attractive value and particularly in the suburban rental space, and particularly against unlisted pricing. And also given where bond rates are at, which have come through in interest costs and the yield of the sector in a re-rate (the sector was down 20% last year).

It could become a one if you start to see corporate activity emerge.

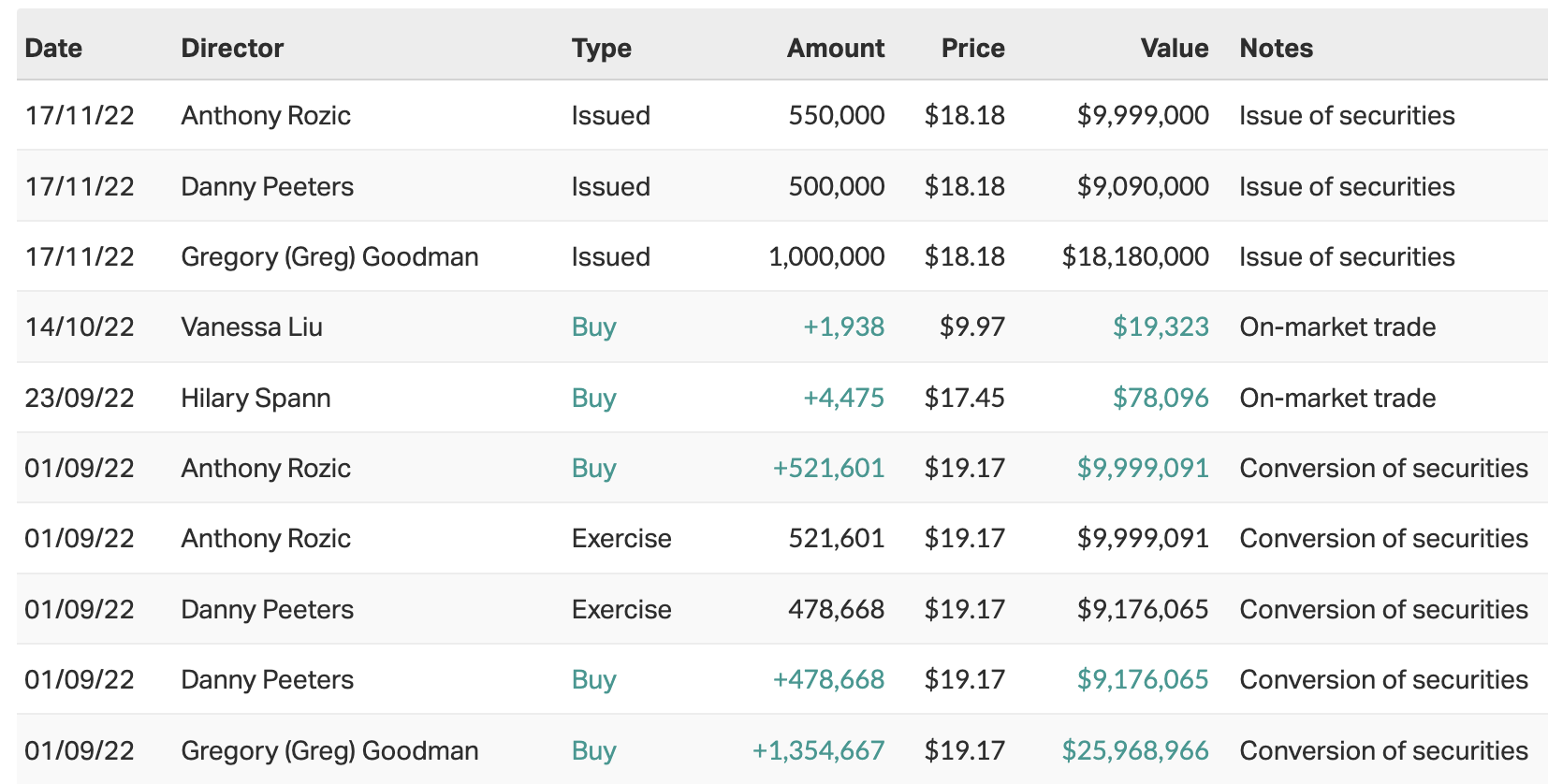

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

2 topics

2 stocks mentioned

1 contributor mentioned